So far, so good.

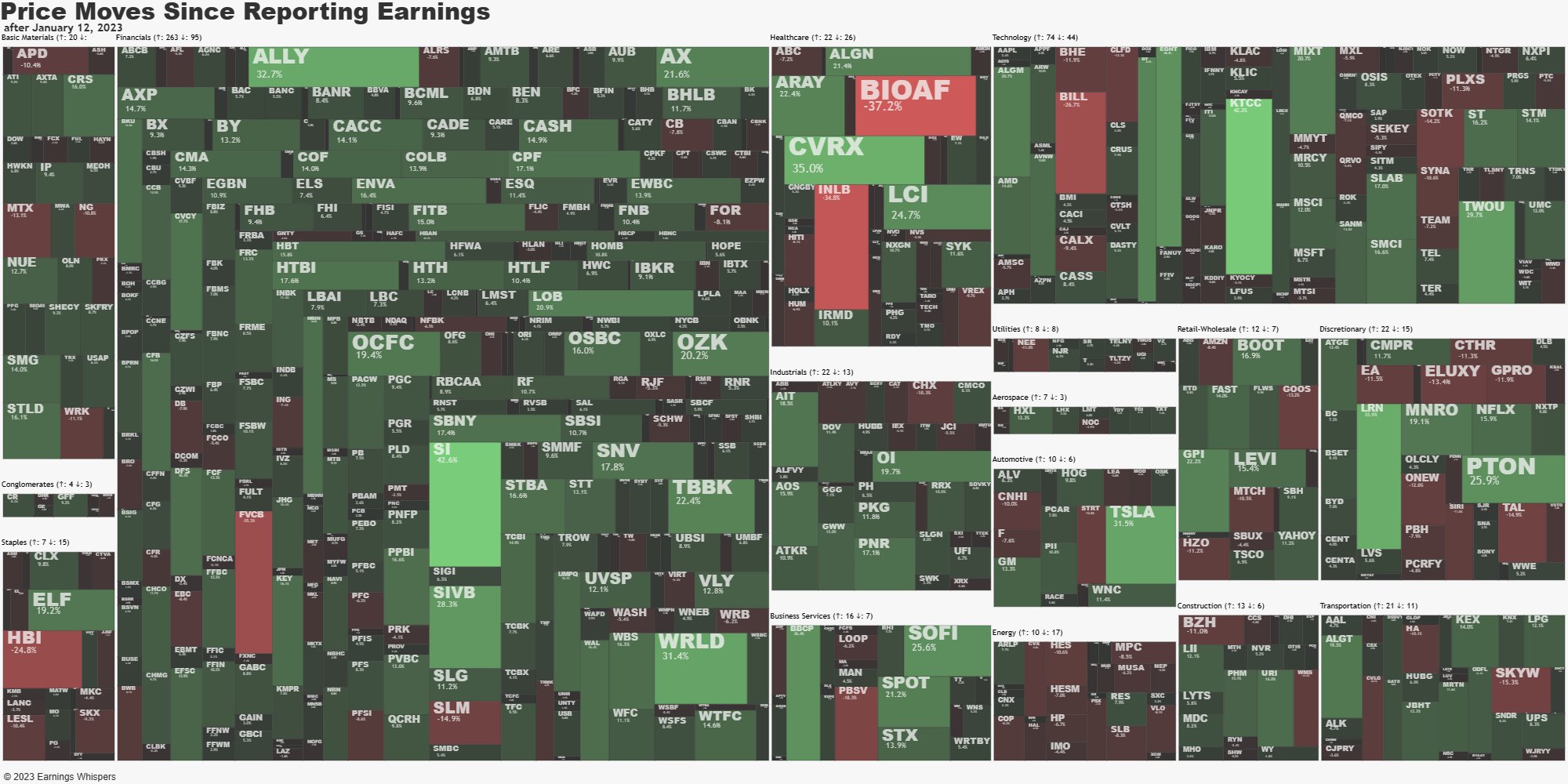

We’re past the Fed but we’re heading into the two busiest weeks of Earnings Season and next week we have Options Expirations so it should be interesting, to say the least. Though a lot of companies have been missing – traders have been in a generally forgiving mood other than, notably, the energy sector, which has seen people fleeing no matter how good the results were.

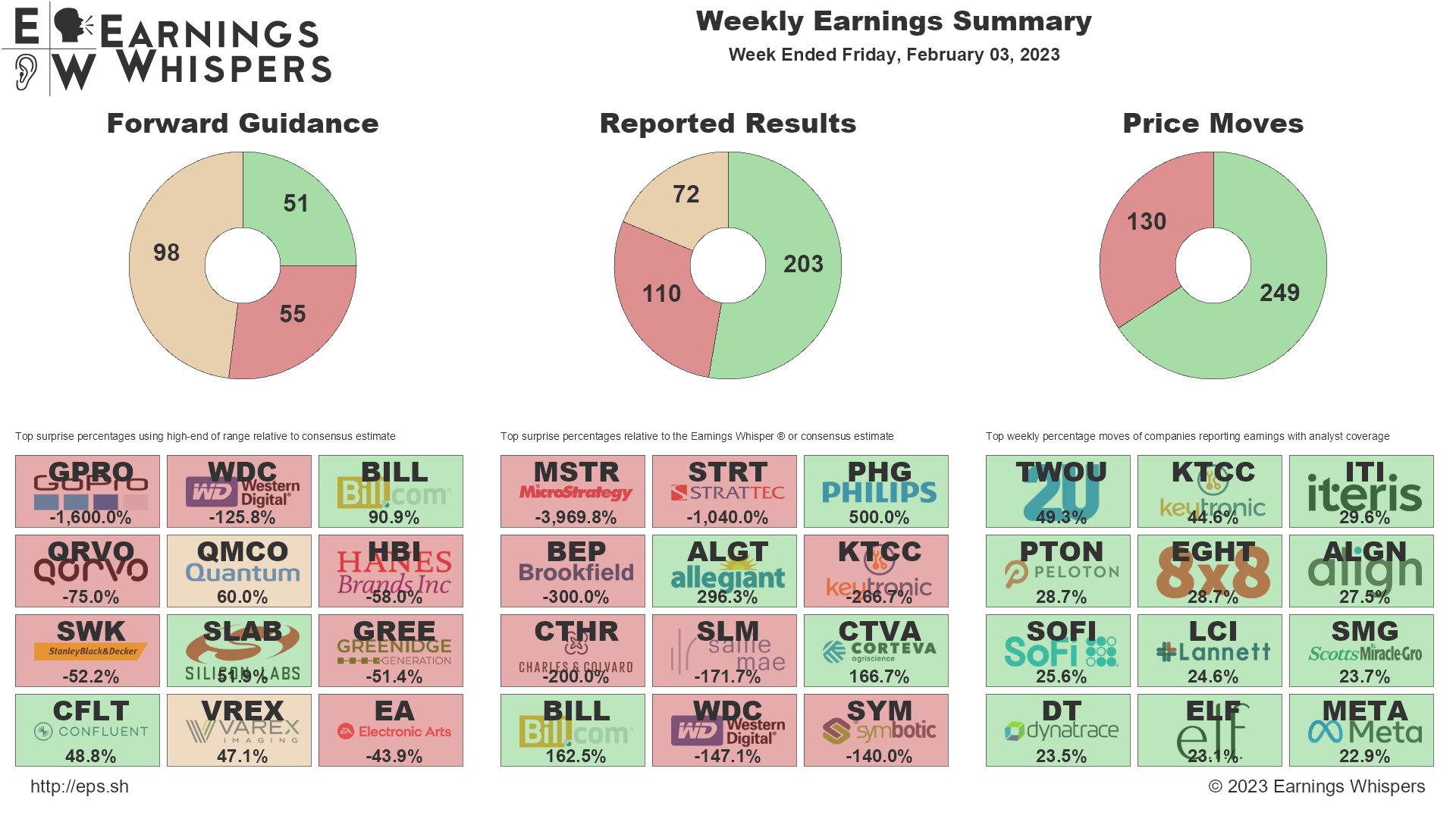

Although only 203 companies actually beat expectations and only 51 upgraded their guidance, 249 companies made positive moves after their earnings reports and, with almost exactly half of the S&P 500 having weighed in, it’s time for us to do a little shopping.

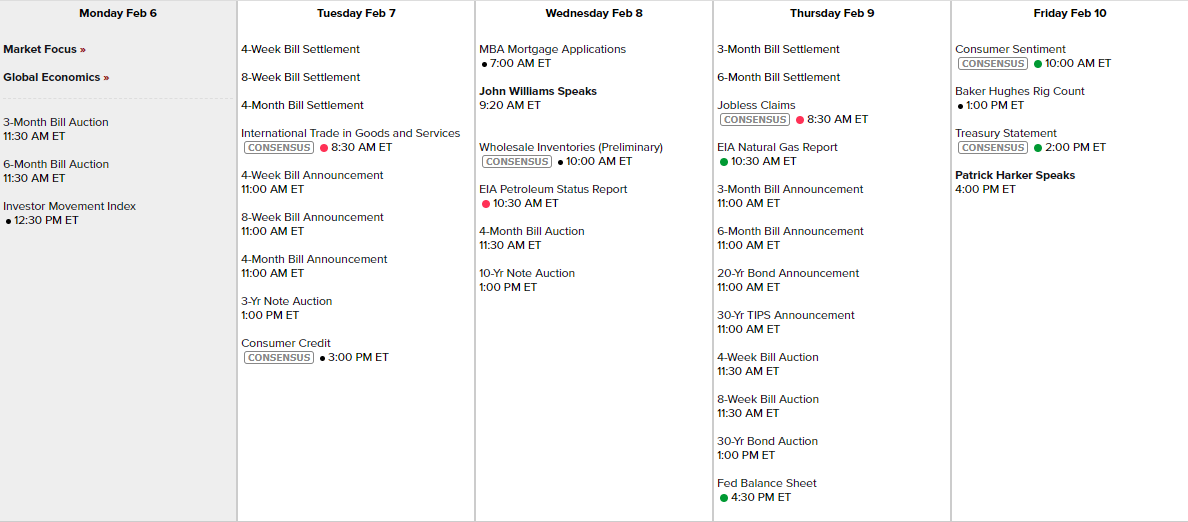

On deck this week we have a lot of big names still to go and it’s a very quiet data week as well, so all eyes will be on these earnings – especially with just the one Fed speaker (Harker) – and that’s Friday after the close.

Not much going on this weekend – we shot down that pesky balloon China sent us, Beyonce won more Grammies and Turkey & Syria had a huge earthquake(1,700 dead so far). None of that changes our investing premises so we’re sticking with our current plan until it stops working.

Not much going on this weekend – we shot down that pesky balloon China sent us, Beyonce won more Grammies and Turkey & Syria had a huge earthquake(1,700 dead so far). None of that changes our investing premises so we’re sticking with our current plan until it stops working.

We have over 100 buying opportunities on our Watch List (Members Only) and we have another 100 long positions in our 8 Member Portfolios. First we will review our long positions and decide which ones no longer serve our purpose (based on new information) and which ones can be improved upon. THEN we will hit the Watch List and look for new stocks to add – AFTER we make sure we are adequately hedged for a downturn (see Friday’s Live Member Chat Room for that discussion).

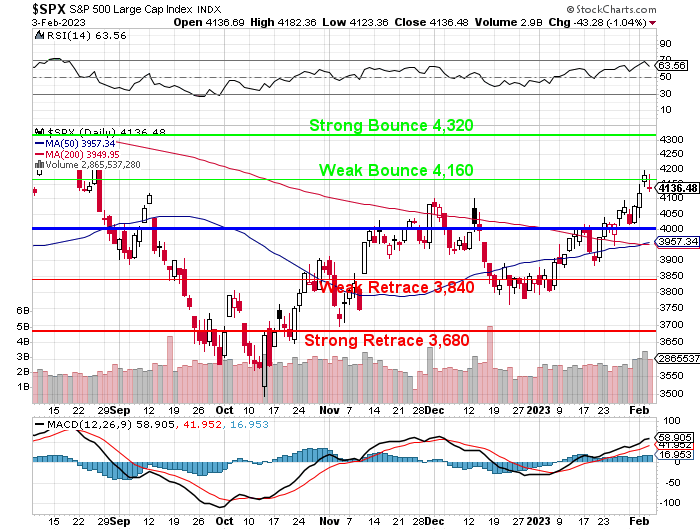

We’re having a bit of a sell-off this morning but 4,120 on the S&P 500 and 12,550 on the Nasdaq are nothing to worry about (4,000 and 12,000 holding are bullish) so we’ll just have to see how the week goes as we get ready to do some shopping.