“No, I would not give you false hope

“No, I would not give you false hope

On this strange and mournful day

But the mother and child reunion

Is only a motion away” – Paul Simon

THAT is the “deal” the GOP have put forward that is exciting Wall Street this morning. And why wouldn’t it? Our beloved Defense Contractors love both getting more money and hiding their profits from the Government – it’s a win win! As we discussed yesterday, the ENTIRE cause of our $32Tn deficit is 40 years of not collecting realistic amounts of money from our Corporate Overlords and this “budget” assures that will continue until the Earth Melts in 2050.

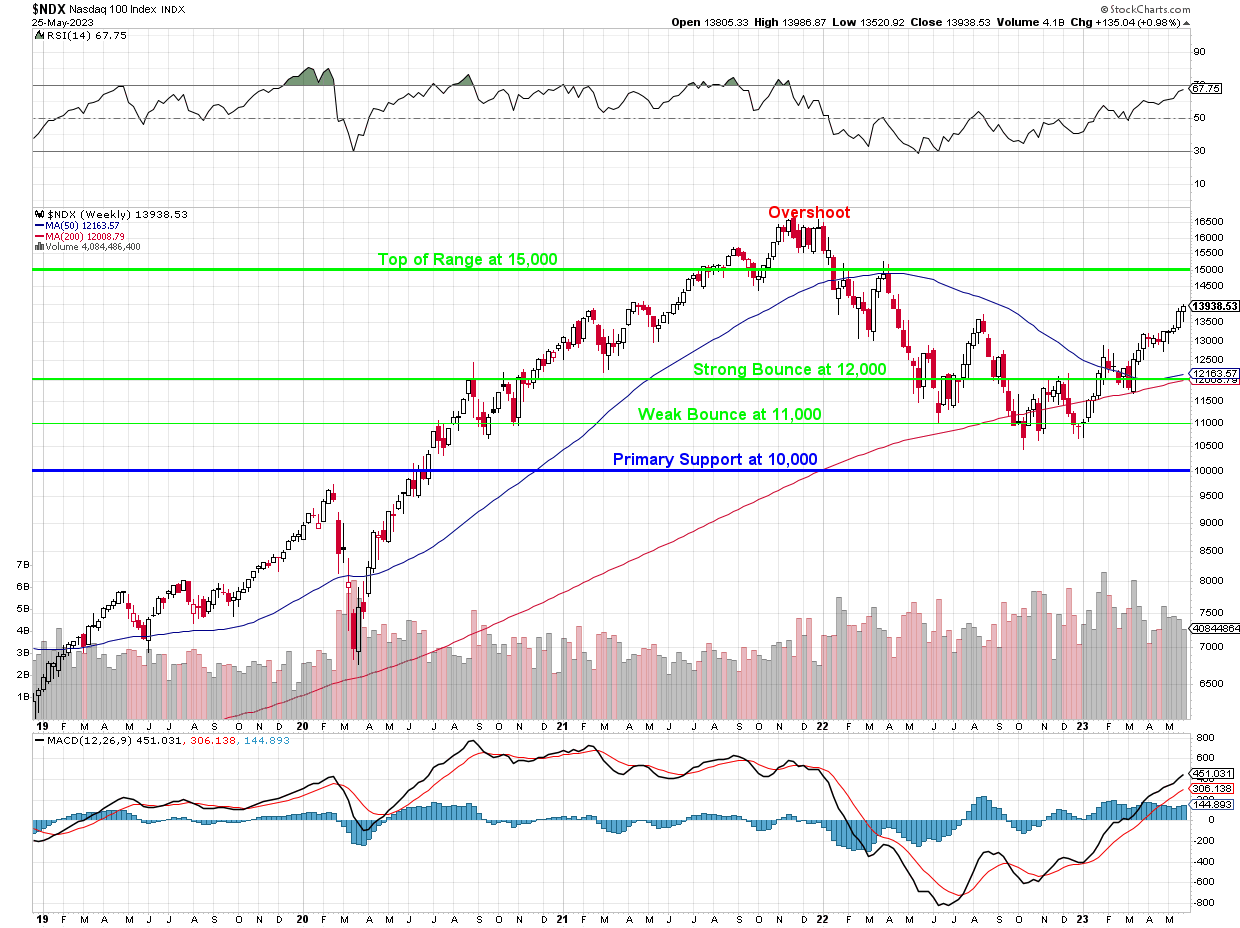

It’s a 3-day weekend and, after that, they have 2 whole days to actually finalize a deal and stop the Government from shutting down so you’ll have to forgive me if I don’t jump on the celebratory bandwagon just yet. On Tuesday we discussed our hedges and they are easy fills this morning with the Nasdaq 100 back over 14,000 – caveat emptor!

The Nasdaq WAS running out of gas at 13,000 but now NVDA has given analysts an excuse to boost targets on so many companies – even though most of them are SPENDING money on AI – not MAKING money selling chips. We’re happy to just go with the flow, the hedges are there to protect the gains in our longs and already, after just one week, our longs are doing well in our new Member Portfolios:

- Income Portfolio – Up 3%

- $700/Month Portfolio – Up 5.5%

- Butterfly Portfolio – Up 1%

- Long-Term Portfolio – Down 2.6% (FL killed us)

- Money Talk Portfolio – Up 228.5% (that one is from Nov, 2019)

- Short-Term Portfolio – Up 0.4%

And we still have about 80% CASH!!! on the sidelines, ready to buy more if this rally holds up past the debt deadline next Wednesday. Until then, it’s going to be a ride ride as we’re heading full speed towards that fiscal cliff. BUYBUYBUY?

From the Fed Minutes and Fed speakers this week, we have learned that there will be NO rate cuts in 2023 – unless something disastrous happens to the economy, of course. The minutes emphasized that the post-meeting statement should NOT be interpreted as signaling rate decreases or ruling out further rate increases. Powell also reiterated this sentiment during the question and answer session, indicating that rate cuts were not on the table.

That sent the markets lower until the fact that NVDA is selling a lot of AI chips reversed everything? How does that make sense? Doesn’t a stronger economy mean the Fed will be more likely to hike? How does NVDA selling chips help GM and F sell cars? How does it stop Commercial Real Estate from collapsing?

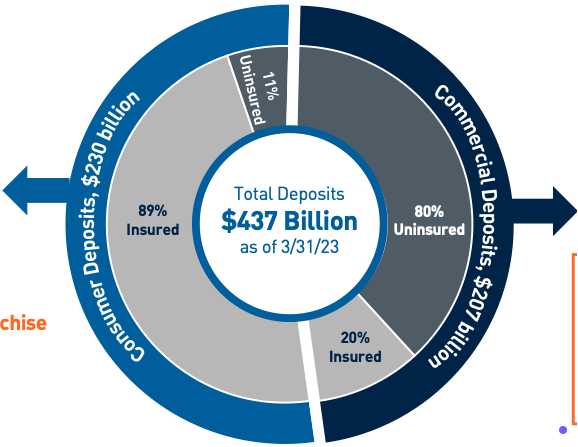

Speaking of which, here’s a good article by Avi Gilburt on big bank exposure to CRE highlighting PNC. Essentially, what the author is saying is that PNC Bank is facing significant stability issues that could pose risks in the future. The bank has a large exposure to commercial and industrial lending, with commercial loans accounting for almost 70% of its total credit portfolio. This concentration makes PNC vulnerable to changes in the macroeconomic environment, as a severe recession could lead to a deterioration in asset quality and higher charge-off and non-performing loan ratios.

Furthermore, PNC has a high share of uninsured commercial deposits, which has been a contributing factor in the failures of other banks in the past. The bank has also seen a notable increase in expensive borrowings from the Federal Home Loan Bank, suggesting potential liquidity issues. Another concern highlighted by the author is PNC’s longer-duration securities book, which exposes the bank to duration mismatch risks.

Additionally, PNC Bank’s operating efficiency is weaker compared to its peers, and its capital adequacy ratios appear relatively low when adjusted for negative Accumulated Other Comprehensive Income. These factors, combined with the bank’s exposure to commercial lending and potential liquidity challenges, raise doubts about its stability in a systemic crisis scenario.

Additionally, PNC Bank’s operating efficiency is weaker compared to its peers, and its capital adequacy ratios appear relatively low when adjusted for negative Accumulated Other Comprehensive Income. These factors, combined with the bank’s exposure to commercial lending and potential liquidity challenges, raise doubts about its stability in a systemic crisis scenario.

The banking crisis isn’t over – it just got pushed back with a quick $2Tn infusion by the FDIC and the Federal Reserve in March but it seems traders have already forgotten that but here’s $199Bn worth of uninsured depots in one bank and we already KNOW CRE is in huge amounts of trouble. Kicking a can down the road does not mean the can no longer exists…

Well, if no one feels like worrying about it why should we? We know how to make money in whatever kind of market. In fact, yesterday, in our Live Member Chat Room, I called for a long on Gasoline, which always goes up into Memorial Day Weekend, saying:

/RBN23 (July) at $2.52 and I think playing for a bounce at $2.50 will be fun – with VERY TIGHT STOP below that line. That captures this weekend and July 4th (and Juneteenth!).

As you can see, that’s going very nicely as we’re already testing $2.60 on the contract and that’s good for about $7,500 on 2 contracts so we’re going to lock that in here by taking it off the table as $7,500 should be enough to pay for the good stuff at the barbeque this weekend, right?

As you can see, that’s going very nicely as we’re already testing $2.60 on the contract and that’s good for about $7,500 on 2 contracts so we’re going to lock that in here by taking it off the table as $7,500 should be enough to pay for the good stuff at the barbeque this weekend, right?

Have a great holiday!

-

- Phil