By Jacob Wolinsky. Originally published at ValueWalk.

Hidden Value Stocks issue for the first quarter ended March 31, 2022, featuring Choice Equities‘s stock pick, Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH).

Introduction

Welcome to the March 2022 (Q1) issue of Hidden Value Stocks. We have our usual two interviews and an extract from Choice Equities’s latest investor letter in this issue.

Q1 2022 hedge fund letters, conferences and more

The first interview is with WCM Investment Management. WCM provides innovative equity investment advisory services for a variety of clients, including corporations, private individuals, public and private funds. The firm manages several strategies, including a global value and US value strategy.

The second interview features Greystone Value. The firm describes itself as a concentrated value investor with a process focused on “patience, good decision making, and daily incremental improvement.” Since inception in Q4 2019, an account opened with Greystone has returned a cumulative +96.8% or +48.4% per year, net of fees.

We hope you enjoy this issue of Hidden Value Stocks, and if you have any questions or comments, please feel free to contact us at support@hiddenvaluestocks.com.

Sincerely,

Rupert Hargreaves & Jacob Wolinsky.

Updates From Previous Issues – Choice Equities’s Stock Pick – SPWH

Mitchell Scott, CFA, the founder and managing partner of Choice Equities picked out Select Interior Concepts (SIC) as one of the firm’s favorite small-cap picks in the Q2 2021 issue of Hidden Value Stocks. Tipped at $10 a share in the issue, Select Interior Concepts was acquired for $14.50 per share at the end of 2021.

Scott’s latest investment idea is Sportsman’s Warehouse (SPWH). He covered the idea in the firm’s Q4 2021 letter to investors:

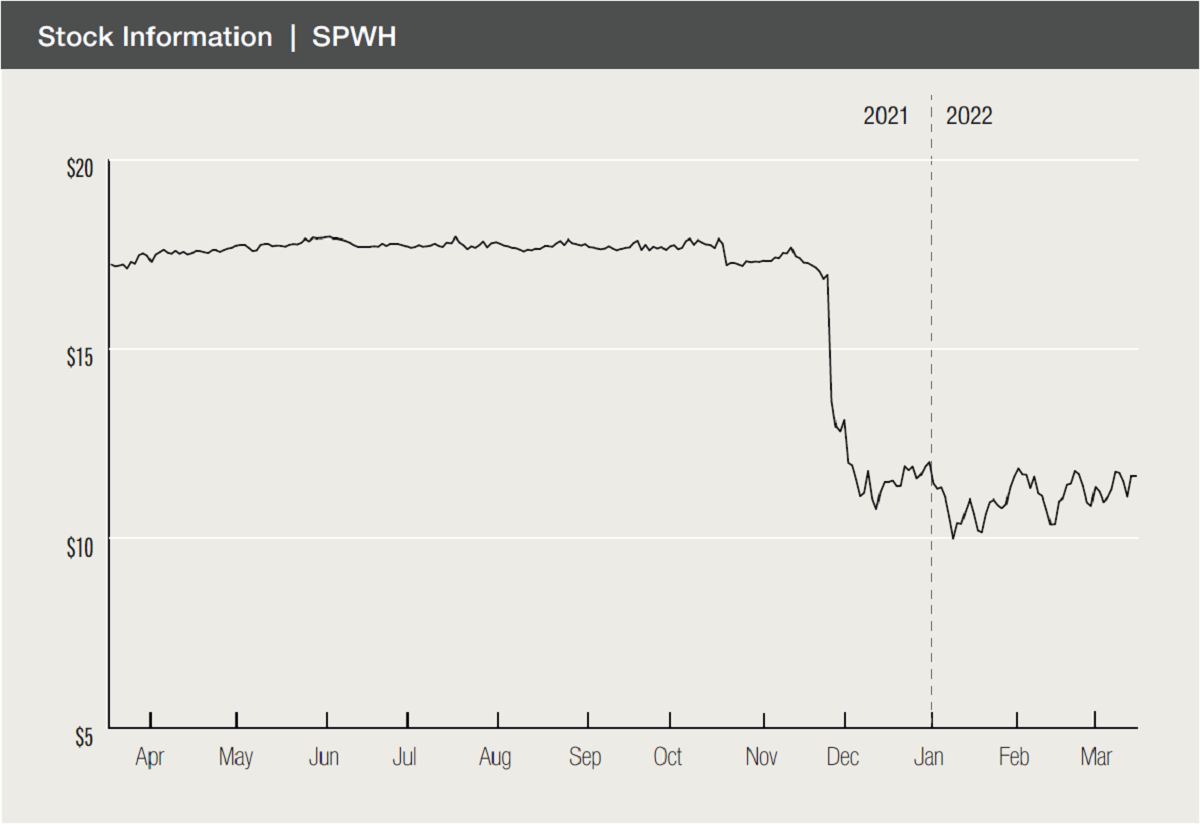

Just before Christmas in 2020, the company received an offer at $18 per share to be acquired by Bass Pro / Cabela’s owner Great American Outdoors Group…Then last December all parties withdrew from the merger proceedings as it became clear it would be unlikely to pass due to anti-trust concerns.

So now, with the stock trading around $10, where does that leave us? Though the offer price is but one input into a valuation exercise, it makes for a pretty decent starting point. However, quite a bit has changed for the company since that original merger offer was received. For starters, the company had another stellar year, generating nearly $100M in free cash flow. Though this trailed the year prior, both are up dramatically from the company’s prior highwater mark of $44M generated in FY19. The company also grew store count about 10%. Then, after the merger was terminated, they received a $55M merger termination fee, or nearly $40M after tax. So now, the company has entirely de-levered their balance sheet to a net cash position and continued to grow the store base all while competitive dynamics within the industry have seen favorable developments of their own. Dicks Sporting Goods Inc (NYSE:DKS), Walmart Inc (NYSE:WMT) and Gander Mountain have chosen to exit the guns and ammo business in recent years. While there is assuredly some concern that gun sales and outdoor sports may have already seen their best operating environment ever, it is also true that there are now 12M new gun owners in the US.

…

And now the company has ample resources. It looks like the upcoming FY 2022 will likely be modestly down from last year on a same-store sales basis due primarily to fewer gun purchases, but it also seems likely that it can serve as a new base year upon which growth can resume. Driven by 7% to 9% new store growth and additional growth from ecommerce, management’s plans to leverage double digit topline growth into a low double-digit earnings growth trajectory appear quite achievable. And this is all before any return of capital decisions are implemented. Trading at just ~8x our view of likely FY22 earnings and now with less competition, a larger customer base and a better balance sheet, shares look to offer quite a bargain.

Updated on

Sign up for ValueWalk’s free newsletter here.