By Jacob Wolinsky. Originally published at ValueWalk.

Whitney Tilson’s email to investors discussing the Pivot conference in Miami; back to Earth or temporary setback? Revisiting the FANGAM stocks; are activist short sellers misunderstood?

Q4 2021 hedge fund letters, conferences and more

Pivot Conference In Miami

1) As you read this, I’m on a flight to Miami for the first-ever Pivot conference, named after the podcast I enjoy that’s hosted by two of my favorite commentators, NYU marketing professor Scott Galloway and New York Times tech columnist Kara Swisher.

I’m looking forward to hearing from them as well as a range of great speakers, including:

- David Solomon, the chairman and CEO of Goldman Sachs (NYSE:GS)

- Aswath Damodaran, a professor of Finance at the NYU Stern School of Business

- Brian Chesky, the co-founder and CEO of Airbnb (NASDAQ:ABNB)

- Meredith Kopit Levien, the president and CEO of the New York Times Co. (NYSE:NYT)

- Sandeep Mathrani, the CEO of WeWork (NYSE:WE)

- Shu Nyatta, a managing partner at SoftBank

I’ll be listening carefully and sharing with you the most interesting things I hear!

Revisiting The FANGAM Stocks

2) Speaking of Professor Aswath Damodaran, he has been valuing tech stocks for years… including, famously and accurately, Tesla (NASDAQ:TSLA), since 2013 (see his latest post on the company here: Tesla’s Trillion Dollar Moment: A Valuation Revisit!).

So I read his most recent post with great interest because it includes three of our core holdings, Amazon (NASDAQ:AMZN), Meta Platforms (NASDAQ:FB), and Alphabet (NASDAQ:GOOGL), in our flagship newsletters, Empire Stock Investor and Empire Investment Report: Back to Earth or Temporary Setback? Revisiting the FANGAM Stocks (you can watch his accompanying 29-minute video here). Excerpt:

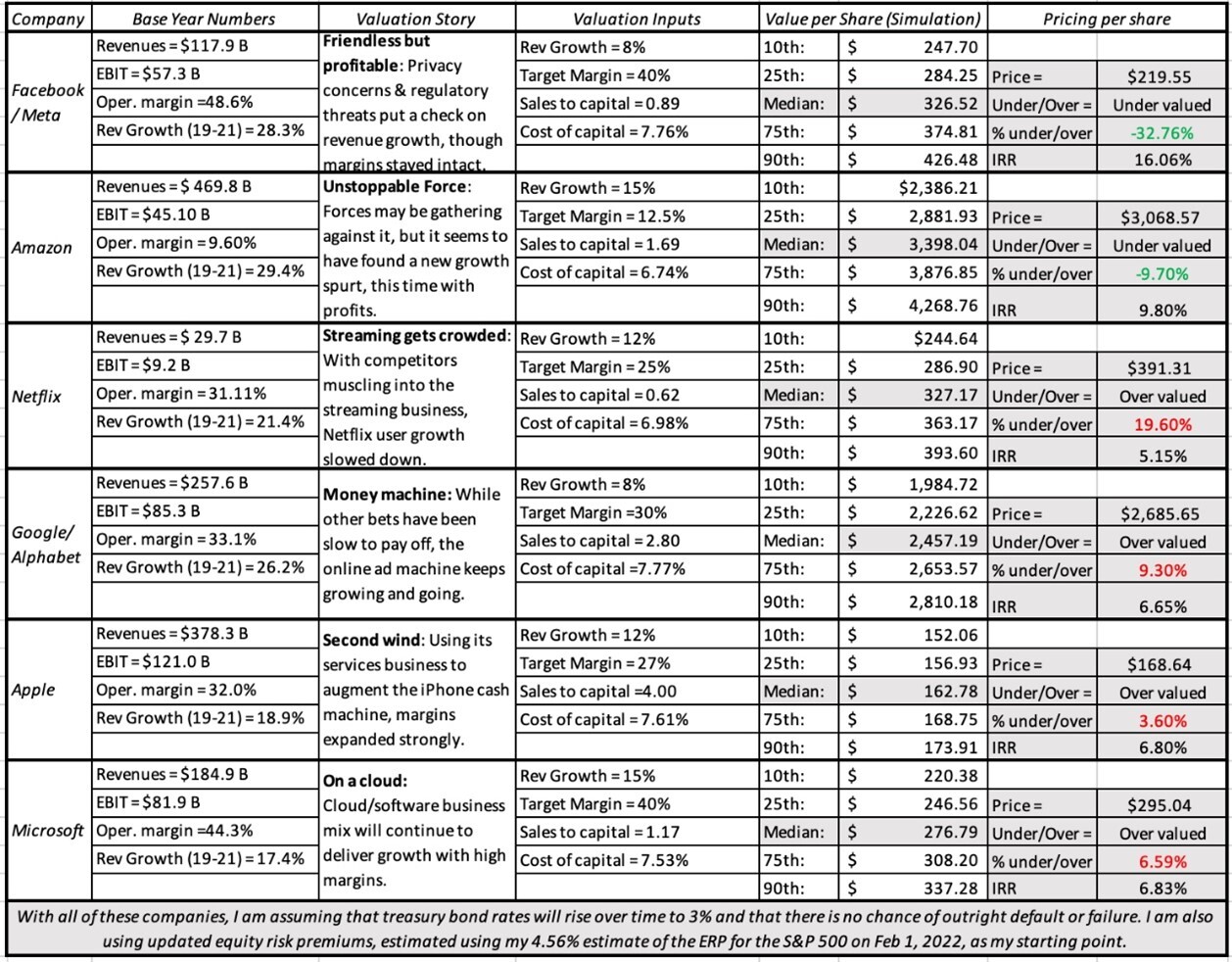

It has been a rocky year so far, in 2022, with worries about inflation competing with hopes about recovery for the market’s attention. In the midst of all the action, to no one’s surprise, have been six stocks (Facebook, Amazon, Netflix (NASDAQ:NFLX), Google, Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT), or FANGAM) that have largely driven U.S. equities for the last decade, roiling the market with their most recent earnings reports. Netflix and Facebook saw drops of 20% or more in market capitalization, following negative earnings reports, but Amazon and Google beat market expectations. In this post, I will be valuing each of these companies, both to assess whether to invest in them individually, and to examine whether there are lessons for the market in their price entrails…

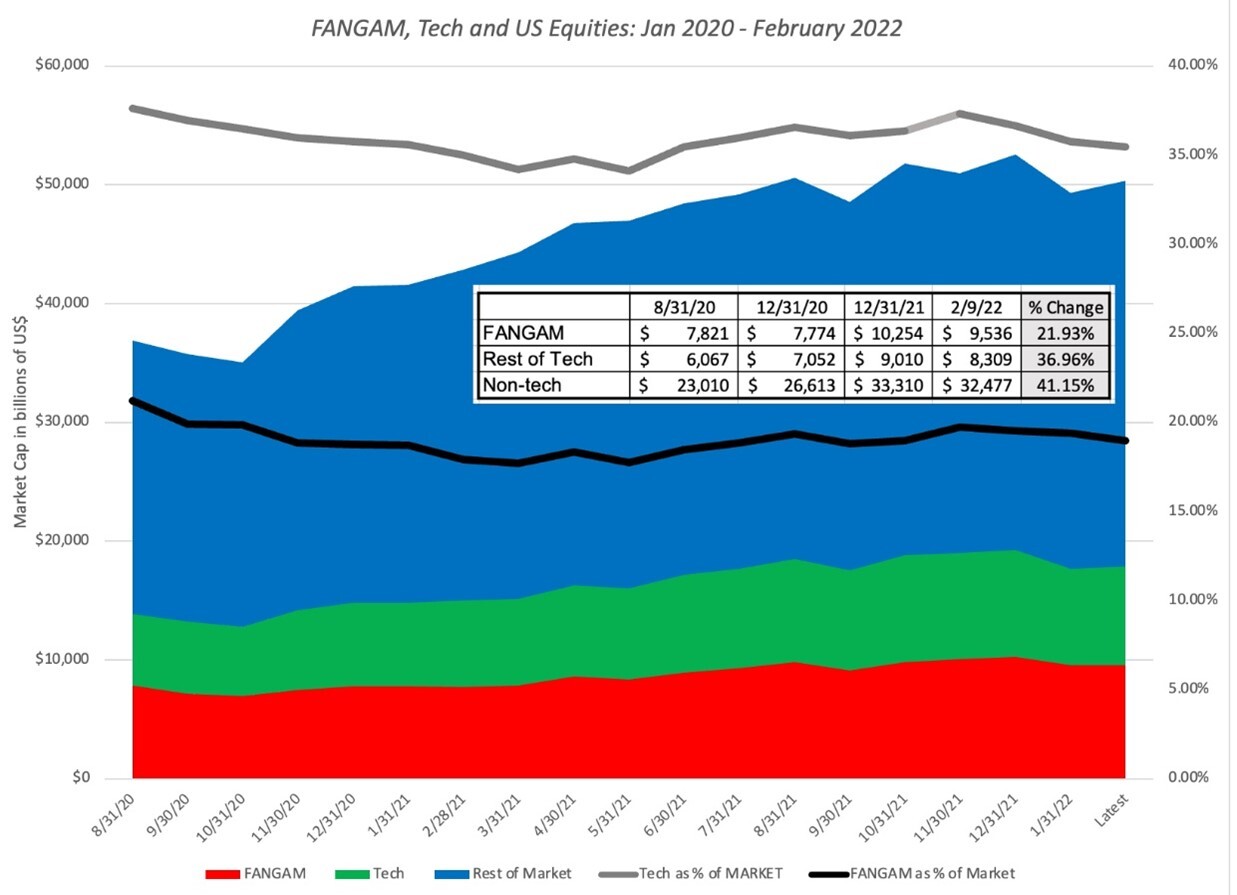

In the eighteen months since I valued these companies, much has happened, to the economy, to U.S. equities collectively, and to these six companies, in specific. In the graph below, I report on the collective market capitalization of U.S. equities, broken down into three groupings, the FANGAM stocks, all other U.S. tech companies and the rest of the U.S. equity market, from August 31, 2020 to February 9, 2022:

During the period, the collective market capitalization of FANGAM stocks increased by 21.9%, but they lagged the rest of the U.S. tech sector (up 37%) and non-tech U.S. equities (41.1%). For the first time in more than a decade, the FANGAM stocks are running behind the rest of the market…

In the trading game, where pricing is driven by mood and momentum, earnings reports and news stories are scanned for incremental news, information that ultimately will have little effect on value, but can move prices substantially. That explains the fixation with earnings per share expectations, and why seemingly trivial surprises, where a company beats or falls short of earnings expectations by a few cents can cause the market capitalization of a company to increase or decrease significantly. If you have been reading my posts, it should come as no surprise to you that I believe in intrinsic value, but I also believe that intrinsic value is driven by narrative. To me, the value effect of earnings reports and news stories comes from how they change (or don’t change) the core narratives for companies. In keeping with that belief, I revisited my narratives for the FANGAM stocks, with the intent of revising these narratives, based upon what we have learned about these companies in the last two years…

At the risk of repeating some of what I have said before, here is what the valuations tell me about these companies, as investments.

- Facebook looks the most undervalued of the six companies, but one reason is that it seems to have lost its story script. For a decade whether you liked or hated the company, the story that drove its valuation was a simple one: a platform of billions of users, about whom Facebook knew a great deal, and they then used that knowledge to deliver focused advertising. In short, this is a company that has built its business on accessing and using private data, and the privacy backlash seems to have finally led the company to try to redefine itself, first by renaming itself (Meta), and then muddying the waters about its business model. I think that the company is still a profit-generating behemoth, with some of the highest operating margins in American business, but I think that until it finds a cohesive story line, the price recovery will be stilted.

- Netflix is the most overvalued company in the mix, even after its major price knock down, after the last earnings report. The company has upended the entertainment business and made everyone else in the business play the game their way, but it has always been on a hamster wheel, where its primary sales pitch to investors is its capacity to keep growing its subscriber base, and the only way it can keep doing this is by spending ever-increasing amounts of money [on] new content. The question of how the company would get off this hamster wheel has always been there, and now that user numbers are starting to slow, and new users are becoming more costly to acquire, the challenge of doing so has become larger.

- Microsoft and Apple have kept their heads low, as the rest of the FANGAM stocks have been buffeted by controversy and blowback. Apple seems to have found a way to be one of the good guys in the privacy battle, and in the process, intentionally or not, it has helped deliver punishment to others (like Facebook) in this rarefied group. For Microsoft, buying Activision advances them further towards becoming a premier platform business, and the company’s diverse platforms (Office 365, LinkedIn, and now Activision) offer the potential for growth and sustained high margins.

- Google surprised me the most, delivering high growth and increased margins, suggesting that Facebook’s problems are its own, and that Google continues to steamroll its online advertising competition. The other bets at Google continue to be cash-draining investments that deliver little in value, and after six years, I am not sure that they will [ever be] big value creators, but that search box is the gift that keeps on giving.

- Amazon has, for much of its life, been a Field of Dreams company, offering investors a promise of revenues now, and if they wait patiently, profits in the future. For the first decades of its existence, all that investors saw was revenue growth, but margins remained slim to non-existent. In the last five years, Amazon’s margins have climbed and the company is solidifying its profit pathway, and while regulators and governments will try to rein it in, its mix of businesses and geographies will make it difficult to legislate against.

Are Activist Short Sellers Misunderstood?

3) In Wednesday’s e-mail, I shared this Bloomberg article, Vast DOJ Probe Looks at Almost 30 Short-Selling Firms and Allies, and concluded:

If regulators have reason to believe that a particular investor (whether long or short) has violated securities laws, then they certainly should investigate.

But that’s not what this looks like… Instead, it appears to be a fishing expedition that will be costly and have a chilling effect on short sellers, especially those with the courage to speak publicly about their findings. This is exactly the opposite of what our frothy, fraud- and hype-filled markets need.

Following up on this, I wanted to share this insightful article by Michelle Celarier in Saturday’s New York Times, Are Activist Short Sellers Misunderstood? Excerpt:

Short sellers aren’t loved, nor well understood, by the general public. They became the target of angry retail investors during the GameStop (NYSE:GME) trading frenzy early last year, blamed for driving GameStop’s stock into the ground before a short squeeze – in which the pace of buying forces short sellers to buy stock to cover their positions – catapulted it to the sky. The fracas sparked investigations into GameStop short sellers’ trading, but they have gone far beyond the wild events of January 2021. An investigation of short sellers by the SEC and the Department of Justice, first reported by Bloomberg, has ensnared at least 25 individuals and firms – most of them activist short sellers – who have received subpoenas and search warrants, an individual familiar with the investigation said.

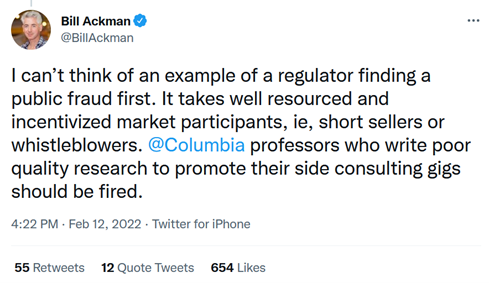

I think Bill Ackman’s take on this is exactly right:

By the way, this report is total garbage, bought and paid for by enemies of short sellers. Here’s Celarier in the NYT again:

The idea that short activists need to be reined in has largely been driven by Joshua Mitts. An associate professor at Columbia Law School who also has a consultancy business, he claimed in a 2018 research paper, “Short and Distort,” that activist stock sellers who wrote under pseudonyms were deceiving the market to make a quick buck, and that the stocks they shorted bounced back a few days later.

Ackman correctly called on Columbia to fire Mitts:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.

Updated on

Sign up for ValueWalk’s free newsletter here.