There is not much going on today.

There is not much going on today.

Not much news to speak of other than Central Banks in Europe raising rates, which sent the Dollar lower, which repriced Equities higher overnight. As I had predicted for our Members yesterday morning, Brent Crude (/BZ) topped out at $85 early this morning and that was our signal to short West Texas Oil (/CL) at $78.50. In the Live Member Chat Room I said:

“We’ll see if Brent can get over $85 but it’s probably a good shorting line (should be a bit less than $79 on /CL). If we hit $80 I have to pick up a short there.“

That’s a good trick for playing Oil Futures: You may not have a good point of resistance on /CL but perhaps /BZ is coming up on one you can use – or vice versa. The same can be done with Apple and the Nasdaq or even certain sectors that are heavily influenced by a single stock.

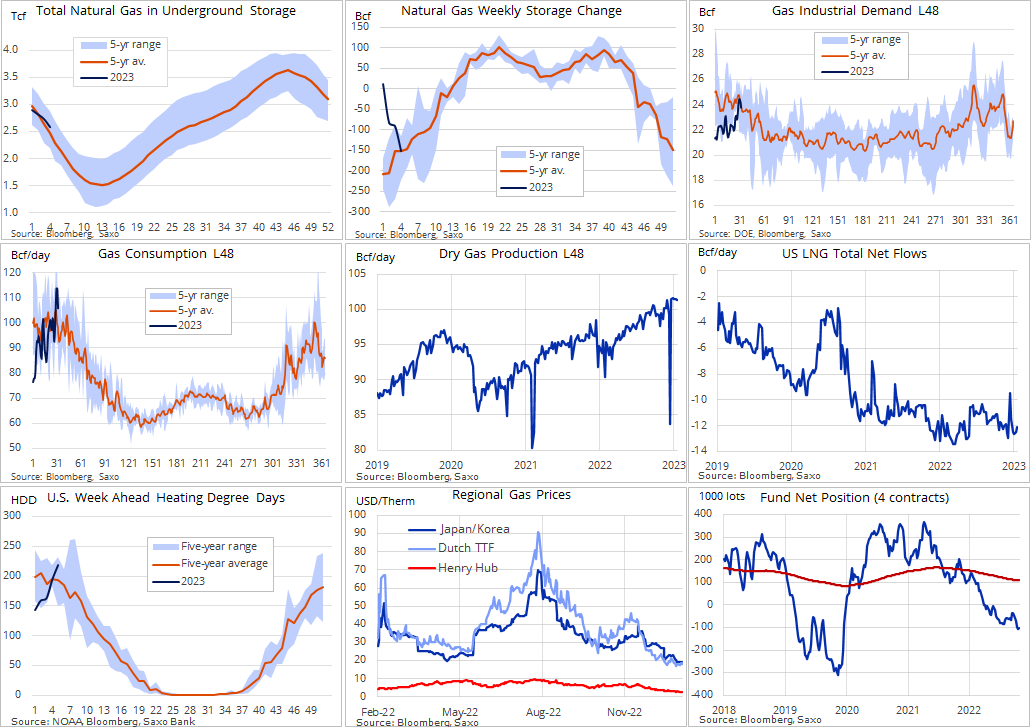

We are still long on Natural Gas (/NG), of course but now we’re playing the April (/NGJ23) contracts at $2.45, which they are back to this morning. Those contracts came down 0.25 ($2,500 per contract) since early yesterday morning so we’re expecting a nice bounce today.

We are still long on Natural Gas (/NG), of course but now we’re playing the April (/NGJ23) contracts at $2.45, which they are back to this morning. Those contracts came down 0.25 ($2,500 per contract) since early yesterday morning so we’re expecting a nice bounce today.

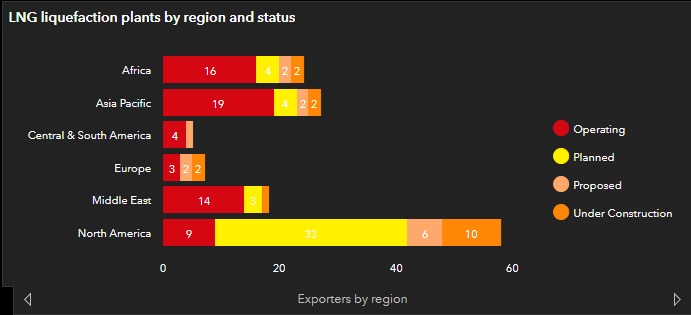

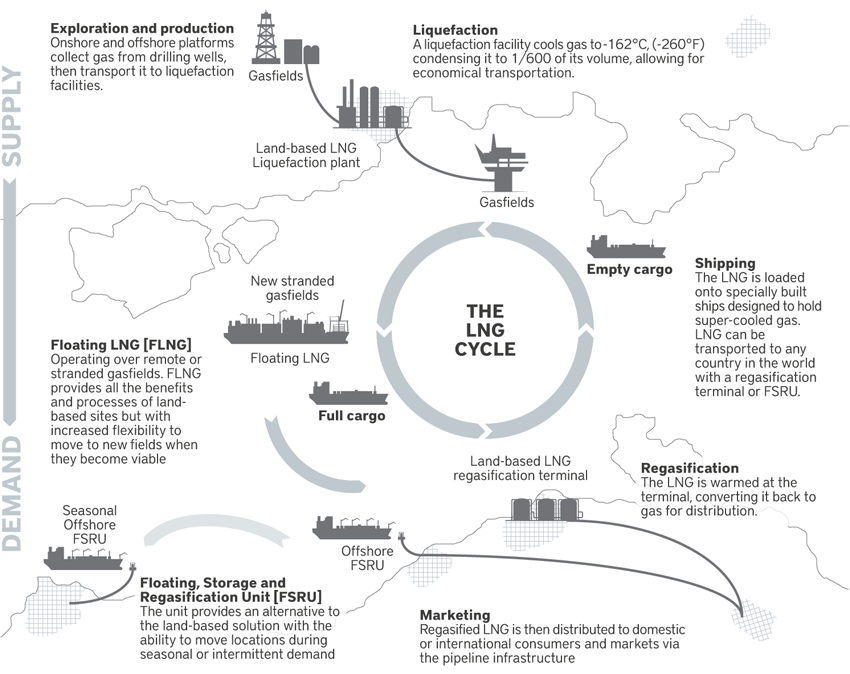

For the longer-run, there are 264 Regasification Terminals proposed or completed in the World. 79 of the open receiving terminals and 57 of the planned receiving terminals are in Asia and 42 open and 32 planned are in Europe – that’s 210. There are only 139 Liquefaction Terminals proposed or completed and Africa has 16 in operation, Asia 19, Central/South America 4, Europe 3, Middle East 14 and US has 9 – and one of them has been down for a month.

That’s why /NG is so cheap at the moment – a combination of a mild winter and 10% of our exports off-line is causing a surplus in the US but notice that 33 new export terminals are planned, 6 more are proposed and 10 are already under construction – which will double our export capacity over the next two years. By the end of this year, exports are expected to be up 50% over last year.

That’s why /NG was speculated all the way up to $9 early last year but the reality of how long it takes to build and permit the terminals (/NG is kind of explosive) along with the pipeline issues began to cool off the speculators and then Freeport LNG in Texas shut down due to an explosion in June, which meant that all the gas that was set for export was now flooding the US markets. Freeport expects to restart in March.

When Freeport comes back online (along with some new terminals), our exports will skyrocket and /NG prices should begin to climb. As you can see from the series below, production has been steadily ramping up to keep up with export demand but then we had the sharp drop in exports that did not affect production so – SURPLUS!

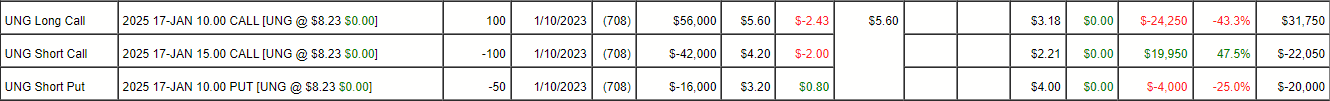

We are not, however, that far up in our storage range and things should be back to “normal” by summer, which is only 4 months from now. That means, in addition to playing the Futures long, we like the Natural Gas ETF (UNG), which we already have in our Short-Term Portfolio (STP) as:

It’s less than what we paid now with a net $10,300 credit on the entry for this $50,000 spread. Given the drop though, as a new trade idea, I would rather go with a lower spread:

-

- Buy 100 UNG 2025 $5 calls at $4.70 ($47,000)

- Sell 100 UNG 2025 $10 calls at $3.20 ($32,000)

- Sell 30 UNG 2025 $10 puts at $4.10 ($12,300)

That is net $2,700 on the $50,000 spread and there’s $47,300 (1,751%) upside potential if UNG gets back over $10 into early 2025 – when more and more terminals will come online. Notice in the above chart, production since 2020 is only up 20%. That means it’s very likely that demand will exceed supply in 2025.

In our STP, we are going to spend net $1.52 ($15,200) to roll our 2025 $10 calls to the $5 calls, which doubles the upside potential but, even at $10, we started with a $2,000 credit so we end up in that spread for net $13,200 and we’d make $36,800 (278%) at $10 and another $50,000 if we hit $15 – that’s not bad for a fallback plan, is it?

Why do we care so much about Natural Gas today? Because it’s cheap! When something gets cheaper than it should be, we check our Fundamentals and, if our premise holds up (we think $4-5 is the natural range for /NG, long-term), we then look for the best ways to invest

We’ll look for a few more opportunities in our Live Member Chat Room, including one of our favorite Dividend Stocks!