Via ZeroHedge

By Eric Peters, CIO of One River Asset Management

“Buyer traffic is becoming increasingly scarce,” explained the Chairman of the National Homebuilder Association. “Even as home prices moderate, building costs have yet to follow.”

When prospective homebuying is this weak, the Fed is typically cutting rates. Yet markets are prepared for another 100bps of rate hikes through next Spring.

US existing home prices were down each of the past four months across all four regions. Price discounts aren’t enough – inventory ratios are higher as nobody wants to move unless they must.

Bond markets are convinced that inflation is going to fall hard – higher real rates, a weaker economy, a stronger US dollar, and a massive deflationary impulse from global trade make it a safe bet.

But there are oddities in the background. Labor is gaining strength. This doesn’t usually happen with a weaker economy and falling inflation. But it is happening.

“Overtime and minimum wage violations are common violations found in food service industry investigations,” said the Department of Labor. Krispy Kreme quickly settled damages filed by 516 workers on Nov 7th. Starbucks workers staged their largest labor action on Red Cup Day, one of their busiest of the year.

“If the company won’t bargain in good faith, why should we come to work,” the mood captured by a shift manager. US rail strikes are scheduled to start on Dec 5 – key chemicals shipments will stop days before. “Congress must quickly intervene to ensure a disruption does not occur,” the National Retail Federation warned. And it isn’t just the US – labor tensions are rising in the UK, Canada, Finland. Central bank balance sheets make unusual the new normal.

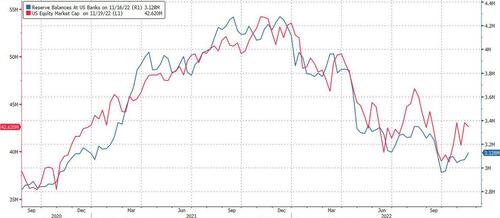

The QT theme continues; the “T” for tightening bit has paused. Fed excess reserves rose again last week, having bottomed seven weeks ago. It’s a complication that policy has never experienced. Demand for US dollars has declined as investors fish for an equity bottom, pushing excess liquidity back onto the Fed’s balance sheet.

Warren Buffet is one of those investors on the hunt for value. Berkshire’s 13F focused on cyclical infrastructure – semiconductors, energy companies, transportation over banks and technology stocks.

What to make of this mix of marbles?

There is a thirst to place current circumstances into a package that resembles the past, to give some comfort that the future isn’t as unknown as it seems. But it isn’t the 1920s or the 1970s, pre-war or post-war. There is no analog. Today’s starting points are like none we have seen.

The biggest risk is extrapolating to the future from a past that feels comfortable, confirmed by recent data. Disequilibrium is the new equilibrium.