Nowhere to run to, nowhere to hide.

Nowhere to run to, nowhere to hide.

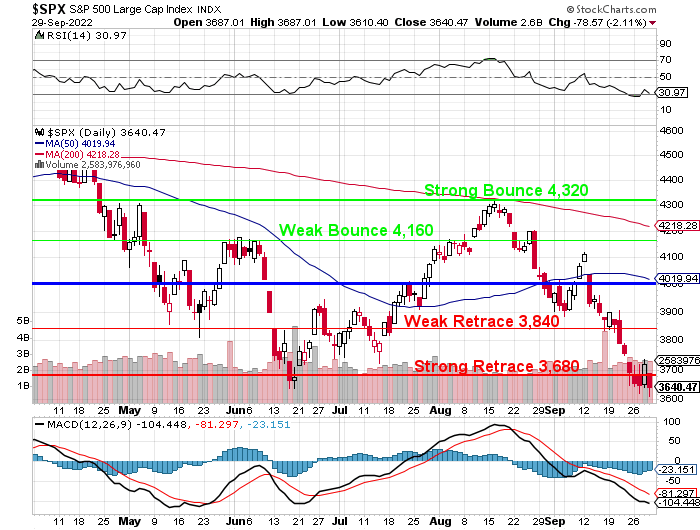

Market losses pretty much doubled in Q3 but we’re no worse off than we were at the end of Q2 – it’s just more disappointing because it looked like we were mounting a rally in July (while the Fed was on a break) but that all fell apart when the Fed came back and upped the ante on raising rates to infinity and beyond.

There are no “safe” places to be other than CASH!!!, which has gone up quite nicely this year (as we expected). Stocks are down, commodities are down, bonds are down. At this point in the year the mounting losses and hazy outlooks have weighed on investors’ spirits, with surveys showing individual investors were the most pessimistic in years and fund managers holding unusually high levels of CASH!!! – along with our PSW Members – finally.

The S&P 500 is down 24% for the year and that is BAD! As you can see from this chart – we have only had two years that were this bad into September and they both (as well as this one) came after we were in clearly overbought markets that ran into changing Fed policy.

The S&P 500 is down 24% for the year and that is BAD! As you can see from this chart – we have only had two years that were this bad into September and they both (as well as this one) came after we were in clearly overbought markets that ran into changing Fed policy.

It’s the overheating that forces the change in the Fed but, no matter how many times traders witness the cycle – they still don’t believe in it until it bites them in the face. While I have said CASH!!! over 200 times in the past two years our first major CASH!!! call of this cycle came on August 17th of 2021, when I sent out a morning Alert to our Members saying:

“Good morning!

A note to all our Members, we’ve cashed out about 50% of the LTP and have moved to 80% CASH!!! – something we intend to do with all our Member Portfolios.

I think the market risks currently outweigh the rewards of sticking it out and all cash does is allow us to find more bargains to buy (see our recent Top Trade Alerts for examples).

Check in on Member Chat this week as we’ll be reviewing all the portfolios and then we get to make a new Watch List featuring most of the positions we’re cutting. Remember – Watch List + Patience = Profits!

Be careful out there….”

That post was titled “Top of the Market Tuesday – Cashing Out While We Can” and yes, my call was a little early but our call to begin buying again on June 14th of 2022 could not have been more on the button – until it all fell apart again.

We managed to amuse ourselves in between but these were our major market calls in the past year and, as I noted back in June, we had already taken Fed Hikes and the Recession (and the war and inflation) into account in our model and by model I mean our 5% Rule™ Applied to the Fair Value of the S&P 500:

“It’s difficult to model panic” – just as it’s difficult to model “irrational exuberance” but it’s easy to model the fair value top and bottom of the market – that’s just math. While a Scientist may tell you the Earth is 4.5Bn years old and many, many people will chose not to believe it – a Value Investor may tell you that the S&P 500 is worth 4,000 and many, many people may choose not to believe that either. Neither one is a matter of opinion – just a fact.

Unlike the age of the Earth, conditions may change that affect the value of the S&P 500 – so it’s a bit of a moving target but not in a way that changes daily, weekly or even monthly. Outside of a 9/11-type event (which Putin now has his finger on) it’s very unusual for the indexes to stray more than 10% outside their true value ranges – which is what our chart represents.

That means the odds highly favor us selling when we are at the top of the fair value range and buying when we are at the bottom of that range. We are once again in the bottom of that range – so we’re buying – not panicking. Going back to that S&P through September chart, opportunities like this only come around once per decade – this may be it for the 20s!

We’re not going all in but we’re building our Watch List and getting ready for earnings – THEN we will KNOW who are the compelling buys – because we will have more data and data is all a value investor cares about.

Have a great weekend,

– Phil