Inflation is not going away.

Inflation is not going away.

Yesterday’s PPI numbers were through the roof (0.7%) and Dec was revised from -0.5% (which caused us to rally, of course) to -0.2% and Core CPI was revised from -0.1% to +0.3% – oopsie! I wonder at what point the Government realized the highly regarded, market-moving report they gave you a month ago was off by 400%? Do they even think about telling you there’s been a huge error in their critical data or do they just punt it along to the next report?

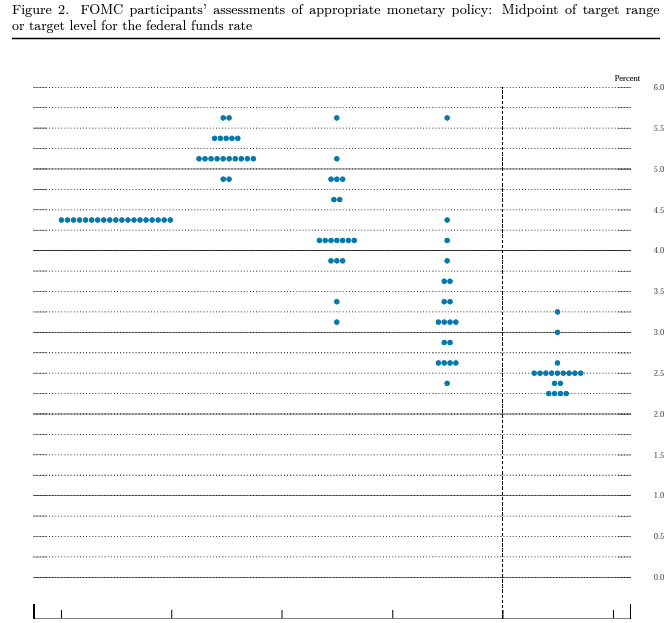

Investors are becoming increasingly concerned that the Fed will be forced to raise rates more than initially expected due to strong economic data suggesting rising inflation and continued growth – despite their best efforts to crush it. The market had previously rallied on hopes that the Central Bank would end its interest rate increases, DESPITE the FACT that the Fed just released their own projections on Dec 14th:

Recent data flows have shown that the Economy is continuing to run hot, and some investors have begun to raise their expectations for the number of times the Fed will increase interest rates in the coming months (I have been saying 6% is the magic number all along – current consensus by Leading Economorons is below 5%). As I previously noted, Bond Investors have been quicker to shift their view, predicting three rate increases of 0.25% each by July, taking the Fed’s target rate above its own December forecast – but still not high enough to get near the Fed’s 2% target.

Oil has finally collapsed (as we predicted last Thursday!) as the bulls’ hopes were dashed as Saudi Arabia’s energy minister said the OPEC+ alliance plans to stick with an oil deal agreed in late 2022 for the rest of the year. The UAE also backed this stance, stating that global oil supply and demand were evenly matched, with inventories comfortable and crude price levels, indicative of balance in the market.

$76 is a nice $4,000 per contract gain from our $80 shorting line so congratulations to all who played along at home!

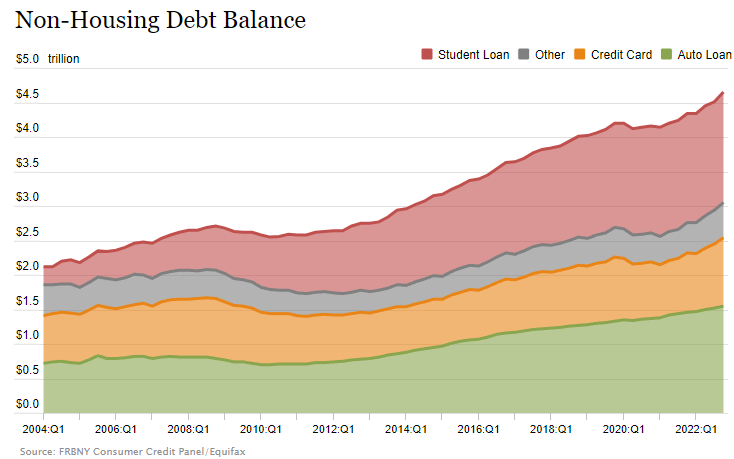

And congratulations to US Consumers, who’s $61Bn increase in Credit Card Debt in Q4 has brought us to just under $1Tn, at $986Bn in revolving debt, blowing away the previous record of $927Bn from Q4 of 2019. Total Consumer Debt in the US is now $17Tn but it’s only half the the Nation’s Debt – so we’re still in great shape compared to our Government!

And congratulations to US Consumers, who’s $61Bn increase in Credit Card Debt in Q4 has brought us to just under $1Tn, at $986Bn in revolving debt, blowing away the previous record of $927Bn from Q4 of 2019. Total Consumer Debt in the US is now $17Tn but it’s only half the the Nation’s Debt – so we’re still in great shape compared to our Government!

Non-housing debt is about $4.7Tn and adding another 1% to that with higher rates will cost consumers $47Bn more and don’t forget we have a $30Bn annual pause in Student Loan payments so there’s another $77Bn in expenses on the immediate horizon for US consumers – not even including Netflix putting a stop to password sharing!

Have a great weekend,

-

- Phil