By Fintel. Originally published at ValueWalk.

Netflix Inc (NASDAQ:NFLX) reported first quarter earnings after market close on Tuesday that saw the stock tumble 25.7% in after hours trading. NFLX has been the 9th most traded stock on Fintel’s Most Bought Securities and is currently the 16th most held security, rising 8 spots this week.

The result saw Netflix report EPS of $3.53, beating the markets consensus forecast of $2.90. Group sales came in at $7.87 billion, slightly below the Street’s forecast of ~$7.93 billion. The firm reported global streaming paid net subscriber additions of -0.2 million vs guidance of 2.5 million and consensus forecasts of ~2.7 million or above. This clearly spooked investors.

Q1 2022 hedge fund letters, conferences and more

Guidance:

In addition, the firm guided Q2 EPS of $3.00 and with revenue of $8.05 billion, both being slightly below consensus expectations. Netflix also guided global streaming paid net additions of -2 million vs the market’s expectation of +2.6 million.

Shareholder Letter:

In the shareholder letter that accompanied the result, Netflix addressed factors that have been impacting its slow growth. In summary, they plan to recellerate viewing and revenue growth by continuing to improve all aspects of Netflix with a primary focus on quality content and recommendations. They see a large medium-term opportunity in cracking down on shared accounts to drive household and subscriber growth up. NFLX believes that longer term growth will come from outside the US.

Bloomberg also reported earlier today that Netflix is exploring a lower-priced version of the service that would include advertising (link here). The article discusses comments from the earnings call, where Co-CEO Reed Hastings said that he was a big fan of subscription simplicity but preferred to prioritise consumer choice, allowing customers who would prefer to have a lower price and are tolerant to advertising to choose an option to suit.

Maria Ripps from Canaccord Genuity believes shares are likely to remain volatile as investors digest the near-term challenges. They do however see other levers for NFLX to reaccelerate growth and profitability.

So what does this mean for the NFLX share price going forward? NFLX has justified a high growth multiple valuation for quite some time but as growth looks like it’s slowing post-pandemic, does that mean it will begin to trade on a normalised valuation?

The stock has a current ~31x PE Ratio (TTM) before trading on the results tomorrow.

Analysis:

NFLX currently holds an ‘overweight’ rating with an average target price of $494, implying +42% capital upside to the share price. We expect the consensus target to fall lower as analysts adjust forecasts in response to the guidance. UBS has been the first investment bank to downgrade their rating ‘neutral’ from ‘buy’ with a significant target cut to $355 from $575.

These are some key metrics that we have highlighted from Fintel’s Quant analysis that interested us:

- NFLX has a Put/Call Ratio of 1.28 that indicates bearish sentiment in the stock. You can find more information options activity here.

- The Put/Call Ratio shows the total number of disclosed open put option positions divided by the number of open call option options. Since puts are generally a bearish bet and calls are a bullish bet, put/call ratios greater than 1 indicate a bearish sentiment, and ratios less than one indicate a bullish sentiment.

- Despite the recent share price activity, NFLX has an Insider Accumulation Score of 74.50 and an Officer Accumulation Score of 81.78. You can find more information on this analysis here.

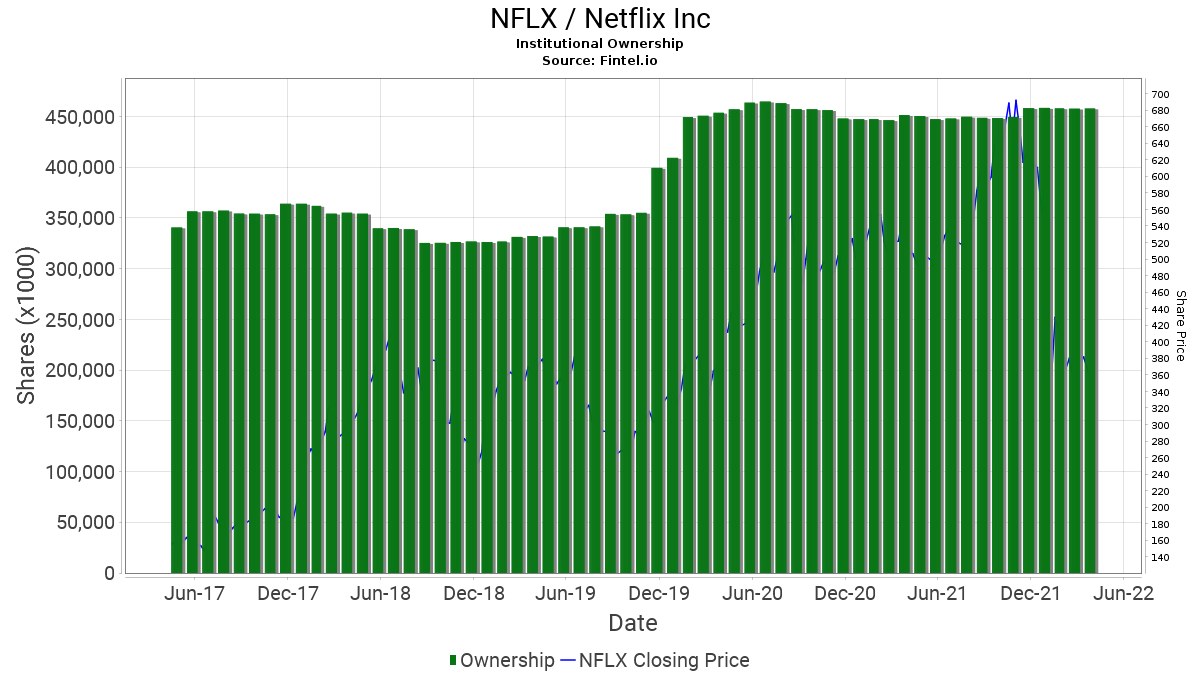

- We have noticed institutional ownership levels holding relatively flat since the beginning of the pandemic in December 2019. We have included the chart below and you can find out more on ownership here:

Article by Fintel

Updated on

Sign up for ValueWalk’s free newsletter here.