By Jacob Wolinsky. Originally published at ValueWalk.

Elm Ridge commentary for the first quarter ended March 31, 2022, titled, “That’s My Story And I’m Sticking To It.”

Graham and Dodd investors are people who place a very high value on having the last laugh. In exchange for the privilege, they have missed out on a lot of laughs in between.” – Michael Lewis

Q4 2021 hedge fund letters, conferences and more

I came in as the sun came up.

She glared at me over her coffee cup.

She said: “Where you been?” so I thought real hard,

And said: “I fell asleep in that hammock in the yard.”

She said: “You don’t know it boy but you just blew it.”

An’ I said: “Well that’s my story and I’m stickin’ to it.”

– Collin Raye, “That’s My Story”

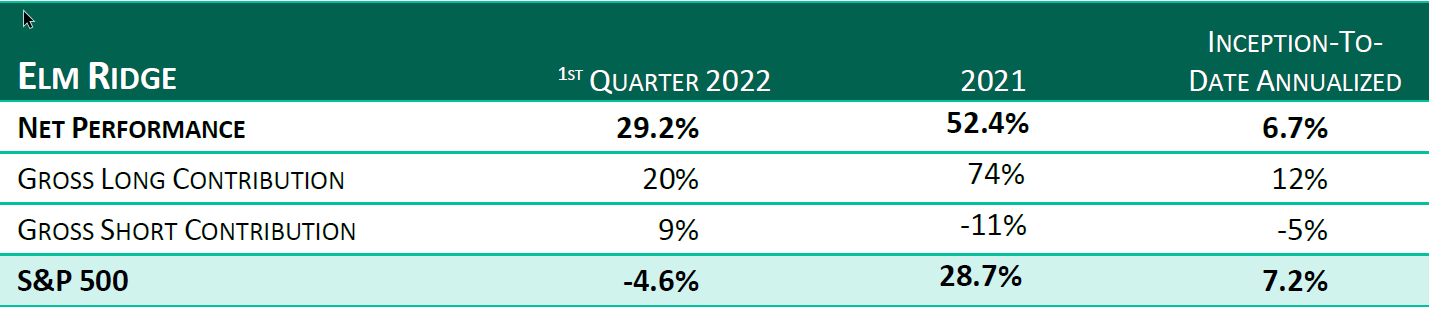

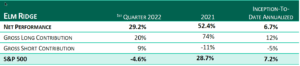

We posted a good quarter, extending our performance to 180% since we were forced to scale back in March 2020 and almost 100% v the S&P. But while it may look to us that we’ve embarked on a new investing regime, the greater investment world is having none of that.

What It Is? What It Was

You can find me in the club, bottle full of bub

Look, mami, I got the X, if you into takin’ drugs

– 50 Cent, “in Da Club”

Let’s go back a year. Retail investors were piling into risky meme stocks. The ARK Innovation ETF (NYSEARCA:ARKK) was inundated with inflows. It seemed everyone of import was piling into the same group of CBGB (Certified Bonified Good Business3) stocks. The prevailing wisdom on the Street was that inflation was temporary and rates were therefore not a threat to high-multiple growth stocks – as the street, Barron’s, and erstwhile value investors had no trouble valuing companies at 40+x forecast (hopestimated) free cash flows 5 years out. And no one gave a $#!% about our portfolio.

And where are we now? Retail investors are piling into risky ETFs and seem to be successfully playing “gamma squeezes” on trillion-dollar stocks.4 The ARK ETF may have lost more than 40% since then, but it is still getting some inflows.5 Check the latest 13Fs and you’ll see little change in “Hedge Fund Hotel” ownership from last year. The story on inflation keeps changing; but is always twisted to support consensus positioning. To wit, just a few weeks ago, with the 10-year yielding 1.8%, I had some investors tell me that even with higher inflation, rates might not rise. Never mind that the Fed just stopped its bond buying after gobbling up an estimated 40% of the MBS issued over the last couple years and up to 70% of treasuries. That supply and demand thing is just for economists. And when that hope came up short, “higher long rates went from being a headwind for long-duration growth stocks to a tailwind… [as] we’ve reached the long rate that will produce a slowdown in the economy.”6 (The implication is that investors will flock back to those few remaining growth stories – the old “I may have messed up, but he messed up worse” logic that they’ve come to know and love). The Street, Barron’s, and erstwhile value investors still have no trouble valuing companies at 40+x forecast (hopestimated) free cash flows 5 years out. And, no one gives a $#!% about our portfolio.

As the investing world continues to cling to the belief that “history” only stretches as far back as 2016 (it seems that every defense of price targets uses “historical” averages that imply recorded history started on or after that date), the few prehistorians among us might note the many ways the current period resembles Spring 2000, just after the internet bubble popped. Just swap Cathie Wood for Ryan Jacobs and Kevin Landis, Tesla for Cisco, retail punters jamming stocks splits and Cramer, for well, retail punters jamming stocks splits and Cramer.

But our business is nowhere near the same. When we started Elm Ridge just around the corner from the Acropolis in 2000, there were still several firms and people who would look at cheap stocks. While the popular press and large institutional mutual fund complexes had bought into The New New Thing, the relatively small hedge fund world, at that point mostly catering to a small group of very wealthy individual investors, had not done so. Indeed, our first partners were people who had built and managed their own fortunes, had been investing for some time, and in a case or two, were very famous investors themselves. But in the wake of their turn-of-the-century success, new institutional investors poured in and the hedge fund business boomed, such that asset-gathering became way more profitable than generating outsized returns.

To digress (once more), I remember a night 35 years ago when I joined a friend at a Rap label party at some then-hip club. She was on the VIP list so we squeezed through the velvet ropes, where it was so crowded that I couldn’t even elbow my way to get a drink. I asked her why we couldn’t just move over to the wide-open bar for regular folks and received a return look like I had three heads. But when she got distracted, I jumped the rope, and became good friends with the bartender for the hoi polloi, assuming my rightful (and properly liquored-up) place all by my lonesome.

True to my nature, so has been the case with Elm Ridge. When spreads compressed in 2010,7 we wrongly chose to keep swinging for outsized returns in a downsized opportunity set, while other value firms played it much safer and started increasing their allocations to “better” (moats; high returns on capital; “asset-light” – that is in the tangible sense, as these companies are allowed to spend as much capital as the asset-heavies on M&A and intangibles – and less economically-sensitive) companies. No doubt we were wrong, and we paid the price. And as our peers’ metamorphosis proved more fruitful over the years, they bought in hook, line, and sinker.

After all, keeping up on the latest news and learning about new technologies is way more enjoyable than calculating returns on new investment in aluminum. They can steer clear of our fishing pond (cesspool) using the bubbe-meise8 that their companies are easier to understand. But from our vantage point, it seems almost all sport some rather opaque disclosures that make it next to impossible for an analyst to figure out where reported profits are coming from. Indeed, it is this opacity that gives the CBGBs multiple levers to report the kind of quarterly results that their supporters demand. And it provides a further respite to the analyst community who can’t independently analyze and forecast financial results. While some enterprising analysts do rather exhaustive channel checks, they are, on the whole, unable to translate these into more accurate earnings and cash impacts. All anyone can do in these cases is call reassuring company contacts for their forecasts.

Finally, running closer to the herd has one last advantage in that if your results turn south, there is a good chance that those of your investors will too, allowing you and them to cast blame on some irrational exogenous event. You are much less likely to deal with emailed insults from former friends or have to console staff that endure them from those too cowardly to do it to your face. So, after a successful run kicking our butt, gathering more assets, and building a portfolio often chock full of crowded CBGBs, my compatriots are more than content to stick with what has worked – and could care less that those once-compressed spreads have since tripled (according to our calculations).9

It’s not that we don’t get the defenses of the five megacap tech favorites10 (that is, if Meta is still one of the in-crowd). While these stocks, as a group, have jumped almost 90% since the COVID outbreak, their 2021 earnings did come in almost 50% above pre-pandemic estimates. Now, to us at least, this begs the heretical question of just how tied they are to spending on consumer durables, making them just a bit more cyclical than the CBGB crew will admit. That’s still an open question. And if – even as they are now bent on attacking each other – they are somehow able to defy the odds once more, shrug off any slowdown in durables spending, maintain double-digit growth rates well into the future11 and the market maintains its near-record high PE, then they should do ok. But that’s a bunch of ifs.

We’ll admit that most of our longs do benefit from an improving economy. But the most important driver of their improved profitability has been the fact that – due to the compounder bros’ utter disdain for their ilk – they’ve stopped investing in new capacity, leaving supply well short of demand. While their balance sheets are in mint condition and profits are soaring, they still see the returns from stock buybacks at currently depressed prices dwarfing those of maintaining adequate supply.

What it will be

“First they ignore you, then they laugh at you, then they fight you, then you win.” – Mahatma Gandhi

“The longer you’re stuck in a position that doesn’t truly challenge you, the less likely you’ll be able to leave it. Inertia, in fact, is one of my worst fears.” – Ryan Holmes

“You worry too much. Eat some bacon… What? I got no idea if it’ll make you feel better, I just made too much bacon.” – Justin Halpern, “Sh*t My Dad Says”

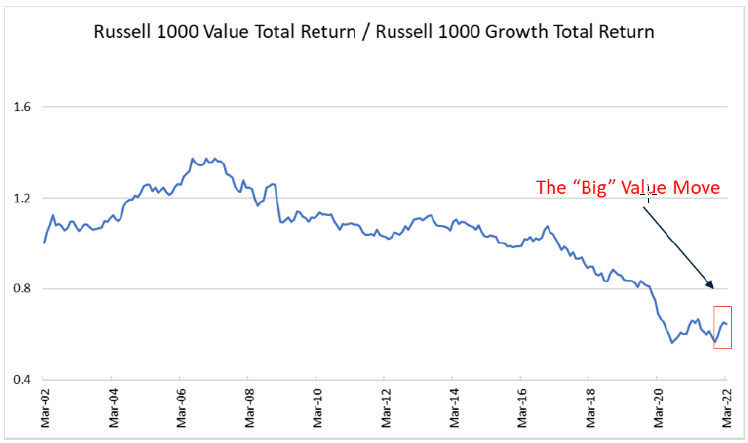

Little did I know then that the standard response to the “What it is?” greeting at my high school, “What it was. What it will be,” was a lesson in investment world forecasting. Trends run, folks jump on the train, buy into the story, reinforce it and eventually ignore the signs that it might be coming unglued. And so, the consensus holds that the “big” value move (see chart above), has run its course – and what it was, will be once more. We beg to differ, and, even after our recent run, are still sitting on an opportunity set at least as large as the one we saw a year ago. While our longs are up 60% since then, beating the S&P by over 40 points, their PE on Street numbers, has fallen from 21.3x to 8.5x (from 11.3x to 6.3x on our estimates) – a calculation that jives with the fact that consensus earnings for the coming year for those companies still in our book have come up more than 50% over that time. Indeed, its forecast free cash flow yield (and we are using $90 WTI oil before the impact of hedges, not the current $100) has actually increased, from 12% to 15%. While this figure dwarfs the 2.5% risk free rate, and those assumed in the stocks pitched toward us, it seems no one could care less.

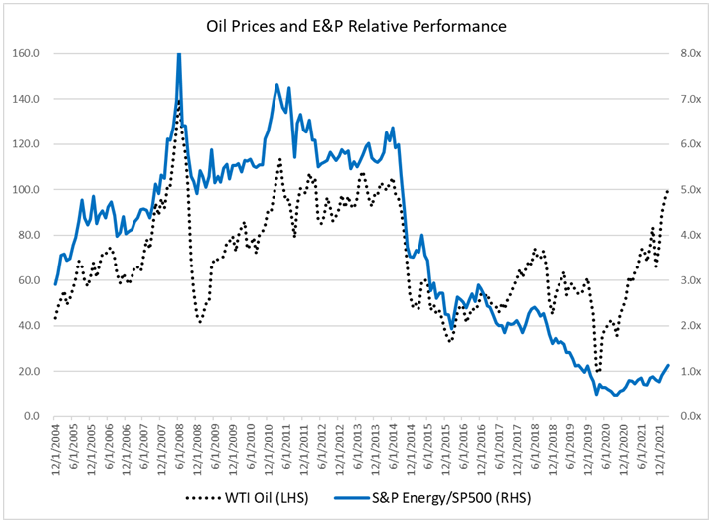

While some of our companies will probably be earning above normal returns in the short-run (note that our normalized energy estimates, where we’ve kept our weight around 45% of capital, are based on $85 oil prices in current dollars, a figure that should probably be nudged higher over time), our auto-related holdings (10%) are being hurt by current component shortages. While folks might attribute recent oil and gas prices to the war in Ukraine, oil was trading in the mid-nineties well before, and the last time it traded at that level, the S&P E&P Index was almost double that of today. For it to have kept pace with the S&P, we have a mere 5x to go (see chart).

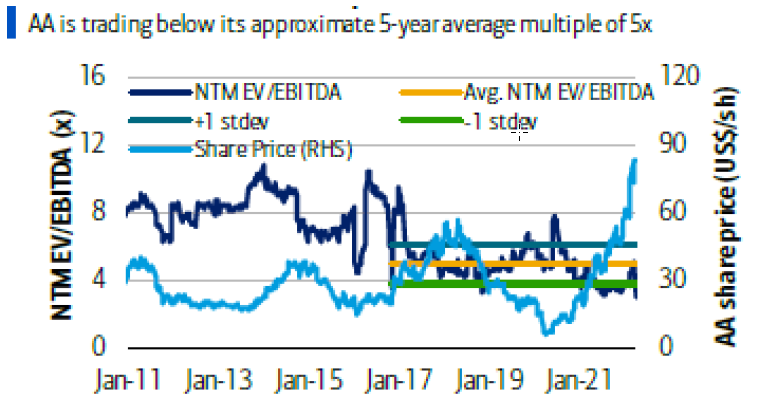

Or take Alcoa, a low-energy cost and carbon-advantaged aluminum producer. While the stock has almost tripled over the past 12 months, improved profitability has left its EV/EBITDA13 multiple steady at 4.3x while spotting a 15% Free Cash Flow yield (on street estimates, double that of last year). Aluminum smelting is very energy intensive, using 14.5-15 Mwh/ton of Aluminum (the average US household uses 11/year).14 Chinese producers, using cheap coal, flooded the market with low capital-cost coal-gobbling capacity over the 10+ years to 2020, and now account for about 60% of world production. But as the industry strained the electric grid, wolfing down close to the equivalent of half of US total residential consumption, their government has put a hard cap on new capacity – although surging electric bills, driving production costs up by more than 25% in just 9 months, might have done that on their own.

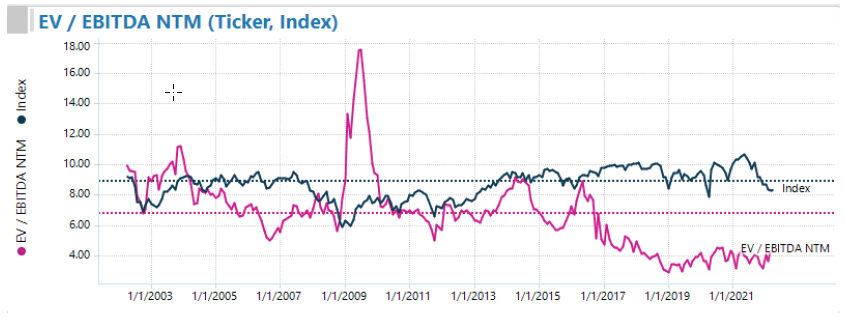

Meanwhile Alcoa sources more than 70% of its power needs from renewables, predominantly hydro, and is not facing the same cost pressures as those so dependent on fossil fuels. This also keeps its emissions down, generating 5.1 tons CO2/ton of aluminum, less than half the 12.8 world average.15 With European carbon credits trading about $80/ton, this difference would be worth a mere $10/share to earnings and free cash (on a $90 stock). But, even though most of the sell-side has jumped on the AA bandwagon, they are still using what-it-was-will-be to set price targets. While corrugated paper producers sell for 9x EBITDA, steel analysts set 6.5x targets on their companies, and the companies who shape the aluminum into cans trade in the mid-teens, most of the street uses a 4x multiple for AA, based on its “historical” average (or the right-hand side of the first chart). If we take a more expansive view of history, when Alcoa was in a similarly advantaged place (see the ignored left side of the first chart or the second one just above16), one could well justify at least an 8x multiple or a mere $100/share higher, which would still leave the stock with a still attractive 7.5% free cash flow yield. Indeed, I’ve been pitching the company to some former colleagues for some time now, getting dismissed with [head guy] “will never buy that,” with my “I’ll bet you he will” rejoinder falling on deaf ears. But lately, as a couple of approved purveyors of CBGB merchandise seem to have given it their stamps of approval, at least two are finally willing to investigate.

I could blather on for any number of our stocks, and shorts too. While the tide seems to be turning, at least in our eyes, we’ve found it personally frustrating that no one seems to give that development a chance. We go on a big run. The other side comes up with a new story to support what-it-was-will-be. We give back a bunch, get a chance to reload and repeat.

So what, if no one cares? Our stocks are working. The longer they stay off the approved investing list, the longer they’ll restrain the necessary capex to meet world demand – and the more we’ll all pay for basic products. The opportunity keeps building and there’s almost no one trying to beat us to the punch. I’m going to get me some bacon.

Updated on

Sign up for ValueWalk’s free newsletter here.