Month 2 for our new portfolios!

Month 2 for our new portfolios!

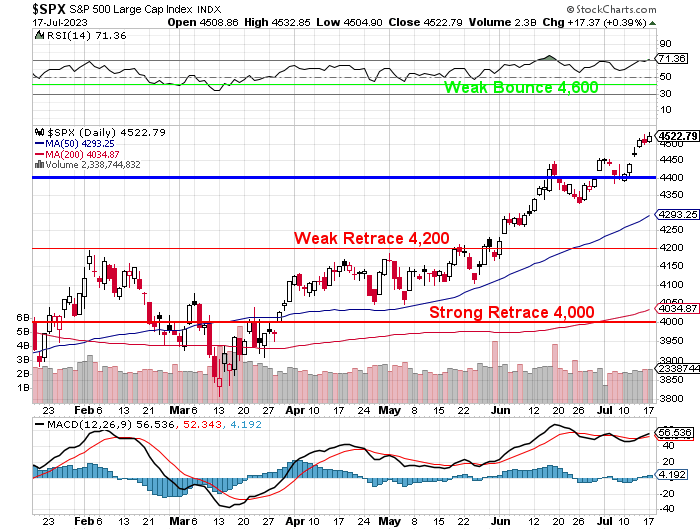

The S&P 500 is at 4,522 this morning and that’s up 184 points (4.2%) since our June review. We keep expecting a pullback, but it never comes and, in fact, we’re now moved our mid-point for the S&P 500 up from 4,000 to 4,400 – a 10% adjustment that mainly reflects inflation as certainly the average S&P company is NOT performing 10% better than it was in 2020 – when 4,000 was our prediction for the end of 2022 (we were actually high).

As the portfolios are mostly new, we would PREFER to see a market correction at this point – while we are still mainly in cash and overly hedged. If not, we’ll just have to keep dipping into our Watch List and picking up the laggards as the market keeps going up and up and up.

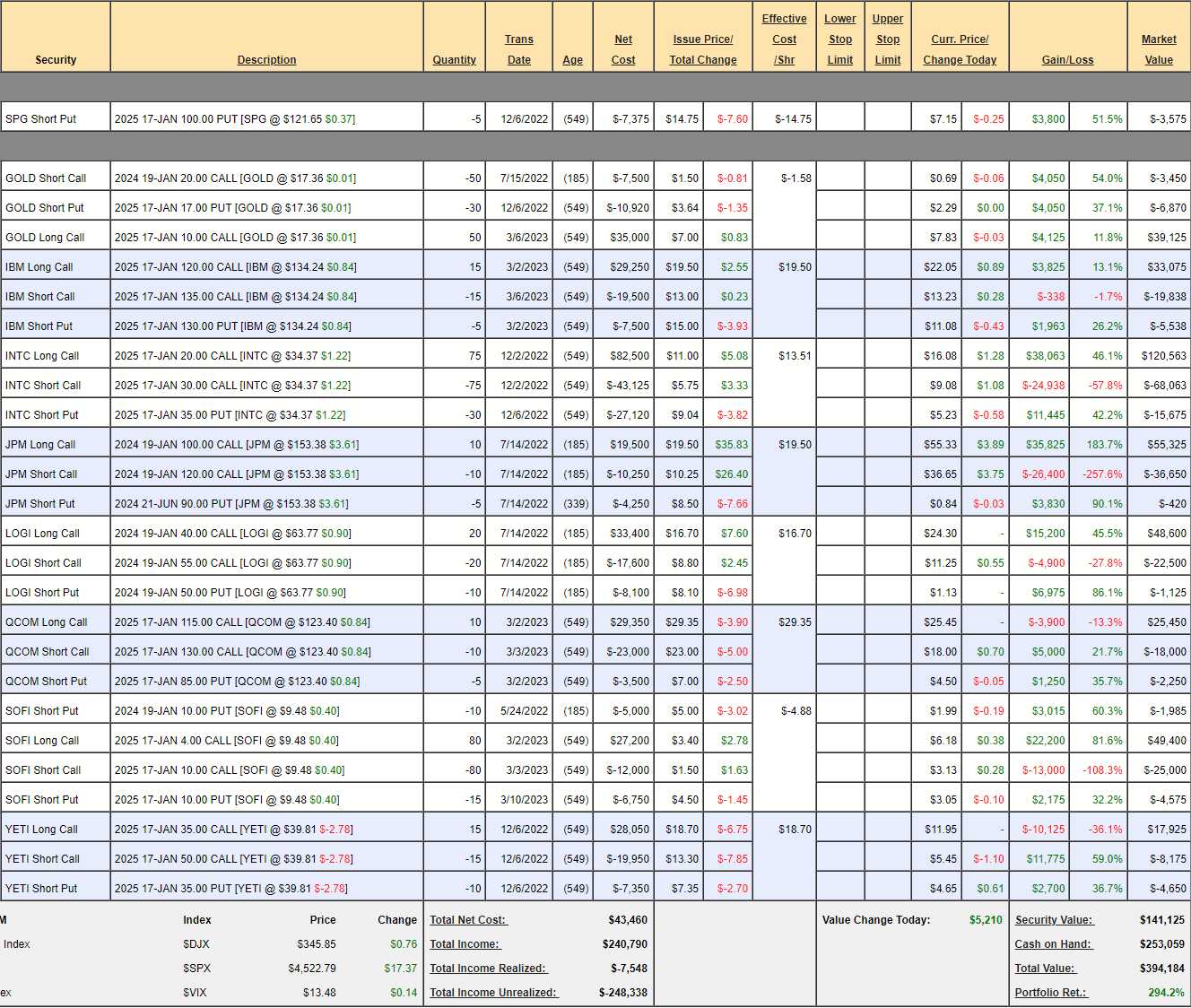

Money Talk Portfolio Review: Our oldest remaining portfolio is up 294% since November of 2019 and we only update it live, on the show. Since I haven’t been on the show since March 1st, it missed the cash-out we did on our other old portfolios. Now I’ll be on the show next Wednesday – so we’re going to have to decide if these positions should stay or go:

-

- SPG – I love this mall operator and we promised to buy 500 shares at net $85.25 but no such luck and we expect the remaining $3,575 to expire worthless and drop in our pockets.

-

- GOLD – Our favorite gold miner. Still under-priced at $17.36 but we played it very conservatively so we’re 70% in the money on our $50,000 spread at net $28,805 so there’s still $21,195 (73.5%) left to gain and we’re very confident.

-

- IBM – Another one of my favorite stocks. We’re in the money on this $22,500 spread but the net is only $7,709, which means we have $14,791 (191%) left to gain if IBM simply stays over $135. Aren’t options fun? This would still be great as a new trade.

-

- INTC – Finally waking up. For 2 years, this has been our Trade of the Year runner-up because it was still too soon but now the investment cycle is ending and INTC will reap the harvest they have sown! This is a $75,000 spread we’ve had all year and it’s up nicely at net $36,825 and it’s almost entirely in the money but we still have $38,175 (103%) left to gain in another no-brainer trade you can still add.

-

- JPM – Boy, this portfolio is full of my favorite stocks! That’s because we can’t adjust them for a quarter at a time – so they’d better be rock-solid picks! This is a $20,000 spread from way back last July and it expires in January. Currently at net $18,255, there’s just $1,745 (9.5%) left to gain so we are closing this one as we can make a lot more than 9.5% using $18,255 elsewhere.

-

- LOGI – We’re deep in the money on this $30,000 spread and it’s net $24,975 with $5,025 (20%) left to gain but it closes in January so 20% is not too bad for 6 more months and we don’t need the cash and it’s hard to imagine we fall back below $55 so I guess we don’t have a good enough reason to close this one.

-

- QCOM – This is why it’s good to do reviews. I can’t believe how far behind QCOM is compared to AVGO and others. We will be making this one a Top Trade Alert today! We’re only up a little at net $5,200 on this $15,000 spread so there’s $9,800 (188%) left to gain if QCOM can make it to $130 in 18 months.

And what is the worse case in this trade? At net $5,000 with the $85 puts sold, the worst possible case is you get assigned 500 shares at $85 and lose $10 per share if the spread is wiped out and that’s still only net $95 ($47,500) which is a 23% discount to the current price – that’s your WORST case! So, the question is, why are you NOT in this trade?

Options are not just fun – they are a portfolio-changing way to trade because we learn to turn the statistics of the market in our favor. In regular casinos, you can’t just jump on the house side of the table but, when you sell options instead of buying them – that’s EXACTLY what you are doing – the house advantage becomes yours!

-

- SOFI – At last our patience has paid off! As you can see from the puts, we started this one last May and we doubled down when it went the wrong way (we knew it was wrong!) and now it’s going the right way at net $14,840 on our $48,000 spread that is almost 100% in the money with $33,160 (223%) left to gain if we can get over that $10 mark.

-

- YETI – Our Trade of the Year for 2023 is now net $5,100 and we started at net $750, so we’re already up 580% and 300% is our goal for our Trade of the Year so that makes this our 13th consecutive winner! Our 2025 target is $50 and that will pay us $22,500 for an upside potential of $17,400 (341%) even if you missed the first 580!

Looks like this portfolio is too good to cut. We have 64% cash and now about 70% after killing JPM (not official until next week) and our other 8 positions are on track to make another $143,121 left to gain by Jan 2025 – that certainly seems worth keeping, right?

And we still have $243,059 + JPM in CASH!!! sitting on the sidelines – so I wouldn’t even say we’re playing aggressively. Not bad for a portfolio we only adjust once per quarter…

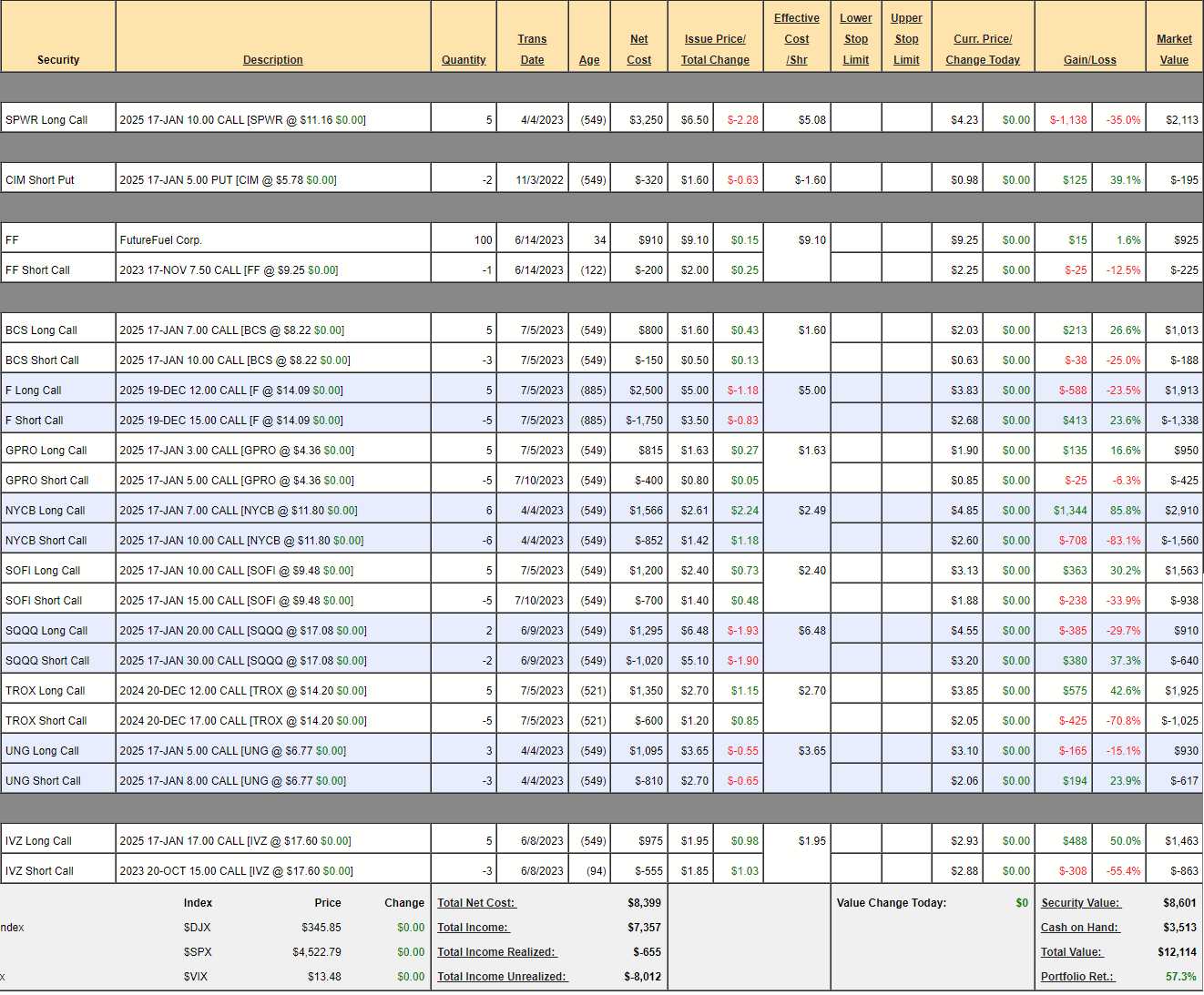

We reviewed our $700/Month Portfolio on July 5th and we were up 37.1% at the time and this morning we are up 57.3% ($12,114) and that’s so silly that I feel like we should cash out but that’s not the point of this lesson, which is to show the value of simply putting away $700 each month and making nice, sensible trades. This is month 11 and we’re miles ahead of schedule (our goal was 20% a year) and outperforming almost every hedge fund on the planet!

We cashed out NYCB so it shouldn’t be in the portfolio anymore!

This is another low-touch portfolio. At the beginning of each month, we put in another $700 and make trades and adjustments. Next month will be our first anniversary! You can still catch up, we still have 349 month left to go!

Butterfly Portfolio Review: Slow and steady wins the race and that’s why our Butterfly Portfolio is our most consistent performer. This one just started on May 19th – so it’s only month 2 and already we’re up $12,910 (6.5%) but, of course, we’re only using $47,835 of our CASH!!!, so we’re up 26.9% on the positions we’ve taken! We only add one or two positions per quarter and it’s all about drawing an income out of our positions (so far, just 4):

-

-

- AAPL – The short Sept calls are now $14 in the money and we sold the for $8 but that $8 in premium is gone – so no worries. Now we have a $6 loss and the Jan $210s are $6.25 so we’re fine with that if we have to but, for now, they are just protecting the gains on our longs. This is a $60,000 spread we bought for net $28,150 and it’s currently net $36,577 so about 40% more to go – plus whatever we end up scratching out on the short call sales.

-

-

- IP – We’re waiting for it to pop so we can sell some short calls.

-

- PFE – The net entry was $1,375 and we sold 120-day Sept $40 calls for $1,700 and, if those expire worthless in 59 days, we have 826 more days to sell short calls. If we get more than $1,375, then we’ll be making a 100% return on our money every 4 months – isn’t that worth playing for?

-

- PM – Just added this one two weeks ago. The base is a $15,000 2025 spread and we sold 60-day Sept puts and calls for $2,000 after a net $2,900 entry and we’re threading the needle with the short puts and calls so far!

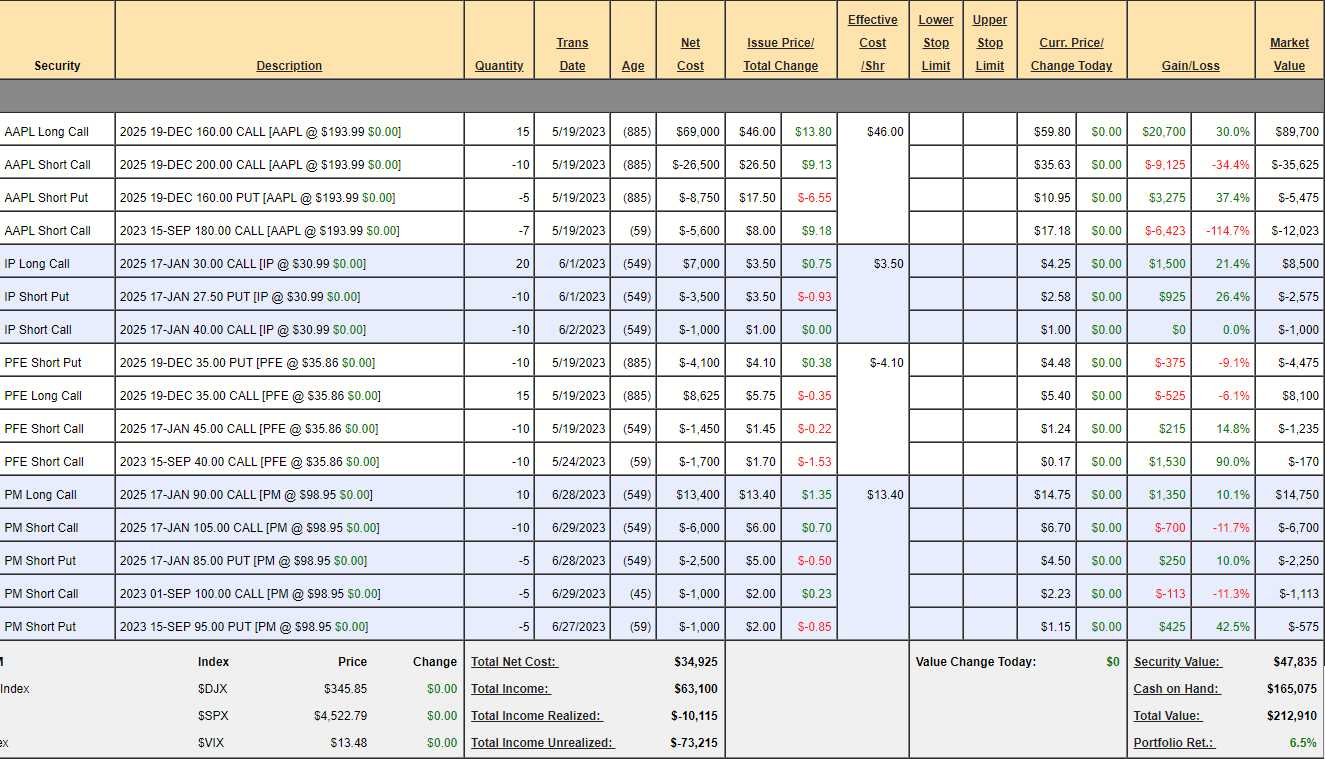

Income Portfolio Review: The goal of this portfolio is to generate $2,000 per month from a $150,000 Retirement Account to almost double a typical Social Security check. I do this so my Mom’s friends don’t have to deplete their savings to keep up with inflation but it’s great for anyone who wants to save and also likes to spend some of it.

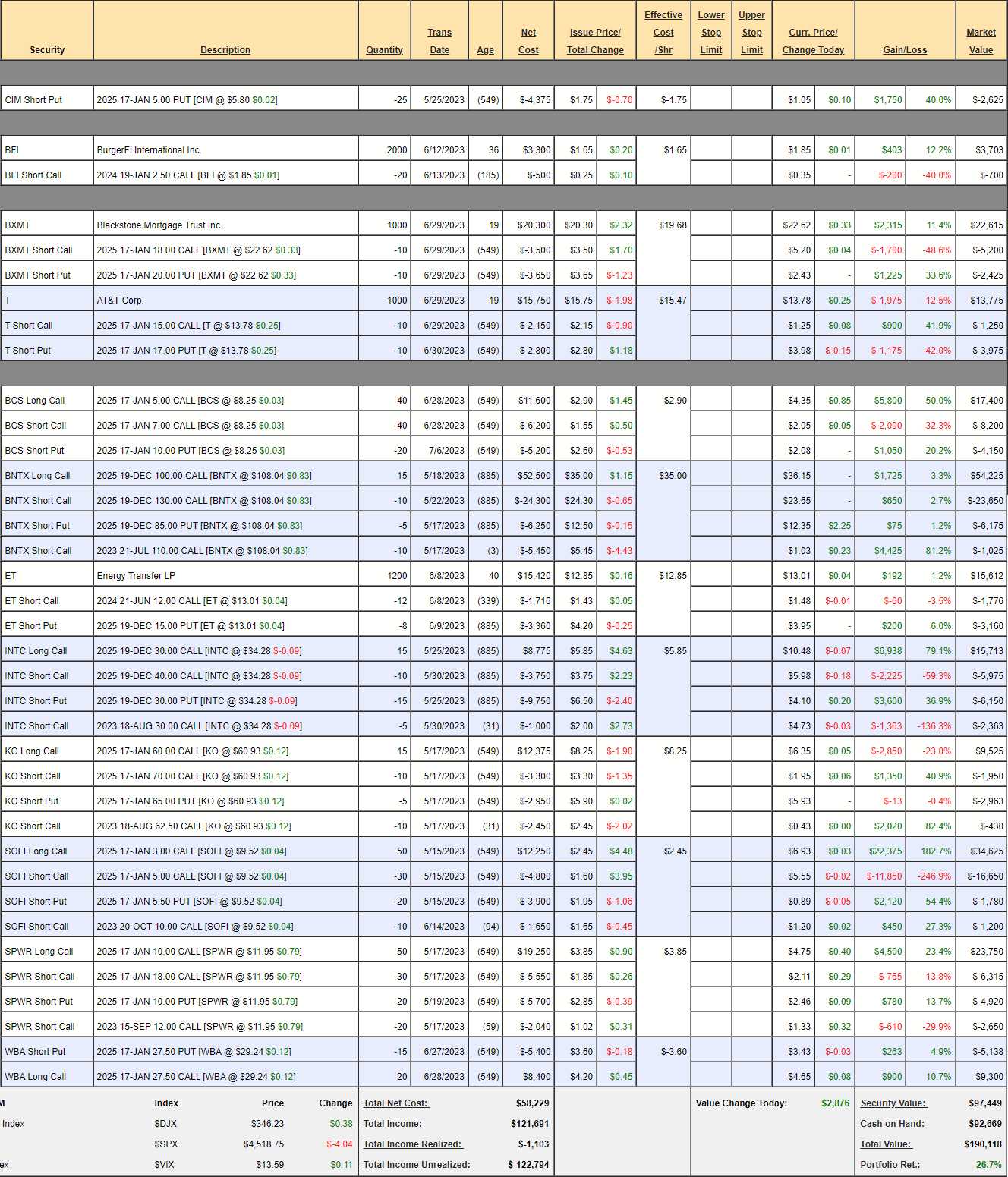

It’s only our second month and our goal is to make about 3% monthly to stay ahead of the withdrawals but we’re already up 26.7% at $190,118 from a $150,000 start on May 15th – miles ahead of schedule!

-

- CIM – My favorite REIT. $2,625 left to gain is $145 a month right there!

- BFI – Small little burger chain that I think is stupidly low at $1.82. We came in at $1.65 but we’re only up $203 but on June 13, we sold the Jan $2.50 calls for 0.25 after buying the stock for $1.65, though they are out of the money, they are 0.35 now. If we get called away at $2.50, we make a quick 0.85 (51.5%) so we are happy and, if we don’t, our net is $1.40 and we sell 0.25 more for the next 6 months and that’s 17.8% semi-annually – also we are happy!

-

- BXMT – We just added them and already a nice profit. Many good REITs got clobbered in the panic and this was one we were watching. Looks like we got in just in time (and we were too conservative). We’re in this one for the $2.48 annual dividends.

-

- T – They were already down and then this lead cable issue hit and yes, that might cost them Billions of Dollars (as well as other carriers) but they sell $122Bn a year and make $17.5Bn and $13.50 is $96.5Bn for the whole company – that’s kind of silly – even with $132Bn in debt. Since all carriers are pretty much in the same boat, they will simply raise prices to cover any costs. If T raised prices 10% – that would drop $12Bn a year to the bottom line.

- So, what we are going to do is buy back the short 2025 $15 calls for $1.25 ($1,250 – up 41.9%) and we are going to roll our 10 2025 $17 puts at $4 ($4,000) to 20 2025 $15 puts at $2.65 ($5,300) so we are getting a net credit of $50 for the adjustment. We sold the $17 puts for $2,800 and we’re collecting $1,300 more so $4,100/20 is $2.05 for each $15 put means our net entry is $12.90 on 2,000 shares if assigned. As long as they keep paying a $1.10 dividend (8.5% of $12.90) and we can keep selling calls – I’m good with that!

Our basis on 6/29 was net $10.80 per share and, if assigned 1,000 more at $17, then our average would have been $13.90. Our changes above have netted us $50 so our basis is $10.75 but now we could be assigned 2,000 more at $15 so $40,750/3,000 would be net $13.58 but we also freed up the short calls, so we should be able to knock off $2,000 more at some point as well. Not bad for a stock that dropped 15% since we bought it. Options are fun!

-

- BCS – Another new one we caught just in time. That’s the discipline, when the bank crisis happened, we spent a couple of days weighing the pros and cons of various banks and BCS was one of our finalists and they went to a watch list and, when they took a little dip – we jumped right in! Huge profits already due to our great timing.

-

- BNTX – One of our first plays as it was coming off a huge downswing so we took advantage of the volatility. The short July calls will expire worthless but I don’t want to be so aggressive for September so let’s just sell 7 of the Sept $120s for $2.50 ($1,750), which is still 10.6% of our $16,500 entry using 59 of the 885 days we have to sell. Any time we’re on track to drop our net to $0 – I am a happy, happy trader!

-

- ET – We are just waiting for our 0.308 ($369.60) dividend! Our net entry was $7.22 so we’re getting 4.2% per quarter while we wait to get called away at $14,400 with a $4,056 (39%) profit on the spread. My favorite dividend stock!

-

- INTC – Finally waking up after a long, long slumber. We’re getting stung by the short Aug $30 calls now and I expect them to keep going so we’re going to roll the 5 short Aug $30 calls at $4.73 ($2,363) to 10 short Nov $35 calls at $2.70 ($2,700) and we’re going to buy 10 Dec 2025 $30 ($10.25)/45 ($4.50) bull call spreads for $5.75 ($5,750) and that gives us another $9,250 of coverage for $5,750 and also gives us more comfort selling 10 short calls in the future and we have 885 days to sell and we’re using 122 of them for November but the original spread was a net $5,725 credit so now we’re at net $312 credit on what is now a $30,000 spread with the potential for 6 more sales of $2,700 ($16,200) while we wait.

-

- KO – Off to a very poor start but that’s fine because we sold 10 Aug $62.50 calls for $2,450 against our net $6,125 entry, collecting 40% of what we put in for the first 3 months out of 19. So if we have 5 more sales like that ahead of us (maybe some puts too!), then we’ll collect another $12,000 and be $6,000 ahead and the spread will be a bonus. INCOME Portfolio!

-

- SOFI – This one really woke up! Net $3,550 on the spread and then we sold the Oct $10s for $1,650 (46.5%) when they moved up (as planned) so now our net on the $10,000+ spread is $1,900 and we only need $5.50 or better – AND we’ll sell more short calls – this is FANTASTIC!!!

-

- SPWR – Our Stock of the Decade is finally stirring (again – we’ve been in and out 4 or 5 times in the first 3 years) and hopefully we won’t bust over our Sept target but it only equals full cover on the $40,000+ spread we paid net $5,960 for. This was also one of the first trades we added and you can see why – now net $9,320 and $30,680 (329%) more to gain if we can get to $18.

WBA – Just added these and already a nice profit! This is an open and aggressive on the laggiest Dow component.

The Income Portfolio is kind of like the $700/Month Portfolio on steroids as we started with $150,000, not $700 so we are able to make more aggressive moves but it’s the same concept, we take fairly conservative positions on value stocks and wait for the market to realize they’ve mispriced the security.

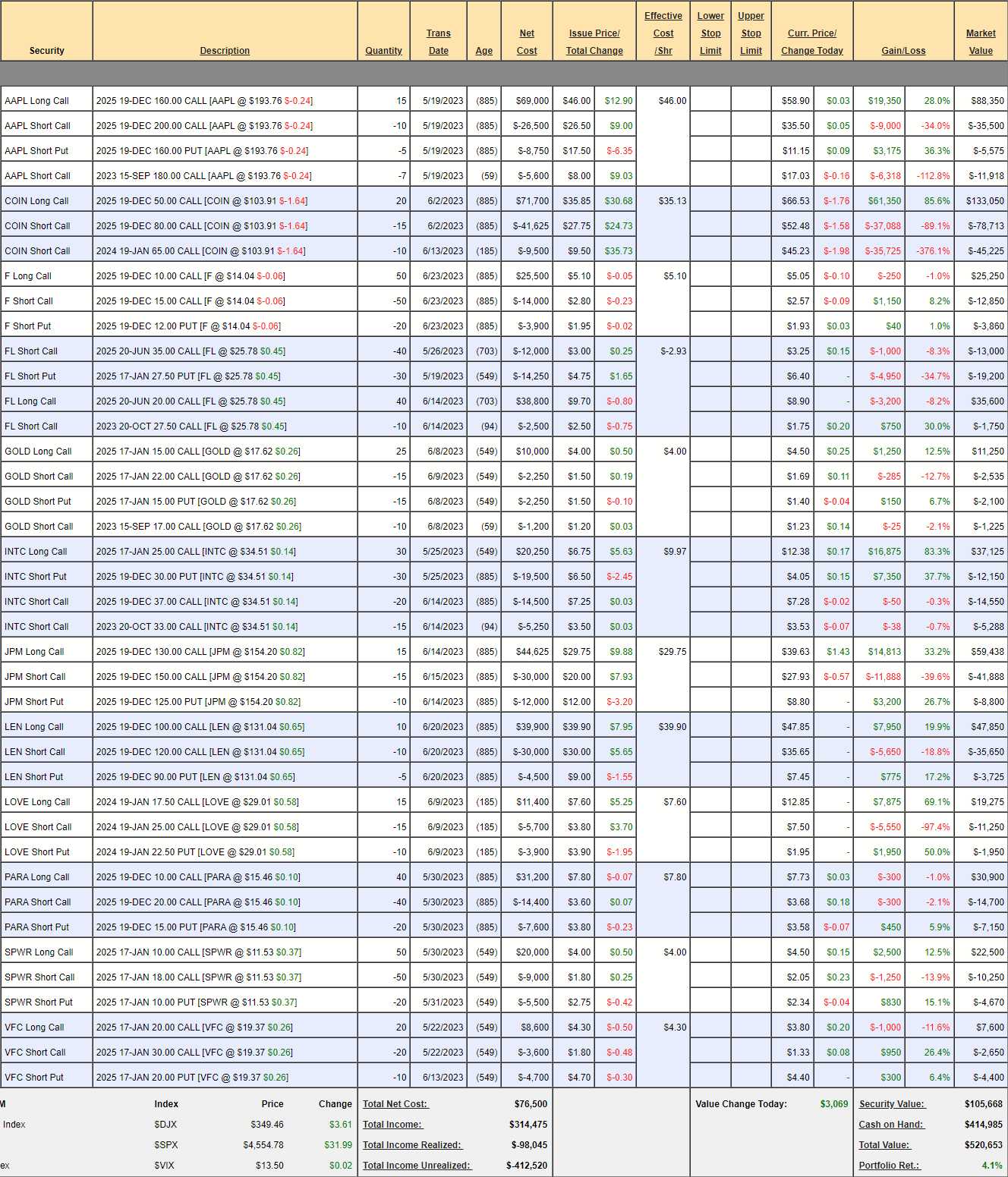

Long-Term Portfolio (LTP) Review: In two months we’re up 4.1%. COIN, of all things, is burning us and it’s one of my favorite picks, so go figure. Still up 2% per month will make us $300,000 (60%) in 24 months and we have over $400,000 (80%) in CASH!!! – so we’ve barely started trading. Let’s put some of it to use:

-

- AAPL – What would a portfolio be like without AAPL? We’re over the line on the Sept $180 calls but $17 still has $3 of premium in it at $194 and the Jan $190 calls are $17 so, as long as that’s a fairly even roll – there’s nothing to worry about. If we have to roll those again then our $60,000 spread will be in the money but, at the moment, the net is just $35,357 so $24,643 (69%) left to gain is just fine.

-

- COIN – Suddenly it pops! We thought it would happen one day – just not this soon. Only 5 of the short calls are an actual problem as we’re covered otherwise so let’s look at the rolls: The Jan $65 calls are now $45.23 ($45,230) but the Dec $80 calls are $52.50 ($52,500) so how is this a problem? It’s not, but it’s messy at the moment.

- So here’s what we’re going to do: The Dec 2025 $100 calls are $46 so we’ll roll 5 of the 10 Jan calls there, leaving us with just 5 short Jan $65 calls to roll. The Dec 2025 $80 ($54)/120 ($39) bull call spread is net $15 on the $40 spread that’s half in the money – seems like a good deal to me so let’s buy 20 of those ($30,000) which is how much we’d make if we sold just 5 of those Dec 2025 $50s ($66.53), which is what we’ll do if $100 fails. Finally, we’ll take our 5 remaining Jan $65 calls at $45.23 ($22,615) and roll them up to 5 April 2024 $90 calls at $35.50 ($17,750) so we’re spending about $5,000 to roll the short calls $12,500 higher. Overall, the adjustments are about net $25,000 and we fixed the short calls and added another $80,000 worth of long spreads so $55,000 (220%) additional upside potential and we’re only doing that because the spread is doing so well…

-

- F – Sold off sharply when they announced price cuts on the F150 Electric Trucks. We discussed it yesterday and decided that was silly – especially for this trade where we only need $15 in Dec 2025. Good for a new trade as it’s pretty much back to where we started.

-

- FL – I love them down here and we made adjustments last month so we need to let those settle in. We sold the Oct $27.50 calls so it’s not like we were expecting a big move up any time soon.

-

- GOLD – Finally coming back and still good for a new trade.

-

- INTC – Thank goodness for this one! Way, way up and I think perfectly positioned. Only net $5,137 on the $36,000 spread so let’s double down on this one as it’s got $30,868 (600%) left to gain! I can’t think of a trade more likely to make 600% than this…

-

- JPM – Another bank we jumped on when others were panicking. Very much on track but net $8,750 on the $30,000 spread “only” has $21,250 (242%) in upside potential – so not as exciting as Intel.

-

- LEN – Brand new addition and great timing – already up a bit.

-

- LOVE – Already well over our target and it’s a Jan trade we expect to collect in full. If they had longer options, we would play them much more.

-

- PARA – So frustrating! I’d kill it but we’re only tying up $9,050 on the $40,000 spread so over 300% upside potential at $20 in 30 months. Nope, can’t quit this one…

-

- SPWR – What’s left to be said? Net $7,580 on the $40,000 spread leaves us with $32,420 (427%) upside potential if our Stock of the Decade can get over $18 in 18 months. We’ll see how far momentum takes us into earnings.

-

- VFC – I hate to start selling calls when they are so cheap so we’ll wait until earnings (8/1) and see how things sound.

So INTC alone can now make us $60,000 and yes, we need to find more stocks to take advantage of during this earnings season.

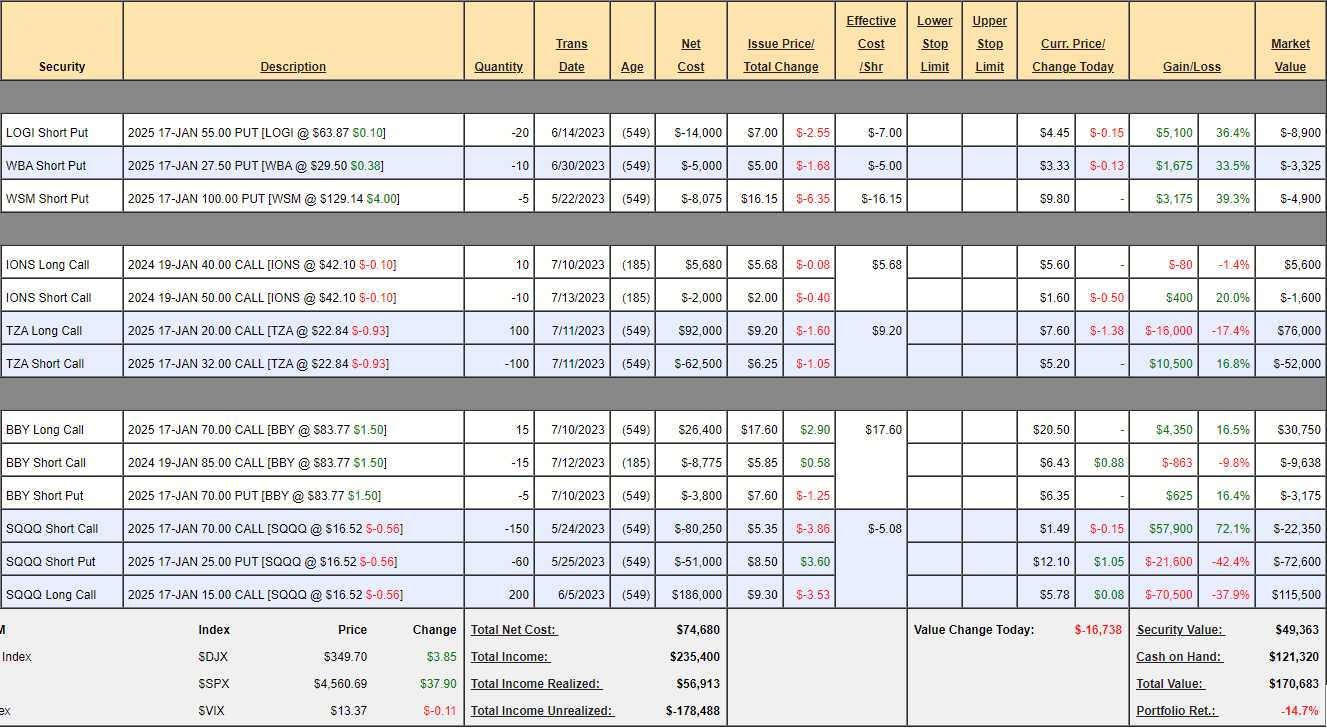

Short-Term Portfolio (STP) Review: Well, we are certainly well-hedged! It’s annoying when you have hedges and they don’t pay off in the way it’s annoying when you have life insurance and keep waking up the next day… If all is going well for the longs, this portfolio is supposed to lose money.

We mitigate that a bit with some long plays – mostly short puts and look how good we’ve been picking those. Up 30% in not even two months is pretty good! BBY also a nice short-term winner.

-

- Short Puts – All well on track with $9,950 in quick profits and double that left to gain.

- IONS – Another bullish offset that’s just few days old. Just a basic $10,000 spread we bought for $3,680 so $6,320 upside potential. The idea is just to recapture what we lose on the short side, not to have huge winners.

-

- TZA – We added this just last week and already costing us $5,500 as the RUT is close to 2,000 but it’s in the money and $32 is not at all out of reach if there’s a correction. At net $24,000 it’s a $120,000 spread so almost $100,000 downside protection for our above portfolios.

-

- BBY – This one seemed pretty obvious to me recently and it’s already up over $4,000. It’s potentially a $22,500 spread currently at net $17,937 so there’s still $4,563 (25%) left to gain but miles ahead of schedule.

-

- SQQQ – Our main hedge is based on the $15 calls and, if the market drops 20%, SQQQ will pop around 60% from $16.52 to $26.43 and that would put the calls $11.43 ($228,600) in the money and the spread is currently net $20,550 so huge $200,000+ protection . We just bought back some of the short calls but we’ll sell some more if earnings don’t cause a sell-off.

If anything, we’re a bit too bearish but that can be fixed with a shopping spree and what better time to buy than earnings season?