Well, that was a heck of a recovery!

Well, that was a heck of a recovery!

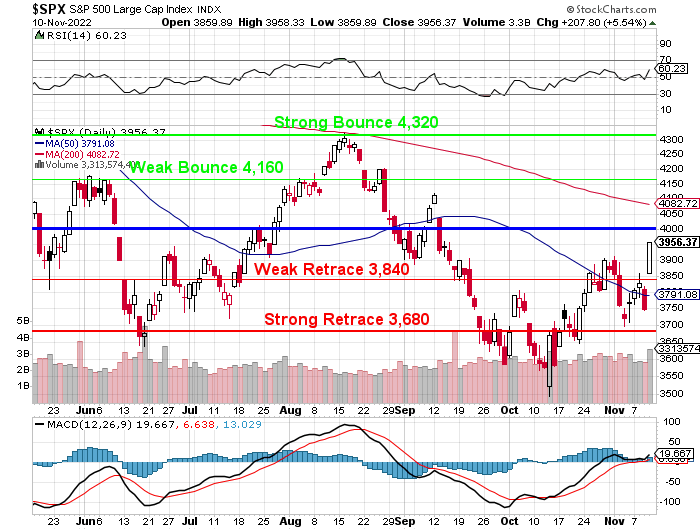

It took just one day in November to accomplish what the last two weeks of October could not – we are back within striking distance of our 4,000 mid-point on the S&P 500. We’ll almost certainly be rejected on our first attempt and there are two ways to look at the expected pullback:

-

- The entire run is from 3,680 so that’s 320 points and the weak retrace is 20% of the run – so 64 points is 3,936 and a strong retrace is 128 points at 3,872.

- As it’s such a sharp move, we just measure from where we started at 3,750 and that’s 250-points so a 50-point retrace is 3,950 (weak) and 3,900 would be strong.

So those are going to be our technical zones of concern this morning and, data-wise, we only have Consumer Sentiment at 10 and that should be getting better if the cooling inflation that led to yesterday’s rally is real but Consumers have also had to deal with the impact of the Fed’s rate hikes, which have made home loans, auto loans, credit card payements, etc more and more expensive each month.

That’s because the Fed has been playing from behind the curve all year, thanks to Powell’s moronic “transitory” BS when inflation first became an issue that was too obvious for the Fed to completely ignore. The Fed’s John Williams spoke last night and said inflation expectations have come down – that was also taken positively by the markets.

So the question is what will hold up into the weekend? If 3,936 holds, it’s a very strong sign we’ll follow-through higher next week and even 3,872 will indicated that there’s no reason to be bearish into the weekend (he said right before Black Monday) but anything below that and we’re going to add more hedges.

So the question is what will hold up into the weekend? If 3,936 holds, it’s a very strong sign we’ll follow-through higher next week and even 3,872 will indicated that there’s no reason to be bearish into the weekend (he said right before Black Monday) but anything below that and we’re going to add more hedges.

Earnings are winding down and we’ll have PPI, Retail Sales, Industrial Production and Housing Data next week so momentum will mean a lot going into the weekend. Oil snuck back to $90 this morning but, on the whole, the quarter beginning in October has had quite a relief compared to Q2 and Q3 and, last year, Oil prices collapsed into December – but that was pre-war.

Speaking of energy, congrats to all our Members who played along with our call to go long on Natural Gas (/NG) Futures, when I said yesterday morning (10:34): “If the Dollar is done dropping then /NG over $6 (tight stops) is a fun play.”

As you can see, those have been good for gains of over $2,500 per contract so far. Futures trading is a good tool to have in your trading toolbelt as a way to take quick advantage of changing market conditions. Of course it’s very possible that it was our own buying that caused the surge in the first place (it came at exactly that time and then mostly reversed) but – as long as $6 held – all went according to plan for a great day’s gain!

The Dollar resumed it’s pullback later in the day and is now at 106.70, the lowest it’s been since early August, when the S&P 500 topped out at 4,320. That’s why, if we can’t get back over 4,000 with the Dollar back at it’s lows (on the likely false assumption that the Fed is nearly done hiking), then we’ll be taking this opportunity to raise a lot of CASH!!! next week – while the CASH!!! is cheap.

The Dollar resumed it’s pullback later in the day and is now at 106.70, the lowest it’s been since early August, when the S&P 500 topped out at 4,320. That’s why, if we can’t get back over 4,000 with the Dollar back at it’s lows (on the likely false assumption that the Fed is nearly done hiking), then we’ll be taking this opportunity to raise a lot of CASH!!! next week – while the CASH!!! is cheap.

With the Dollar down 7.5% from the November high, S&P 4,000 is up 7.5% from the November low – do you sense correlation? Yes, it’s that simple, the Dollar drops so you need more Dollars to buy the same amount of stock – not much else has changed.

That means these gains can disappear as fast as they came but, for the moment, there is SPECULATION that the Fed will slow their hikes while other Central Banks have indicated nothing of the sort (since they were behind even our slow Fed) and that can keep some downward pressure on the Dollar – keeping stocks afloat. But, as an owner of those stocks – that’s a pretty crappy reason not to sell them, isn’t it?

Have a great weekend,

– Phil

Oh, PS – Finally someone else has realized the Dems might be keeping control of the House: The path to 218: Why Democrats aren’t out of the race for the House yet