By Fintel. Originally published at ValueWalk.

Standard Lithium Ltd (NYSEAMERICAN:SLI) is a company that is using modern processing technologies and strategic partnerships to bring the first new U.S. based lithium project into production. SLI’s main project is in south Arkansas and is the largest and most advanced lithium brine project in the U.S. with a 3.94 million tonne lithium carbonate equivalent resource.

SLI’s share price took off in 2021 when it reached its all-time high price of $12.92. The stock currently trades -52% below its October 2021 peak and after a recent bull run in March, the stock has given the gains back in April falling by -32% again.

Q1 2022 hedge fund letters, conferences and more

So is now the time to be looking at Standard Lithium? We know there is a backdrop of rising lithium carbonate prices and a growing concern that the market will be undersupplied to meet the growing demand for batteries but lithium stocks have continued to fall recently.

According to our data, activity started picking up in late April. During the month, there was a spark of activity from institutions that may have contributed to the rally. SLI was initiated at Echelon Wealth with a target of $13.15 and a ‘speculative buy’ rating, while Roth Capital upgraded their ‘buy’ target price from $11.50 to $16. Stifel also hosted SLI’s management for a day of investor meetings. Stifel’s analysts highlighted the Lanxess project as having multiple advantages that will help it get to market quicker than other lithium development projects.

Today, the company announced that they have commenced a Preliminary Feasibility Study (PFS) at its South West Arkansas Lithium Project which is located ~35 miles west of the Company’s Lanxess project. The company noted that “The PFS will consider an integrated project including; brine supply and injection wells, pipelines and brine treatment infrastructure, a Direct Lithium Extraction (“DLE”) plant using the Company’s proprietary LiSTR technology, and a lithium chloride to lithium hydroxide conversion plant.”

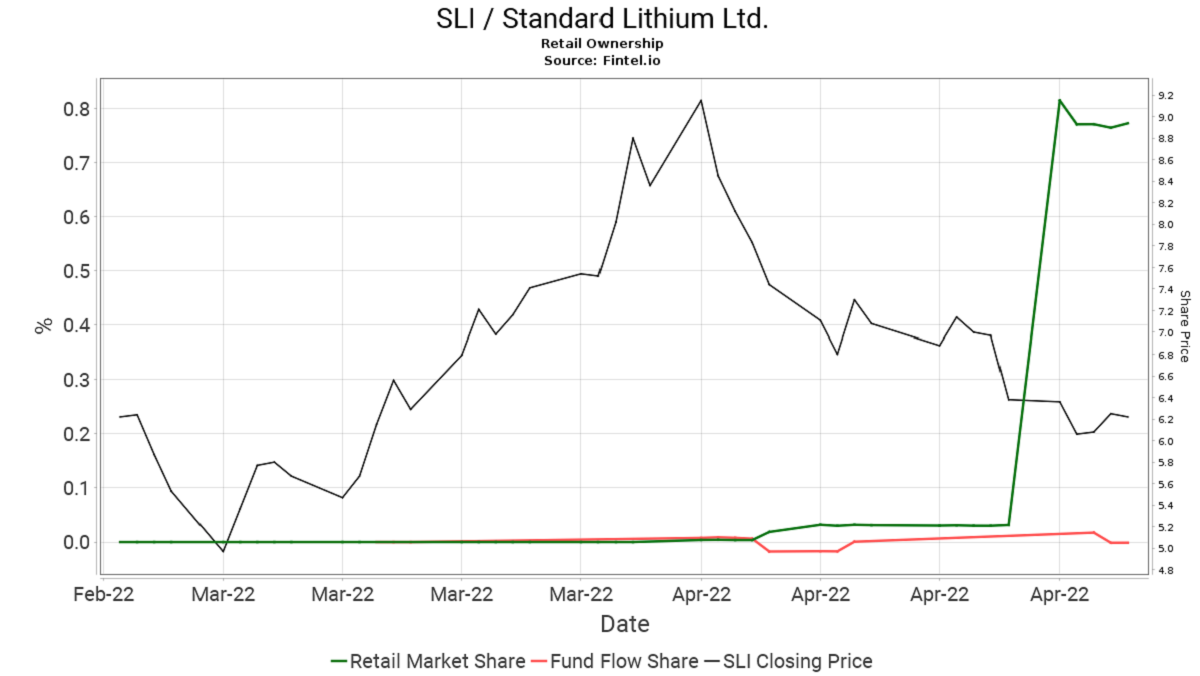

We have included a chart below that shows the recent jump in Retail Ownership. You can also see more by - clicking here.

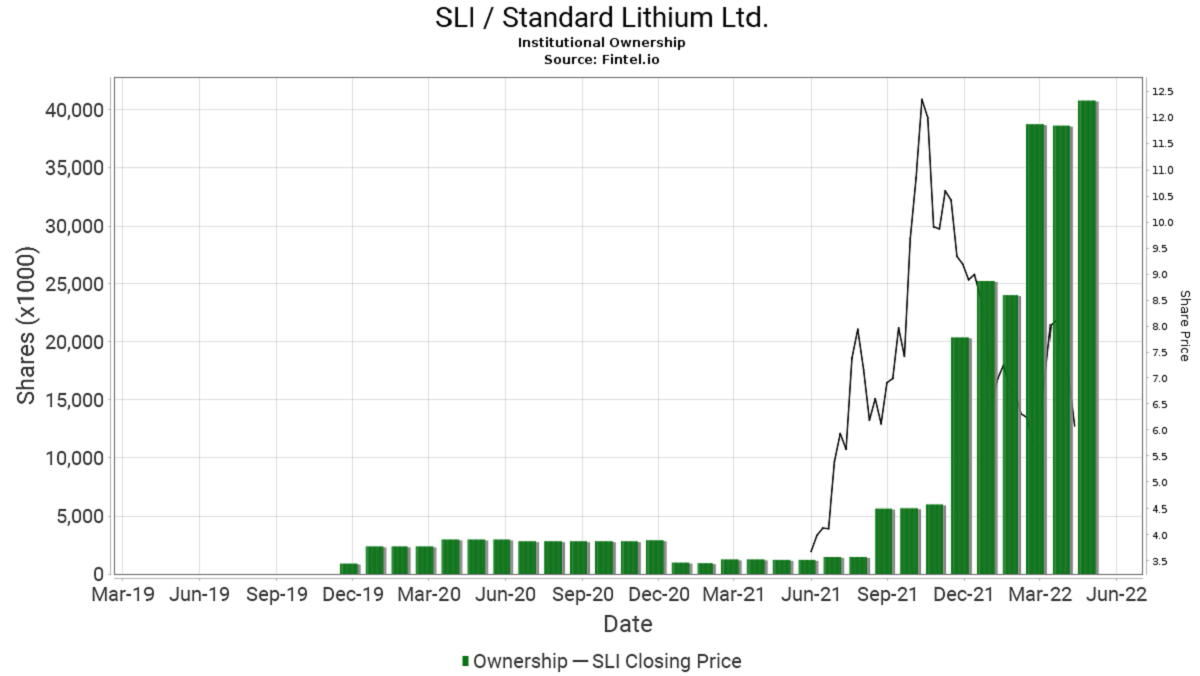

For comparison, we have additional longer-dated data that shows Institutional Ownership levels and is included in the chart below. Institutional investors missed the initial rally and began accumulating on the initial declines from the $12.92 high. SLI has an Ownership Accumulation score of 89.20 which ranks it in the top 600 of 24,000 companies! To find out more data on institutional activity – click here.

We also noticed SLI has a very high Fintel Short Squeeze Score score of 86.39 which means it has a higher chance of a short squeeze rally. The Short Squeeze Score is the result of a sophisticated, multi-factor quantitative model that identifies companies that have the highest risk of experiencing a short squeeze. The scoring model uses a combination of short interest, float, short borrow fee rates, and other metrics. The number ranges from 0 to 100, with higher numbers indicating a higher risk of a short squeeze relative to its peers, and 50 being the average. To find out more on this – click here

Standard Lithium has an institutional consensus ‘buy’ rating with an average target price of $14.40 for the stock implying a +75% upside to the current stock price. We note that while the consensus target has remained above the $12 range since October 2021 while the share price has been falling.

Article by Ben Ward, Fintel

Updated on

Sign up for ValueWalk’s free newsletter here.