By DIVIDEND GROWTH INVESTOR. Originally published at ValueWalk.

Costco Wholesale Corporation (NASDAQ:COST) operates membership warehouses in the United States, Puerto Rico, Canada, the United Kingdom, Mexico, Japan, Korea, Australia, Spain, France, Iceland, China, and Taiwan. You may have seen its stores mentioned in news stories, where long-lines of shoppers are waiting to get in the store. You may have also seen Costco material on empty shelves that used to have toilet paper before.

Q1 2022 hedge fund letters, conferences and more

Costco Increases Dividends

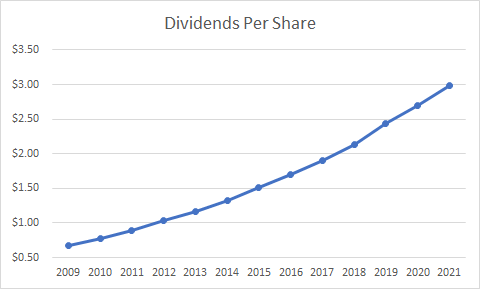

That company managed to increase its quarterly dividend by 13.90% to $0.90/share. (Press Release) This marked the 18th consecutive annual dividend increase for this dividend achiever. Over the past decade, the company has managed to increase dividends at an annualized rate of 12.70%.

Costco has paid special dividends on three separate occasions over the past decade. The company paid $7/share in 2012, when taxes on dividends were supposed to increase ( they didn’t). Costco also distributed $5/share in 2015, and $7/share in 2017. The last special dividend was $10/share in 2020.

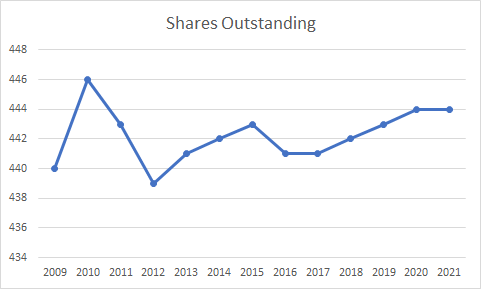

Costco is a great company that cares about its employees, customers and shareholders, and has created a unique business model that benefits all stakeholders. The ability to distribute special dividends shows this to me. The company is a rarity today, since it has largely kept the number of shares outstanding stagnant. It favors special dividends to share buybacks, so it is a company after my own heart.

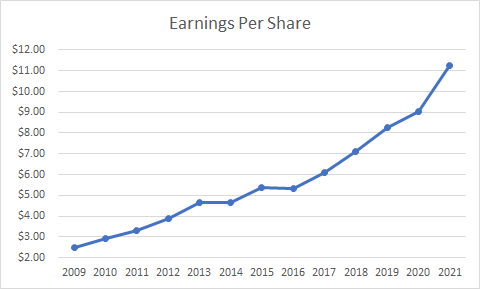

The dividend growth was supported by strong earnings growth. Earnings per share increased from $2.47/share in 2009 to $11.27/share in 2021.

Prior to the financial crisis, the peak earnings for Costco were in 2008 at $2.98/share. This makes the decrease to $2.47/share not that bad. Otherwise, earnings per share have been trending upwards. The company is expected to generate $13.04/share in 2022.

The company tends to offer a large quantity of limited variety products at competitive prices. Costco buys directly from vendors in bulk. It also has a quick inventory turnover. This results in generating cash from a sale before having to pay the supplier invoices. Shoppers are loyal to Costco, and employees love working there. Employees are paid very competitively, which is why they stick around, reducing costly turnover. Most of the profits are coming from recurring membership fees, as Costco largely sells its merchandise at a price to cover its expenses.

Charlie Munger, the investing partner of Warren Buffett is a director at Costco since 1997. He has seen the inner workings of the retail giant closely for over two decades. This statement of his is insightful about the inner workings of Costco:

“It has a frantic desire to serve customers a little better every year. When other companies find ways to save money, they turn it into profit. Sinegal passes it on to customers. It’s almost a religious duty. He’s sacrificing short-term profits for long-term success.”

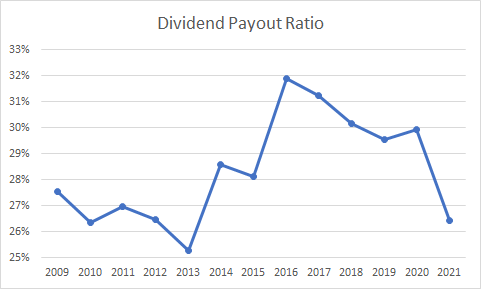

Dividend Payout Ratio

Costco has also maintained a relatively stable dividend payout ratio. It has largely remained between 25% in 2013 to a high of 32% in 2016. This is a fairly tight range, and shows that dividend growth was entirely driven by growth in earnings per share.

I have liked Costco’s business model, and have also been a member for several years. I believe that this is a business built to last, which will be successful in the long-term. However, the valuation has always stopped me from initiating a position in the stock, which seems like a mistake in hindsight.

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | |

| High Price | 460.62 | 349.06 | 299.95 | 233.52 | 183.18 | 169.73 | 156.85 | 126.12 | 120.20 | 99.28 | 83.95 | 62.12 |

| Low Price | 307 | 271.28 | 189.51 | 154.11 | 142.11 | 137.50 | 117.03 | 109.50 | 93.51 | 76.59 | 55.74 | 49.95 |

| P/E High | 40.9 | 38.7 | 36.3 | 32.9 | 30.1 | 31.8 | 29.2 | 27.1 | 26 | 25.5 | 25.4 | 21.2 |

| P/E Low | 27.2 | 30.1 | 22.9 | 21.7 | 23.4 | 25.8 | 21.8 | 23.5 | 20.2 | 19.7 | 16.9 | 17.1 |

The stock has not sold at less than 20 times earnings since 2011 – 2012. This is fascinating.

Currently, Costco is selling for 44.57 times forward earnings and pays a dividend yield of 0.90%. While it has a high valuation and a low yield, we can expect a higher dividend growth. At the right balance of yield and growth may come the right opportunity for the enterprising dividend investor.

Relevant Articles:

- Four Notable Dividend Increases Expected for April 2022

- How to select winning retail stocks

- The advantages of being a long-term dividend investor

- Dividend Achievers Offer Income Growth and Capital Appreciation

Article by Dividend Growth Investor

Updated on

Sign up for ValueWalk’s free newsletter here.