$3,008,907!

$3,008,907!

That is up $194,874 since our last review and it's the first time we've ever gotten our Paired Portfolios (LTP and STP) over the $3M mark – we usually cash out when they get to $2M from our usual $600,000 combined starts. Of course, this was the point of running them longer this time – we wanted to demonstrate the compounding effect of putting those profits back in play over time. So far, so good!

The S&P was at 4,372 on March 18th and now it's back at 4,440 so not a lot of movement but we made a lot of bullish adjustments last month and caught a 2.5% rally, which just caused us to bump our hedges in the Short-Term Portfolio (STP) up to $1.7M and we hit the turn on the nose. In fact, the STP made more money than the LTP this month! That should be plenty of protection but we don't want to be foolish as that $200,000 can go as quickly as it came in our Long-Term Portfolio (LTP).

You know you are in good shape when your protection has locked in a 200% gain and that's where we'd be if the LTP were wiped out and the STP paid us our $1.7M ($1.8M would be 3x our $500K/$100K initial outlay). But we don't have $1.7M, we have $3M and the idea is to protect it – but still take PRUDENT risks to at least keep up with inflation.

The best thing about the LTP is we have $1.7M in CASH!!! on the sidelines and, as I've been emphaisizing lately, our biggest risk factor is in our Short Puts – so let's make sure we do REALLY want to be in the stocks we sold those puts against – especially in a rising rate environment.

As we discussed in last week's Live Trading Webinar, the conservative rule of thumb is to assume that 2% of the company's debt will be subtracted from Net Income as rates rise. This is conservative for several reasons – most notably that rates rise over time and won't immediately impact earnings in full and also the interest is tax-deductible, so about 1/3 of the damage will be mitigated by lower taxes – maybe more if they have clever accountants. It's a short week (tomorrow is a holiday), so that will be our project for next week – checking our debt levels.

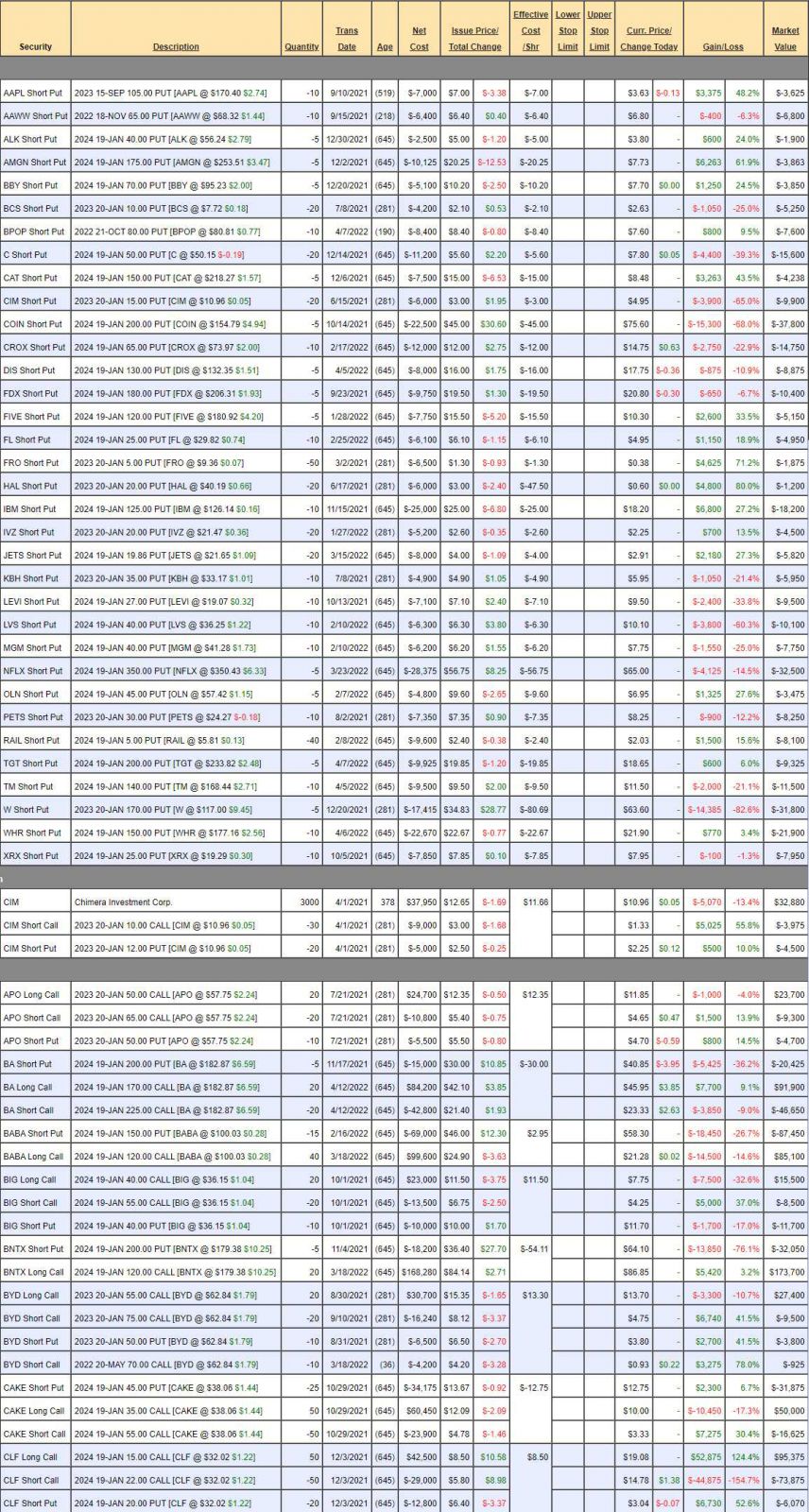

Long-Term Portfolio Review (LTP): $2,461,928 is "only" up $69,793 and now up $157,325 since our Feb 16th Review, when I said

As usual, I'd love to cash everything out but, as usual, these are positions that have already run the gauntlet in a market I have no faith in – so it's hard to let go and our hedges seem to be in very good shape protecting up (they were all of this month's gains) but hope springs eternal and maybe I'll find some things I can bear to part with this month:

Last month I noted that I think the Government has one more round of stimulus left and that's the only thing preventing me from pulling the plug and we've just survived a 20% pullback in good shape – so I'm not too worried about that either but World War III is just a button-push away – so we don't want to be over-exposed to a potential, sudden correction:

- Short Puts – Yesterday, in our Live Webinar, we noted we were down net $25,000(ish) on our short-puts and we've sold $365,000(ish) worth of puts and, for the most part, they are still all premium. So if the market is flat or up going foward we have $365,000 coming to us but it's down we're worried about and, whether we like the stocks or not – this is where we'll have to pull the plug if things turn ugly again. Better to take a $100,000 loss and be done with them than have a noose around our necks while the market sinks. We have massive buying power – but it will be eaten up quickly if the short puts start going in the money so we're going to watch this carefully, though no changes at the moment (but do keep in mind we have a ton of hedges or I'd never risk it).

- CIM – Back at $11 I would buy more of these in a better market. As it is, let's buy back the 30 Jan $10 calls at $1.33 as we regretted sellling them at the end of last year. REITs get sold off in rising rate environments but we have confidence in CIM's management to steer through it. And they pay a $1.32 (12%) dividend while we wait so great for a new trade!

- APO – On track.

- BA – We just added the bull call spread so good for a new trade. I'm not going to get into this for each one but this is, as an example, a $110,000 spread currently priced at net $24,825 so there's $85,175 (343%) upside potential – even if you missed our better entry on the bull spread (timing is everything – it was a Top Trade Alert on Tuesday.

- BABA – Charlie Munger got half out. He just got in and already he's out – that worries me. Still, I think $100 is stupidly cheap and earnings are next month so I'd like to at least see those before pulling the plug.

- BIG – Got crushed but no debt and only $1Bn to buy the whole company at $36.15 so I think this is silly. We could buy back the short calls but $55 is still a fair target so the money is better spent rolling the 20 2024 $40 calls at $7.75 down to 20 2024 $30 calls at $11.50. That will be spending $7,500 to put our spread $20,000 deeper into the money so it not only opens us up to make more profits but the wider spread means we can make up that $7,500 selling some short calls on a bounce. The July $40 calls, for example are $2.60 so 5 of them would fetch $1,300 using 92 of our 645 days we have to sell. 6 sales like that would pay for the roll but I want to sell the $45s for that price – so we'll wait. Obviously good for a new trade.

- BNTX – Our "loss" on this spread is out net $163.60 short puts having a ton of premium since the stock is at $179.38 so, if expired here, we'd gain $32,050 on that spot alone. A bit too scary for a new trade but it's the kind of thing you can play with when your portfolio is up almost 400%.

- BYD – On track.

- CAKE – They do this all the time – get out of favor with the sector and then people remember why they shouldn't be treated like the rest of the sector and start buying again. Good for a new trade, back where we started.

- CLF – Out of the park home run. It's net $15,430 on the $35,000 spread so you "only" make $19,570 (126%) if CLF manages not to fall $10 (31%) going forward. Realistically, that's still good for a new trade – even though we already made $14,730 (2,100%) from our intial net $700 investment in 4 months.

I know it seems like we have amazing timing with our entries but that's because we don't try to time them at all. We are VALUE investors so, when a stock gets to a valuation level where I can't resist it (and the macros favor the move) – then we buy. It has nothing to do with the chart and that's why our Members are able to be "ahead of the curve" so often. The information we have is like having GPS – we don't need to see the road to know where we're going – we just need to have faith in the data...

Also, and I cannot stress this enough, please note that the VAST MAJORITY of our holdings are the bluest of blue-chip stocks – names everyone knows, with proven track records and solid management. This is the same strategy Buffett uses – we just use options to leverage the returns while he just buys the stocks. We don't mess around with what's new and what's hot – this is a portfolio that's meant to build a retirement around and to be solid enough that it can be left to the next generation as well.

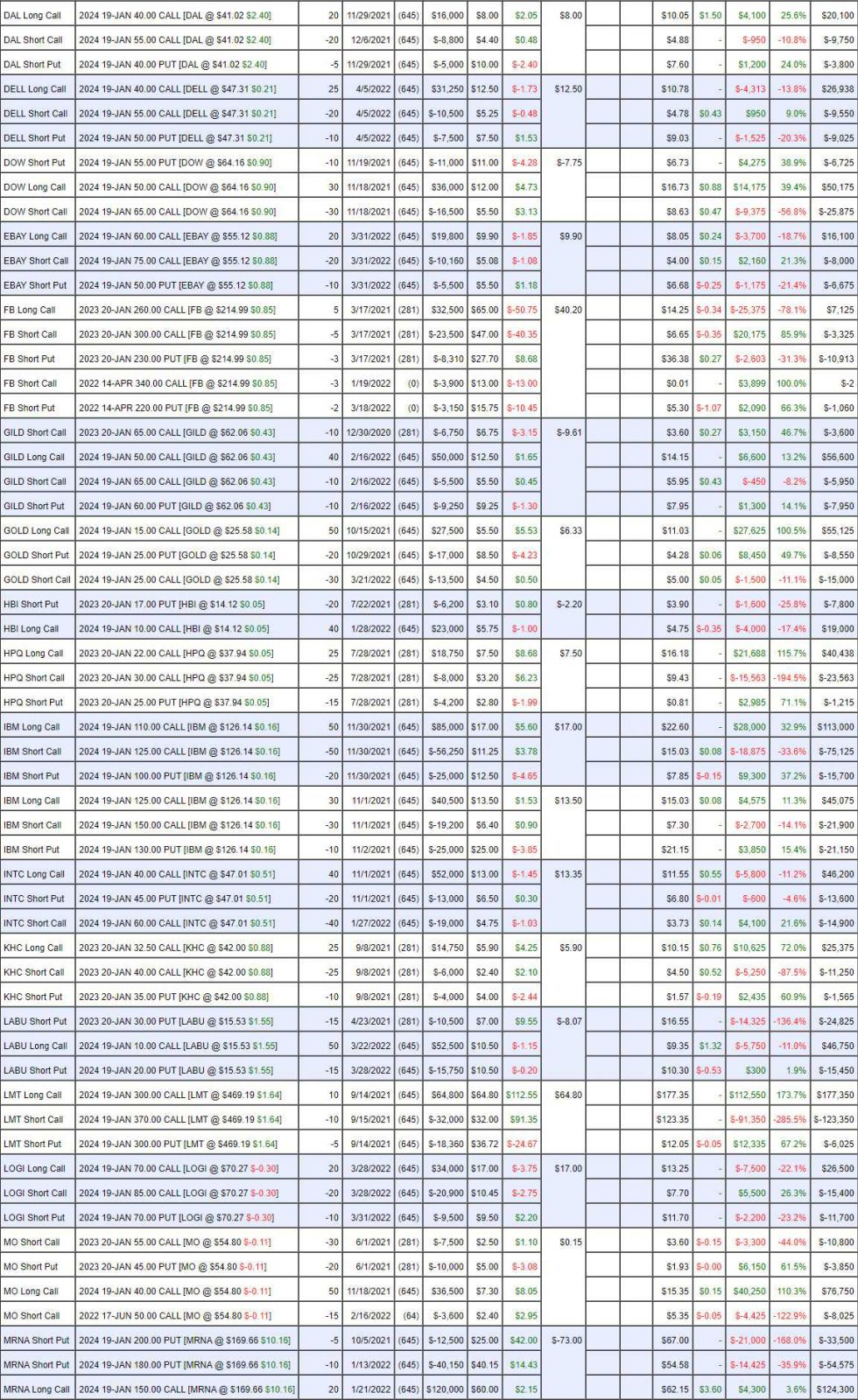

- DAL – My second favorite Airline (ALK is #1) but it was a better deal so we bought it. People were panicking into earnings but they turned out fine – things should get better from here.

- DELL – Still has that new trade smell and much cheaper than our 4/5 entry so good for a new trade.

- DOW – At our target already.

- EBAY – Good for a new trade.

- FB – That Zuckerberg be CRAZY! They plan to charge 47.5% of revenues for people to do business in their Metaverse – he's like Thanos with your bank account… This is confusing because we don't care about the Jan spread – it's just there to make sure short call sales don't burn us but it's the puts burning us this month – though not too badly. We sold $3,900 in calls and they are going worthless and we sold $3,150 in puts and they are still $1,060, so we'll just roll that along. Still we made $5,990 for the quarter against our net $690 cash outlay so I'd say it was a good 3 months. I'm more bullish now than I was in January, when FB was over $300 so let's wait for earnings to sell more calls but let's sell 3 July $220 puts for $20 ($6,000) as that's net $200 and that seems solid to me.

- GILD – On track.

- GOLD – Finally back on track my hands were getting sore from banging the table on this one below $20.

- HBI – Crazy cheap at $14.12 – great for a new trade. This one is a good debt example. HBI has $2.8Bn in debt as they run a low-margin business with tons of inventory. 2% of $2.8Bn is $56M and we can assume that's the bite out of theri normal $650M in profits so call it $600M going foward but $14.12 is $5Bn so still trading at 8.3x earnings – even after we account for the impact of rising rates against their high debt to value ratio.

- HPQ – Miles over our target already. Buffett started buying with me.

- IBM #1 – On track.

- IBM #2 – Still good for a new trade at net $2,025 on the $75,000 spread. That's $72,975 (3,600%) upside potential – you can see why our portfolio has a 400% return! IBM is, of course, our Stock of the Year, though we favored the more conservative spread for our 2022 trade. The Stock/Trade of the Year is not about who goes up the most but what stock we feel we can build a 300% trade around that has the best chance of success. Note in trade #1, we were far less aggressive, selling the $100 puts and only aiming for $125 – which they've already hit. Trade #2 is going for it over the longer term.

- INTC – Disappointing but not surprising so far. Good for a new trade.

- KHC – As boring as HBI but not out of favor at the moment.

- LABU – Notice Biotechs are our exceptions to our normal boring blue chips. I strongly believe in the 10-year macro for these trades and I want us to have irons in the fire when they take off again.

- LMT – War is a nice bonus for them but they are our Stock of the Century for Space and Fusion. Despite being miles in the money it's still only net $47,975 on the $70,000 spread so another $22,025 (46%) left to gain over 20 months is better than leaving the money in the bank, right?

- LOGI – So many dull stocks! This is new and still good for a new trade.

- MO – At our goal already. We'll have to roll the short June calls but, for now, they are providing protection for our long gains.

MRNA – Another Biotech. We are aggressively long and I think it's great for a new trade.

- MT – Another new one. We added the rest of the spread to our short puts. Still good for a new trade.

- MU – We'll see what they say about their supply chain on earnings, but not until early June, unfortunately. They made $2.14/share in their last report and did not indicate concerns. 4x $2.14 is $8+ for a $72 stock – easy math! Another debt-free (net) company I love.

- PAA – We're in this one for the dividends, which are 0.87 (7.69%) but we only paid net $6.75 so it's 12.8% to us!

- PARA – Used to be VIAC and we finally got a little pop out of them – another table-banger.

- PFE – This is the mircrosoft of pharma – just a money-printing machine with a ticker symbol. We're aggressively long and it's still good for a new trade.

- PHM – I'd like to hear earnings. I don't like the home-building sector but low debt ($1Bn) with $2.5B in earnings and $1.4Bn in 2020 and $1.9Bn in 2021 means they can ride out whatever and, at $43, you're buying the whole company for $10Bn – that's just silly. Probably great for a new trade but the macros are against them this year.

- QSR – I can't believe what people are willing to pay for a fried chicken at Popeyes. Donut people are also idiots and they are keeping the Whopper at $3.99 vs $4.89 for a Big Mac and I have to think people will notice that and drive across the street to save 20%. Assuming they actually make money selling a $3.99 Big Mac – QSR should be doing well BUT $12Bn in debt x 2% is $240M off their $1.35Bn in profits – that stings. Call it $1.2Bn then but $60 is $18.5Bn so we're still reasonably priced – and with 20% to raise prices before being as expensive as MCD, who trade at 25x earnings, which would be $30Bn for QSR.

- RIO – Gotta love the materials stocks.

- SKT – Right on track now and we're still super-aggressive (1/3 cover) as I think it's still a huge bargain.

- SPWR – Our Stock of the Decade though I guess it's irresponsible not to sell 50 (1/2) of the 2024 $25 calls for $6 ($30,000) to lock in some of the gains. We can always roll to 2x a higher strike if the blast through $25.

- T – Hey, we're getting ripped off as T should be worth more these are post spin-off prices. I need more info to fix this so ignore the net loss. Have to wait until earnings to see if I like the new T going forward but I think I do.

- TD – My favorite bank and we nailed the short calls after a brief scare. Let's sell 10 July $75 calls for $3 ($3,000) as now I am a bit concerned about potential Russian write-offs and I'd rather be protected..

- TUP – On track.

- VALE – More materials. At goal already.

- VTOL – The logic here is that oil prices will put people back on rigs and VTOL is like an air-taxi service for rig workers. Also in their favor is global warming causing more hurricanes so more evacuations means more trips, etc. This is the silver lining to that cloud. What caused us to jump in is their progress on electric helicopters for air taxi and short-haul "trucking" is very interesting.

- WPM – I was so faffled when they were dowin earlier in the year – so much so that we added another trade, more aggressive than the first. All better now.

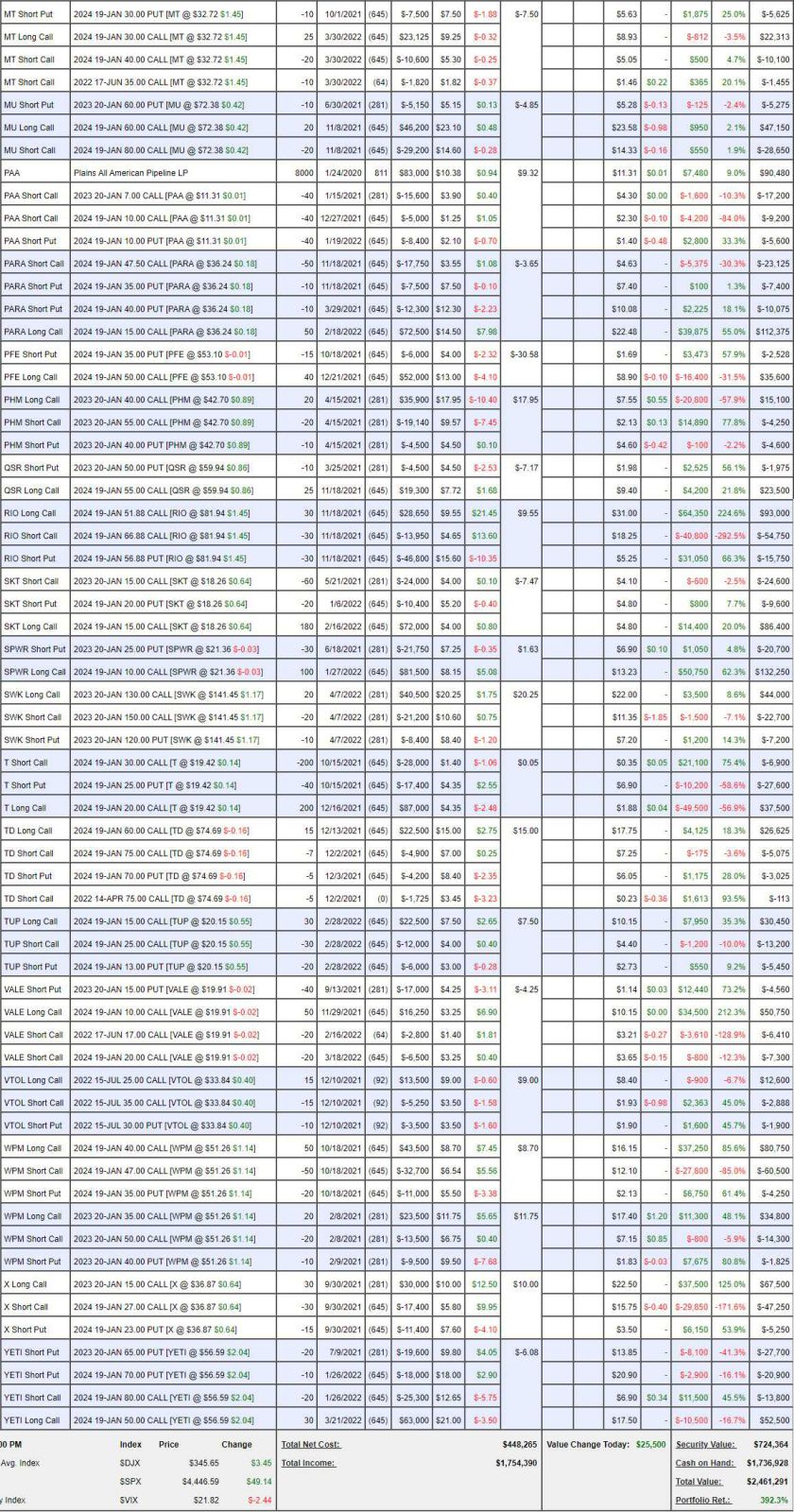

- X – Stell that's actually made in the US to avoid shipping bottlenecks? Yes, please!

- YETI – Another kind of speculative one. Good for a new trade but I'd just sell 10 of the Jan $65 puts. It's tempting to buy back the short $80 calls as they are up 45% but we'll just be thrilled if we hit that and net $90,000 on what is currently a net NEGATIVE $9,900 spread so upside potential is $99,900 but it's a specualtive trade for sure. Earnings are May 12th. No debt, $250M in profits and the company is $5Bn at $56 so not terribly cheap but great growth.

IN PROGRESS