By Pierre Raymond. Originally published at ValueWalk.

The Broad Market Index was down 2.41% last week and 57% of stocks out-performed the index.

New Securities and Exchange Commission (SEC) financial statements reported last week completed the update for companies with fiscal quartered ended March. Now we have a lull for two weeks as we wait for companies with quarters ended April.

These recent filers are mostly retailers and they can sway the index average particularly this quarter when many retailers are experiencing the downside of the virus wave. This wave in increased sales growth is the recovery from the steep drop associated with the early response to the virus lifted sales growth above 20%.

Q1 2022 hedge fund letters, conferences and more

That very high level of sales growth has now been sustained for over a year and with gross profit margins up and fixed costs down companies are accelerating cash like never before.

The Bigs Versus The Smalls

Last year at the peak of the virus wave, 84% of companies (accounting for 74% of total market capital) recorded improved sales growth. We have collected first quarter 2022 sales data for 1220 of the 1451 comparable record companies in the Otos Total Market Index representing 87% of the capital value.

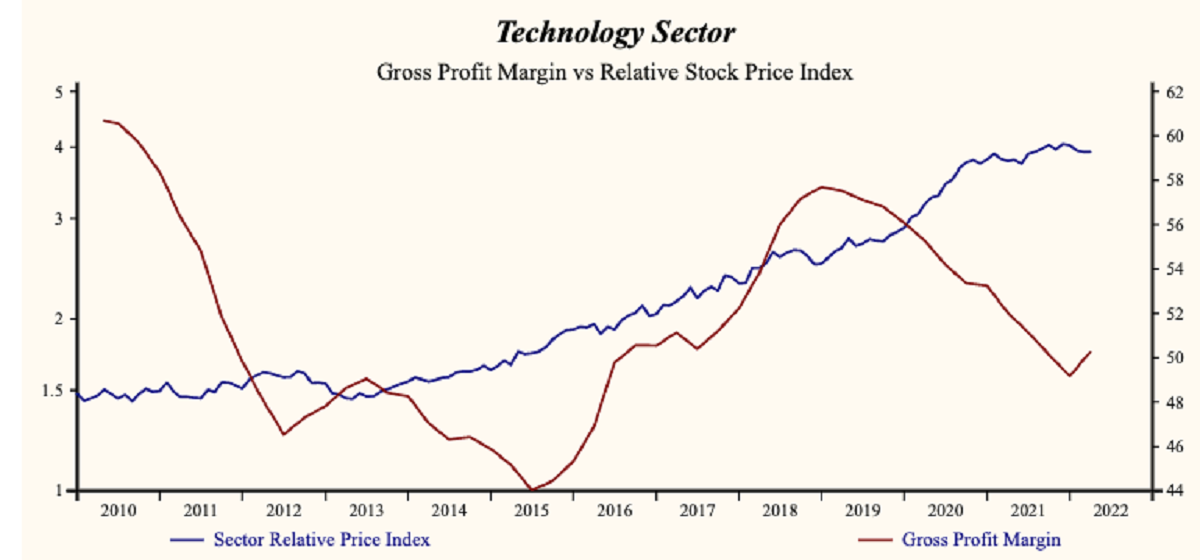

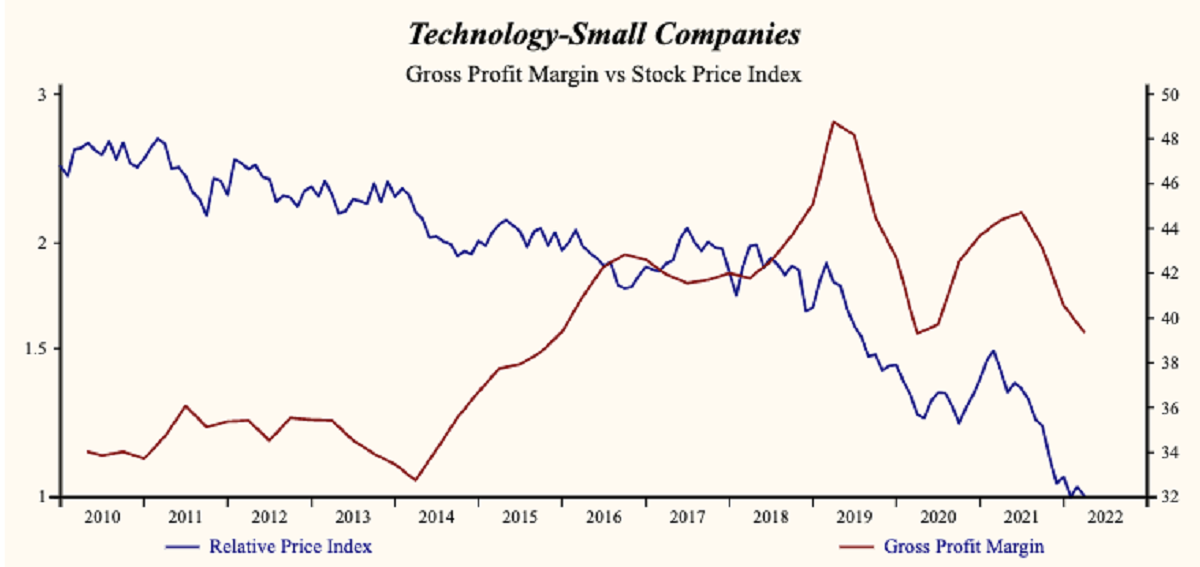

The Index capital weighted average sales growth rate is now 23.1, with 60% of companies (accounting for only 42% of market capital) recording a sales growth improvement. That suggests that lower sales growth is a bigger issue among large companies that small ones. That gap is clearest in the technology sector where 56% of companies (accounting for only 19% of market capital) are recording an improvement in sales growth.

Oil Price Effect

The large rise in oil prices and the inflation wave that has been associated with the recovery from the virus has exaggerated sales growth upward and the recent quarterly data suggests that sales growth will remain elevated for a while yet. That makes future cash flow growth a function of profit margins.

Higher inflation lifts costs initially as raw material costs rise. As time goes by and inflation becomes expected, labor costs will begin to rise. Higher material and labor costs will depress the gross profit margin if the company is not capable of passing rising costs through to the consumer as rising product prices.

Big Pricing Power

So far this quarter 44% of companies (accounting for 56% of market capital) are achieving a rising gross profit margin and the average profit margin is up. That suggests that larger companies have more pricing power. High sales growth makes it easier for companies to manage fixed costs downward. On average, higher gross profit margins and falling operating costs (SG&A) are creating unprecedented growth in corporate cash.

Profit Margins Are Key

The direction of the gross profit margin is now the most important growth attribute. Make sure that all your portfolio companies sustain a profit margin improvement. This is illustrated by an Otos MoneyTree with a golden pot.

What Next?

The future is now challenging as we work through the duration and magnitude of the coming growth slowdown. So far, stocks continue to outperform bonds as the gap between bond yields and inflation begins to close. Corporate growth is the only available inflation hedge now. The best strategy to navigate the turmoil is to own stocks of accelerating companies. The Otos MoneyTree with a tall, large green tree in a golden pot.

Amazon.com, Inc. (NASDAQ:AMZN) $2261.100 BUY This Rich Company Getting Better

Amazon has been an exceptionally profitable company with persistently high cash-return-on-total-capital (15.2% on average over the past 21 years). Over the long term the shares of Amazon have advanced by 278% relative to the broad market index.

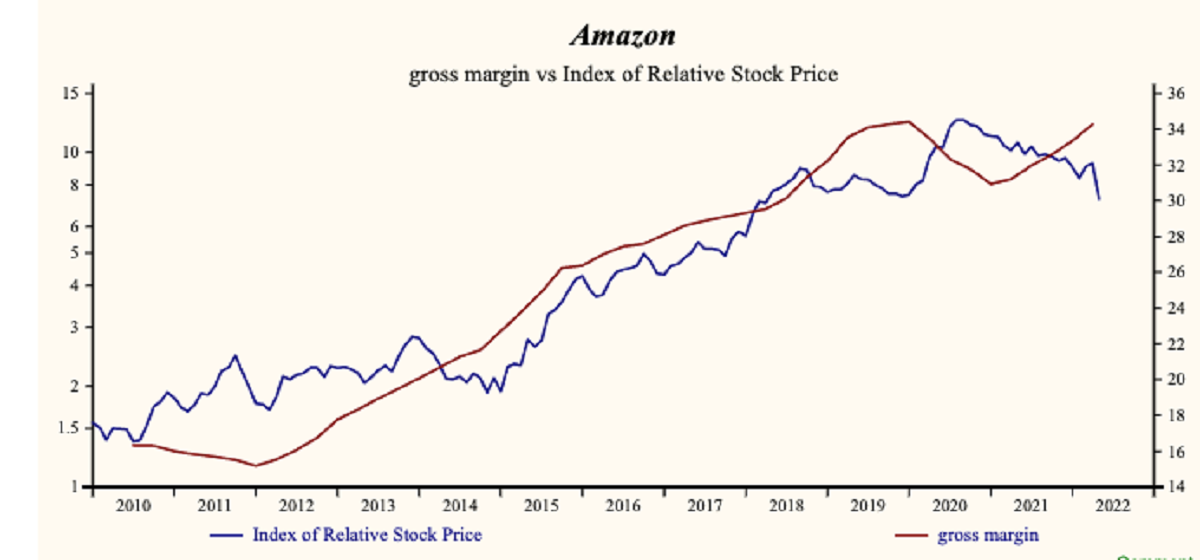

The shares have been very highly correlated with trends in Growth Factors. A dominant factor in the Growth group is Gross Profit Margin which has been 91% correlated with the share price with a five-quarter lead.

Currently, sales growth is 13.1% which is low in the record of the company and lower than last quarter.

Low Quality Growth Trend

Amazon is recording a rising gross profit margin. However, SG&A expenses are high in the record of the company and rising. That implies that the company may be capable of accelerating EBITD relative to sales with lower costs; but Amazon has yet to achieve any sustainable cost reduction.

The gross margin is for now rising at a faster rate than SG&A expenses producing a rising EBITD margin and therefore sustaining rising cashflow. Since future cash flow growth is now a function of a company’s profit margins cost management will key in Amazon’s future.

More recently, the shares of Amazon have declined by 42% since the September, 2020 high. The shares are trading at lower-end of the volatility range in a 20-month falling relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.

Updated on

Sign up for ValueWalk’s free newsletter here.