A Reverse Minsky Moment

I will remember this week for the rest of my life. As an investor, you get used to stock market volatility. Economic volatility on the other hand has a way of sticking with you.

In the aftermath of the pandemic, the Fed was driving an overheating economy at 150 miles per hour. And when it realized it was going too fast, it jammed on the brake pedal as hard as it could. For a myriad of reasons, it took a while for the car to crash. Today it hit a wall.

Yesterday the world learned that Silicon Valley Bank was coming under financial pressure. Today, the company collapsed and is now in the arms of the Federal Deposit Insurance Corporation. The question now is, was this a tech/startup thing, or is this a sign of bigger problems? I’ll come back to this in a minute.

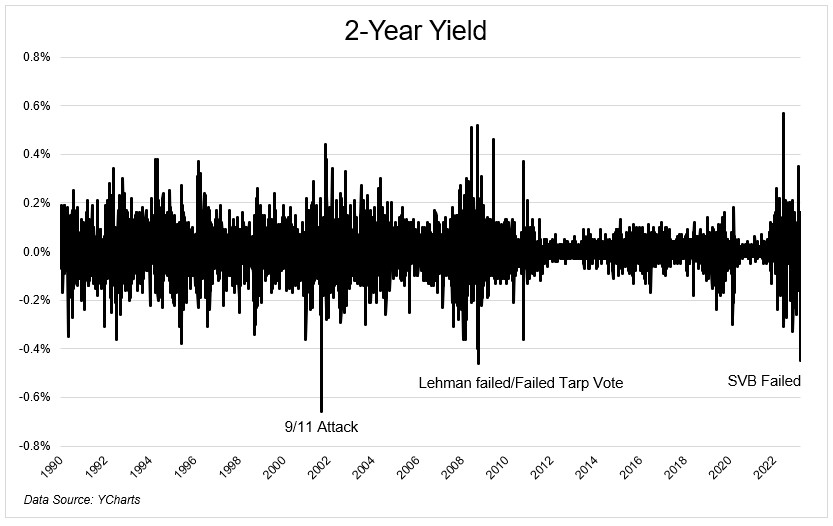

Silicon Valley Bank’s collapse will make all the headlines, but what happened in the bond market deserves a lot of attention. The 2-year yield collapsed over the last two days to an extent only seen around historical events (h/t Jim Bianco). Since 1990, the only other times we saw a decline of this magnitude was after the 9/11 attack, when Lehman Failed, when the TARP vote failed, and this week, when SVB failed.

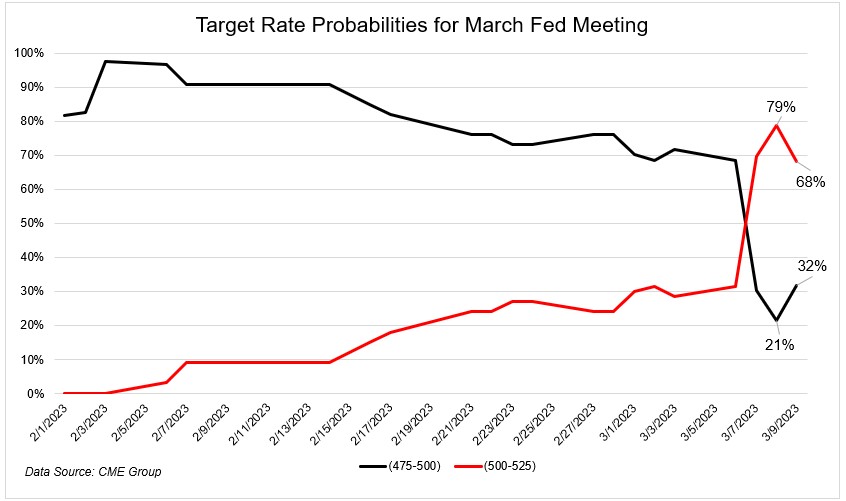

At the beginning of February, the market expected a 25 basis point rate hike at the March meeting. And then we got economic data that showed inflation and the economy accelerating, and investors started to think a 50 basis point rate hike was possible.

When Powell spoke earlier in the week, the odds of 50 spiked from 30% to 79%. Now today they’re back down to 68%. This is what I mean by economic volatility. Interest rates should not trade like a pre-revenue biotech stock.

This thing with SVB is a very big deal. I feel horrible for all the companies and individuals whose lives have been turned upside down in the last 48 hours.

I don’t know enough to intelligently speculate on whether there is anything left to salvage. I would assume that now that the bank run is over, there are attractive parts of the business that might be sold off. I would also assume that the equity is worthless and that the depositors will be made whole.

Returning to whether there are larger things to worry about, I mean, part of me says yes. This is a huge blow to confidence. While SVB primarily worked with venture-backed companies, that doesn’t mean it wasn’t huge. At the end of last year, they were the 16th largest bank by deposits, behind Morgan Stanley and in front of Fifth Third Bank.

SVB is the bank for startups who, for the most part, aren’t raising money anymore. In fact, they’re burning a lot of it, which is one of the reasons why the bank found itself in this position. To shore up the balance sheet and to calm people down, they sold equity to raise money. This had the opposite impact because, again, it comes back to their customer base. Since these are businesses and not individuals, $250,000 of FDIC insurance is not enough to prevent a bank run. Roughly 97% of deposits are over 250. So they ran to the tune of $42 billion. The bank would have been okay had everybody just chilled, but that’s not how humans work. Samir Kaji put this best, saying

What’s likely happening: Everyone is looking to run out of a burning building that isn’t really burning. But in the stampede of not wanting to be last out, everyone runs over the single lit candle burning, creating the blaze that potentially burns the building down.

This is a big deal. A lot of companies need a bank to, ya know, make payroll and things like that. Pure speculation on my part, but I think this thing will get fixed in a hurry. Like by Monday. There is too much on the line.

I was watching Michael Santoli today who made a great point about greater contagion. Of course nobody knows where this goes, but at least today, junk bonds and bank loans did not show signs of concern. These areas of the bond market are mostly pure credit risk, and they were flat on the day. Again, just one day, but I thought that was an interesting observation.

The banks on the other hand were trading as if it were not just a Silicon Valley thing. The thing is, banks are so much better capitalized today than they were in 2008. If your head is going there, stop it. Stop it right now. Yea, they’re sitting on massive losses on their bond portfolio, but we’re talking treasuries for the most part, not toxic subprime garbage.

But just because this isn’t 2008, it doesn’t mean this isn’t bad. This is bad. I’m worried. And I think the fed is too. They’ve been jamming on the breaks for the better part of the last two years, but only today did they slam into a wall. Yeah, there have been layoffs in tech (not trying to minimize it), and yes housing activity is down big, but those were gradual while today was an event.

We might be experiencing a reverse Minsky moment where instability leads to stability. The Fed has been trying to break things. Mission accomplished. They broke tech and housing and startups. How much more damage do they want to do? We’re starting to see cracks in the commercial real estate market too. If that goes, forget about it.

We’ll see in a few weeks, but I think and I hope that this took 50 bps off the table. Hopefully the instability that we saw today leads to stability in the near future.

Image by WikiImages from Pixabay