What a ride!

What a ride!

The Dow blasted up 600 points from yesterday's open, half of it since the markets closed last night and there's no actual reason for this – the market manipulators are simply taking advantage of the lower volume to boost everything back up so they can start selling again. This is what we expected to happen in Monday morning's PSW Report, where I noted:

Generally, the market has trended higher in dull, low-volume weeks and this week, we don't have time to lay about as our bounce chart is wrecked and we need to be over those strong bounce lines by Friday or the whole week can be written off as a consolidation for a move lower – so let's watch our levels carefully:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

Since Monday morning, the Dow and the S&P have added green boxes but we need more than just the Dow to be over the strong bounce line to call it progress. The S&P (/ES) Futures are at 4,547 this morning – so closing in on 4,559 so that's the inflection point we'll be watching and it will get interesting as we have the Fed's Michelle Bowman speaking at 10:30 followed by Loretta Mester at noon and then we have a $37Bn, 10-year note auction at 1pm, where we'll see if those notes can bounce off their (so far) lows:

The Treasury market selloff that’s lifted the 10-year yield by nearly half a percentage point this year — to a high of 1.938% on Monday — is likely to shift into higher gear once the yield reaches 1.95%, strategists say. At that level, mortgage-bond investors would be induced to protect their portfolios against the effects of rising yields by selling Treasuries or doing the equivalent in interest-rate swaps, termed convexity hedging.

Even after a correction in tech stocks and surging yields on U.S. government bonds, investors still don’t understand the risks they’re taking in equity and debt markets, according to Mark Spitznagel, manager of the best-known fund protecting against so-called black swan events.

Spitznagel said he doesn’t believe in trying to time the market. Instead, Universa tells clients to think of hedges not as a source of profit but rather as a kind of catastrophe insurance they should have at all times. With the knowledge that they’re protected in the event of a meltdown, those investors can, in theory, take risk without the need for traditional diversification in the form of Treasuries, gold or hedge funds, he said.

In other words, Spitznagel agrees with our strategy using the paired Long-Term and Short-Term Portfolios, with the STP acting as a hedge for our long-term positions. We went over our STP in yesterday's Live Member Chat Room and decided we're comfortable with what amounts to roughly $900,000 worth of insurance against our now $2.25M LTP so about 40% covered at the moment and we're using our bounce chart to let us know when we need to pull the trigger on more.

Meanwhile, it's a watch and wait kind of week but here's a great article from Barry Ritholtz on our favorite topic:

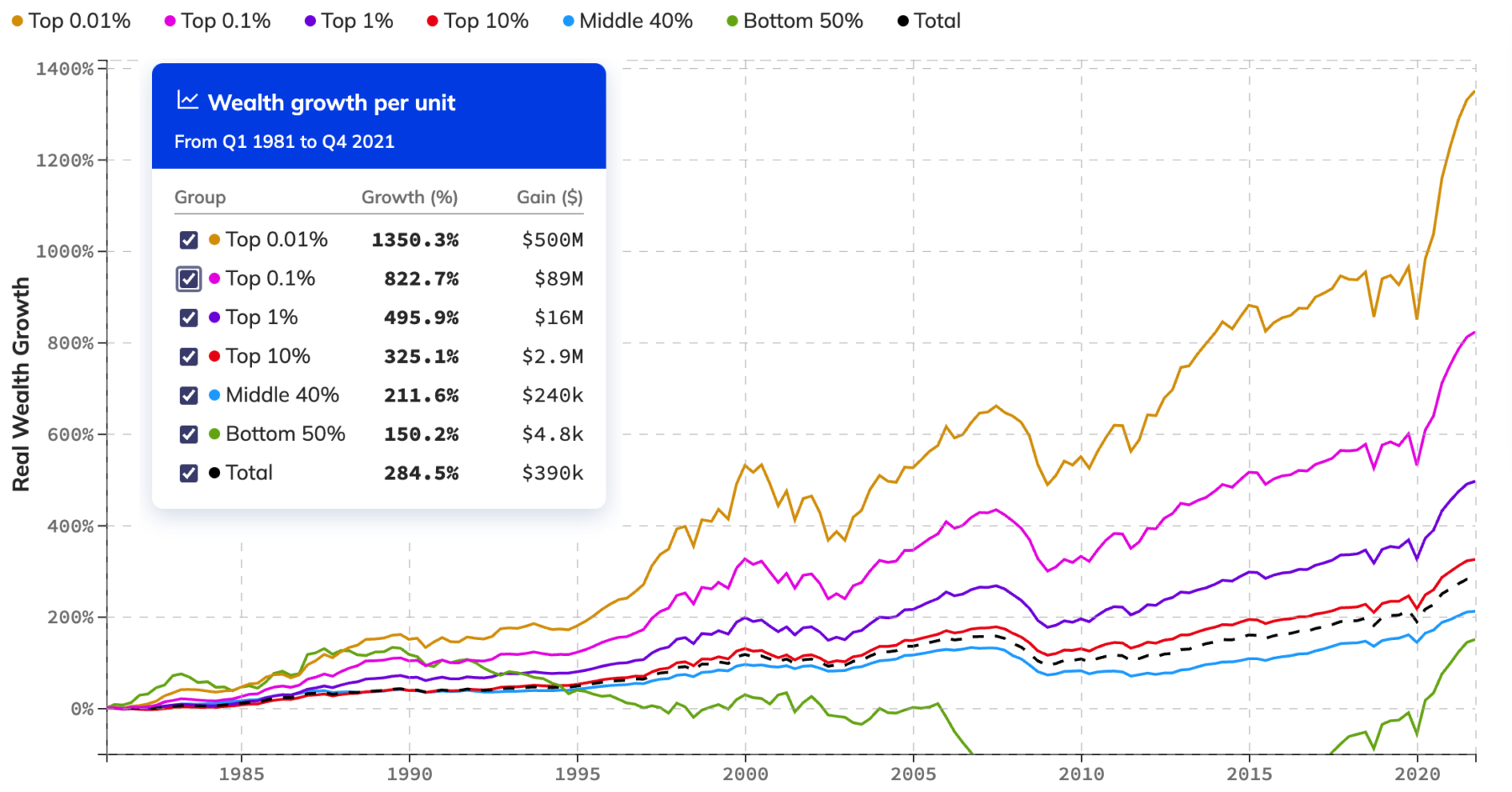

The Super Wealthy versus the Merely Rich

That's right, the bottom 50% have gained $4,800 in wealth in the past 40 years – that is over $100 per year! The rest of the Bottom 90% have gotten a whopping $5,800 per year richer – Retirement here they come! And we wonder why those economic confidence numbers are heading towards Great Depression-levell lows…

To Solve Income Inequality, Increase Economic Mobility

Also a good point!