November finished with a bang!

November finished with a bang!

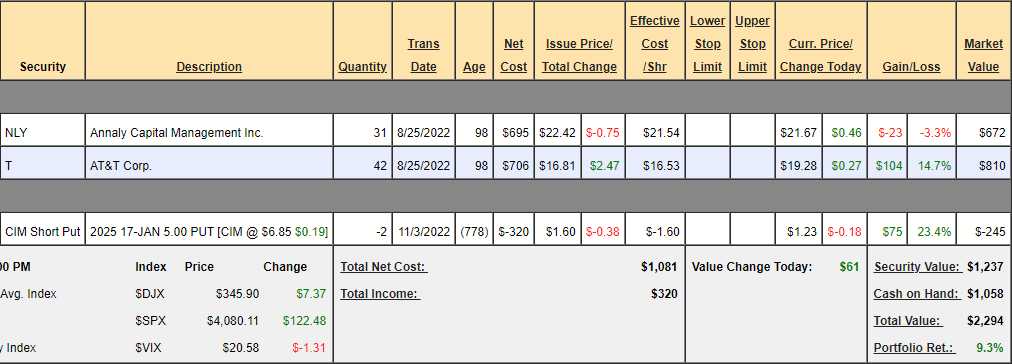

Powell spoke yesterday and indicated the Fed may slow their pace of tightening as soon as the next meeting and it wasn’t news – it was exactly what we expected – but it made the markets happy and now the Dow is only down 5% for the year. This doesn’t affect our slow, steady investing strategy for our $750/month Portfolio, which began on August 25th and, as of last month’s review, was down 0.7% with $2,100 invested.

Our goal in this portfolio is to show investors how to use slow, steady, simple options strategies to amass over $1M over 30 years by investing just $700/month ($252,000). If you can apply this discipline in your early working years – your retirement will be a breeze.

Our goal is to make 10% a year on our investments and, though it has only been 3 months – the portfolio is up 9.3% already – so we’re back on track. No dividends were paid out in the last 30 days but Annaly Capital (NLY) did make a nice recovery after reverse-splitting and it’s very hard to stay mad at them when they pay out $3.52 per $21.67 share (16.24%) in annual dividends.

AT&T (T) has gained about $1 this month and the short puts we sold on Chimera Investment (CIM) are already up 23.4% ($75) in their first month – as we caught a nice bottom with our entry.

The key to this strategy is picking the right stocks in the first place. Fortunately, we are Value Investors – it’s what we do… We would rather have our stock selections stay low long enough for us to accumulate at least 100 shares – which is the point at which we can begin to sell options and I do expect us to be rangebound into next quarter – despite yesterday’s little pop.

Now, we have another $700 we can put to work and we are fresh off picking our 2023 Stock of the Year, which is Yeti Holdings (YETI), but YETI is a $45 stock (now that we popped it 7% yesterday), so a bit much for this portfolio at this stage of our process.

HOWEVER, we did have some good finalists including the very reasonable Energy Transfer (ET) at $12.54 and SoFi Technologies (SOFI) at $4.83. While I do love SOFI as a speculative investment, ET pays a whopping $1.06 (8.4%) annual dividend and we are just $1,254 away from having 100 shares and being able to sell the 2025 $10 calls for $3.30, which would drop our net to $924 – essentially this month’s investment.

Once we are covered, we’ll still have $476 to spend next month while we can expect $106 in dividends from the ET shares x 2 years ($212) and another $76 when called away at $10 in Jan 2025 (unless we roll the calls, which is likely) and that’s $298 (32%) back on our net $924 investment over 2 years.

Is that going to be the best use of our $700 this month? SOFI is $4.83/share but we can sell the 2025 $5 puts for $1.85 and that would give us a net entry of $3.15 – 35% below the current price. So, over $5, that would clearly make us 35% in 2 years but really we could sell 2 for $390 and that would tie up $630 in margin so our return on margin would be 62% with our worst case being that we own 200 shares of SOFI at a 35% discount.

OR, we could buy 100 shares of SOFI for $483 and sell 1 2025 $4 call for $2.40 ($240), which is a ridiculous premium due to more people than me thinking SOFI is way too cheap. We can pare that with 1 short 2025 $5 put at $1.85 ($185) and our net cost of 100 share is $58 and we’re tying up $500 in margin (assignment risk) and, if we get called away at $4 we make $342, which is 61% of $558 cash and margin.

If we could sell 2 of them, them I’d do it that way but we don’t have the margin for it so let’s be a bit more aggressive and sell the $5 calls for $2.07, which raises our net by $33 but gives us a potential $409 profit at $5 out of $591 cash and margin, so a 69% potential return in two years.

That would be the winner except for the fact that SOFI doesn’t pay a dividend – so why should we pay $483 to own the stock when we could, instead, set up an artificial position using options. So our $700 play on SOFI will be:

-

- Buy 5 2025 SOFI $3 calls for $2.85 ($1,425)

- Sell 5 2025 SOFI $5 calls for $2.07 ($1,035)

- Sell 1 2025 SOFI $5 puts for $1.85 ($185)

The net of this spread is $205 and we need $500 in margin so $705 cash and margin (we had $58 left last month, so we’re good) and this is a $1,000 spread at $5 that is almost entirely in the money to start. So now, using the same amount of cash and margin that we hoped would make us $400 at $5 in 2025, we are now potentially able to make $795 against $705 in cash and margin – that’s 112%!

Meanwhile, let’s not take the rally too seriously until we see what sticks next week. Powell made some nice noises yesterday and that caused the Dollar do drop 2% and the markets generally move 2x inverse to the Dollar over the short-run and, so far, it’s a very short run:

See it’s all very logical…