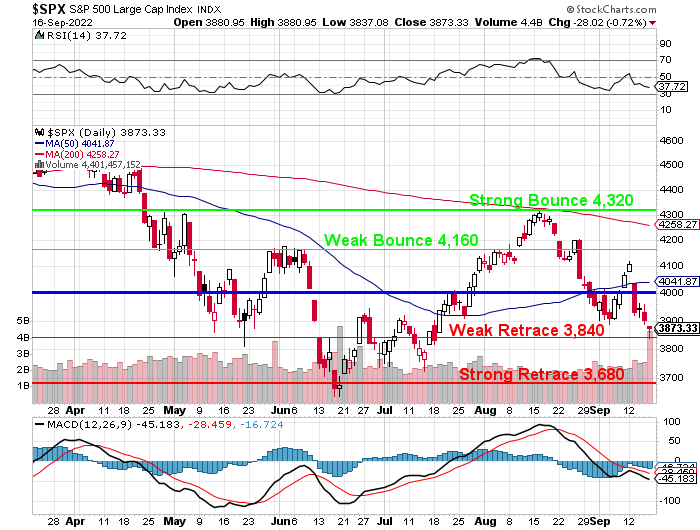

Will 3,840 hold?

Will 3,840 hold?

That’s our Weak Retrace Line on the S&P 500 and, if we can’t hold that – then we’re off to retest the Strong Retrace at 3,680 – down another 4.2%. We’ve already fallen from 4,100 to 3,860 and that’s 5.8% so 3,680 would make an even 10% drop from where we thought things were improving just last Monday but I warned:

“…This is why we are only at the beginning of the Inflation Cycle that is likely to go on for years. Maybe $22 is too much but $15 is not enough and 30 states in this country still pay less than $10/hour to workers, who take home barely $1,000 per month to live on.

“Getting to the right spot, whatever it is, will take a very long time because we’ve been underpaying workers (leading us to overstate realistic profits and realistic prices) for years and that won’t be fixed by a couple of rate hikes. ”

We closed at 4,110 that day but the next day we got our CPI Data and it was running hot and the party ended swiftly and the S&P opened Tuesday at 4,037 and finished the day 100 points lower at 3,932 and we spent the rest of the week falling 60 more points so it’s all about the inflation data and, of course, fear of the Fed – who make their rate decision on Wednesday.

We closed at 4,110 that day but the next day we got our CPI Data and it was running hot and the party ended swiftly and the S&P opened Tuesday at 4,037 and finished the day 100 points lower at 3,932 and we spent the rest of the week falling 60 more points so it’s all about the inflation data and, of course, fear of the Fed – who make their rate decision on Wednesday.

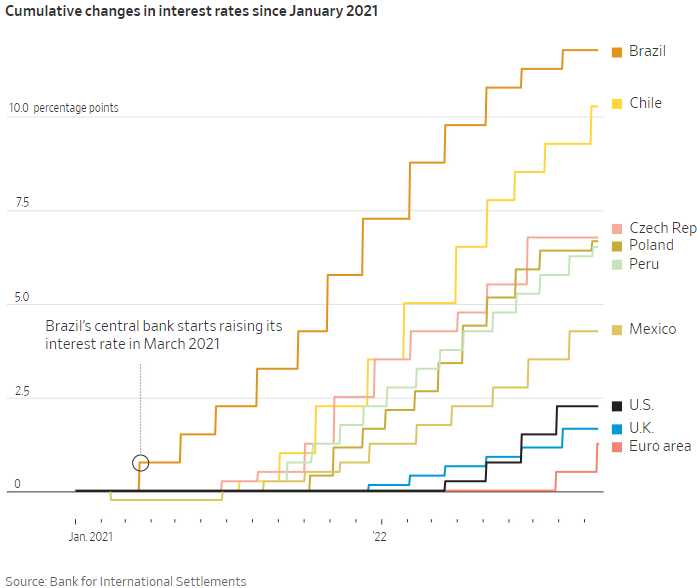

As you can see, it’s the Dollar that reversed course and took the markets with it. The Euro has held up at $1.0062 because they just raised 0.75 and seem intent to keep up with the Fed going forward but the UK did not make that commitment and the Pound is down to $1.14 and Canada has once again fallen to 75 cents on the Dollar – a good time to go on vacation there.

As you can see, it’s the Dollar that reversed course and took the markets with it. The Euro has held up at $1.0062 because they just raised 0.75 and seem intent to keep up with the Fed going forward but the UK did not make that commitment and the Pound is down to $1.14 and Canada has once again fallen to 75 cents on the Dollar – a good time to go on vacation there.

While the rising Dollar helps to contain inflation here – it makes it worse everywhere else and it impacts our Corporate Earnings as close to 60% of the S&Ps income comes from outside the United States. The IMF put out a warning last week that the Global Economy is heading towards a recession, saying:

“Many countries have not been through a cycle of much higher interest rates since the 1990s. There’s a lot of debt out there augmented by the borrowing in the pandemic. It’s not going to be contained.”

A stronger dollar makes the debts that emerging-market governments and companies have taken out in U.S. dollars more expensive to pay back. Emerging-market governments have $83 billion in U.S. dollar debt coming due by the end of next year. “You have to look at this through a budgetary lens,” said Daniel Munevar, an economist at the United Nations Conference on Trade and Development. “You enter into 2022 and all of a sudden your currency goes down 30%. You’re going to probably be forced to cut back expenditure on healthcare, on education to meet those [debt] payments.”

A stronger dollar makes the debts that emerging-market governments and companies have taken out in U.S. dollars more expensive to pay back. Emerging-market governments have $83 billion in U.S. dollar debt coming due by the end of next year. “You have to look at this through a budgetary lens,” said Daniel Munevar, an economist at the United Nations Conference on Trade and Development. “You enter into 2022 and all of a sudden your currency goes down 30%. You’re going to probably be forced to cut back expenditure on healthcare, on education to meet those [debt] payments.”

Our rate hikes are torture for smaller countries with debt issues. Argentina raised rates Thursday to 75% as their Peso is one of the currencies down 30% against the Dollar and Ghana raised to 22% but it’s not enough as their currency keeps falling. Even the Euro is down 12% to the Dollar this year and that has only stopped as the ECB last week tried to match the Fed with a 0.75% hike but the Fed will up the ante this week and they’ll have to keep playing catch-up.

“The strong dollar has created a headwind for about every major asset class,” said Russ Koesterich, co-head of Global Asset Allocation at BlackRock. “It’s another aspect of tighter financial conditions and that affects everything.”

In the U.S., hourly wages of private-sector workers were up 5.2% in August from a year earlier, a slower increase than 5.6% in July but much faster than around 3% before the pandemic. A different measure compiled by the Federal Reserve Bank of Atlanta, which isn’t affected by shifts in jobs between high- and low-paying industries, put wage growth at 6.7% in July and August, the fastest in at least a quarter-century. Both, however, are lagging behind consumer prices, which rose 8.3% in the year through August.

In the U.S., hourly wages of private-sector workers were up 5.2% in August from a year earlier, a slower increase than 5.6% in July but much faster than around 3% before the pandemic. A different measure compiled by the Federal Reserve Bank of Atlanta, which isn’t affected by shifts in jobs between high- and low-paying industries, put wage growth at 6.7% in July and August, the fastest in at least a quarter-century. Both, however, are lagging behind consumer prices, which rose 8.3% in the year through August.

Bank of England Governor Andrew Bailey urged U.K. workers not to ask for big pay raises in an effort to cool inflation that is running at 9.9%, prompting criticism from Labor Unions. U.K. wages are currently rising by 5.5% a year, up from about 3.5% in 2019 – still nowhere near enough to keep up with inflation.

That’s why I say we’re still early in the cycle and it’s NOT something that’s going to be fixed by Fed hikes – unless they hike so much that they destroy the economy and cause a massive recession in which we lose more than the 11M jobs that are currently unfilled. Then workers will be happy to go back to getting whatever scraps our Corporate Masters see fit to dole out – after they take even more profits than they took the quarter before – of course.

That’s why I say we’re still early in the cycle and it’s NOT something that’s going to be fixed by Fed hikes – unless they hike so much that they destroy the economy and cause a massive recession in which we lose more than the 11M jobs that are currently unfilled. Then workers will be happy to go back to getting whatever scraps our Corporate Masters see fit to dole out – after they take even more profits than they took the quarter before – of course.

So it is quite literally all about the Fed this week and Powell speaks Wednesday at 2:30 – which we’ll monitor from our Live Trading Webinar. Before that we have housing data and some note auctions and Thursday we have Leading Economic Indicators and the KC Fed and Friday we’re back to inflation data with the PMI Report.

There are hardly enough earnings to mention – Q2 is officially over – on to Q3!

Despite all the headwinds, I’m expecting 3,840 to hold. Traders seem to be expecting the worst (a 1% hike) but I think the worst is now priced in an we should get a bit of relief after Powell speaks – unless he’s found some new way to torture us.