"Nothing really matters, Anyone can see,

Nothing really matters,

Nothing really matters to me

Any way the wind blows…" – Queen

Powell emphasized we have maybe two half-point hikes ahead of us and the market loves it this morning!

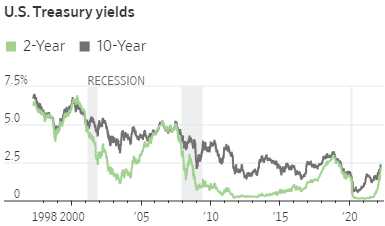

Yield curves are flat, which reliably predict every recession – gotta love that! 3.5M people have left Ukraine, causing a refugee crisis in the rest of the World – more love. One-month anniversary of a war that's getting worse – love it. Banks in China have seized $2Bn worth of Evergrande properties as that company continues to spiral down – lovin' it! Miami Beach is under curfew in a State of Emergency – sping breakin' it! Biden is warning of impending Russian Cyber Attacks on US Companies – who doesn't love that?

Yield curves are flat, which reliably predict every recession – gotta love that! 3.5M people have left Ukraine, causing a refugee crisis in the rest of the World – more love. One-month anniversary of a war that's getting worse – love it. Banks in China have seized $2Bn worth of Evergrande properties as that company continues to spiral down – lovin' it! Miami Beach is under curfew in a State of Emergency – sping breakin' it! Biden is warning of impending Russian Cyber Attacks on US Companies – who doesn't love that?

Here are the two and 10-year notes as they race to oblivion. Bond investors like to think their money is safe but the cash value of the 2-year notes have lost 4% in 6 months and the 10-year notes have dropped 12% in two years. Yes, if you hold them to maturity you get all of your investment back plus all the promised interest – but that money buys 50% less gasoline, 20% less house, 40% less gold, 20% less food, etc. Powell is promising much more of the same to the bond holders yet, this month, the US Government willl attempt to sell $250Bn worth of debt at the same stupid-low rates. Something has to give at some point…

Meanwhile, since the markets don't seem to mind any of this stuff, for the first time since March 3rd we can take a look at our more bullish bounce chart. The 20% Bounce Chart assumed the indexes would fall 20% and the Russell and the Nasdaq did but the Dow and the S&P remained resiliant BUT, unfortunately, still down 15% and, as of this morning – only the Dow is close to reclaiming the higher chart – which charts the retracements from the highs:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

|

The S&P and the Russell are not to far away and that's AMAZING as these markets can apparently shake off any bad news. Of course, to some extent, Inflation feeds the market as higher prices end up being higher profits and, as the buying power of the Dollar decreases, the commodity cost of the stock itself rises – so you simply need more Dollars to buy the same stocks.

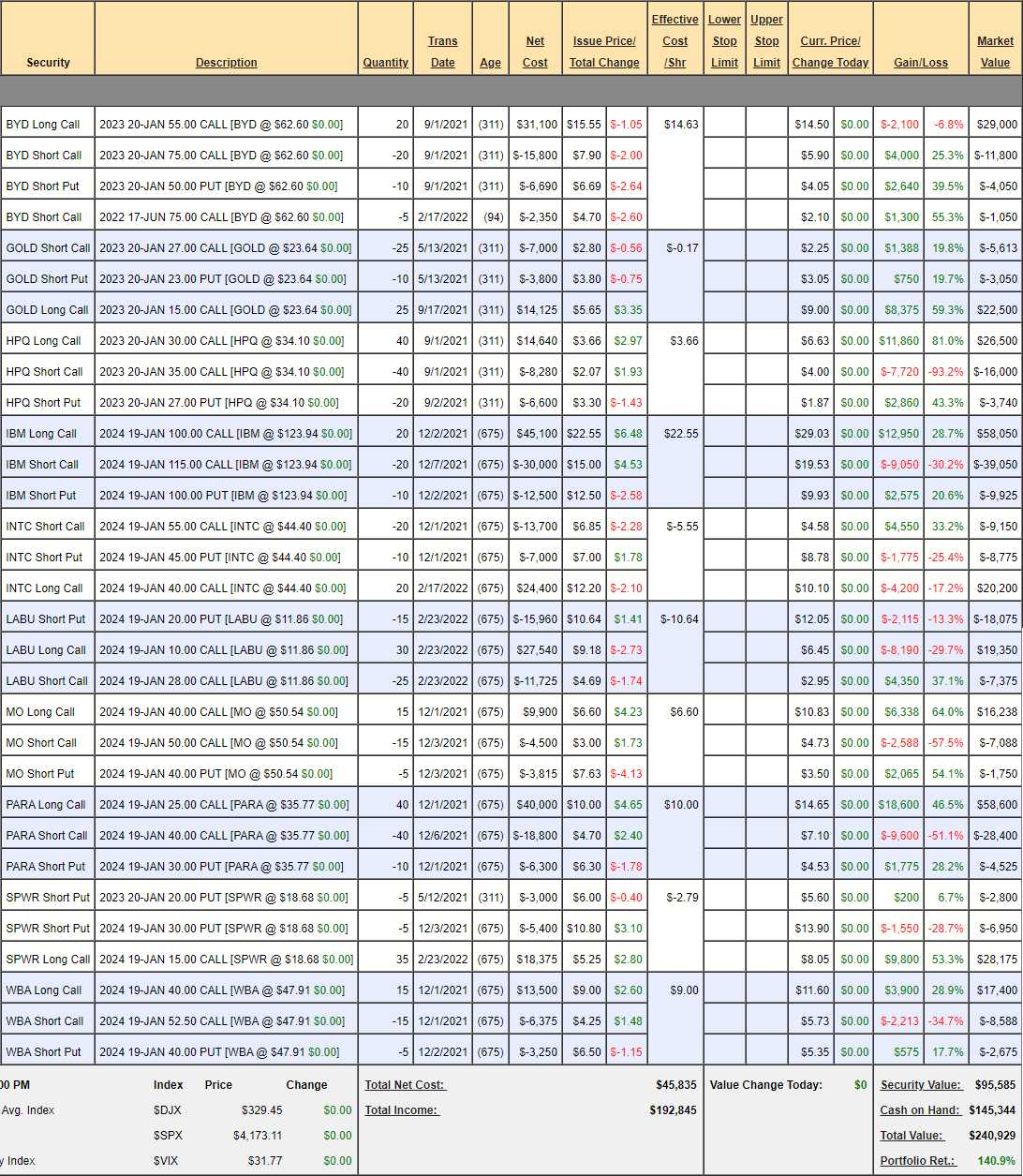

Take, for example, our Money Talk Portfolio, which we reviewed last Tuesday and, because we only make changes right on the show, not a thing was touched but look what happened to the positions in just seven days. Last week, we were at $240,929 – up 140.9%:

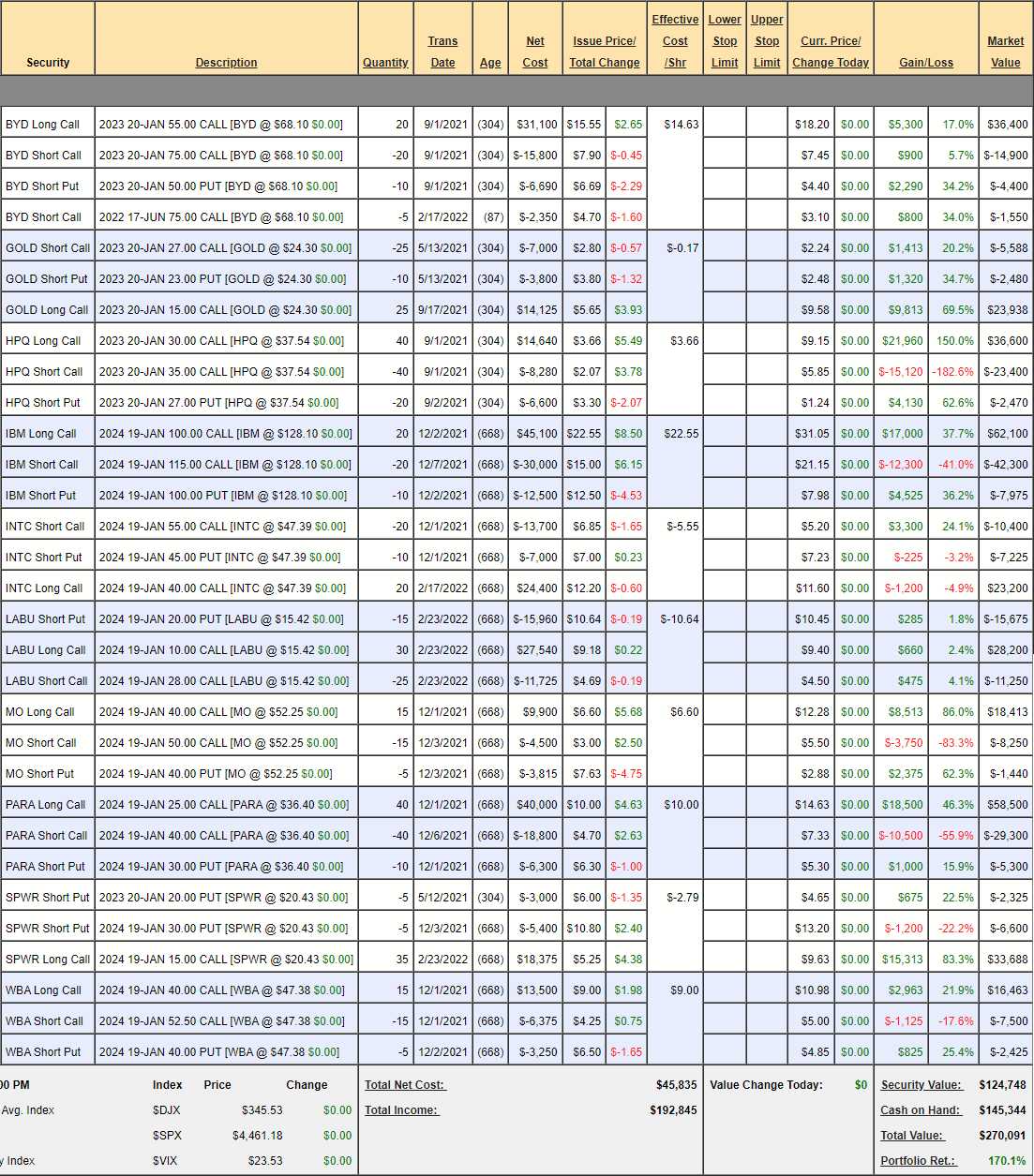

Now, just 7 days later, those same positions are at $270,748 – up 170.1% and up $29,162 (29.2%) for the week. That's just silly, isn't it?

This is why we are loathe to let go of our long positions in this kind of environment – scary though it may be. The market is like a water-ballon race and we're just betting the balloon will get bigger before it pops. When it does pop, we have our Short-Term Portfolio, which is holding up well so far and carries about $1M of downside hedges (see last week's STP Review for details).

As the LTP grows, we generally take about 1/3 of our unrealized gains and push them into improving our hedges – just in case. At the moment, the market is pretty much ignoring all the bad news. Natural Gas (/NG) popped back over $5 this morning and Oil (/CL) is down from $113 but still $110 yet equities are up about 1%. When the market is down, these are all the same reasons they point to, aren't they? We've seen this behavior before – right before the last two crashes. Will it matter this time?