Down Round

Courtesy of Scott Galloway, NoMercy/NoMalice, @profgalloway

A week of contrasts that mark the age: A Russian president launches the invasion of a sovereign nation ahead of schedule; and a (former) U.S. president can’t launch a microblogging platform on time. At least our innovators will keep inspiring us. My favorite headline this week: “Artist Blows up Lamborghini Huracan to Sell Videos of Shrapnel as NFTs.” But I digress.

What’s thankfully diverted my attention from the full-scale war in Europe is spelled out below. As in look out below. Way below.

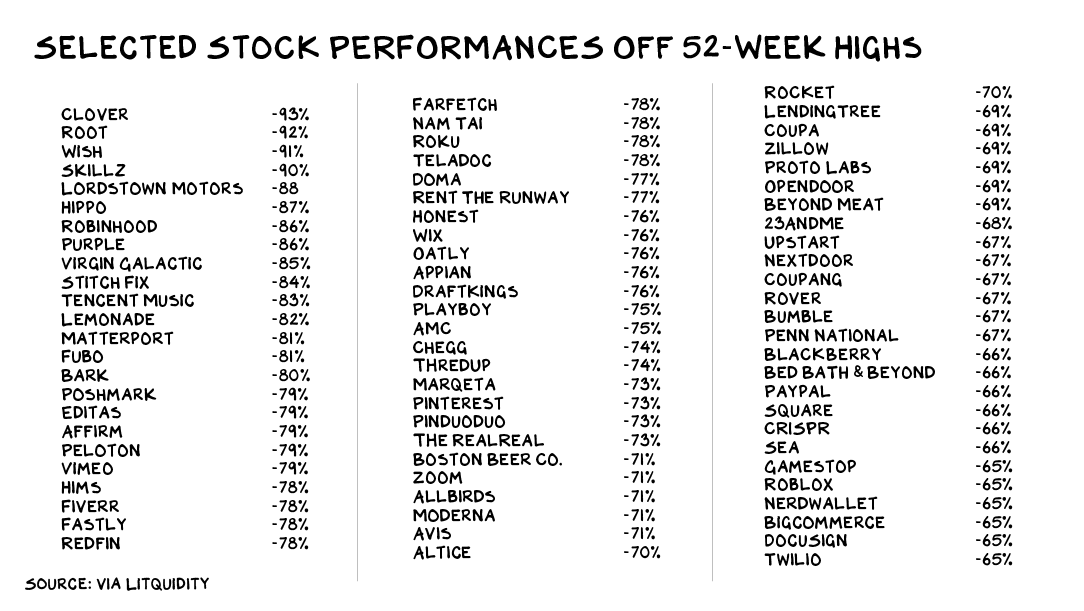

These aren’t cryptocurrencies. They’re stocks — many of them, large-cap stocks. OK, there are a few meme stocks in there, but there’s a mess of good, even great, companies that have shed more than two-thirds of their market value: Paypal, Zillow, Bumble, Roku, etc. Aggregate the losses above and you get … $2.2 trillion. So the aforementioned businesses have lost the equivalent of the GDP of Canada.

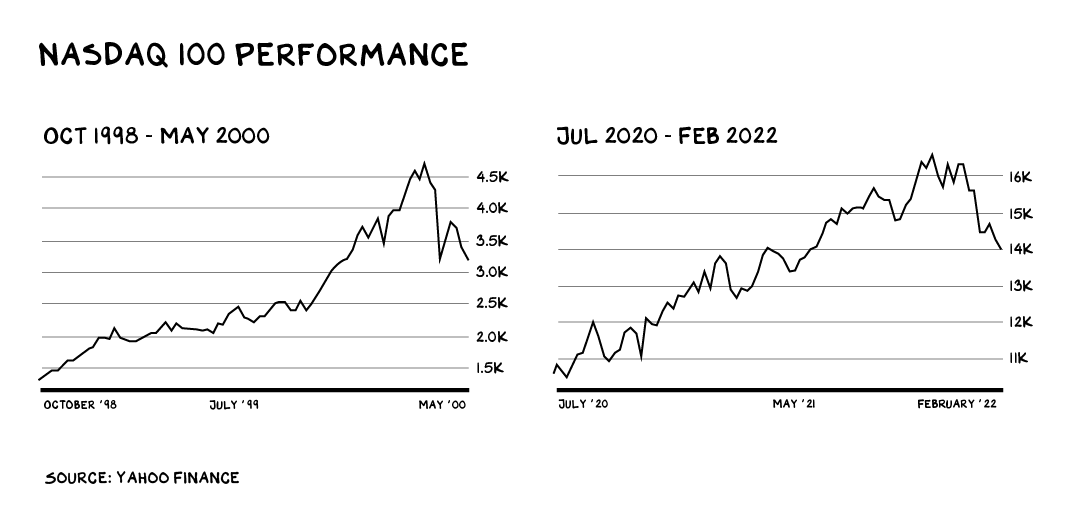

History doesn’t repeat itself, but it rhymes. Check that — it is repeating itself. If you’re too young to have seen Heathers, what’s going on may feel alien or as if it will soon revert back to “normal.” But if your perspective is broader (i.e., older), you probably recognize this is what the beginning of a bear market looks like.

The last big swing in the market followed the 2008 meltdown. For tech that was only a speedbump, not a tractor-trailer pileup. We need to venture back to the turn of the millennium for a deep, cyclical transition in tech. It’s feeling very 2000: record venture funding, record quit rates, day trading frenzies, a mass tech movement that promises to better humanity. BTW, my favorite movie of 2000 was Magnolia. That same year, I moved to New York to join the faculty of NYU and registered a (paper) wealth decline of 95%. Good times.

Public markets synthesize billions of signals every second and distill these bits and emotions into an indifferent number that points to a direction. Private markets take longer to reflect reality, because private ownership changes hands less often, and out of view. But private markets inevitably come in line, and just like the tail of a whip, the smaller market can deliver greater pain.

Growth hedge funds are registering their worst numbers in years. Earlier this month, Tiger Global announced it was pulling back from funding large, late-stage startups. So did D1 Capital, another growth specialist. Q: Why? A: Simple. They believe there is now better value in the public markets.

Eyes Wide Shut

If you’re under 35, the year 2000 might as well have been the Middle Ages. Which means founder/CEOs are about to add a new phrase to their vocabulary: “down round.”

For two decades, the script, lighting, and backdrop have all centered around one narrative: Grow … at any cost. More raising, hiring, building — the fun parts of running a company. All the while, investors rubbed the smalls of CEO’s backs and channeled their inner Billy Joel: “I love you just the way you are …”

Tales From the Crypt

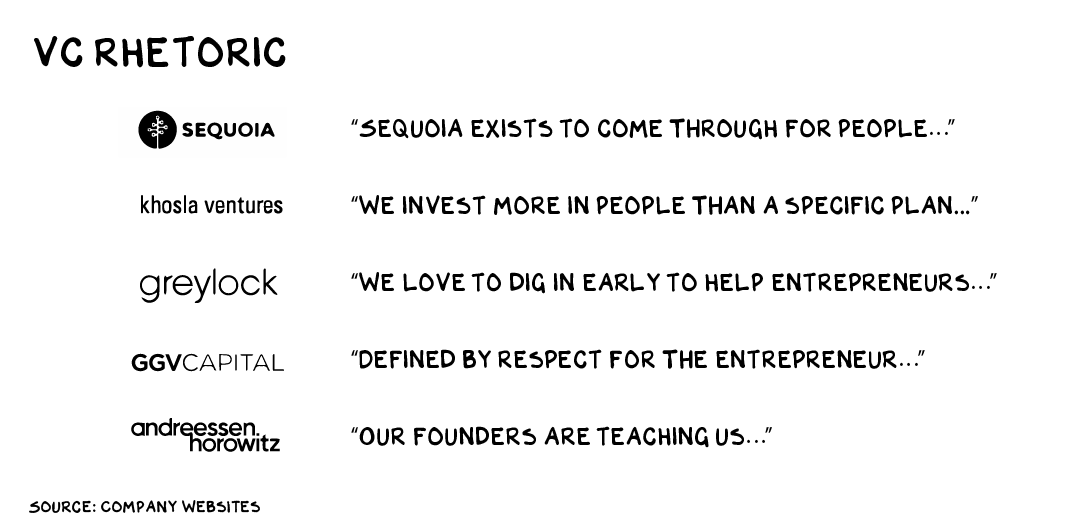

There’s no way, short of experience, to appreciate how violently things can turn. I’ve been on this ride: It’s nauseating and, though it’s lightning fast, feels as if it will never end … leverage shifts from ideas (founders) to capital (investors). In a bull market, money is everywhere, chasing ideas and founders. When money becomes scarce, its stewards accrete power. Adam Neumann may have been peak founder; super-voting shares and his investors’ fear of losing face gave Mr. Neumann leverage that garnered him a 10% commission on $12 billion in losses. This fulcrum of advantage, like a clock’s pendulum, is rarely in a place of equilibrium. The asymmetric advantage can and will flip to capital.

Power is the medium through which this conflict plays out. Power on the cap table, on the board, to determine the exit and who gets liquidity. Dilution becomes punishing as capital becomes more dear. Companies are forced to raise money at a valuation below that of their prior round: the dreaded “down round.” But they have no choice, because they’re built to burn and need the fuel. So investors take bigger and bigger chunks, while founders’ shares dwindle. In three financing rounds from 1999 to 2002, onerous terms (see above: asymmetric leverage) reduced my ownership in Red Envelope from 30% to 6%.

After years of acting as the doormen, DJs, and dealers at the disco party, VC firms begin scolding CEOs for their profligate spending and demand they sober up. Boards, correctly, ask management to construct a plan that acknowledges the new reality, which is Latin for “fire people.” Over the past three decades, I estimate I’ve hired (personally) 400+ people and fired 100. It’s always awful. It never gets easier.

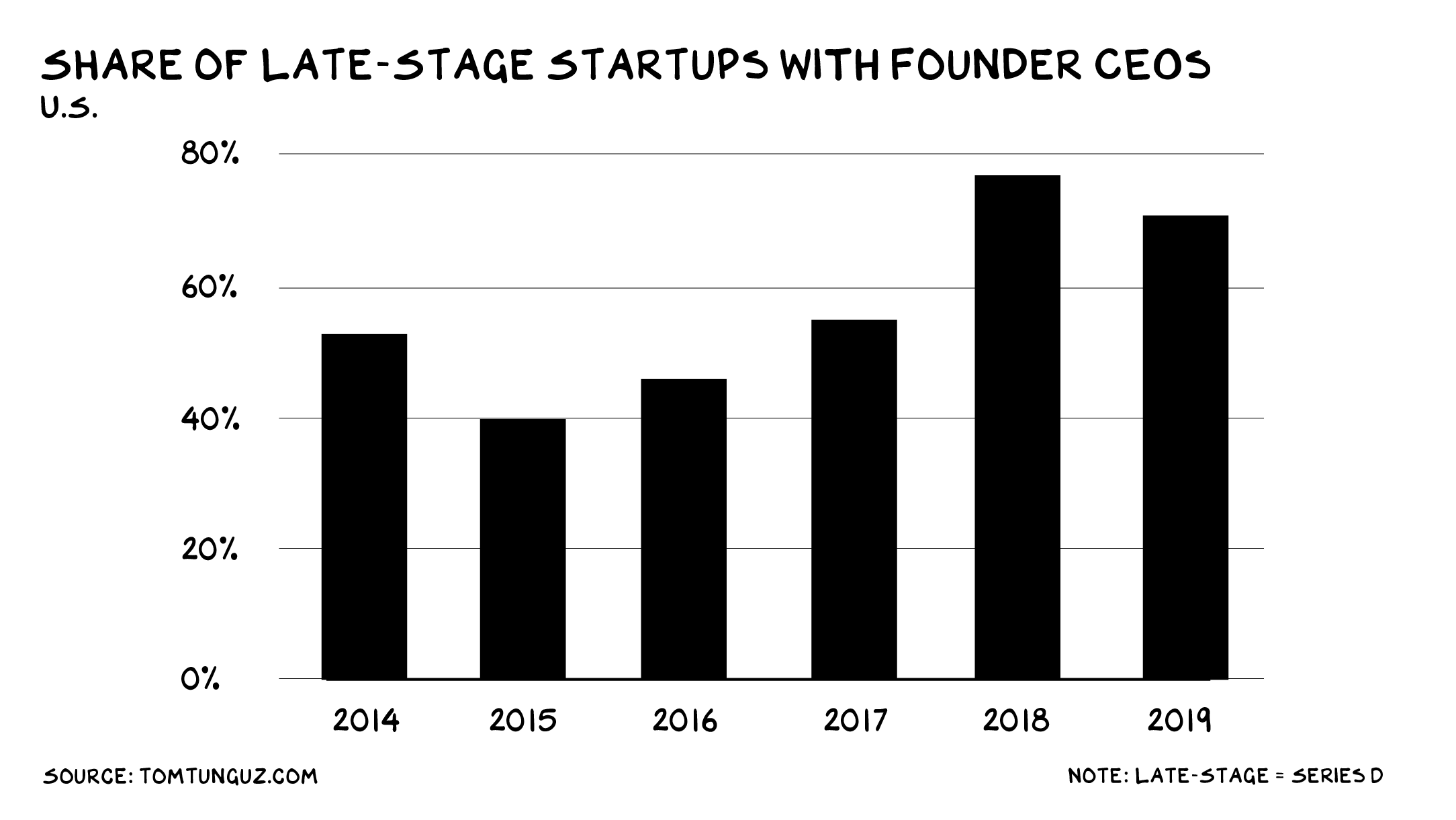

Founders rarely get fired, but you should expect to see a rise in tweets announcing how thrilled these thirtysomething wunderkinds are to have the wisdom of a new CEO (who the board forced in above them). The share of late-stage startups that are founder-led has been growing, but that will come to an end this year. Prediction: By 2025, the trend in the chart below will be sharply down.

If this is the beginning of a correction, Big Tech will be (wait for it) a winner. For years the narrative has been how difficult it is to hire talent, and how startups with limitless upside are poaching from established players. In 2001, B2C and B2B (as in, business-to-consumer commerce and business-to-business commerce) went from being the two pillars of the dot-com venture-backed boom to being derided as “back to consulting” and “back to banking.” This time, it will be B2BT.

The Walking Dead

A host of illusionist tricks will be deployed to obscure what’s actually happening in the private markets. Deals will be structured so the headline valuation stays high, but the terms — liquidity preference, control mechanisms, and deal structures — will radically change the economics and governance. The next step is euthanasia. Expect to see a lot of unicorns bought for undisclosed amounts. The deals will be presented as strategic, but they’ll really be acqui-hires. The best talent gets new options on more viable equity, the lawyers pick over the patent portfolio, and everything else gets quietly shut down. Peace with honor, sort of.

As you read this, some unfortunate partner at Andreessen Horowitz is pitching a Web3 portfolio firm on a real-time social-audio platform that would be synergistic — and it can be yours for the price of the cash on the balance sheet. The terms of the deal will not be disclosed. We’ll also see a lot of venture firms disappear. Money has been pouring into early-stage investments for years, but as go the private markets, so go VCs. With less money looking for a shepherd, the newcomers and weaker brand names will be unable to raise another fund.

9 to 5

I still shudder at the memory of calling a third of the employees at my first startup into a room and telling them they didn’t have a job any longer. It was horrible, especially because I knew I was the person in the room who’d lost the least that day. But we couldn’t afford them, and if we hadn’t laid them off, we’d have shut the whole business down six months later. Instead, that firm is now a $100+ million business with offices on three continents, employing far more people than we did the day before we fired a third of the team.

Your company is not your family, and your job is not your life. In this growth cycle, the workplace errantly became a platform for your conscience and political beliefs. It isn’t. Your job can be the ink in your pen, but it’s not your story. And despite the Hallmark Channel version of work, where management wraps itself in a progressive blanket and pretends to give a shit about your views on societal issues, don’t bring your whole self to work. This isn’t your family … it’s a team. Do what Jack Grealish did and go where the opportunity is. I have been fired, kicked off boards, had VCs hire Kroll in an attempt to intimidate me, and taken companies through chapter 11 receivership. All of it hurt, a lot. But each setback presented an opportunity, a new perspective, and a chance — even if it wasn’t clear at the time — to allocate my human capital elsewhere at a better return.

Breath of Fire

“Hi, this is Nurse Amanda from Gulfstream School. Your son threw up in class. Poor thing isn’t feeling well — can you come get him?”

Ughhh … I jump in the car, and at school I meet Nurse Amanda and a pale, sweaty 11-year-old. He’s got a minivan strapped to his back and holds a sole-purpose, neon-blue plastic bag. Nurse Amanda recommends he drink plenty of fluids and stay at home tomorrow.

We get in the car, and before I can reassure him he blurts out, “So I started feeling nauseous and went to Mr. Matthew’s desk and … Dad … I began vomiting. So much … it was like the breath of a dragon, and everyone was scared of me. The class began screaming, so I started chasing people as I was vomiting.” There’s real pride in his voice as he walks me through his barf bacchanalia.

Of course, I ask if he caught anybody. He turns serious. “Ethan … He’s slow.”

I had to pull over, I was laughing so hard. Once I caught my breath, I looked over to see my son fixated on me with the type of awe you register when you see something extraordinary for the first time. I don’t laugh out loud a lot. He seemed so happy … that I was so happy.

This Friday we’ll assemble in the school chapel, and they’ll read the names of all the fifth graders who made the head’s list. Last semester my son’s name was on that list. Not this term. But everyone in that chapel will know I am the father of the boy who chased kids down to vomit on them.

I don’t believe it’s possible for him to know how much joy he gives me. What does any of this have to do with the markets melting down? Nothing. But neither does anything really important.

Life is so rich,

P.S. If I’m right — and frankly I hope I’m not — the next five years will introduce early-stage companies to the meaning of the word “crisis.” I cover crisis management in the Brand Strategy Sprint — let’s get to work.