By Refinitiv. Originally published at ValueWalk.

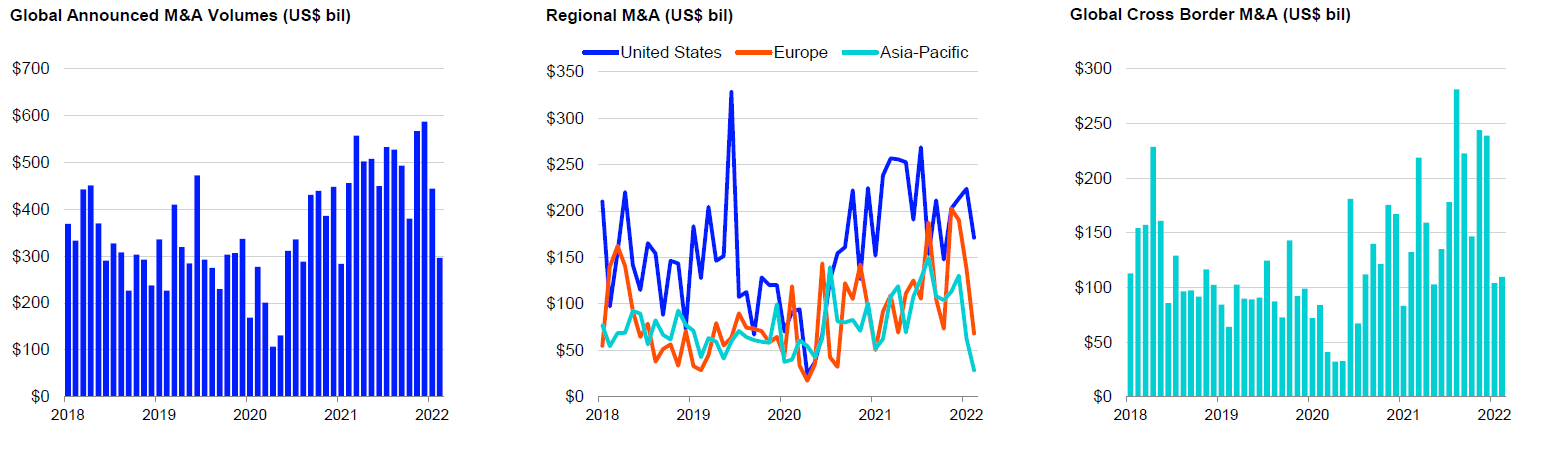

“US$740.9 billion worth of deals were announced globally during the first two months of 2022, levelling the value recorded during the same period last year and a year-to-date total only exceeded once since our records began in 1980, in the year 2000 (US$761.7bn). Deals totalling US$296.7 billion were announced during the month of February 2022, down 33% compared to the value recorded during January 2022 and 35% less than value recorded during February 2021,” comments, Lucille Jones, Analyst, Deals Intelligence, Refinitiv.

Q4 2021 hedge fund letters, conferences and more

Refinitiv Deals Intelligence | February 2022 – Global M&A Snapshot – Global M&A Hits $741bn YTD – Only Exceeded Once Since Records Began in 1980

- US$171.2 billion worth of deals involved a US target during the month of February 2022, down 28% compared to the same month last year. Deals involving a European target reached US$68.2 billion, down 26% compared to February 2021 and the lowest monthly total in ten months. Meanwhile merger activity in Asia Pacific totalled US$28.4 billion, down 54% compared to February 2021 and the lowest monthly total in five years.

- Cross border M&A totalled US$213.7 billion during the first two months of 2022, down 1% from the same period last year. Deals worth US$109.7 billion were recorded during the month of February 2022, up 5% from the previous month but marking a 17% decline from February 2021. Cross Border transactions account for 29% of all deals by value so far this year. The United States is the most active nation, with US acquirors accounting for 41% and US targets accounting for 23% of cross border M&A activity so far this year.

Record annual start for PE-backed and Technology deals; Spac deals slow to 19-month low

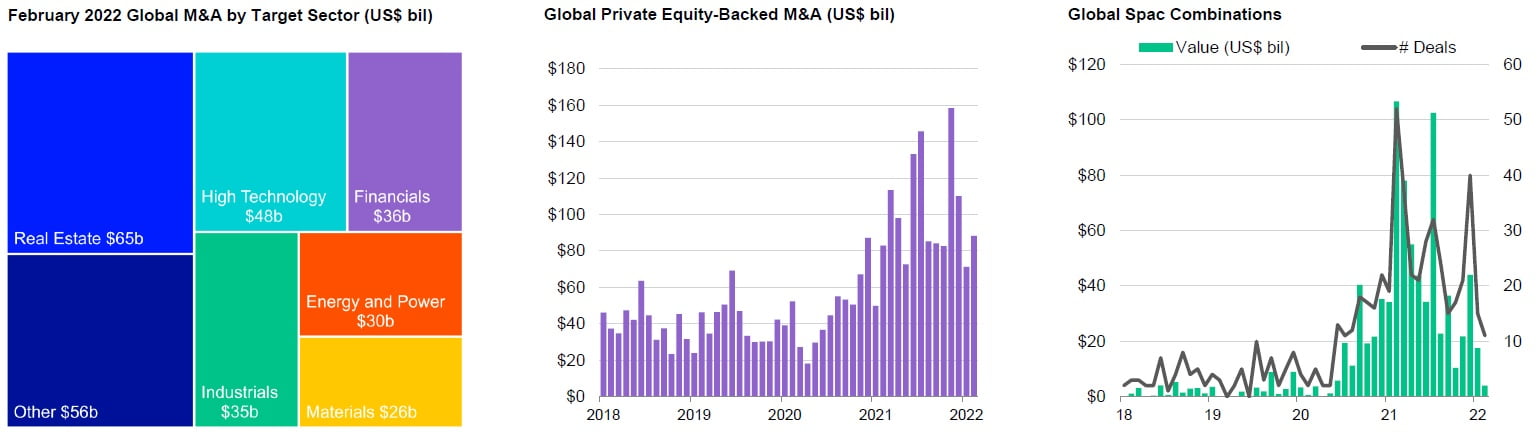

- Deals in the real estate sector totalled US$65.4 billion during February 2022, double the value recorded during January and a three-month high. While real estate leads by value, Technology is the most active sector by number of deals announced during February 2022. Technology has been the leading sector by number of deals during each of the last 26 months. Tech M&A totals US$187.4 billion so far during 2022, up 24% from last year and an all-time year-to-date record.

- Private equity-backed M&A transactions totalled US$88.3 billion during February 2022, up 24% from the previous month and 7% more than the value recorded during the same month in 2021. Deals worth US$159.7 billion were recorded during the first two months of 2022, up 20% compared to the same period in 2021 and the highest year-to-date total since our records began in 1980. Private equity deals account for more than one-fifth of all deals by value this year, the highest share since our records began.

- Eleven acquisitions by special purpose acquisition companies were announced globally during February 2022, the lowest monthly tally since July 2020. The combined value of these deals was US$4.0 billion, compared to US$106.6 billion during February 2021, the all-time monthly record. Spac acquisitions reached US$21.4 billion during the first two months of 2022, an 85% decline from YTD 2021.

Sources: Data – “Refinitiv Deals Intelligence” | Commentary – “Lucille Jones, Analyst, Deals Intelligence, Refinitiv”

Updated on

Sign up for ValueWalk’s free newsletter here.