By Fintel. Originally published at ValueWalk.

Purple Innovation Inc (NASDAQ:PRPL) is a provider of comfort technology products and manufactures various products, including mattresses, pillows, cushions, bases, and sheets. The company has designed many technologies, including the Hyper-Elastic Polymer material and the Purple Grid structure.

Purple Innovation shares have lost 84% of their value over the past year in one long gradual decline from a peak of $41.08 in Jan. 2021. The significant fall in market capitalization valuation to around $400 million has prompted various insiders to increase their position sizes.

Q1 2022 hedge fund letters, conferences and more

PRPL is grabbing attention in 2nd rank this week on Fintels Significant Insider Buying Activity Leaderboard, with a score of 99.46. The leader board shows companies with the most compelling insider trading quant score and analyses the data of purchases and sales from insiders over the last 90 days. The research shows that a net $87 million worth of shares has been purchased in the previous three months at an average of $5.62 per share. This implies that the net insiders have lost 16% of their capital since the purchase.

Significant academic research suggests corporate insiders outperform the market when buying shares in their own companies. This screen identifies companies with substantial insider buying by corporate insiders.

We note a recent insider form 4 for Purple Innovation relating to holder Coliseum Capital. The form 4 disclosed the purchase of around 4.1 million shares, bringing Coliseum’s total holding to about 35 million shares. Coliseum is the largest shareholder on the register and almost owns 50% of the total float.

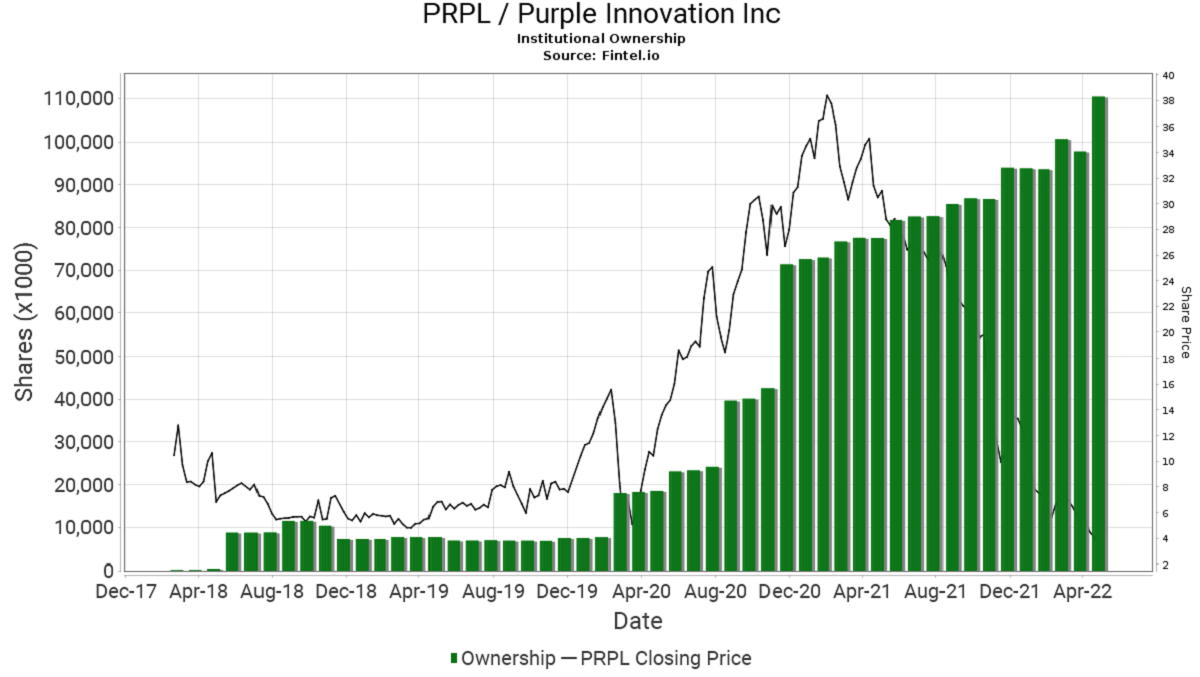

Included below is a chart that shows the level of institutional ownership in PRPL over the last five years. The chart visually shows the growing level of ownership by insiders over time.

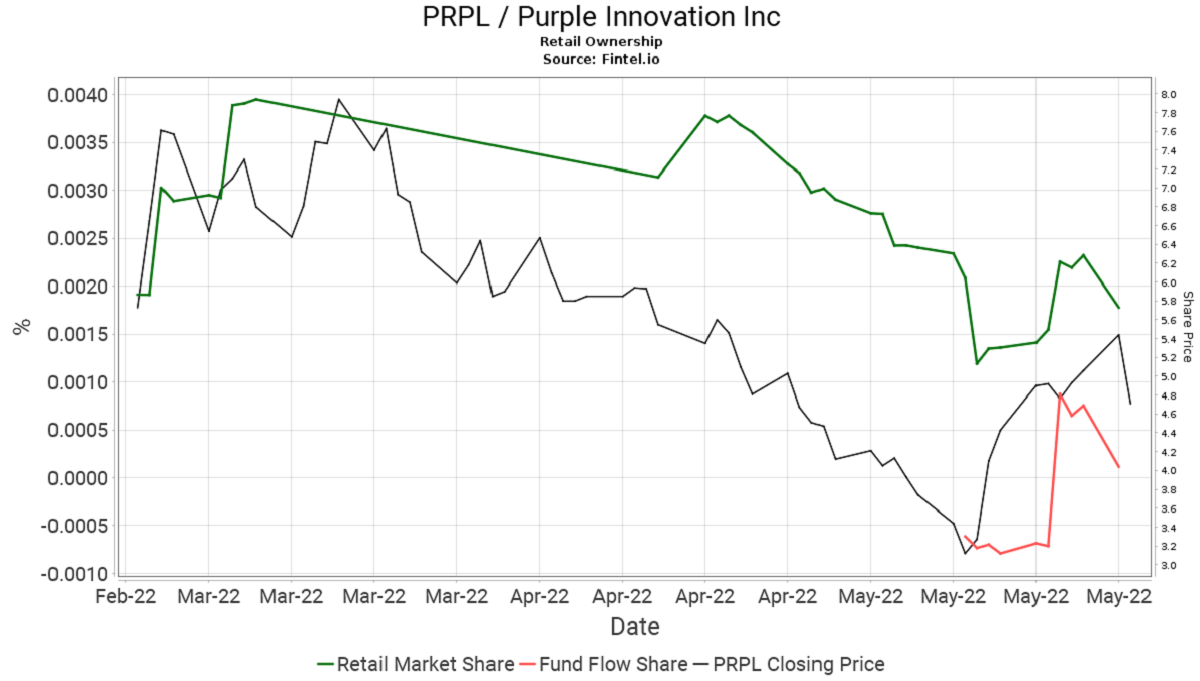

For comparison to the institutional activity in the stock, below is a chart of the retail activity over the past three months that closely follows the share price.

In May, Purple Innovation reported first quarter earnings that topped analyst estimates at both the top and bottom line. PRPL reported EPS of -24 cents per share compared to a forecast of -35 cents. The group posted revenue of $143.2 million vs. an expectation of $130 million.

In addition to the result, Purple guided for the full year and reiterated that they would achieve profitable growth in the second half of 2022. In terms of financial guidance, the company downgraded FY22 revenue forecasts to $650-690 million from the previous guidance of $790-830 million. The market had been forecasting a slight beat above guidance of around $750 million before the release. At the profit level, the company reduced adjusted EBITDA forecasts to $21-27 million from $26-33 million prior. The reduced guidance still came ahead of the market’s forecast of $15 million.

PRPL expects sequential improvements in financial performance each quarter.

Other Fintel quant analysis highlighted a very high Short Squeeze Score of 91.85, placing the stock 16th out of 5,400 included companies. The score was calculated using a multi-factor quantitative model that ranks companies with a higher risk of seeing a short squeeze. Some of these factors include 16.3% of the firm’s float currently being shorted, according to Nasdaq and Capital IQ.

What Do Analysts Think Of The Stock?

Jeremy Hamblin from Craig-Hallum Capital believes new management will have to regain shareholder confidence after a series of earnings misses, unreasonable guidance targets and poor execution with eroded credibility for the stock. The firm maintained its ‘hold’ rating but lowered its target price to $4 from $4.50.

Bobby Griffin from Raymond James believes Purple’s product is unique and can gain market share over the coming years. However, slowing industry demand makes it challenging for investors to support the stock. They believe the stock may continue to see weakness over the next few quarters until investors regain confidence that gross margins are starting to stabilize. The firm stays ‘market perform’ rated on the stock.

Atul Maheswari from UBS notes the Q1 result was soft but not as bad as the market had feared. They see the stocks multiple remaining under pressure while current macro uncertainty continues. The firm stays ‘neutral’ and lowers its target to $4 from $6.50 prior.

PRPL has a consensus ‘hold’ rating with an average target price of $6.50 on the stock, implying a 38% capital upside.

Article by Ben Ward, Fintel

Updated on

Sign up for ValueWalk’s free newsletter here.