By Louis Navellier. Originally published at ValueWalk.

For weekend reading, Louis Navellier offers the following commentary:

Q4 2021 hedge fund letters, conferences and more

ARKK Is Now A Broad Market Indicator

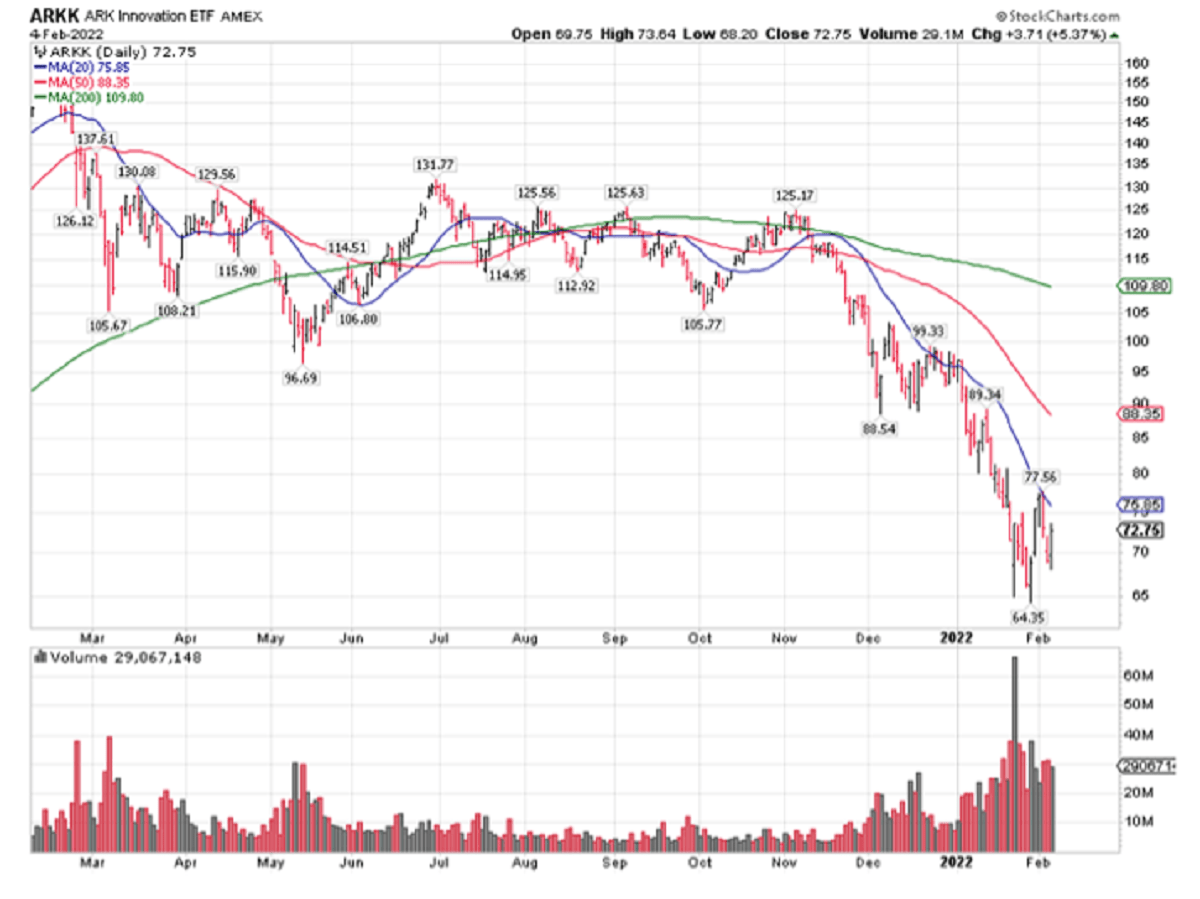

Catching a bid over the past week, the Ark Innovation Fund (NYMARKET:ARKK) is now an indicator for when high-beta assets are rebounding – or coming under renewed pressure. I don’t believe that ARKK has a lot of upside potential, but suffice it to say that if it rallies past last week’s high of $77.56, we are further away from the January bottom and there is likely more upside for the stock market. On the other hand, a close below last Friday’s low of $68.20 implies a retest of the January stock market lows. I don’t think ARKK can rally past the high $80s on this move, and I believe the recent bottom at $64.35 is on soggy ground.

If it weren’t for the Federal Reserve, what you saw at the end of January would have been a pretty good stock market bottom. It still is, but the Fed can override it. The Fed has said it will hike rates in 2022, but we don’t know how many times it will raise rates. They don’t want to invert the yield curve, so they will try to push 10-year yields higher, either with open market operations, or by just jawboning.

There is a head and shoulders bottom on the 10-year yield (black line, above), which implies a move to 2.50%. German bund yields already turned positive and now are at +0.20% after being negative for nearly three years. Other world central banks are hiking rates, so it is only a matter of time before the Fed follows. In a monetary tightening cycle like this, I believe that looking for a lot of upside from ARKK’s type of stocks – those with little or no earnings – would be foolish.

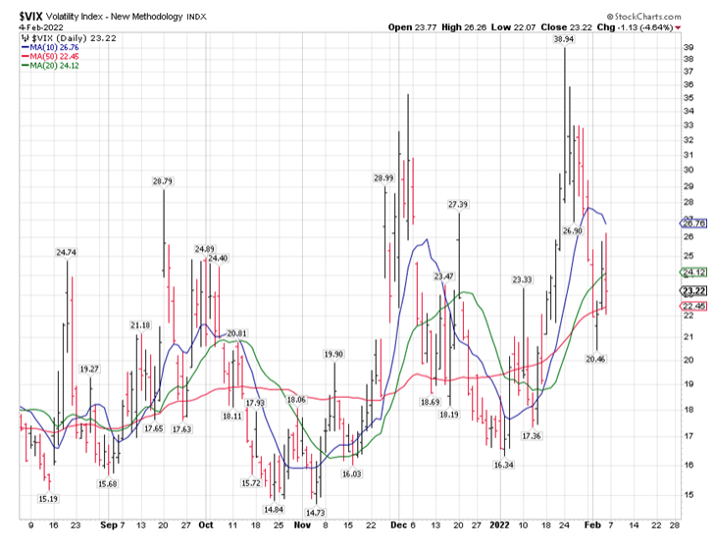

The VIX pattern is pretty promising – and similar to the Omicron bottom in December. We could retest the late January bottom, creating a lower VIX spike. If it holds, it could be an intermediate-term bottom. A lot is riding on how the Fed handles the situation, but so far the ups and downs in stocks are very similar to what we saw in 2018, the last time we had a Fed tightening cycle.

The U.S. Dollar Has Further to Run

There was a sharp short squeeze in the euro last week, driven by the European Central Bank’s (ECB) statements that they may have to tighten their monetary policy this year. So far, it was assumed, rightfully so, that the Fed will be more aggressive in its monetary tightening than the ECB, as the U.S. economy is further behind the curve on inflation, and it has seen better labor market improvement.

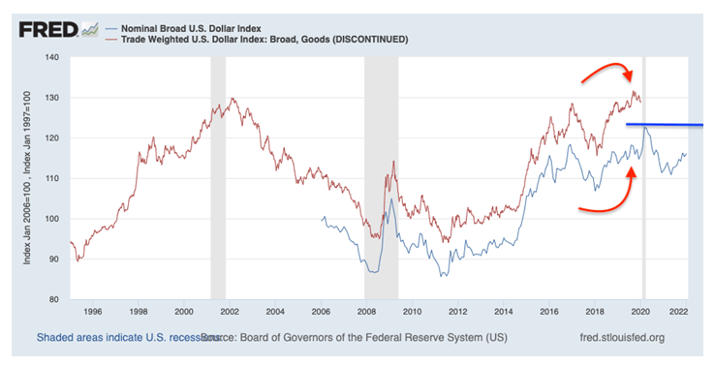

But the euro is only half the story of the dollar’s valuation. The Broad U.S. Dollar Index, which includes all major emerging market currencies, suggests much more appreciation, similar to the way it did in 2018, which was the last time the Fed tightened in earnest. The dollar kept on running even after Jay Powell was done, registering a fresh all-time high at the end of 2019, when the old index was discontinued (red line).

The new “Nominal Broad U.S. Dollar Index” (blue line) is very similar but on a slightly different scale. I have shown them both, above. The blue line registered a new all-time high in the initial pandemic panic in March 2020, which may be challenged again if Powell keeps tightening the way he says he wants to do.

The dollar should also rally if Russia invades Ukraine, which (if it happens) should happen after the Olympics conclude (February 20), as Vladimir Putin would not want to embarrass China at this critical juncture.

China may also invade Taiwan, sooner rather than later, which is another dollar-bullish political development that should happen while Joe Biden is President, as the Chinese perceive him as being less aggressive militarily than Donald Trump.

Without Taiwan’s supply of chips, the world would be crippled, as it has been with the present bottleneck, so there is little hope for help on Taiwan’s behalf.

Updated on

Sign up for ValueWalk’s free newsletter here.