I hope we didn’t come all this way just to fail?

I hope we didn’t come all this way just to fail?

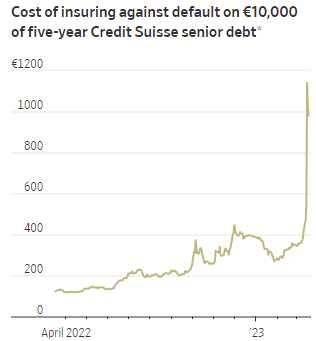

We finally had two positive days in a row (and it only cost us $2Tn in bailouts and counting) but, unfortunately, Credit Suisse is back on the chopping block – shares slid 10%, reversing some of the surge the bank enjoyed the day after it said it would borrow $50Bn from the Swiss National Bank.

Prices on Credit Suisse’s Credit-Default Swaps, which protect investors in case the bank doesn’t meet its obligations, remain at extremely high levels. Credit Suisse’s so-called bail-in bonds traded at around 44 cents on the dollar Friday, indicating that investors believe the bank’s fortunes are still very much in peril.

Despite reassurances from bank executives and Swiss authorities, large investors and major banks have either pulled back or declined to increase their exposures to Credit Suisse, trading stocks, or writing up contracts tied to interest rates. Although the bank has high capital levels and ample liquidity, its troubles stem from its customers cutting exposure to the bank, a continuing “run” that is leading to lost revenue at its investment bank and exacerbating last year’s significant losses.

Despite reassurances from bank executives and Swiss authorities, large investors and major banks have either pulled back or declined to increase their exposures to Credit Suisse, trading stocks, or writing up contracts tied to interest rates. Although the bank has high capital levels and ample liquidity, its troubles stem from its customers cutting exposure to the bank, a continuing “run” that is leading to lost revenue at its investment bank and exacerbating last year’s significant losses.

Credit Suisse had $169 billion of long-term debt outstanding as of the end of 2022 and a further $25 billion in short-term borrowing. Around $16 billion of its debt are from the bail-in bonds, which get written off in the event the bank is taken over by regulators or its capital drops below a certain level. It also had $23 billion of securities financing transactions, which includes repurchase agreements, or repos, a common type of borrowing in which one side lends another money backed by shares or bonds.

The bank’s more senior bonds could face haircuts in an insolvency situation, since regulators often give priority to depositors. It will be up to Credit Suisse’s lead regulators, the Swiss National Bank and the financial regulator Finma, along with politicians in Switzerland, to decide exactly how to structure a rescue plan and who would come out whole. In a typical bank failure, equity holders get wiped out.

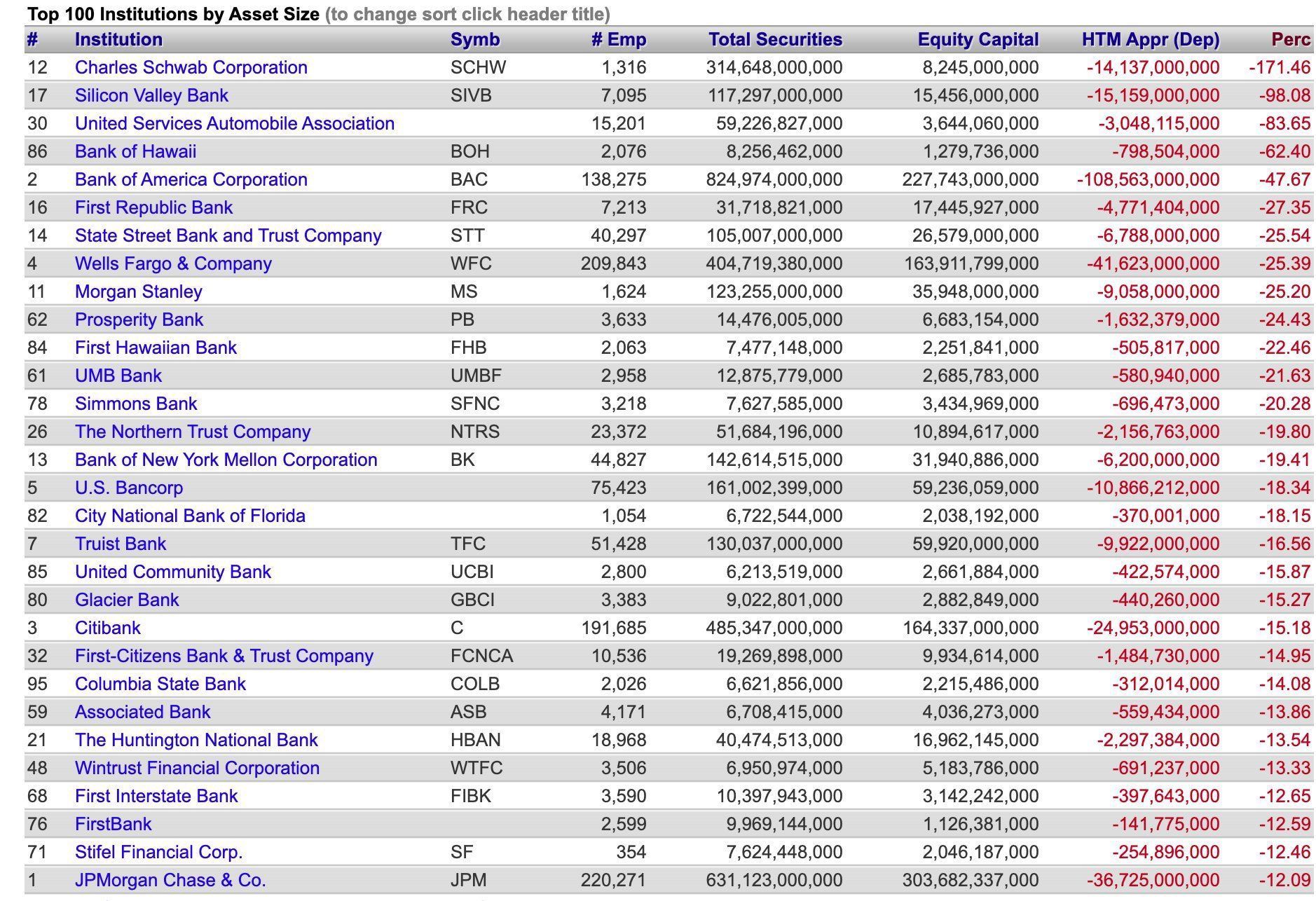

This interesting table was shared by Paul Noring – Berkeley Research Group. It shows the unrealized depreciation on Hold to Maturity Securities (HTM) for top 100 banks versus equity. These unrealized losses are NOT reflected in profits or a deduct to equity via Other Comprehensive Income (OCI) – only in the footnotes! The losses are also NOT reflected in stress tests or measures of capital adequacy.

Until these unrealized losses are realized or transferred to the Fed (so we can pretend they never happened), the uncertainty is bound to continue and, while our Fed may have pledged Trillions of Dollars that they don’t have to support our banks – that doesn’t solve ANYTHING for banks in the rest of the World – who are assuredly in the same situation!

First Republic shares plummeted over 20% in pre-market trading after the bank’s board suspended its dividend and major US lenders deposited $30 billion in the bank to prevent a financial panic following two bank failures. This news has not helped regional banks, with PacWest Bancorp declining around 10% and Zions Bancorp shares edging down 3.5%.

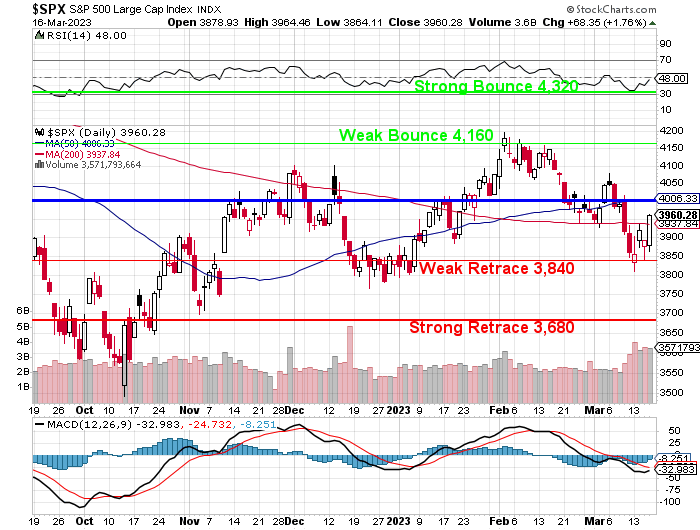

Given all of this news, it’s clear that there are significant risks in the banking sector that could have far-reaching effects. We still recommend continued caution into the weekend.

Tiger Global is feeling the heat from the recent tech sector downturn. According to sources familiar with the firm, Tiger has marked down the value of its investments in private companies by a whopping 33% across its venture-capital funds in 2022, erasing a cool $23 BILLION from their portfolio of startups around the World, including big names like TikTok parent ByteDance and payments company Stripe.

In the fourth quarter alone, Tiger’s newest Venture Funds lost between 9% and 25%. While these markdowns are substantial, they highlight a lag in private markets compared to fast-growing public companies. Tech stocks took a beating last year, but large venture-capital investors have only reported more modest declines so far. It’s a tricky process to value private companies, and managers have wide discretion to do so, relying on recent transactions, revenue, and comparable company performance. The lag in private-market valuations during a rout in technology stocks should be a huge red flag to Investors.

Of course, this disconnect hasn’t gone unnoticed by more sophisticated Investors, including Harvard University’s Endowment, whose chief suggested in his annual letter last fall that Venture Managers had not written down their private investments sufficiently. That could create a blind spot for investors deciding whether to invest in new funds managers are raising. For Tiger, these recent write-downs have changed some of its performance stats significantly, with its internal rate of return dropping from 22% to 9% in its “2020 PIP 12 Fund.”

Tiger has already reported far larger losses for the year in its flagship Hedge Fund and in its Long-Only Fund, which invest heavily in public markets and focus on high-growth, largely unprofitable tech companies. Tiger lost 56% in its Hedge Fund and 67% in its Long-Only Fund, although the losses could have been even worse, since the funds include some private investments.

Have a great weekend,

-

- Phil