$2,693,308!

$2,693,308!

That is down $315,599 (10.5%) in our paired Long-Term and Short-Term Portfolios since our April 14th review. That is EXACTLY where we want to be as the purpose of the STP hedges (see Tuesday's review) is to MITIGATE the damages on the way down – not completely eradicate them. If you try not to have any losses at all you end up trading yourself into a neutral corner and – if you are doing that – why not just be in CASH!!!?

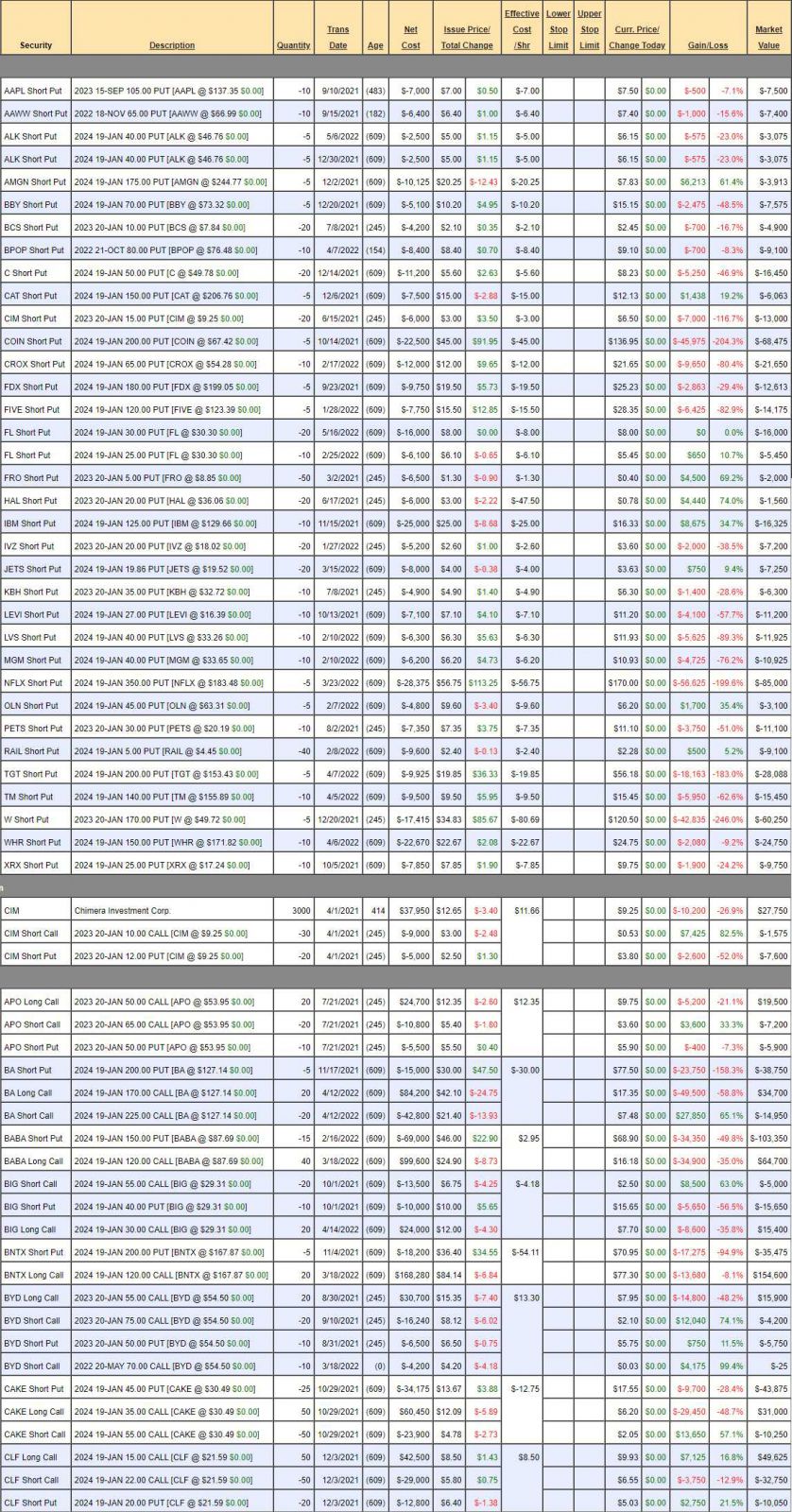

And we are mainly in CASH!!! with $1,770,488 of it in the LTP and $1,182,271 in the STP – there's actually more cash than equity in both. Because we sell a lot of puts, having low equity doesn't take out our risk of loss in a downturn but the cash helps us make adjustments – which is what we'll be concentrating on today.

Losing 10% in a 20% down market indicates we are properly hedged and ready to take advantage of the dip. We don't need our sideline money for more hedges and our positions are fundamentally sound – dropping less overall than the broad market. Now we have to do the real work of going over them, one by one, and seeing who needs help and who needs to go – although we've purged this portfolio so many times it's full of nothing but strong, strong stock choices.

Short Puts – We are happy to own C, CIM, CROX, KBH, LEVI, LVS, MGM or TM if they go lower. W we don't like but it's a leftover from a short. The only put side adjustment is going to be:

- COIN – We're obligated to own 500 shares at $200 ($100,000) less the $22,500 we sold them for so $77,500 committed here and it costs us $68,475 to close it out. We can instead sell 15 of the 2024 $100 puts for $52 and that's $78,000 so the roll costs nothing and we still have $22,500 in our pockets so the net is $85 if we are assigned ($127,500). So we're increasing our obligation by 50% but we'll have 200% more shares for our money if assigned.

- CIM – I forgot to log the 0.33 dividend they paid on March 30th. Not bad for a $9.25 stock. The way we sold puts and calls (aggressively) it is a net $7.15 stock for us and that makes the $1.32 dividend 18.5% annually. You could run a very nice hedge fund just investing in this stock!

- At the moment, the 2024 $8 calls and puts are $1.75 each so $3.50 off and $9.25 base is net $5.75 so it would be silly for us not to buy 3,000 more for $17,250 at that price since we'll get $3,960 (22.9%) in dividends while we wait to get called away at $24,000 for another $6,750 (39%) profit so we're talking about 42% annual returns on this "boring" dividend play.

- APO – Good for a new trade.

- BA – Let's roll our 20 2024 $170 calls at $17.35 to the $120 calls at $33.25 for net $15.90 ($31,800) and pay for it by selling 5 more 2024 $200 puts for $77.50 ($38,750).

- BABA – I think we're brave enough here but I'm getting a bit more faith.

- BIG – I'm happy enough with the targets, great for a new trade but we have positions that need love more than this one.

- BNTX – How many Biotechs are we going to nurse back to health? $40Bn market cap, $6Bn in the bank over debt, making $8.6Bn this year… Kind of hard to let go, right?

- BYD – Holding up well. Let's take advantage and buy back the short $75 calls and let's roll the 20 Jan $55s at $7.95 ($15,900) to 40 of the 2024 $50 ($15)/65 ($9) spreads at $6 ($24,000). We started out with a net $3,760 entry on a $40,000 spread that paid off at $75 and now we're in a $60,000 spread that pays off at $65 for net $11,860 – not bad for a stock that collapsed on us. SCALING IN is the key to success!

- CAKE – Wow, these sale prices are amazing! $30.50 is $1.6Bn and they make $150M with good growth. Out of principle I have to roll the 2024 $35 calls at $6.20 to the $25 calls at $9. How can we not?

- CLF – Still at our goal.

- DAL – Holding up pretty well and doesn't seem to need our help.

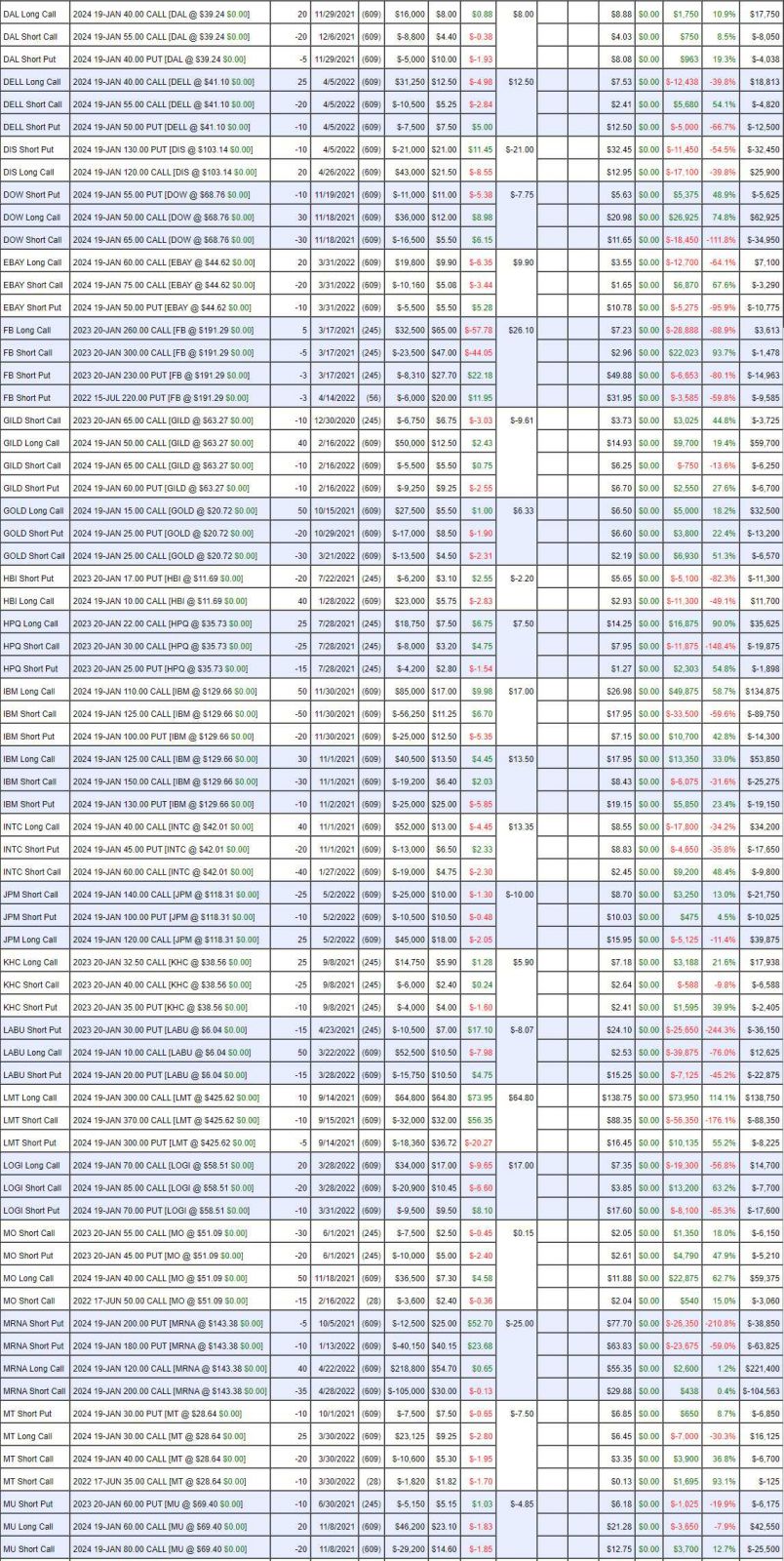

- DELL – You have got to love algo selling! $41.10 is $31.2Bn and Dell makes over $5Bn a year. At this point we're just waiting for Buffett to show up. What's more bang for the buck, doubling down on the $40 calls or rolling them to the $30s at $13.50? Well that roll is $6 ($15,000) and gives us $25,000 more upside while the DD is $18,813 and gives us $37,500 more upside. Double down it is! That's because we still believe in the target and also, we're not covering the new calls yet – that will eventually knock off about $10,000.

- DIS – Some day my price will come… $103 is $187Bn and DIS is good for $10Bn+ but not this year as things are ramping up so $7.5Bn but Disney+ is killing it and no movie misses yet. The 2024 $120 calls are $13 and the $100 calls are $22 so we'll spend $9 ($18,000) to roll down $20 and double down ($44,000) and sell 20 $130 calls for $10 ($20,000) so we're half covered on the $100/130 spreads for net $42,000 more on the $120,000+ spread.

- DOW – So boring they don't go down.

- EBAY – Fortunately, we only spent net $4,140 on our initial entry and we promised to buy just 1,000 shares at $50 and that's not unreasonable – even with EBAY now at $44.60. The 20 2024 $60s at $3.55 can be rolled down the to $40s at $10.20 for net $6.55 ($13,100) so let's do that and see what happens.

See what we're doing? Just a little improvement here and there and not spending a lot of CASH!!! – maybe $100,000 so far but we've given ourselves close to $1M of additional upside if things simply go back to where they were last month. We don't need a full recovery – we just need the markets to stop dropping at some point.

And the money we spend is an INVESTMENT because, down the road, we'll be able to sell short-term calls and begin to recoup our CASH!!!

- FB – Every time I get to this one I'm thinking "FB, why do we have FB?". It should be in the Butterfly Portfolio beacuse it's just a vehicle to sell puts and calls. At the moment, the July puts are in a bit of trouble but I think $200 is a good floor so let's buy back the 5 short Jan $300 calls for $1,478 and see if it bounces. Since we're not here to stick with FB, I'm not eager to put more money in but we could take the remaining $7.23 in the Jan $260 calls and find a 2024 spread. No hurry.

- GILD – Holding up near our target.

- GOLD – Surprisingly weak but still in our zone.

- HBI – The 20 Jan $17 puts at $5.65 ($11,300) can be rolled to 40 of the 2024 $13 puts at $3.30 ($13,200) and yes, I'm happy to own 4,000 shares at $13. The 40 2024 $10 calls at $2.93 ($11,700) can just be doubled down at this level as this level is bat-shit crazy for a company that sells $7Bn worth of underwear at a $600M profit yet you can buy the whole thing for $4Bn at $11.50.

- HPQ – Notice how the winners still have covers. That's because they all start with covers – we just buy them back from the stocks that slip so we can re-sell on the upswing – which hasn't happened yet.

- IBM x 2 – Still on track, thank goodness.

- INTC – So for 48% off, I won't buy back the short $60s and that's still our target for 2024 anyway. 40 is a good amount of longs so let's just roll those to the $30s at $13.60 for net $5.05 ($20,200). The wider spread opens up the possibility of selling short-term calls, like 10 Sept (119 days) $45s for $1.70 ($1,700). 6 sales like that would pay for half this roll but too low at the moment.

- JPM – Just added them and already falling.

- KHC – On track. We should circle these kinds of stocks in gold though this week hasn't been kind.

- LABU – We already bought back the short calls and we don't want to get assigned so let's roll the 15 Jan $30 puts at $38,150 to another $15 of the 2024 $20 puts at $22,875 so we're spending $13,500 to drop $15,000 but we're buying another year to bounce back and cutting the likelihood of assignment. Let's roll the 50 2024 $10s at $2.53 ($12,625) to 100 of the 2024 $5s at $3.60 ($36,000) and sell 50 2024 $10s to some other sucker for $12,625 so that's net $23,375 to add a $25,000 $5/10 spread AND move our 50 longs $25,000 lower. That seems sensible.

- LMT – Way over target thanks to WAR! This is why we diversify.

- LOGI – Another nice, boring stock that's getting no love but $58 is $10Bn and they make $800M so I'm going to keep dating her no matter what my friends think. We're in for net $3,600 and, very simply, we didn't get lucky so now we have to make our own luck by rolling the 20 2024 $70 calls at $7.35 ($14,700) to 30 2024 $55s at $13.50 ($40,500). So now we're getting serious and spending net $25,800 which is now net net $29,400 for what is now 30 $55 calls and our break-even is now about $65 – which is lower than where we came in.

- And, once again, we've set ourselves up to sell short calls and 15 of the Sept (119 days) $65 calls at $3 would bring in $4,500 and have almost no chance of hurting us so we can look forward to recouping much of what we just laid out – but let's give them a chance to bounce first.

- MO – Still on track but another gold star stock that's getting killed this week. Nothing is safe in this market.

- MRNA – I can't let this go as it's so crazy. $135 is $57Bn and they have $10Bn in the bank net of debt and they are going to make $11.6Bn this year and that's only under their current Covid contracts – which may expand on this rebound in Global cases. Even if Covid goes away, they'll have $20Bn in cash and they have PROVEN their system works and it should apply to 100s of diseases – it's just that Covid has had their attention the past few years and they've sold about $90Bn worth of vaccines and made $33Bn doing it. I'll buy that for $57Bn, thanks! We're already positioned here as they've been down for a while and I'm still confident they get back over $200 – once people stop being idiots. OK, call it semi-confident…

- MT – Another staple stock. No need to adjust.

- MU – Still on track.

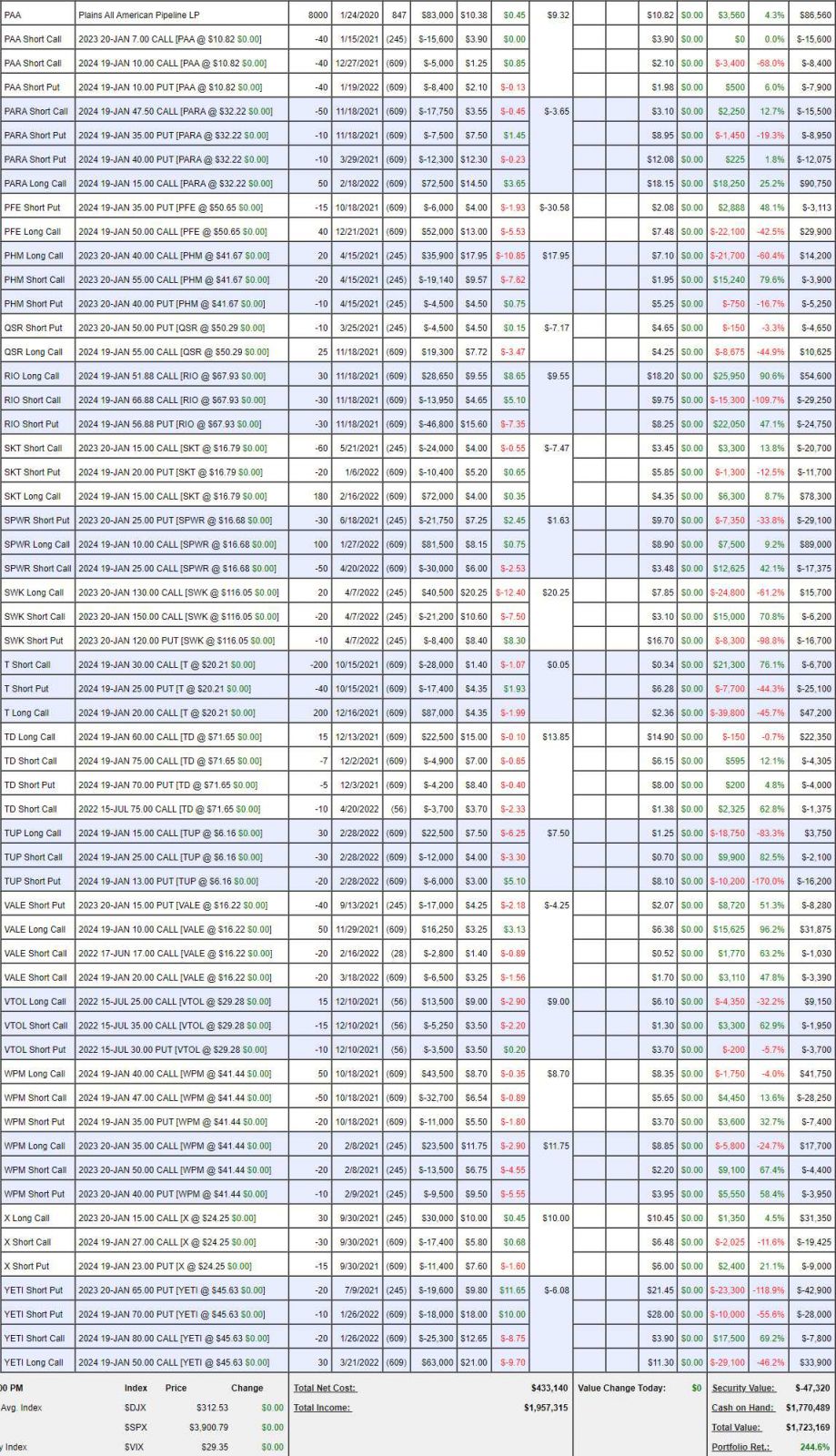

- PAA – Another stock I didn't log the dividend on. Paid 0.218 on 4/28 so that's $1,744. We expected it to be lower so this one is right on track.

- PARA – Too early to take a victory lap but I am warming up.

- PFE – We already bought back the short calls so I'll keep it where it is.

- PHM – Home builders are tricky but, long-term, we're going to want them. There's clearly not enough homes in the US – the trick is figuring out how to help people afford them.

- QSR – These guys we can roll as the 2024 $40s are $12 so net $7.80 to roll down $15 is fine by me.

- RIO – Still on track.

- SKT – Remember how I used to bang the table for them? Well, they are cheap again.

- SPWR – Another table-banger. On track.

- SWK – Pretty new and alredy disappointing. We're in for net $10,900 and it will cost us $11.50 to roll the $130s down to the $100s at $21.50 and that will be $23,000 more so net $33,900 and if we get back to $150 it's a $100,000 spread and our break-even is just $117.

Another good example of spending $23,000 to add $60,000 of upside and pushing our break-even below our initial entry. SCALING IN IS GOOD!!!

- T – Have we FINALLY found a bottom? This is a $200,000 spread currently net $17,300 – fun!

- TD – Glad we sold those July calls. Let's buy those back before someone notices how cheap TD is. We'll just wait for the next selling opportunity but that was a quick $2,525 bonus money while we wait for our net $13,465 spread to hit $22,500. This was an income generating example, otherwise I'd buy more as I love TD.

- TUP – Really, is the world ending? People won't buy Tupperware anymore? For one thing, think how silly it is that you can buy a brand like TUP for $282M at $5.95. The name alone is worth $500M. They're not stupid, they are buying back $75M of their own stock. They made $28M in Q1 (10% of the company's entire value) but withdrew guidance due to uncertainty in China, Ukrain and with how they will be passing through cost increases – so people FREAKED OUT. I'm not even going to sell the 2024 $15 calls but let's sell 20 more 2024 $13 puts for $8.15 ($16,300) and buy 50 2024 $5 calls for $3 ($15,000) so no cash outlay but a commitment to own 2,000 more shares at $13. Of course, if that happens, we sell more puts and calls to lower the basis…

- VALE – On track.

- VTOL – On track.

- WPM x 2 – On track.

- X – On track

- YETI – Another crazy one as $44.50 is $4Bn and they are making $250M so less than 20x with rapid growth. They just (May 11) beat on earnings and RAISED guidance so go figure on these market reactions. All it is is an opportunity for us so let's roll 30 2024 $50 calls at $10.60 ($31,800) to 50 of the 2024 $40 calls at $15 ($75,000) and let's consolidate the 20 Jan $65 puts at $44,500 and the 10 2024 $70 puts at $28,800 to 50 of the 2024 $50 puts at $14 ($70,000) so net $3,300 on the put roll and that would be a weird way for us to end up owning $250,000 worth of YETI and we spent $43,200 on the roll which is $46,500 on top of the net $100 we had spent already is $46,100 to have 50 2024 $40 calls and 50 2024 $50 puts. If YETI is at $50 in 2024 – we get back $50,000 and everything over that is PROFIT!

We spent around another $100 on the second half so we should still have $1.5M left for additional adjustments. You can see how we end up with those amazing spreads that are deep in the money in the LTP – in times like these, we simply make adjustments and end up with bigger commitments.