Money-market funds saw inflows and banks’ usage of the Fed’s emergency BTFP facility hit a new high this week, so what malarkey does The Fed have in store when it tries to explain what happened to bank deposits.

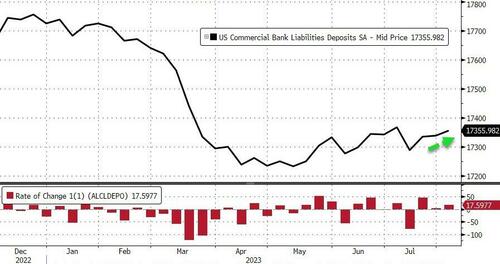

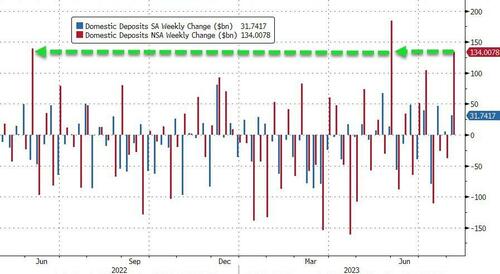

Seasonally-adjusted, total deposits rose by $17.6 billion last week (the 3rd straight week on SA inflows)…

Source: Bloomberg

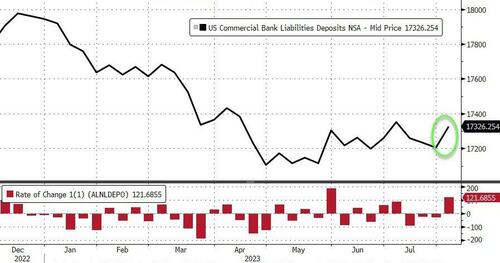

And for once, non-seasonally-adjusted deposits rose too (by a huge $121 billion!)

Source: Bloomberg

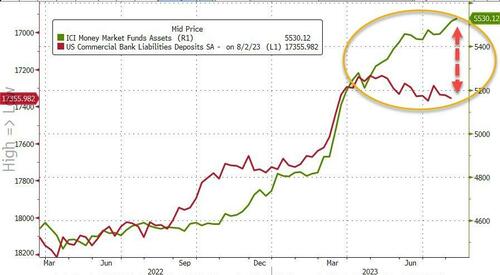

The divergence between money-market fund assets and bank deposits remains extreme…

Source: Bloomberg

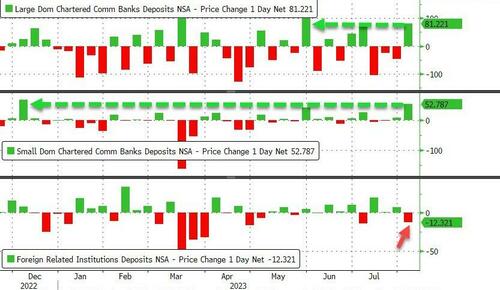

On a non-seasonally-adjusted basis, Large banks saw $81BN inflows and Small banks $53BN inflows (while Foreign banks suffered a $12BN deposit outflow)…

Source: Bloomberg

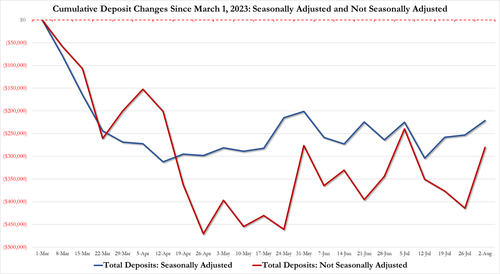

The big surge in NSA (out of nowhere) magically recoupled it with the cumulative SA deposit outflows…

Domestically (removing foreign deposit flows), banks saw a massive $134BN inflow (NSA), which was whittled down to a $31.5BN inflow (SA)…

Source: Bloomberg

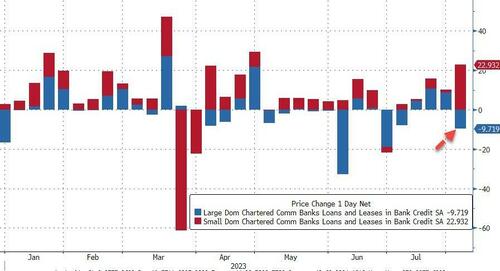

On the other side of the ledger the story gets murkier with large bank loan volumes tumbling almost $10 billion as small bank lending accelerated…

Source: Bloomberg

Make of it what you will – but ‘baffle em with bullshit’ comes to mind on this dataset.