Things are deteriorating.

Last Monday, I warned: "Friday, in addition to NFP, we have 3 Fed speakers – which makes me think the NFP report is going to be disappointing and they are lined up to spin it." The Non-Farm Payroll Report was indeed a disappointment, with only 199,000 jobs added in December, just 1/2 of what had been predicted by leading Economorons.

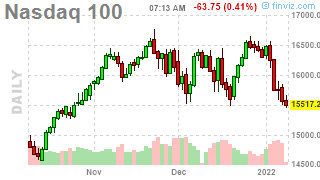

It was, overall, the terrible week for the markets – especially the NASDAQ, which fell 1,000 points (6%) – 2/3 of the way to our predicted correction at 15,000. It will, however, be a sad state of affairs if the 15,000 line on the NASDAQ does not provide at least some support for a bounce. This stage, a weak bounce would be 200 points and the strong mounts would be 400 points – those are the tests we will be looking for this week.

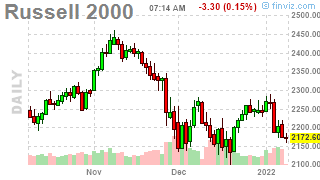

A 10% correction on the Dow would take us all the way to 33,000 and 4,320 on the S&P 500 and 2,200 on the Russell and, oops, we just failed 2,200 on the Russell last week and that was the sign we've been watching for all winter to tell us when it was time to hedge more aggressively. So the other major thing that we have to watch out for this week is whether or not the Russell can take back that 2,200 line. If not, there's not much hope for a recovery from the other indexes and it becomes very likely that we are heading lower.

A 10% correction on the Dow would take us all the way to 33,000 and 4,320 on the S&P 500 and 2,200 on the Russell and, oops, we just failed 2,200 on the Russell last week and that was the sign we've been watching for all winter to tell us when it was time to hedge more aggressively. So the other major thing that we have to watch out for this week is whether or not the Russell can take back that 2,200 line. If not, there's not much hope for a recovery from the other indexes and it becomes very likely that we are heading lower.

We prepared for this on Friday by adding $327,000 of additional downside protection to our Short-Term Portfolio (STP), but in such a way that we are now able to cash in some of our early Russell hedges if the index gets back over that 10% line. The Dollar is still strong, up around 96, which means it has a lot of room to fall and support the indexes should we get any Fed speak to indicate a softer stance.

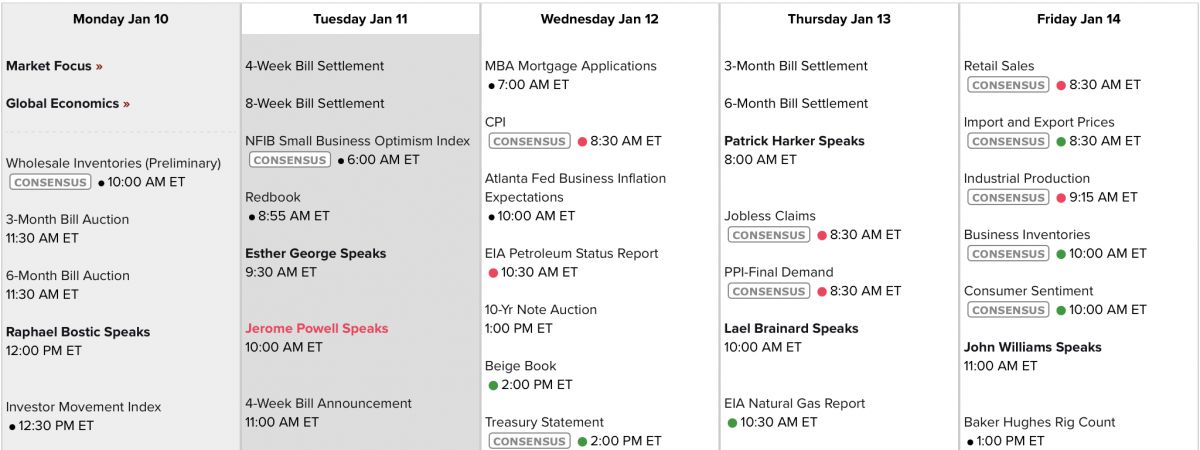

That brings us to our Economic Calendar and, this week, we have a good amount of data starting with the Fed's Bostic (slightly hawkish) at noon today and then Esther George speaks tomorrow morning, but who cares as Powell is speaking at 10 AM? That is his testimony to Congress so we better pay attention. Small Business Optimism is another thing we need to pay close attention to in the midst of Omicron. Wednesday we have CPI, Inflation Expectations and the Beige Book, but certainly we shouldn't discount the 10 year note auction (get it?). Thursday we hear from Harker (slightly hawkish) and Brainard (very dovish) and we wrap up the week with Retail Sales, Import Prices, Industrial Production & Consumer Sentiment topped off with a statement from John Williams – who is generally dovish.

Earnings Season kicks off on Friday when the big banks start to report but we will certainly be curious as to what Delta has to say about last quarter's travel situation.

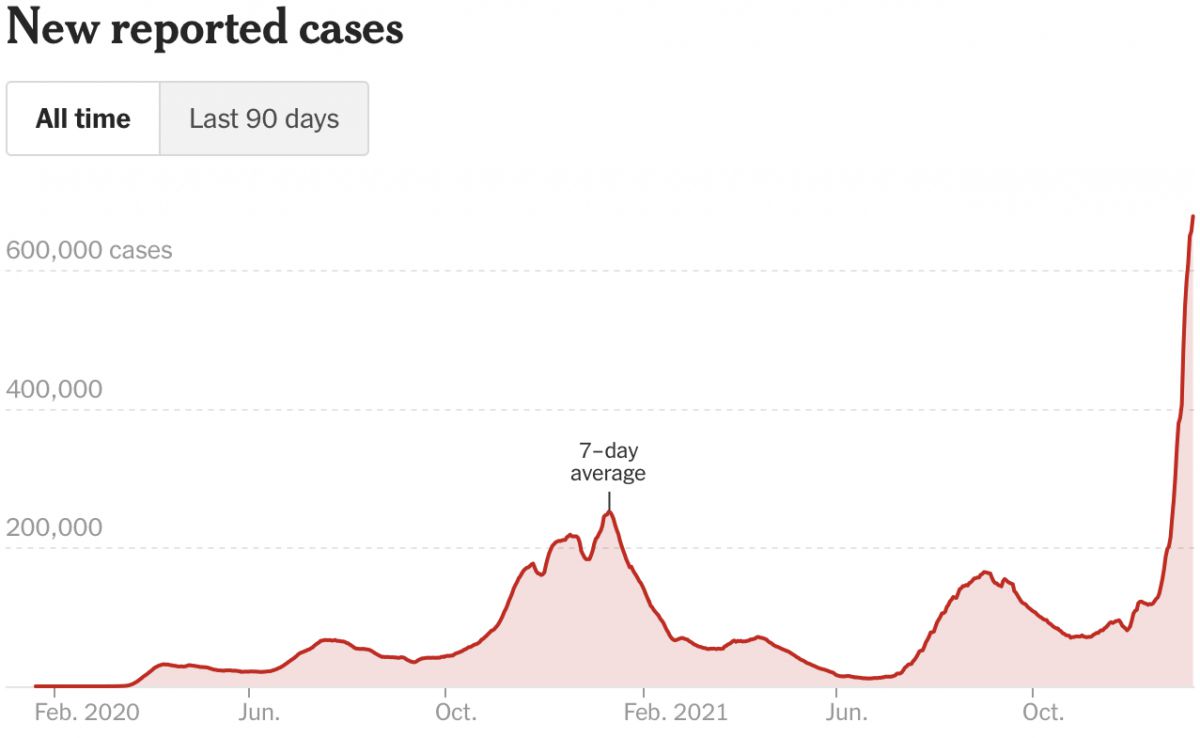

And yes, Covid is still a thing with over 60 MILLION confirmed cases in the US (20% of us) and a whopping 10M of those cases have hit us in the last month. The seven day average number of infections is now three times higher than it was at the prior peak. I know this is just all boring numbers but holy crap people, can't you read a chart?

And yes, Covid is still a thing with over 60 MILLION confirmed cases in the US (20% of us) and a whopping 10M of those cases have hit us in the last month. The seven day average number of infections is now three times higher than it was at the prior peak. I know this is just all boring numbers but holy crap people, can't you read a chart?

Not you guys, of course, I am talking to the rest of America who I have had the pleasure of sharing Orlando with this weekend and the gist of what I am getting from talking to people in this area is that the Orlando real estate market is booming as more and more people are moving away from the north east because they are sick of being told to take precautions. We took the kids to Midieval Times last night and, though there were numerous signs telling people they had to wear masks, no one in the 1200-person audience was wearing one – just the wait staff…

As we have certainly learned in the past two years – the best way to handle a deadly pandemic is to ignore it!

Be careful out there…