A quiet day on the macro-front removed headline risk and allowed the algos to play on a very technical-feeling day.

-

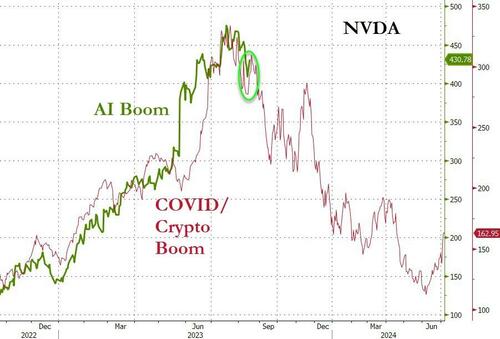

NVDA rebounded above its 50DMA

-

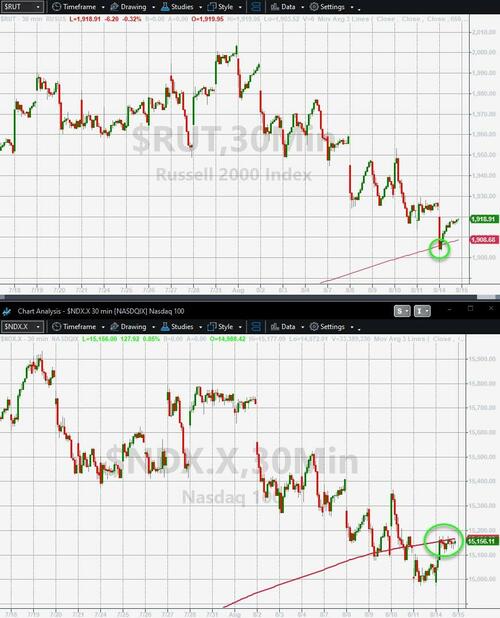

Russell 2000 found support at 50DMA

-

Nasdaq rallied back up to its 50DMA

-

USD Index rallied up to its 200DMA

-

Gold fell to its 200DMA

Notably, rate-hike expectations extended their hawkish shift today, erasing all of the dovish-response to payrolls…

Source: Bloomberg

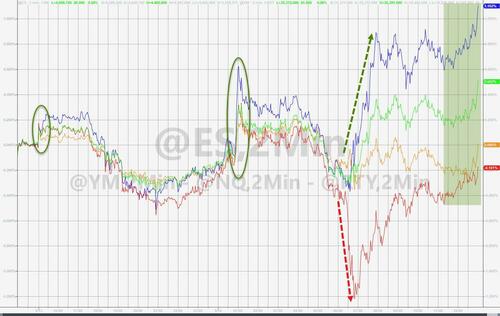

Futures were ugly overnight until hopes of China stimulus sparked a brief buying panic at the end of the Asia session / open of European session. That did not hold well and selling pressure began early in the US session. The cash open sparked Small Caps selling, big-tech-buying but at around 1000ET, 0-DTE traders began to aggressively fade the rally but the S&P held its gains…

Small Caps ended the day’s biggest loser and The Dow was red and barely better. Nasdaq took al the glory with the S&P far behind but green…

Small Caps bounced perfectly off their 50DMA. Nasdaq rallied back up to its 50DMA…

NVDA opened lower, testing its trillion-dollar-market-cap, but then a wave of buying emerged as a major 0-DTE gamma squeeze swept into the AI-Angel…

…and lifted it back above its 50DMA…

The timing of the NVDA bounce is right on cue…

Source: Bloomberg

‘X’ marked the spot of acquisition exuberance today – up 40% as it appears in play…

Amid a choppy day, Treasuries were sold across the curve today with the short-end significantly underperforming (2Y +7bps, 30Y +2bps). We note the period from the US open to EU close saw buying…

Source: Bloomberg

2Y yields rose for the 4th straight day, erasing the payrolls puke in yields and back up toward 5.00%…

Source: Bloomberg

10Y Yield hits highest since Nov ’22…

Source: Bloomberg

Dollar Index rallied further, pushing above its 200DMA…

Source: Bloomberg

But it could not hold the 200DMA intraday…

Source: Bloomberg

China’s offshore yuan tumbled to Nov ’22 lows as the nation’s struggling economy prompts capital outflows…

Source: Bloomberg

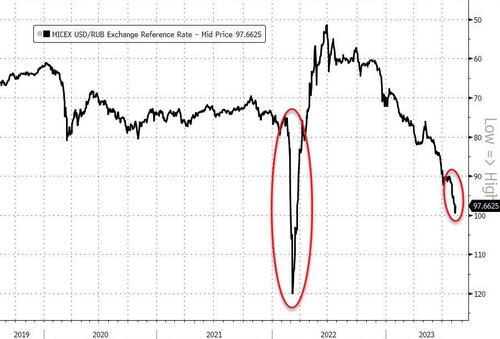

Russia’s Ruble continued its rout as the country’s current account surplus tumbled 85% from a year ago. But then it stalled after headlines about an ‘extraordinary’ key rate meeting…

Source: Bloomberg

Gold fell to its 200DMA…

Source: Bloomberg

Finding support just above $1900 at the 200DMA intraday…

Source: Bloomberg

Oil prices clipped lower on the day – after trying to back to even multiple times…

Finally, there remains an alternative…

Source: Bloomberg

6-mo bills yield 94bps more than the S&P’s earnings yield… do you feel lucky?