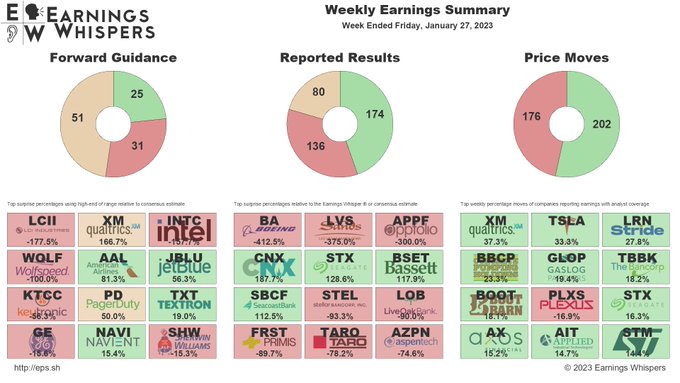

As you can see, so far we have 136 misses and 174 beats and that is NOT GOOD – and look at Forward Guidance – it’s got more red than green! The Fed has certainly done their job in making it impossible to make money and they’ve destroyed the confidence of consumers but they STILL have not gotten companies to lay people off and that is, simply, because it’s been so hard to hire people that it does seem kind of silly to lay people off, doesn’t it?

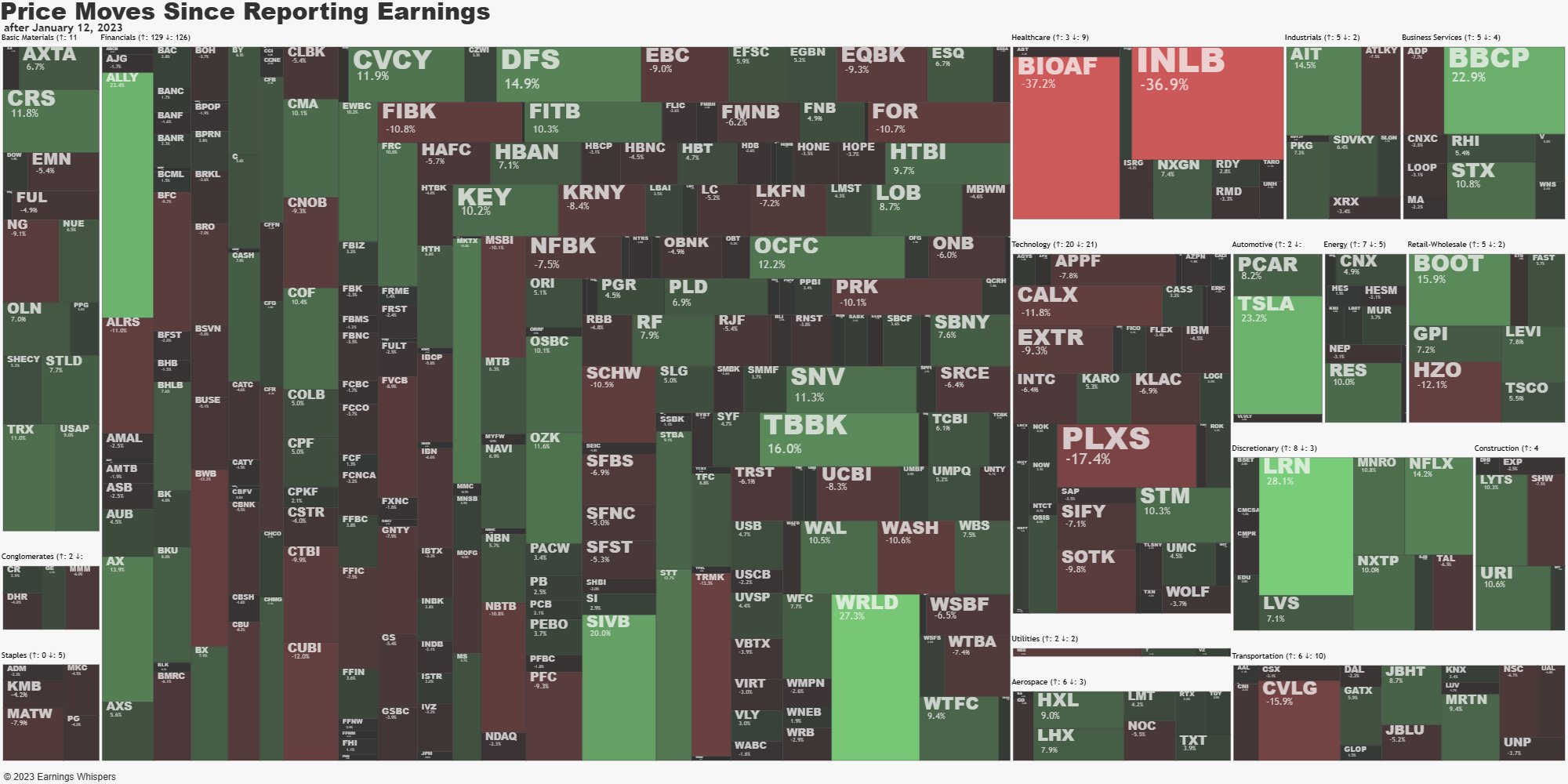

As you can see, Basic Materials (top left), Discretionary (LRNs area), Automotive (TSLA) and Retail (BOOT) have been the bright spots so far but there has been a slew of Retail downgrades this morning and we have tons more of reports before this chart is completed:

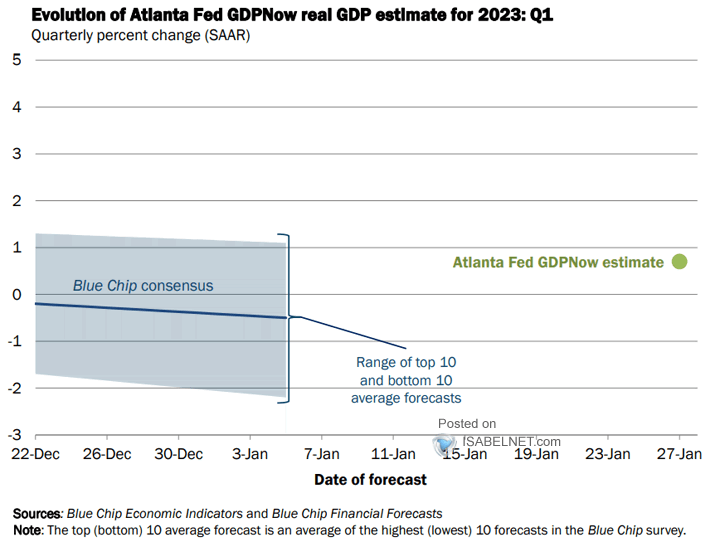

We also have a busy data week ahead of the Fed (Weds, 2pm) and Powell (Weds, 2:30) with the Dallas Fed this morning, Case-Shiller, Chicago PMI and Consumer Confidence tomorrow. Wednesday there is PMI & ISM Manufacturing & JOLTS ahead of the Fed and then Thursday we have Job Cuts, Productivity and Factory Orders and Friday it’s the Big Kahuna: Non-Farm Payrolls along with PMI and ISM.

There’s still a lot of fun to be had with individual stock picks. SoFi Technologies (SOFI), for example, was one of our Trade of the Year runner-ups on November, 29th and, this morning, they announced a 0.03 profit vs an expected loss of 0.05 – so a very nice beat indeed and the stock is up 10% pre-market at $6.50.

Back in November, with the stock at $4.45, we had the following position:

40 2024 $7.50/12.50 bull call spreads at 0.72/0.27 ($1,780) and 10 short 2024 $10 puts at $5.675 ($5,675). That was a net credit of $3,895 and already the spread is $1.14/0.35 ($3,160) and the puts are $4.30 ($4,300) for a net $1,140 credit (as of yesterday’s close) and that’s up $4,534 (80%) already and it’s a $20,000 spread so there is still $21,140 (1,854%) of upside potential left. Aren’t options fun?

All we did on that spread to get such a credit was aggressively promise to buy 1,000 shares for $10, which gave us a credit that more than paid for the also aggressive bullish spread. That’s because, FUNDAMENTALLY, we felt SOFI was ridiculously undervalued at $4.50 and we didn’t actually need to get to $12.50, or even $7.50, to make a lot of money, though now it looks like we’re on track anyway.

We did not pick SOFI because there were too many variables and the trade was too aggressive to call it a near-certainty for a 300% gain (the goal of our Trade of the Years) but notice, in the article, all but one of our finalists (GOOGL) has already made great gains since Thanksgiving:

Unfortunately (or fortunately if you haven’t gotten in yet), our trade of the year, YETI, is right where we came in as well.

The trade idea was:

We have a big YETI position in the LTP (100 2024/2025 $35/50 bull call spreads with 50 short 2024 $50 puts) that’s very aggressive but, as a new trade, we could try this:

-

- Sell 10 YETI 2025 $35 puts for $8 ($8,000)

- Buy 20 YETI 2025 $35 calls for $16.50 ($33,000)

- Sell 20 YETI 2025 $50 calls for $11 ($22,000)

That’s net $3,000 on the $30,000 spread that’s $12,000 in the money to start so all YETI has to do is not go down and the 2025 $35/50 spread is $13/6.80 ($12,400) and the 2025 $35 puts are $5.50 ($5,500) so that would be net $6,900 for a $3,900 (130%) profit so we can assume that’s what would happen if YETI stays flat for a year BUT, if the VIX calms down, the advantage would strongly go to us as we’re in the money by $12,000. We certainly don’t mind owning 1,000 shares of YETI at $35 – happy to DD if they drop 40% ($24.50) or we would take the $10,000 loss if we don’t like the outlook but if that’s our unlikely risk and our reward is the very realistic $27,000 – that makes is a very good trade.

The puts are now $6 because the VIX is much lower now (and 1 of 9 quarters has passed) and the $35/50 spread is now $18.50/11.50 ($14,000) so net $8,000 is up $5,000 (166%) but still $22,000 (275%) left to gain is not too bad.

Over the weekend, I was playing with https://beta.character.ai/, which lets you chat with almost anyone (artificially), and “Warren Buffett” had this to say:

Welcome to the age of AI!