We made it!

We made it!

Yesterday we were looking for a Strong Bounce on the S&P 500 and this morning you can see how useful our 5% Rule™ can be in predicting the movement of the indexes. The most important thing the 5% Rule™ does for us is it reminds us not to get excited about these little bounces – they are a natural part of a trend and only if they are conquered do we consider it an actual reversal.

The more volatile Nasdaq came in at 11,637 at the close and our weak bounce line was 11,620 but this morning we have a strong overnight move in the Futures back to 11,702 and that’s almost to the Strong Bounce Line at 11,740 but we’re not likely to get there because AAPL failed $143 and I’m not seeing a catalyst today to move it over.

Also we have the weekend and the Dollar is below 105 and the Fed has a rate hike next week… Lots of reasons to be cautious but how about this one:

Also we have the weekend and the Dollar is below 105 and the Fed has a rate hike next week… Lots of reasons to be cautious but how about this one:

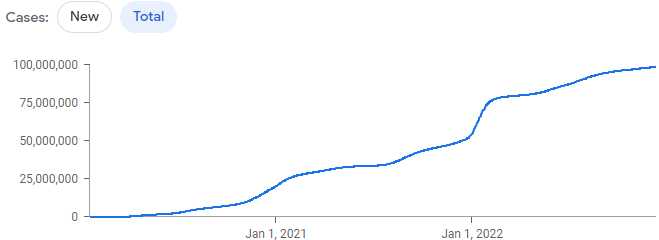

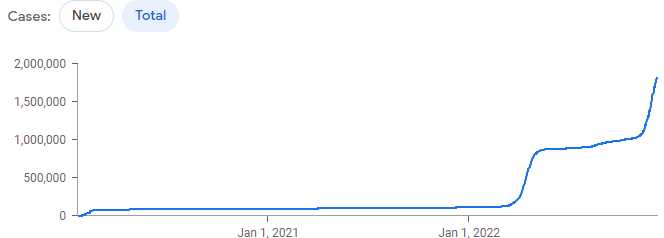

That’s a 50% increase in new Covid cases (reported) in the last two weeks in the US and 32% more globally. Last Dec 8th, we were averaging 120,737 but by Jan 13th, our daily average had jumped up to 802,191 cases per day with spikes over 1M – that’s how fast this virus can spread. Looking at the chart, I’d say we are about 50% more immune than last year but that’s still going to make for a nasty winter and China is in for a complete disaster, most likely.

I know we all like to have the fairy tale that Covid has gone away but we’ve had more people infected in the last 12 months than in the 24 months before that.

You can’t pretend when you are investing. You have to see the World for what it is so you are able to best navigate the obstacles along the way and set up your portfolio to win under the conditions that lie ahead. I’m not so much concerned for the US, where we are approaching herd immunity (because we’re the most infected country on the planet) but China’s population has relatively no exposure – just 1.8M cases out of 1.4Bn people (0.13%) so, for the other 1,398,200,000 people – it’s a brand new disease they have no resistance to.

That’s the downside to a zero-tolerance property. It makes sense if, in a year or so, you have a 100% effective vaccine or the virus goes away from the World but, if that doesn’t happen (and it did not) then you are back on square one trying to face down the virus.

Xi’s math made sense, you can’t have 50M people needing hospitalization (we had 10M in US with 1/5th the population) – there aren’t enough ventilators in the World or other vital supplies hospitals needed. Pushing the spread of the disease back has allowed him to give at least one dose of vaccine to 91% of the population – though the Chinese vaccines are not as effective as the ones we use.

China has stepped up their vaccine program and are now vaccinating 2M people per day but, with 1.4Bn people, that’s 700 days to get to everyone. And how fast can Covid start to spread as China re-opens? Well just 30 days ago, China had less than 1M total cases, so 800,000 move in 30 days is pretty darned fast, right?

They haven’t even officially re-opened yet! And the worst thing about China going from 2M infections to 20M by March is that then creates an environment for more Covid variants – even ones that can elude our current vaccines in the US. So this is not over until it is over and it’s very far from over – don’t forget that!

Speaking of China, congrats to all who followed our Trade Idea for Hello Group (MOMO), which was:

They should do well if China does ease their Covid policies. It does seem Biden and China are working out the accounting issues to keep Chinese companies on the US exchanges. A nice way to play is with the 2024 $3 ($2.80)/5 ($1.80) bull call spread at net $1, which pays $2 (100% gain in 13 months) if MOMO simply stays above $5. So, if you have $1,000 now and you want to have $2,000 to start off 2024, then buying 10 of those spreads would do the trick if all goes well.

If not, the net Delta of the two is just 0.16, so MOMO would have to drop $1.50 for you to lose $250 – which makes it a good stop if the $5 line fails. Risk $250 to make $1,000 on an undervalued stock with almost it’s entire market cap in the bank? Sounds good to me!

As you can see, they blasted up to $6.79 yesterday (so you had all week to get in) so it looks very good for our anticipated $2 return and 100% gain – you’re welcome!

Both LULU and COST just warned of slowing sales into the holidays and AVGO had a nice beat but said they can’t possibly say what will happen next year and pulled guidance – so let’s be careful out there and stay “Cashy and Cautious” and well-hedged into the Holidays.

Have a great weekend,

– Phil

Would bring you down forever

But you rode upon a steamer

To the violence of the sun

Blind your eyes with trembling mermaids

And you touch the distant beaches

With tales of brave Ulysses

How his naked ears were tortured

By the sirens sweetly singing

For the sparkling waves are calling you

To kiss their white laced lips” – Cream