Thank God for hedges!

Thank God for hedges!

As of Tuesday morning's review, we had $800,000 worth of hedges in our Short-Term Portfolio and suddenly, on Friday morning – we're already wondering if that's enough, right? This is why we ALWAYS hedge – especially in a toppy market and, as Fundamental Investors – we know when a market is toppy. We also have RULES about hedging, like putting 25-33% of our unrealized gains into our hedges. That's how our hedges rise proportionally with our portfolios – so we don't let ourselves get complacent in a rally.

Our Short-Term Portfolio (STP) is paired with our Long-Term Portfolio (LTP) and acts as the primary hedge there but it also has enough to spare to cover our other portfolios against a 20% correction. Above that and we're in trouble but, of course, we simply add more hedges when 10% fails and again when 20% fails. At the moment, 10% seems ready to fail.

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,000 has bounce lines of 15,300 (weak) and 15,600 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

That's the chart we've been using to track a 10% market correction, using the Nasdaq as our primary indicator as 1,500 was our predicted test into January earnings but we blew right past that yesterday by, yes, 300 points and that's a 20% overshoot of the 300-point drop —- so far. It COULD, as I noted in yesterday morning's PSW Report, simply be the halfway point, on the way to 14,500 and, if we lose that last line on the Dow today – that's how we'll be playing it into the weekend.

So far, we haven't taken too much damage in our long portfolios. That's because we mostly buy the kind of safety stocks people run to when there's a correction and also because, to some extent, our trades are self-hedging – as we tend to sell a lot of premium, which enables us to ride out small dips but, past 10% and things are still going to get ugly!

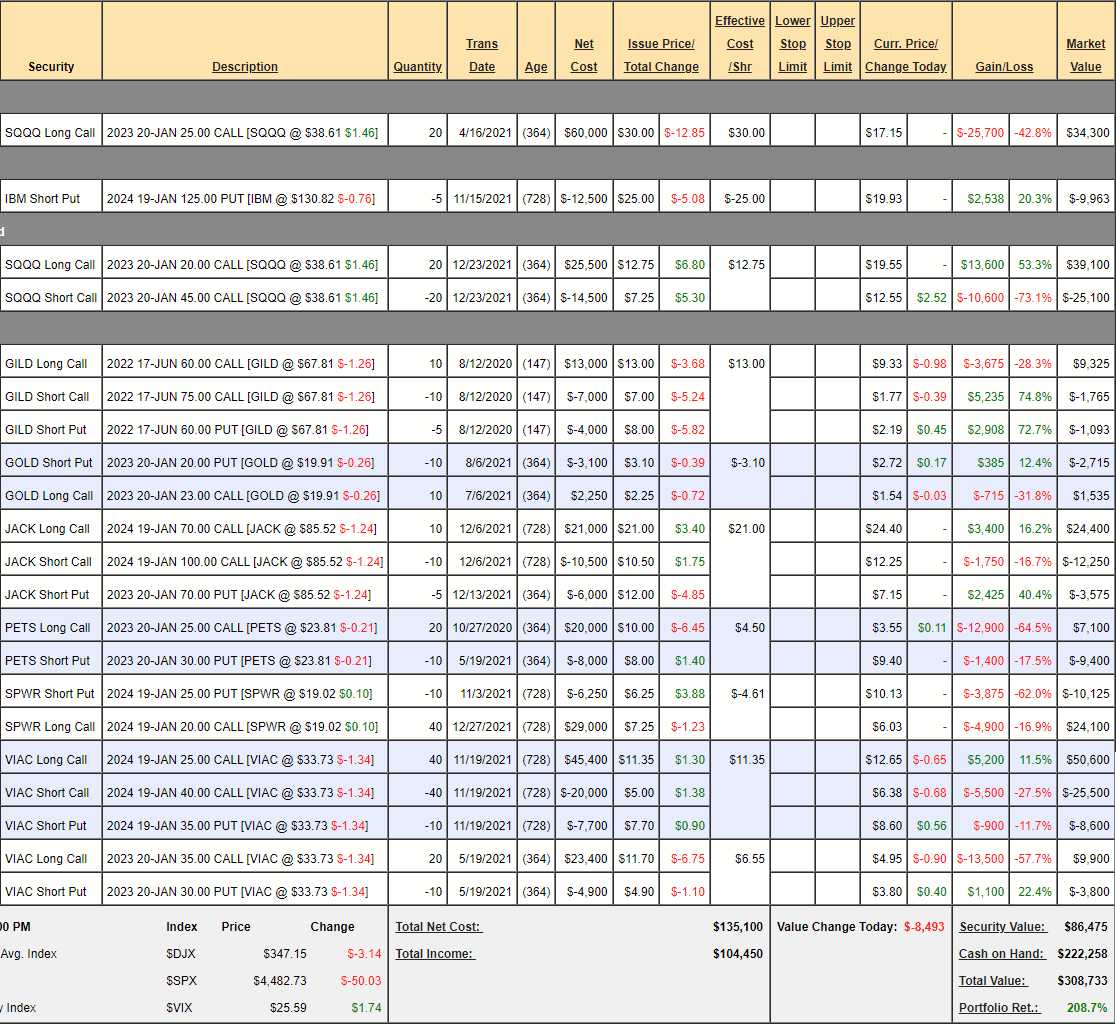

Earnings Portfolio Review: $308,733 is up $11,060 despite the downturn because this is a self-hedging portfolio which we added a second round of SQQQ calls to in our last review on Dec 23rd. That was very good timing and made all the difference as our SQQQ positions gained $26,450 – more than offsetting the losses in the primary positions. This is why it's critical to know the POTENTIAL upside to your hedges – you have to be aware of where your protection runs out – as we can see how fast this market can fall.

- SQQQ #1 – The $25 calls are $13.60 in the money and SQQQ is a 3x ETF so, if the Nasdaq falls 20% more, then we can expect 1.6 x $38.61 = $61.77 and that would bring our longs up to $36.77 or $73,552. Currently we're at $34,300 so this is $39,252 of protection.

- IBM – Short puts that we are not worried about over the long-term, though there may be some short-term pain. We have lots of cash and margin so no need to change these. We expect to gain the full $9,963.

- SQQQ #2 – This is our new spread (post-split) and it maxes out at $50,000 and is currently net $14,000 so $36,000 of protection.

- GILD – On track and we have no problem with GILD as a long-term hold. It's a small position so we'd be happy to improve upon it if it gets cheaper. Currently net $6,467 on the $15,000 spread so we expect to gain $8,533 over time.

- GOLD – We're aggressively long here and it's a good inflation hedge so no regrets. We're looking for at least $25 which would put us $2,000 in the money and currently net -$1,180 so $3,180 expected gains. Another one with no need to hedge as we'd happily make it a much larger position if it got cheaper.

- JACK – This is a $30,000 spread at net $8,575 so it's on track to make us $21,425 (249%) – that's good for a new trade!

- PETS – Aggressively long with the $25 calls and let's say $35 would give us $20,000 and currently net -$2,300 so $22,300 in upside potential here.

- SPWR – Yet another aggressive long. Getting back to $30 would be $40,000 and currently the spread is net $13,975 so a lovely $26,025 in upside potential is about 200% if all goes well.

- VIAC – Very aggressive and was starting to pay off but fell back yesterday. Anyway, let's say we get to $40, then we have 40 of the $25s for $14 ($60,000) and 20 of the $35s for $5 ($10,000) so $70,000 potential and currently net $22,600 so $47,400 (209%) of upside potential if we can get back over $40 – I love this one!

I really don't understand why people think this system is complicated, do you? We have $138,826 in upside potential and $75,252 in downside protection and we also have $222,258 in CASH!!! to deploy as we only have net $86,474 in total positions. Our big risk is being assigned (from the short puts) 500 shares of IBM, 500 shares of GILD, 1,000 shares of GOLD, 500 shares of JACK, 1,000 shares of PETS, 1,000 shares of SPWR and 2,000 shares of VIAC.

That would be our worst-case in a catastrophic market breakdown and, unless they all go Bankrupt, we can deal with that too – epecially as we'd be getting $75,252 in additional cash to buy/adjust them with along the way. So, unless the World ends, this is a fantastic portfolio to roll into 2022 with!

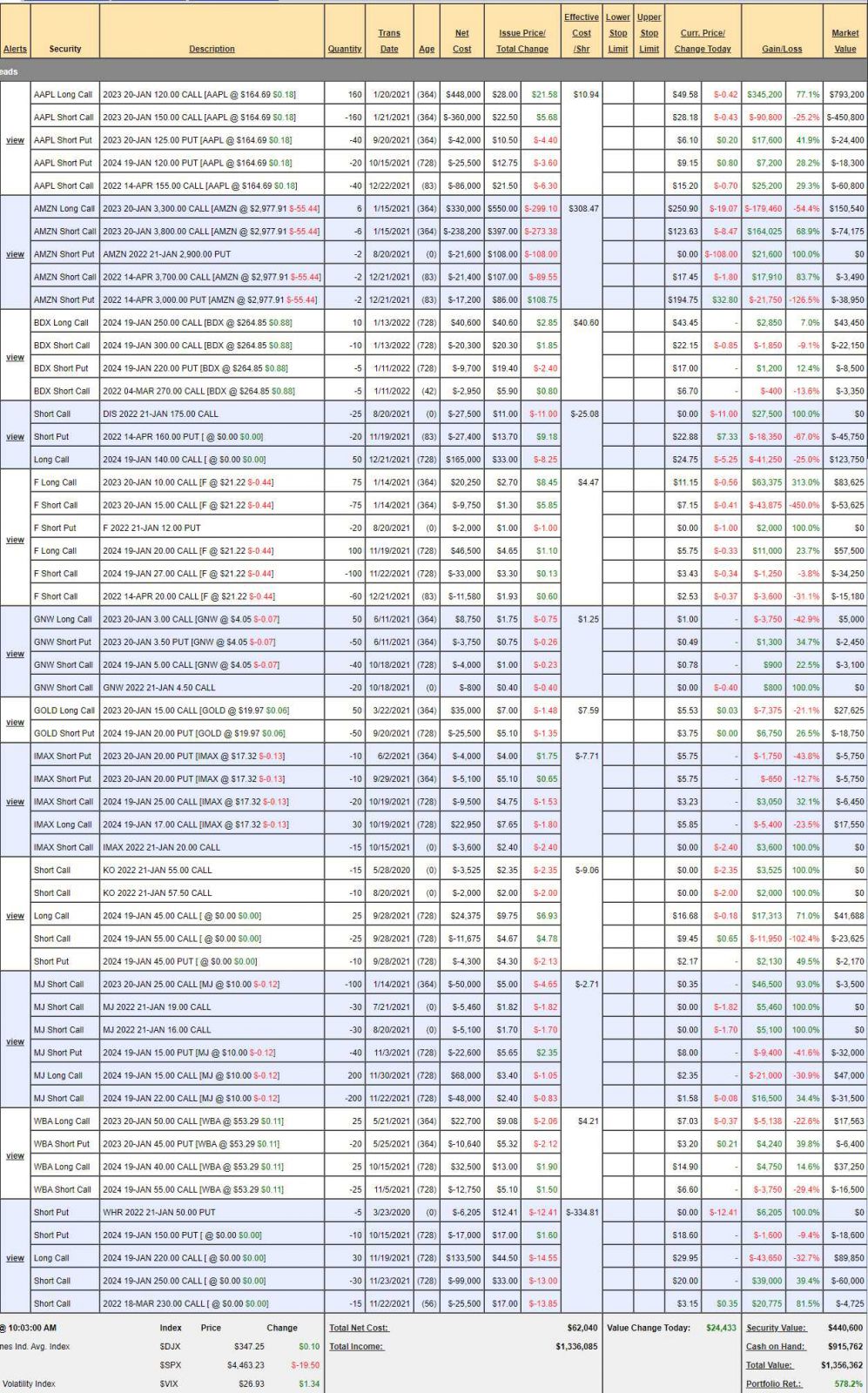

Butterfly Portfolio Review: $1,356,362 is up 578% from where we started on Jan 2, 2018 in our oldsest portfolio but it's also down $35,027 in choppy waters since our Dec 21st review. No big deal though, we just need to make sure we're not over-exposed as this too is mostly a self-hedging portfolio but mostly we rely on short calls to protect us in our Butterfly plays.

- AAPL – Big pullback on our biggest position but of course we have long-term faith and those short April $155 calls were deep in the money and now we're simply back on track and still way over target.

- AMZN – The short Jan puts are going worthless (barely) and we're going to take the 2 short April $3,700 calls off the table and see if there's a bounce. If not, we'll sell much lower calls (probably $3,000) to balance out the short puts that are now in the money.

- BDX – This is our newest addition and doing fine so far.

- DIS – The stock is at $137 so the short April $160 puts are an issue at the moment but the short calls will expire worthless so let's wait and see how bad next week is before adjusting.

- F – Miles in the money on our older play and the other play is on track so not much to do but wait.

GNW – The short $4.50 calls will go worthless and the rest is on track. March $4 calls at 0.32 aren't worth selling so better off waiting and seeing.

- GOLD – Aggressively long.

- IMAX – The short $20 calls are going worthless and I think we should sell 15 of the March $19 calls for $1 ($1,500) as that's enough to pay for us to roll the 2024 $17 calls to the $15 calls.

- KO – At $61.05 we have to roll the 15 Jan $55 calls to 15 of the April $57.50 calls at $4.35 and no new put sales until we see if $60 holds up.

- MJ – Testing $10 today so the Jan calls will go worthless but what next? We picked up $10,560 on that sales and it's a net $0 spread but we risk being assigned $4,000 shares at $15 ($60,000) so we'd better keep making some money. With 200 longs, we can certainly afford to sell 50 of the April $10s for $1.25 ($6,250) and let's sell 25 of the April $10 puts for $1.10 ($2,750) and we'll see how that goes.

- WBA – Seems a shame not to sell some short calls since we have 25 uncovered longs. Let's sell 15 of the April $52.50 calls for $3 ($4,500) and see what happens.

- WHR – The short Jan puts are expiring worthless with the stock at $204.66 and we sold the March $230 calls so all seems well here.

We have a lot of adjustments at the end of a quarter but, otherwise, it's a nice, dull portfolio where we sell premiium for income and whether or not the long position is winner is a bit of an afterthought. This is our most reliable portfolio but people ignore it because there's not much to do. The reason we left it running after the last purge was to demonstrate how powerful it becomes over time and now we're up 578% in 4 years and still no one seems to care. Oh well….

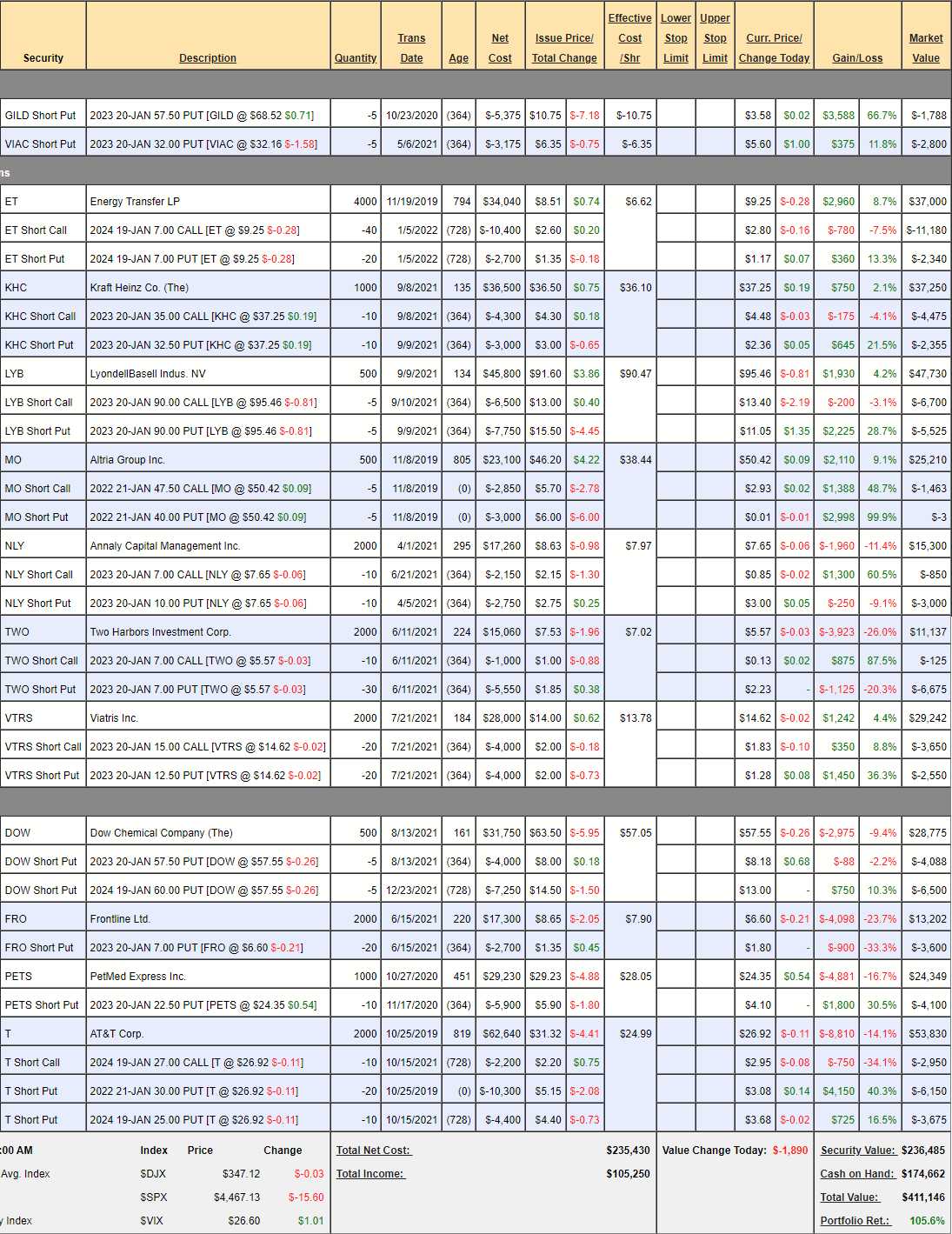

Dividend Portfolio Review: $4,105 is just the dividends we collected this quarter. I LOVE dividends and our strategy in the Dividend Portfolio is to lower our basis to $0 over time on each position and keep collecting those dividends. It's amazing how powerful this strategy is over time but we're only two years into this one. At the moment, we're at $411,146 which is up 105.6% since our Oct 25th, 2019 start with $200,000 and we're up $19,869 since our Dec 23rd review, where we only adjusted DOW and cashed out PFE – very low-touch!

- GILD – On track

- VIAC – Back on track.

We only have 2 short puts and only 11 long positions so this sell-off will be a good time for us to promise to buy more stocks if they get cheap.

- ET – Perfect for our targets.

- KHC – Perfect.

- LYB – Perfect

- MO – Perfect but the short $40 puts are going worthless and we'll have to buy back the short $47.50 calls for $2.93 ($1,463). Now we can sell 5 of the 2024 $45 puts for $5.25 ($2,625) and 5 of the 2024 $50 calls for $4.50 ($2,250) and that's another net $3,412 collected and our original net was $17,250 so, not including dividends, we have reduced our basis to $13,838 yet we're still collecting $450 per quarter or $1,800 per year for a 13% annual return and in 4 more cycles (8 years, 10 total years) we should have recovered all the money we laid out PLUS the dividends, which we will collect forever more.

- NLY – A bit low as we were aggressive with the short puts but we don't mind owning more NLY, who just paid $440 against a net $11,450 position. That's better than 10% annually on just the dividends.

- TWO – Slipped a bit on us but another nice dividend payer as we just collected $340 against the net $8,510 position so we certainly won't mind being assigned 3,000 more at net $5.15 – if it gets that low. Meanwhile, $1,360 is a 16% annual return on what we have at the moment.

- VTRS – Perfect.

- DOW – Pretty new and right on track.

- FRO – The only one that does not pay a dividend but I want to be in it when they reinstate it – which is my theory. They just took a hit but basically on track.

- PETS – As we expected, they went back to paying a dividend and we got $300 last Q so $1,200 against a $23,330 position is just 5% a year but I'm sure it will increase and we'll sell calls to lower our basis next time they pop. The 2024 $25 calls are $4.50 so we could knock $4,500 off the basis right now if we wanted to but, no thanks.

- T – The king of the dividend stocks. Just paid us a lovely, reliable $1,040 so we're collecting $4,160/yr against our net $45,740 position and we sold $17,100 worth of puts and calls in the first round so perhaps only 8 years until we have all our money back while STILL collecting $4,160/yr.

Notice it's incidental to this strategy whether or not the spread actually works out. We WILL get our basis down to $0 and we WILL keep collecting those dividends. In the case of T, above, we made a big put commitment because we love and trust them and, if they happen to get called away at $54,000 – that's a net gain of $8,260 (18%) on top of the 8%(ish) dividends we're collecting. We're only 1/2 covered on the calls too, so we can collect another $2,000+ selling more calls.

That's what's great about this strategy – so many ways to generate cash and, over time, it becomes a very powerful money-maker.

Have a great weekend,

– Phil