Courtesy of Chris Kimble

Before major market pullbacks, it is common to see internal market disconnections or divergences. And they often go on for much longer than investors think they will.

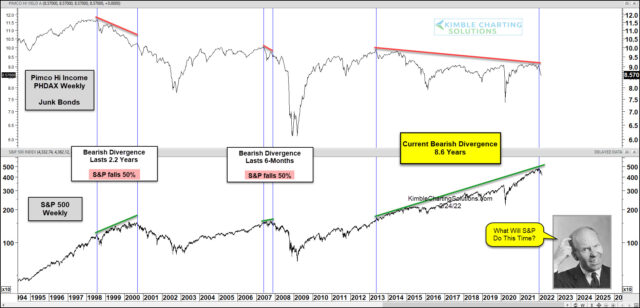

Today we look at high yield junk bonds and when this asset diverges from the broader equities market. It’s normal for junk bonds to perform well when stocks are heading higher as it’s a sign of “risk-on” (investors willing to take risks).

However, when junk bonds diverge and underperform while the stock market heads higher, it can be a warning sign that “risk-on” is fading.

Before the 2000 stock market crash, high yield bonds created a bearish divergence that lasted 2.2 years. Then in 2007, they created a 6 month bearish divergence before the market cracked.

Well, looking at the chart below we can see an 8.6-year bearish divergence. Yikes! Wonder what the S&P 500 will do next?

Maybe it will be different this time!

This article was first written for See It Markets.com. To see the original post CLICK HERE.

To become a member of Kimble Charting Solutions, click here.