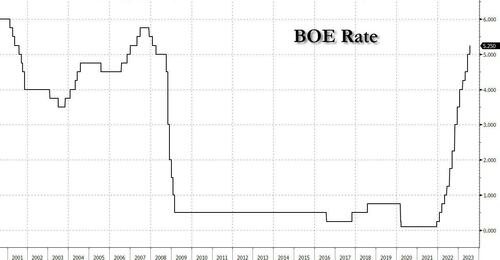

With the market split ahead of today’s BOE decision whether the central bank would hike 25 or 50bps (markets priced in a 1-in-3 chances of another 50 basis point jump following last month’s 50bps hike), moments ago the mystery was settled when the BOE raised the key rate by a dovish quarter point to 5.25%, the highest in 15 years, but disappointing the more hawkish corners in the market.

The nine-member MPC split three ways on the decision Catherine Mann and Jonathan Haskel voted for a half-point hike, while Swati Dhingra pushed for no change. The majority led by Governor Andrew Bailey and his deputies voted for a quarter point hike.

The Monetary Policy Committee voted by a majority of 6-3 to raise #BankRate to 5.25%. Find out more in our #MonetaryPolicyReport: https://t.co/fGooUBPP4w pic.twitter.com/ch5hQ2xQ6u

— Bank of England (@bankofengland) August 3, 2023

The BOE maintained its forward guidance that “if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”

The guidance also included a new sentence suggesting that once the tightening cycle is finished, rates may remain elevated for some time. It said:

“The MPC would ensure that Bank Rate was sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

According to Bloomberg, this is a signal that once the tightening cycle is finished, rates may remain elevated for some time. It’s a warning for markets not to start anticipating rate cuts anytime soon – maybe for years.

The central bank also repeated that “the current monetary policy stance is restrictive” and that it will “ensure that Bank Rate is sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

Given the significant increase in Bank Rate since the start of this tightening cycle, the current monetary policy stance is restrictive. The MPC will continue to monitor closely indications of persistent inflationary pressures and resilience in the economy as a whole, including the tightness of labour market conditions and the behaviour of wage growth and services price inflation. If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required. The MPC will ensure that Bank Rate is sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with its remit.

Commenting on the (somewhat dovish) hike, BOE head Andrew Bailey said that “inflation is falling, and that’s good news. We know that inflation hits the least well off hardest, and we need to make absolutely sure that it falls all the way back to the 2% target.”

Looking ahead, the BOE’s growth forecasts indicate stagnation through 2025, providing a bleak backdrop for the next election. Governor Bailey said the MPC needs to make absolutely sure that inflation falls all the way back to 2%.

The MPC reduced near-term inflation forecasts and now see the inflation rate hitting 4.9% in the fourth quarter. That’s down from their previous forecast of 5.1%. This suggests that Rishi Sunak is likely to make good on his promise to halve inflation by December this year, but it’ll be a closer call than he might have liked.

Meanwhile, inflation forecasts were revised up slightly over the longer-term, with the BOE building in more evidence of persistence in price increases; to wit, the BoE said there are some upside risks to its modal CPI forecasts, with risks skewed to the upside but less than in May. Says wages data shows risks of more persistent inflation may have begun to crystalize.

Growth:

- 2023 0.50% (prev. 0.25%)

- 2024 0.50% (prev. 0.75%)

- 2025 0.50% (prev. 0.75%)

Inflation:

- 2023 5.00% (prev. 5.00%)

- 2024 2.50% (prev. 2.25%)

- 2025 1.50% (prev. 1.0%)

Notably, the BOE has sidestepped the question of how much it will reduce the size of its balance sheet going forward. Traders had hoped to get a hint on the scale of QT going into its second year. The MPC confirmed it will lay out its plans on the pace of asset sales under its quantitative tightening program for the year starting October 2023 at the next meeting in September, judging that the first year had a small impact on gilt yields and the economy.

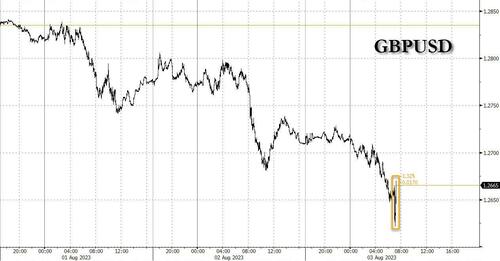

In kneejerk response the decision sparked an immediate dovish move, given the unwinding of circa. 40% market pricing for a 50bp hike before hand. As a result, sterling dropped to session lows but then promptly rebounded to pre-BOE levels which were still just off the lowest level in the past month.

… as the accompanying commentary made clear that further tightening could occur and the vote split showed two members, Haskel & Mann, in favour of a 50bps hike. However, as participants then digested the full details of the MPR and the lack of any tweak to the pace of QT further downside has been seen in Cable as the internal commentary from the 6 who voted for 25bp made clear that the “monetary stance was weighing on economic activity” while the accompanying forecasts saw downgrades on the growth front.

Additionally, the BoE statement stated that the monetary stance is restrictive – potentially a hat-tip to being near the end of the tightening cycle. Over the medium- term inflation is seen below target, however, it has been acknowledged by many that the MPC is placing less weight on its forecasts.

Overall, Newsquawk noted that the statement had something for both the hawks and the doves and as such we look to the presser from Governor Bailey for clarity on the next steps and just how much further tightening markets should expect.

Commenting on the rate hike, Samuel Zief, head of FX strategy at J.P. Morgan Private Bank, said today’s decision “looks to us like a central bank that wants to stop hiking”.

We continue to prefer to stick to short-dated UK fixed income given that it provides a compelling yield and a buffer against any further economic resilience that might mean the BoE has to go to 6% or beyond. That said, as we get closer to peak rates in the back half of this year, the risk reward in extending duration is becoming more compelling. That backdrop isn’t supportive of GBP in our view.

Looking ahead, traders now see a 68% chance of a 25bps rate hike in September, and 32% odds of no change; the projected terminal rate dipped modestly from 5.74% pre-BOE to 5.65% after the announcement.