We are already in month 5! Months 1, 2, 3 and 4 are available for review.

We are already in month 5! Months 1, 2, 3 and 4 are available for review.

This is an opportunity to learn our portfolio-building strategies step by step that, hopefully anyone will be able to follow. Our goal in this portfolio is to show our Members how to use slow, steady, simple options strategies to amass over $1M over 30 years by investing just $700/month ($252,000). If you can apply this discipline in your early working years – your retirement will be a breeze.

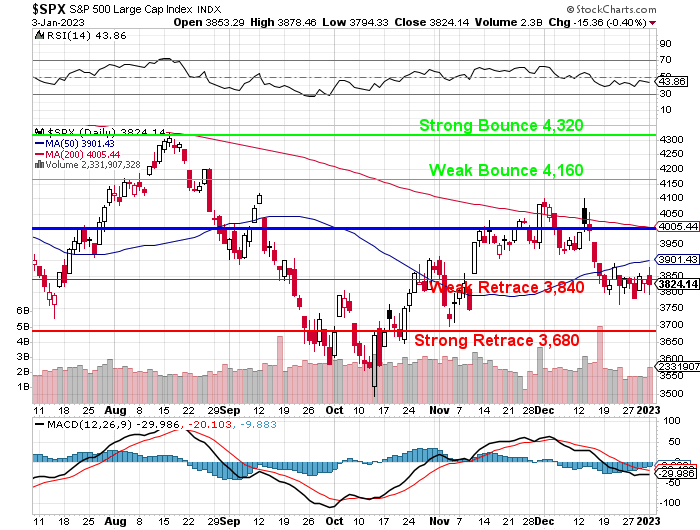

Our goal is to make 10% a year on our investments and, though it has only been 4 months – the portfolio is up 5.5%, which is right on track, despite the disappointing market. When we started the portfolio (Aug 25th), the S&P 500 was at 4,000, so being up at all is a nice accomplishment as we’re back at 3,840. As with all our PSW portfolios, the returns tend to accelerate as our positions mature.

Last month, we added the SOFI position, which used $205 in cash and $500 in margin and it’s right about where it was at the time – so you haven’t missed much. SOFI is $750 in the money and the spread is net $198 so $802 (405%) upside potential if we get to $5 on just that spread.

Last week left us with $80 in unused buying power and we’re going to add $700 more cash to the mix and we’ll see what we can do with it.

We collected 0.88/share ($27.28) on NLY last week and that’s why we love our dividend-payers. That NLY dividend is about 20% of our total profits to date. We need to close the loop on T and NLY so we can get around to selling options on those positions – that’s when things get fun!

69 more shares of NLY would be $1,479.36 and then we’re at 100 shares so we could sell 1 2025 $20 call for $3.20 ($320) for net $1,159.36. The problem with NLY is they reverse-split since we bought them and the shares are more expensive than we’d planned. Still, the dividend is nice so we’ll just get there later than sooner.

58 more shares of T, on the other hand, would be $1,086.92 and we can then sell 1 2025 $17 call for $3.15 ($315) for net $771.92 and that makes sense since T will also be paying us a 0.277 ($27.70 on 100 shares) dividend on January 9th – so that’s the trade we’ll go with this month:

-

- Buy 58 additional shares of T (100 total) for $18.74 ($1,086.92)

- Sell 1 T 2025 $17 call for $3.15 ($315)

That leaves us with just a few extra Dollars for next month and we look forward to collecting $27.70 on the 9th, which is 0.79% of our entire (now) $3,500 portfolio!

Selling the 2025 $17 call may seem a bit strange with T at $18.74 but we’re selling the calls for $3.15 so the net sale is $20.15. If we are called away over $17, that’s a nice 15% profit as we spent $706 on the first 42 shares and now $1,086.92 for 58 more LESS the $315 is net $14.78/share. We will also be likely to roll the call out to a higher strike for 2027 if possible in Jan 2025. PLUS we get those dividends, 8 sets of 0.27 is another $2.16 or 15% of our $1,478 net outlay.

We prefer to lean a bit conservative in our targets when we’re first building our positions as the damage done from losing money far outweigh the benefits of making a little extra by taking bigger risks.

So this simple little play, which began as our first purchase on Aug 25th, will make 30% if T is just over $17 in Jan, 2025 for a total return of $1,916 against our $1,478 outlay. And we can make that every two years after that as well – reinvesting and growing our returns over time. Numbers like that can blow us miles past our goal of making “just” 300% in 30 years (and, don’t forget, we’ve only invested $3,500 (1.4%) of a planned $252,000 so far).

Next month, we’ll have had a chance to see some of the Q4 earnings reports but it’s most likely we’ll spend the next two cycles filling our NLY position before we move on to something new.

Most likely…