Happy Death Cross Day!

Happy Death Cross Day!

There's no excuse for forgetting to bring a present – I told you this was going to happen last Thursday, when I said:

As we predicted in our Live Trading Webinar last month, we're about to hit that "Death Cross" on the S&P 500 and that is BAD. Even though we could see it from literally a mile (and a month) away, it will still come as a surprise to traders and analysts, who use TA completely wrong on a mass scale. As I said at the time, if you understand HOW a chart is made, then you can predict what it will look like in the future. If you are GUESSING where the market will go based on the chart you see – you're doing it wrong.

Very simply, the 50-day moving average changes slower than the 200-day moving average and "slower" isn't just some vague notion – it does, in FACT, change at a pace that is 25% slower than the 50-day moving average so every day the market closes below the 200-day moving average, it drags the 50-day moving average 4x lower than it does the 200-day. Therefore, we KNOW how many days it will take before we get our crosses long, long in advance.

What does the Future hold? Well we have the Fed Meeting next week and inflation is out of control so it's not at all likely they don't hike at all and the market expects 0.25% and 0.5% would be a big negative – so there's no likely positive there. We also have PPI, Retail Sales, Housing Starts, Industrial Production and the NY and Philly Fed – hard to see any of those things popping us over the 200 dma so, if we assume we have another 7 trading days below the 200 dma – that is likely to pull the 50 dma below 4,450 – where we'll get our cross into Q1 Earnings – which are not going to be very positive either.

Meanwhile, we watch and wait for the market to resolve itself but that looming Death Cross means it's not likely we'll be jumping off the sidelines in the next two weeks. We went over our hedges yesterday and they seem adequate but I do keep thinking I'd rather be in CASH!!!

And thank goodness we didn't as all these head fakes were just that and, this morning, China is melting down (also as we predicted) with the indexes over there down more than 5% this morning and now more than 10% below their pandemic lows. The main catalysts for China are the ongoing builder crisis, the sudden persecution of tech giants and now Covid is spreading though the Middle Kingdom, shutting things down again.

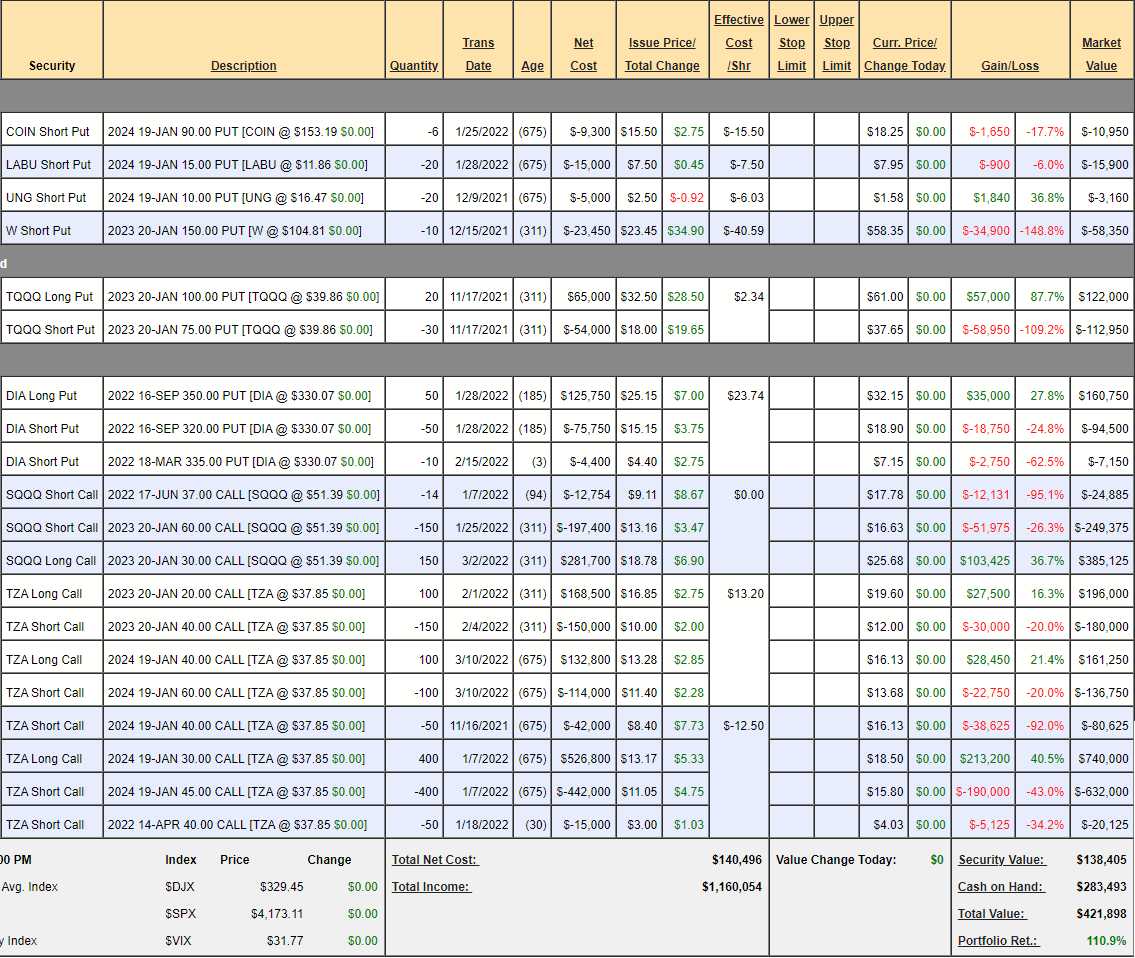

CASH!!! was a good call and still is as – looking at China's market melt-down – there is NOWHERE to hide once investors start selling so I'm still strongly considering pulling the plug on our portfolios, rather than trying to ride out this storm. That brings us to our Short-Term Portfolio Review (STP), which is where we hedge our long portfolios. Let's see if we feel like we have enough insurance after last week's adjustments in our Live Member Chat Room (CVX yesterday dropped too fast so it was a voided play):

- COIN – Not worried at all.

- LABU – Happy to own them for net $7.50.

- UNG – Easy money.

- W – Killed us in the past week, losing another $12,000 but our net is $126.55 and we can roll the Jan $150 puts to 20 of the 2024 $90 puts at $27 for about $4,000 (we collected $23,450 to start), which would put us in 20 2024 $90 puts at net $9.75 so $80.25 if assigned is our longer-term target and we can live with that. Keep in mind this is a bullish offset in a bearish portfolio.

- TQQQ – This is a $50,000 spread that's well in the money on 20 and then we have 10 short Jan $75 puts. The spread is at $24 out of a possible $25 so it's of no further use to us so we'll close 20 and that leaves us with 10 short 2023 $75 puts and, rather than buy them back at $37.65, let's buy 10 TQQQ 2024 $70 puts at $37. The premium on the short Jan $75s will wear out faster than the 2024s and, once that happens, we can roll to a 2024 spread and hopefully retain some of the net.

- DIA – Dow is falling a little faster than we thought but the March puts expire on Friday and we'll either roll them along or sell new puts for the next cycle. This is a $150,000 spread at net $59,100 so we have $90,900 worth of downside protection.

- SQQQ – Thos was our original primary hedge but we've cashed most of it out. Still $450,000 at net $110,865 so $339,135 of downside protection if SQQQ goes up 20%, which would be a 7% drop on the Nasdaq.

- TZA 1 – We have 50 extra short Jan $40 calls and we're at $37 but we'll just buy more longs and roll them if we have to. This is 2 $200,000 spreads – one is in the money and the other one is really there to cover the extra 50 short Jan $40s, so we won't count that as protection. So the $200,000 Jan $20/40 spread (calling the extra 50 part of the 2024 spread) is net $76,000, so we have $124,000 left to gain at $40.

- TZA 2 – Here we have a $600,000 spread and the short April calls are still out of the money so just a lot of premium there. We're at net $87,875 not counting the 50 short 2024 $40 calls, which we will have to deal with some day. That means we have an incredible $512,125 of downside protection at $45 which is also about 20% away so a 7% drop in the RUT would put us in the money. This is fantastic for a new hedge (with just the short April calls).

A few things to make note of: These hedges don't pay out unless the indexes go down AND STAY DOWN into the expriation date. They are hedges, not BETS – which means their main purpose is to let us keep our longs so, if the market bounces back – we lose on the hedges and win on the longs. If we start cashing out longs – these become bets and our strategy will need to shift.

As it stands, we have $1,066,160 worth of downside protection, most of which kicks in after just a 7% drop from here. It's a lot of protection and, so far, our long portfolios are holding up well so I'm not inclined to add more at the moment. Unlike our other portfolios, we adjust the STP whenever we need to (as opposed to monthly around expirations), so I don't see any reason to change. If anything, we'd like a bounce to get us out of trouble on some of these short-term covers we sold that are in the money.

As it stands, we have $1,066,160 worth of downside protection, most of which kicks in after just a 7% drop from here. It's a lot of protection and, so far, our long portfolios are holding up well so I'm not inclined to add more at the moment. Unlike our other portfolios, we adjust the STP whenever we need to (as opposed to monthly around expirations), so I don't see any reason to change. If anything, we'd like a bounce to get us out of trouble on some of these short-term covers we sold that are in the money.

We have a Fed day tomorrow and we'll be in our Live Trading Webinar so, if things go crazy – make sure you're watching us live as we may need to adjust things then.

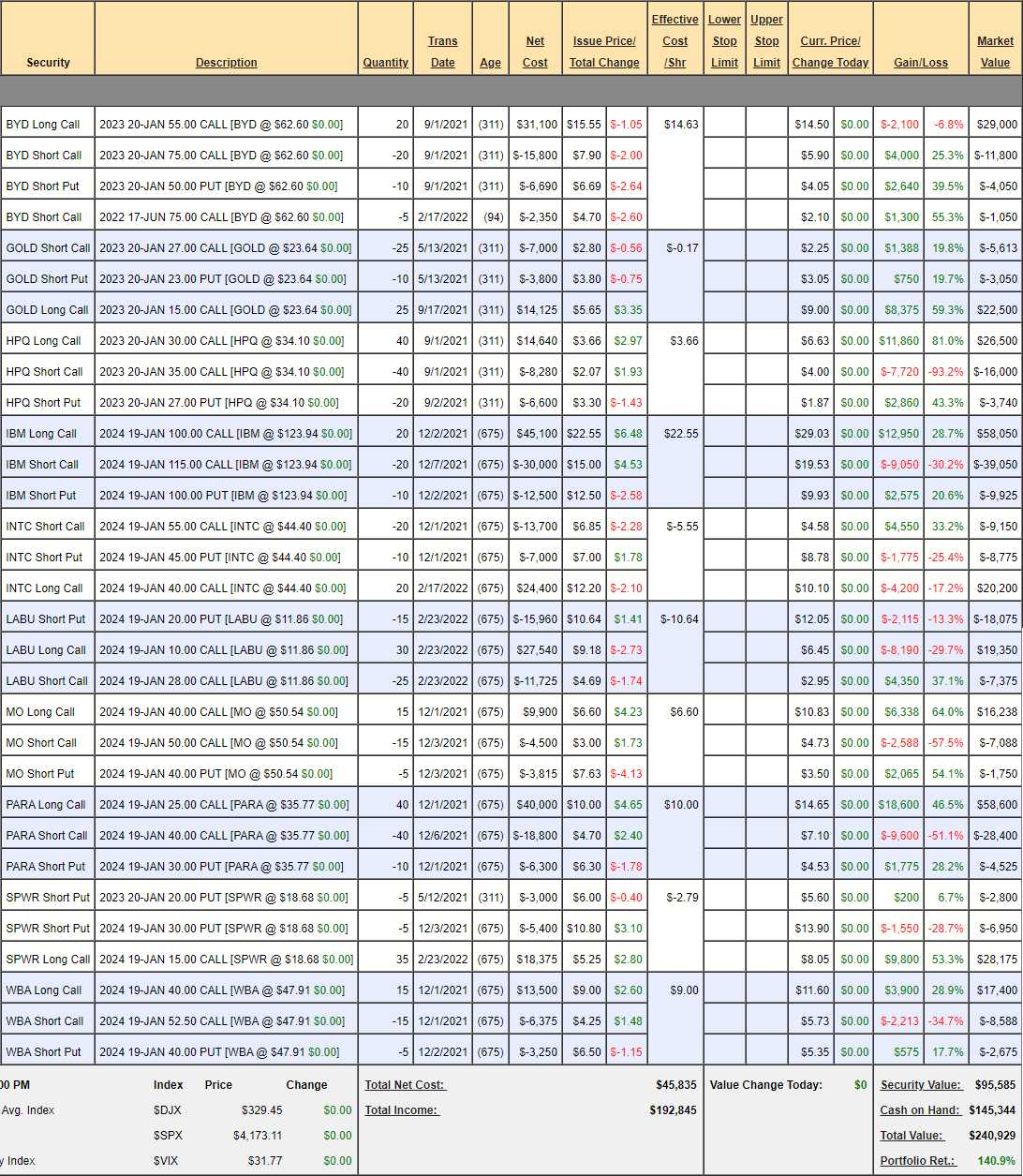

Money Talk Portfolio Review: $240,929 is up $3 since our Feb 16th review. I am so proud of that as it shows we are very well-balanced and the S&P was at 4,460 that day, now 4,192 so down 6% for the month yet we held up. It's important that we are balanced in the MTP as we can only make changes when we're live, on the show – about once per quarter.

I am super-proud that we took a big chance and got more bullish on SPWR as it was right before they finally popped – now we have to hope they can hold it as we're stuck bullish until probably May. Still, it's a very strong collection of stocks in generally well-hedged positions yet we're still up 140.9% in just over 2 years – nothing wrong with that:

- BYD – Right on track at net $12,100 on the $40,000 spread so we have $27,900 (230%) left to gain by Jan if BYD makes $75. What's not to love?

- GOLD – Gold is up and down like crazy but I think $2,000 is the right price for Gold and that makes GOLD (Barrick) undervalued at $27, which is our target. This is a $30,000 spread that's currently net $13,837 so $16,163 (116%) left to gain and we're already $8.64 ($21,600) in the money. Aren't options fun?

- HPQ – Hit our goal a year ahead of schedule yet we're only at net $6,760 on the $20,000 spread. That means there's $13,240 (195%) left to gain by January if HPQ can get over $35 – just one more Dollar! If not for the markets turning sour, this would simply be free money there for the taking and I still love it as a new trade but we came in with a net credit!

- IBM – Our Trade of the Year for 2022 and we're well in the money at net $9,075 on the $30,000 spread and yes, that's correct, there is $20,925 (230%) left to gain DESPITE the fact that we're already in the money. Options be CRAZY! Needless to say it's good for a new trade – even though our Members and Money Talk Viewers came in at just $2,600 in December – they are already up $6,475 (249%).

- INTC – Supply shortages are killing them and we knew 2022 was going to be rough but we didn't want to miss it if they popped. No danger of that at the moment. So, you can get in better than our entry at net $2,275 on the $30,000 spread that's $8,800 in the money to start. This spread has $27,725 left to gain and we have two years so I'm still confident.

- LABU – We just added these on last month's show and no luck so far as we got crushed on the $54,000 spread. It's currently a net $6,100 credit so the upside potential is $60,100 (985%) but I'm not going to count this one since LABU is looking so bad but it's a Biotech ETF and I'm sure it will get hot again when things settle down.

- MO – So nice and boring. It's a $15,000 spread that's in the money at net $7,400 so $7,600 (102%) left to gain – yawn.

- PARA – Changed their name (was VIAC) and perked up a bit. This is a $60,000 spread that's $40,000 in the money but only net $25,675 so there's still $34,325 (133%) left to gain and I've broken 5 tables banging for people to buy this stock so I'll just say it's good for a new trade and leave it at that.

- SPWR – Damn, we hit $20 and now pulling back. That's OK, I'm very confident we hit $25, which would put us $35,000 in the money and we're currrently net $18,425 so $16,575 (90%) left to gain but we'll reduce the basis selling short calls, hopefully in May.

- WBA – Still holding up is a good sign. This is an $18,750 spread at net $6,137 so $12,613 (205%) left to gain makes it great for a new trade.

So we have 10 positions that we expect to gain $177,066 over the next two years and we still have $145,344 of CASH!!! on the sidelines to play with. If the market doesn't collapse, we're well on track towards making another 50% for each of the next two years, which is the goal of this portfolio (30-40% really).

IN PROGRESS