Authored by Simon White, Bloomberg macro strategist,

The likelihood of significant fiscal and monetary stimulus in China has risen sharply as the country strives to avoid a Japan-like debt-deflation trap.

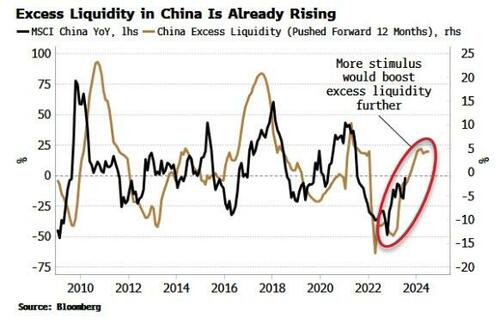

Beaten-up equities are poised to benefit disproportionately from a substantial boost to excess liquidity.

It is often darkest before dawn. After a slew of dismal economic data, China’s room for maneuver is narrowing. Decisive stimulus is increasingly likely to prevent the economy from protracted stagnation or a deep recession.

Stimulus is required on three fronts:

1) to salvage the property market and thus avert a debt-deflation;

2) to boost consumption; and

3) to increase investment.

A combination of both monetary and fiscal stimulus is likely, with the emphasis on the latter.

As is often the case when China goes through a rocky patch, there is a growing chorus of those who believe a bust is imminent. While that may be the ultimate outcome, China still has a few stimulus hands to play to keep the game alive.

Equities are poised to benefit as rock-bottom sentiment combines with buoyant excess liquidity, likely to be boosted yet further by stimulus of increased intensity.

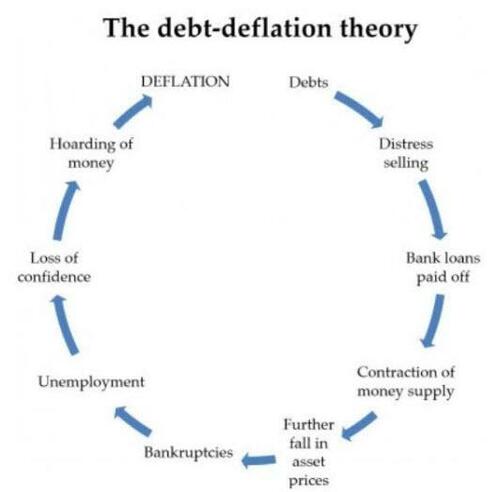

No country wants to experience the fate of Japan. Its property bust in the 1990s triggered a debt-deflation: an unenviable situation when the value of assets and the income from those assets fall in relation to the value of liabilities. Debt becomes increasingly difficult to service and pay back, leading to lower consumption and investment, entrenched deflation and derisory growth.

Source: knowen.org

Policy makers in China do not want to repeat Japan’s mistakes.

Local governments are indebted to the tune of almost $8 trillion, or ~45% of GDP, according to JP Morgan, much of it collateralized by land values. This was similar to the dynamic faced by Japan, where land values – which had been the focus of rampant speculation – collapsed, forcing corporates and banks to retrench and focus on repairing their balance sheets, causing demand and investment to crater.

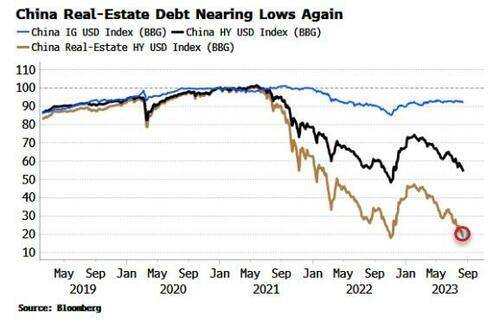

The property market in China remains on its knees. House prices overall are barely rising on an annual basis, while prices in tier-1 cities are contracting. Growth in real estate transactions has slumped from 20% year-on-year to 12% and continues to fall; mortgage demand is very weak; while floor-space-started of new houses is falling at a 26% annual rate.

On top of that, property developers remain in dire straits, with Country Garden the latest that may have to default on its debt. High-yield real estate debt in China is back near its lows, at about 20 cents in the dollar.

China has introduced a raft of property-easing measures in recent months, to little avail so far.

But the specter of Japan ensures that even more potent property stimulus is on the way as policy makers determinedly head off a debt-deflation.

It won’t be enough, though, to restore China’s economic fortunes.

Further stimulus will be needed to boost consumption and investment.

Here we are likely to see fiscal as well as monetary measures.

First, the central government in China still has plenty of scope to borrow. Its debt-to-GDP ratio sits at 51%, low by international standards. Local governments and their financing vehicles account for another ~45% of GDP but, as mentioned above, averting a debt-deflation will go a long way to stabilizing the dynamics here.

Rising fiscal stimulus could be used for infrastructure investment – much of which is now unproductive, but would nonetheless give a medium-term fillip to growth.

Fiscal spending could also be used to boost consumption. It was badly hobbled in the pandemic. Policies in China during lockdowns were aimed at supporting the export-orientated SOE sector at the expense of the household sector. As a result, the latter’s share of income fell from already low levels, capping domestic demand and condemning the economy to increasingly anemic growth.

Low consumption also means private investment slows as demand falls, adding to the growth impairment. Reinvigorate consumption, then, and China is more than on its way to restoring higher, better-quality growth (expect announcements like today’s to be increasingly backed up by action).

One way to do that is through increasing the household sector’s share of income. As the economist Michael Pettis has explained, this can be achieved through measures such as reduced taxes, better pensions and subsidized rents, supported by fiscal spending.

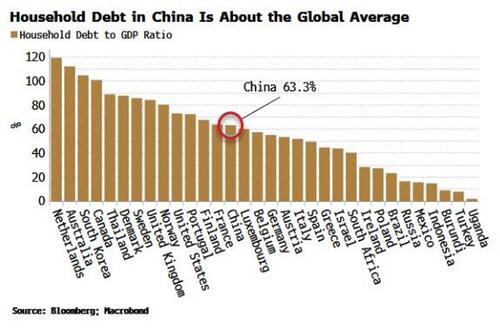

The other way is to encourage more consumer borrowing. China has professed a reluctance to allow this after the rapid rise in household debt in the previous decade. But China’s household debt, like its central government’s debt, is also not high relative to its global peers.

A rise in consumer borrowing relies on there being demand for new lending, but China has a history of bank-mandated lending to the corporate sector, so it is not an impossibility the same outcome could be engineered in the household sector too.

Sentiment on the Chinese economy and equities is terrible, but we are seeing some contrarian bottoming signs, such as the Chinese authorities’ request that some funds refrain from net selling stocks. We saw something similar in early 2020, which along with other measures preceded a +60% rally in the market over the next year.

Despite the gloom, China’s day of reckoning is likely not here yet. In which case stocks are poised for explosive moves higher, as the sweet spot of rising stimulus meets an unloved market with cheap valuations.