Indexes are selling off this morning.

Indexes are selling off this morning.

Nothing drastic but, as I often remind our Members: “What can easily be done can just as easily be undone.” In other words, when you have one of these fantastic rallies – especially when they are low-volume affairs – then it can be, essentially, a house of cards – just waiting for a passing wolf to blow it all back down.

Above is the chart of Germany’s DAX, which topped out in June at the same time as our indexes did but Germany has already begun to face realities that US investors simply don’t believe in – yet.

Above is the chart of Germany’s DAX, which topped out in June at the same time as our indexes did but Germany has already begun to face realities that US investors simply don’t believe in – yet.

As I keep reminding our Members, we don’t mind adding longs because FIRST we added hedges and even our $700/Month Portfolio has hedges – because it would be very tragic to give up our gains due to complacency, wouldn’t it? Let’s get to that review first and then we’ll get back to market conditions:

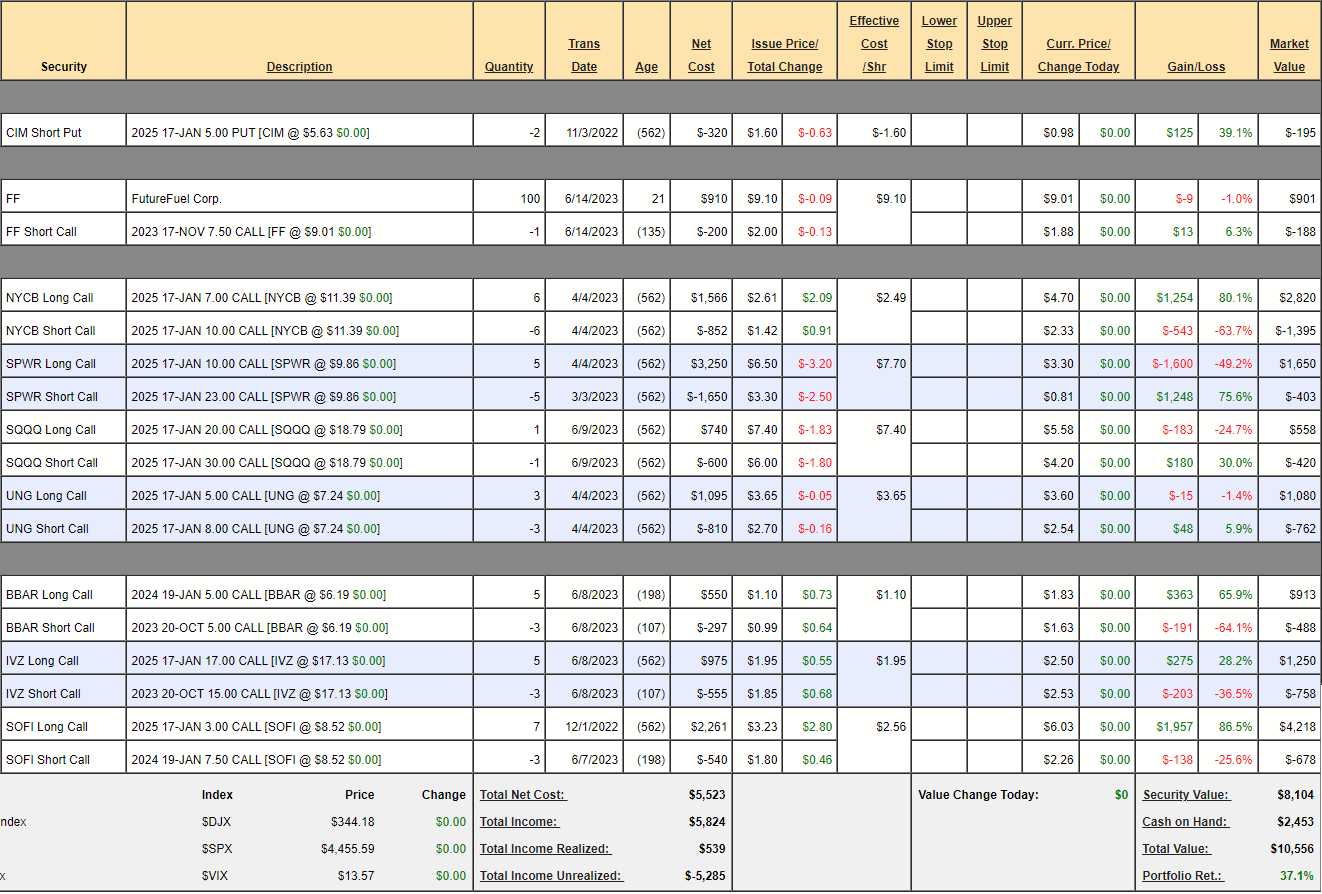

$10,556 is up 37.1% in 10 months!

That is up from just $9,123 (30.5%) in our last review (June 7th) and that is on $7,700 invested (including this month’s $700 addition). Congratulation to all who played along at home in months 1, 2, 3, 4, 5, 6, 7, 8, 9 and 10 and don’t worry if you missed it – we are doing this for another 349 months and intend to make at least $990,199 more by the time we are done to hit our $1 Million Dollar Goal.

At the moment, we are using $1,000 in margin (we are assuming a small IRA/401K account that requires 100% withholding) so we have $1,453 in buying power for adjustments and new positions. As we do every month – let’s carefully review our positions first:

-

- CIM – If we’re going to own a REIT, this is the one so we’ve obligated ourselves to buy 200 shares at $5 ($1,000) but we got paid $320 to make that promise by selling the puts so net $680 is our risk of ownership for 200 shares ($3.40/share). CIM currently pays 0.92/share in dividends so we’d be making 27% dividends if we were to be assigned so PLEASE – let that happen! We have $195 left to gain otherwise if, sadly the stock stays over $5.

-

- FF – We just added them last month and it’s in the red at the moment – so cheaper than we paid as a new entry. We paid net $7.10 and we’ll get called away at $7.50 so we’re certainly in it for the dividends, which are usually 0.06 per quarter (3.1%) but they have a propensity to call for special dividends and we expect to catch one in this cycle (which will cause the stock to drop – hence the low short call). We will roll the calls and keep lowering our basis but at $7.50 we make 0.40 plus 0.12 for two dividends is 0.52 ($52) is 7.3% for 5 months, not terrible. We’re using this one to teach the strategy, more so than going for the gold.

-

- NYCB – Off to a good start at net $1,425 on the $1,800 spread so we are up $711 (99.5%) from our original $714 entry in April and we have $375 (26.3%) left to gain and we’re well over our $10 goal. As it’s a 2025 spread and up almost 100%, we’re going to take it off the table as we know we can do better than 26.3% on a fresh 18-month trade.

-

- SPWR – Still cheaper than where we started and we’re up 75.6% on the short 2025 $23 calls so we’re going to buy those back for $403 and wait for a bounce to sell more calls. I still think $20 is very realistic and that would be $5,000 and the new net will be $1,650 so $3,350 (203%) left to gain if it ever turns around in 18 months.

-

- SQQQ – Notice our hedge has not lost much money – despite the massive rally. That’s the advantage of going out to 2025. We’re still at the money and SQQQ is a 3x inverse ETF that will gain 60% if the Nasdaq drops 20% so call it $31 and that would return $1,000 and now the net is $138 so we have $862 left to gain (protection) and, at this price, it’s a no-brainer to spend $138 more and have another $862 in protection against our $2,856 worth of gains!

-

- UNG – A little bit of profit and hurricane season hasn’t even started yet. It’s a $900 spread at net $318 so we have $582 (183%) upside potential at just $8 in 18 months. That’s another one I’m tempted to doubled down on!

-

- BBAR – Another one we have to kill with a $172 profit as Argentina is getting worse and worse – so why risk it? Keep in mind we made that $172 in a month on a $253 spread – that’s 67.9%!

-

- IVZ – Yet another new one! We’re up a little already at net $492 on what we decided could end up a $1,500 spread so $1,008 (204%) left to gain.

-

- SOFI – We finally got a pop in June but flat since then but we’re up huge at net $3,540 on the $3,150 spread (if it were fully covered). I don’t like one spread being 1/3 of our portfolio so we are going to close it out for $3,540 and spend $525 on 5 of the 2025 $10 ($2.45)/15 ($1.40) bull call spreads at $1.05. That will pay us another $2,500 ($1,975 upside potential) if it goes well and, if not, we still pulled $3,015 off the table.

We have taken $4,324 off the table and we had $1,453 in buying power so now we have $5,777 to spend of the $7,700 we’ve invested to date. Despite all the cash-outs, the remaining positions still have $7,162 (93%) of upside potential – we really don’t need to do anything else at all to be well on track AND, we doubled our hedges too! BRILLIANT!!!

This is VERY good for 10 months of work and here’s what we’ve been considering for this week:

- Barclays (BCS) is from our Watch List at $7.68, which is $30Bn but they make $5Bn so 6x is stupidly low. They pay almost 5% and actually have $16Bn laying around on top of that – half of their market cap!

- B2 Gold Corp (BTG) is a gold producer with a 5% dividend at $3.58, which is $3.8Bn and they make $350M so p/e about 11. They also have $600M in the bank and we like gold as a hedge.

- Ford (F) barely missed the cut last month at $12.56 and now it has zoomed up to $15.24, which is $60Bn and they made $6Bn last year and should bump 10% this year. I’m pretty sure, 30 years from now, you’d be kicking yourself for not buying this one. Dividend is a nice 5% too. $95Bn in debt is the dark cloud but autos, inventory, etc. – it’s kind of normal.

GoPro (GPRO) is $4.19 and that’s $660M and they are making $22M this year (31x) but expect $83M next year and that’s 8x so it’s a question of whether you believe them or not.

- Global Ship Lease (GSL) is a container ship leasing company who are paying a 7.3% dividend against their $19.63 stock ($700M cap) but they made $274M last year and expect to grow about 20% this year – so a nice little company.

- Nokia (NOK) is still alive and more of an equipment service provider these days. $4.18 is $23Bn and they make about $2.5Bn so 10x but just a 1.79% dividend. They do have $4Bn in cash though – I like that!

- Petrobas (PBR) – Would be great but the Government forces them to essentially give oil away to Brazilians. Even now, they are trying to sell assets and the Government is interfering. In a riskier portfolio, I don’t mind but not here.

- Tronox (TROX) – Specialty materials are always fun and sales are up to $3.2Bn from $1.8Bn in 2018 and profits are $220M but $12.45 is $2Bn so call it 9x. 3% dividend as well.

Those are our contenders and we COULD buy them all but let’s deploy about half ($2,500) and see what happens.

-

- BCS is, as I said, stupidly low. They are at $7.69 and the 2025 $7 ($1.60)/10 (0.50) bull call spreads are just $1.10 on the $3 spreads but cheap enough that we can buy 5 longs ($800) and only cover 3 ($150) for net $650 on the $1,500+ potential spread. That’s $850 (130%) upside potential.

- F is $15.37 but $15 was our easy target so let’s stick to that and buy 5 of the Dec 2025 $12 ($5)/$15 ($3.50) bull call spreads for $1.50 ($750) on the $1,500 spreads so we have $750 (100%) upside potential if they just hold $15.

- GPRO seems too good to pass up down here. We can buy 5 of the 2025 $3 ($1.70)/5 (0.80) bull call spreads for 0.90 ($450) and that’s got $550 upside potential at $5.

- TROX is very interesting as a “No Recession” play and I’d hate to see them get away so let’s add 5 Dec 2024 $12 ($2.75)/17 ($1.20) bull call spreads for $1.55 ($775) on the $2,500 spread with $1,725 (222%) upside potential if they manage to hold $12.

So we’ve spent $2,625 and we added $3,875 (147%) of upside potential and the spreads we closed were only going to make another $1,203 if all went perfectly so we added net $2,672 of upside potential AND we still have $3,152 left to spend and another $700 will be added to that next month, as we celebrate our one-year portfolio anniversary.

Meanwhile, the indexes popped back at the open but still mostly red. Factory Orders came in at 0.3% vs 0.6% expected and you know how the market loves a Recession (doesn’t it?). Fed minutes at 2pm, during our live trading webinar, which starts at 1pm.