By Alan Condon of Becker Hospital Reviews

Healthcare bankruptcies have spiked this year as staffing shortages and climbing interest rates continue to challenge hospitals, health systems, physician staffing groups and other healthcare companies, according to Bloomberg.

The healthcare sector was propped up largely by demands stemming from the pandemic. The federal government distributed more than $700 billion in health spending related to the pandemic, according to the Committee for a Responsible Federal Budget. That includes $160 billion in grants to hospitals, assisted living facilities and other providers.

The end of the government money brought a “day of reckoning” for many struggling companies, Dragelin said.

SiO2 Medical Products, which filed for Chapter 11 in March, said in its filings that its “liquidity crisis can be traced, at least in part, to government contracts the Company was awarded in the wake of the COVID-19 pandemic, and the rapid ensuing change in government and customer demand.”

“Once the government money ran out, once all the stimulus dollars around healthcare ran out, there was essentially going to be this backwash,” Timothy Dragelin, a healthcare director at FTI Consulting said. “The fact that labor costs increased substantially—you also had the issues with supply chain and supply chain caused some disruptions.”

Sluggish economic factors that have contributed to a general rise in Chapter 11s have also hurt the healthcare business. But the industry requires large staffing and the aftereffects of rising labor costs have been particularly acute.

Five things to know:

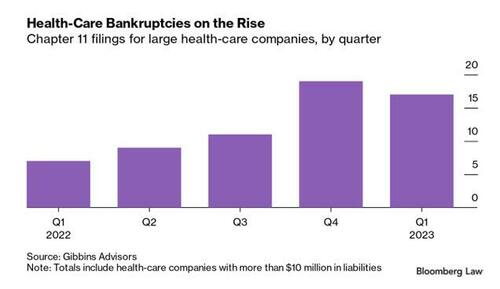

1. In the first quarter, 17 healthcare companies with more than $10 million in liabilities, including a hospital, senior living centers and a pharmaceutical developer, filed for Chapter 11 bankruptcy, according to Gibbins Advisors, a healthcare restructuring consulting firm. Seven companies filed for Chapter 11 in the same period in 2020.

2. Economic challenges have led to a general rise in Chapter 11s bankruptcy filings, according to the report. The healthcare industry has been hit particularly hard as it grapples with a nationwide staffing shortage and rising labor costs.

3. Two private equity-backed companies, Envision and GenesisCare, and two hospitals — Madera (Calif.) Community Hospital and Beverly Hospital in Montebello, Calif. — are among the Chapter 11 bankruptcy filings in healthcare so far this year.

4. Healthcare bankruptcies spiked in late 2022, and cooled slightly in the first quarter of 2023. However, first-quarter numbers are up year over year, and the rate of new bankruptcy filings are expected to spill over into coming quarters, according to the report. .

5. Inflation and rising interest rates are also contributing to challenges in the healthcare sector. Medicare and Medicaid reimbursement generally comprise a large portion of a healthcare providers’ revenue, but federal payments typically lag behind inflation, Clare Moylan, co-founder of Gibbins Advisors, told Bloomberg.