Three Things Dampening the Pain

The year is basically over. And barring a miracle, the stock market will finish with its worst annual return since the great financial crisis. Despite the deep drop in stock prices and the sharp increase in borrowing costs, things probably don’t feel that bad for most of you reading this.

I can’t quantify people’s happiness, but I speak to a lot of investors, and the Animal Spirits inbox gets ~50 emails a week. If there was a palpable amount of economic anxiety out there, I think I would feel it.

I can’t speak to things that happened before I was born, but this might be the least painful bear market of all time. Of course, things very well might get worse, and maybe next year hurts more than this one does, but most people’s lives look a lot better than the stock market. There are three main reasons for this, as I see it.

People aren’t getting laid off. Yes, there are headlines out of Twitter and Netflix and Snap, but those high-profile companies are not representative of the overall economy. First of all, Netflix only laid off 300 people. Snap laid off 20% of its workforce, which is a huge percentage, but it’s only ~1,300 people. And with ~10 million job openings, these folks have likely had little trouble finding new employment.

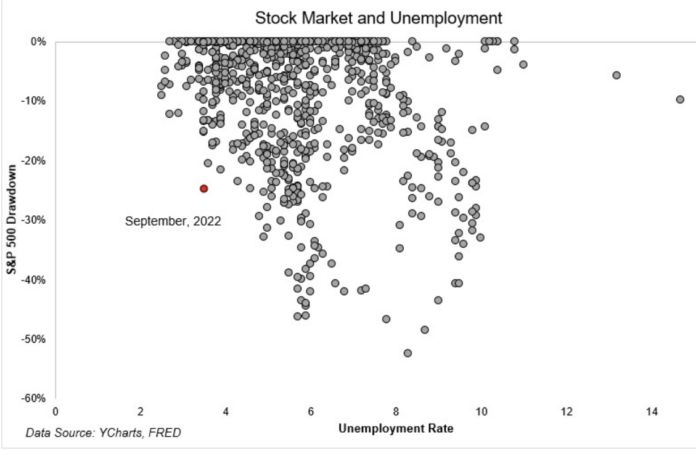

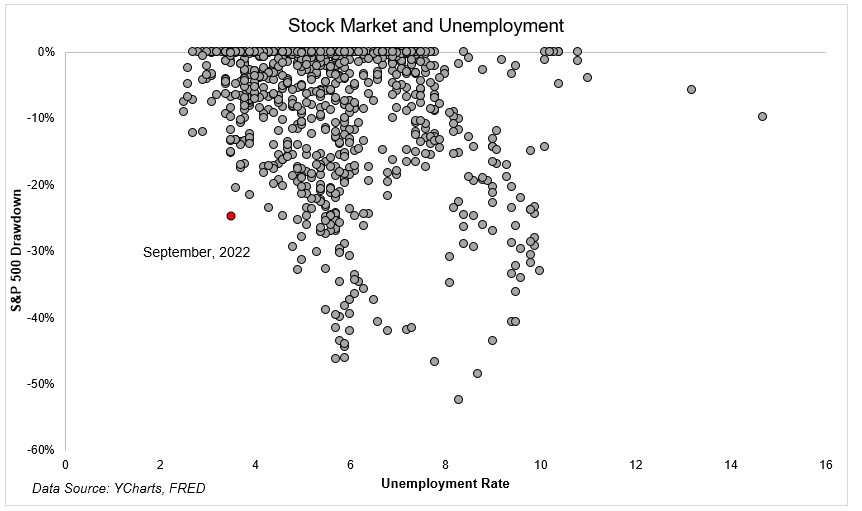

When you look at the national level, the unemployment rate is down to 3.5%. The last time it was lower was 1969. It’s weird that the stock market is down more than 20% while unemployment isn’t rising, usually bear markets and rising layoffs go hand in hand.

The S&P 500 has never experienced a decline this deep with unemployment below 4%. This goes a long way toward explaining why people seem okay despite a bear market, rising prices, and rising interest rates.

Remote work. Another factor in people seeming to be less upset than the stock market would lead you to believe is tens of millions of people working from home at least some of the time. The number of people working remotely tripled from 5.7% pre-pandemic to 17.9% today. Not having a commute has been a huge mental boost for millions of Americans, myself included. I sleep later, spend less time on the train, have time to exercise, and spend more time with my kids. Not commuting an hour plus each way five days a week has been a life changer, and I do not use those words lightly.

Remote work also means less time at the water cooler with co-workers. This is a bummer, but in a bear market, it’s a blessing. If a portfolio falls 20% and no one is around to hear it, does it make a sound?

Excess savings. Consumer balance sheets are still in good shape due to the pandemic. A combination of not being able to travel and spend money, coupled with the government sending out trillions in stimulus, has allowed consumers to withstand rising prices and higher interest rates. For now at least.

From 2020 through the summer of 2021, U.S. households accumulated $2.3 trillion in savings above and beyond what they would have had if pre-covid trends continued. Since the end of 2021, about 1/4 of these excess savings have been spent, according to an analysis from the Board of Governors of the Federal Reserve System.

I don’t want to be insensitive. There are plenty of people that are deeply impacted by the current economic environment. But on balance, strong employment, remote work, and excess savings have made a bear market tolerable for most Americans.