By Seth Carpenter of Morgan Stanley, via ZeroHedge

Predicting with Precision Is Hard

A key concern we hear from clients is that the labor market is tight and wage inflation is high, which means that the fall in inflation witnessed so far could stall, largely because of services inflation. You can probably move that fear further down on your list of concerns.

Few things can be predicted with precision, but I will bet you have heard about wage-price spirals in the media, from colleagues, or in econ classes.

welcome to 2023 pic.twitter.com/t1yf0OEO6n

— Kenny Lay (Parody) (@EnronChairman) January 28, 2023

Both headline and core inflation in the US have peaked and are falling. But with a tight labor market and wage inflation still elevated, the story goes, inflation’s descent could stall, and we are likely to see sticky, high inflation. The story is intuitive, because labor is roughly 60% of total value added in the US and therefore should be key to production costs. This inflation fear is a common concern among clients, but here are some thoughts to put things in perspective.

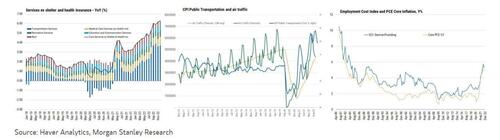

Core goods inflation has been negative for a couple of months now, and the disinflationary force accompanying it will last for some time. And the fact is, most consumer goods are imported, so the “cost-push” narrative is not so relevant. As for rents – which constitute 40% of core CPI – we know that new contract lease inflation has already fallen sharply, so the CPI component of shelter inflation will almost mechanically come down. And of course, rents are charged for existing units, so there is no “production function” with labor as an input driving up the price. Consequently, any wage inflation fears have to focus on “other” services, which represent roughly 35% of core PCE and 25% of core CPI. Indeed, Chair Powell has emphasized this component, saying it is “really a function of the labor market and is likely to take a substantial period to get down.”

There are several reasons why we do not worry about this particular mechanism, illustrated by the charts below. First, the lion’s share of the acceleration in other services was in transportation. Other services inflation went from about 1%Y in January 2021 to roughly 6%Y in December 2022, and roughly 4 percentage points of the increase is explained by transportation. Within transportation, airline fares are the key component, but the recent surge in airline fares was more a function of fuel prices and pent-up demand for travel amid capacity restrictions … not a rise in wages. Moreover, nominal wage acceleration has been widespread across services industries, but only transportation CPI inflation has increased. Indeed, because wage inflation has been generally lower than price inflation, real wage growth has been negative, pointing away from a cost-push story. Taking a longer-run view, over the past 35 years, the consumer price inflation we have now is unknown, but the peak in wage inflation is not particularly exceptional.

But of course, there is still some connection. In a recent publication, we used historical data to calculate the wage-price passthrough for other services. Our results are aligned with Chair Powell’s comments suggesting that other services have the highest wage-price passthrough of all CPI components. Historically, on average, the recent increase in nominal wages would be associated with 140bp more other services inflation one year ahead. But with other services’ relatively low share of the overall index, the boost to core inflation is only 35-50bp – hardly the stuff of nightmares, but the reason why wringing the last bit of inflation out could be hard. More detailed analysis shows that the highest historical correlations are with medical care and education inflation, so we know which data to track.

Why is the link so much weaker than intuition suggests? Partially, there has been a clear upward trend in market concentration across all industries since 1990, which means higher profit margins and more room to let margins shrink after wage upswings. Indeed, from 2000 to 2015, the labor share of income fell sharply, and has not recovered its previous long-term level. Also, lower unionization rates compared to the 1980s means reduced [increased?] wage inertia. In the 1980s, wage increases in one industry were used as benchmarks for other negotiations, leading to wage-wage spirals that are now largely gone.

But as I said at the start, few things can be predicted with precision, and other services inflation has been particularly hard to predict recently. We might be wrong, but all the information at hand simply points to a low probability that current wage inflation is a critical issue – even within services.