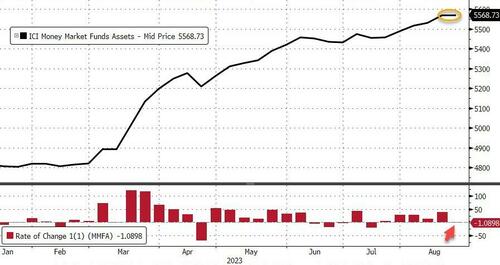

For the first time in 6 weeks, US money market funds saw outflows (admittedly a tiny $1BN)…

Source: Bloomberg

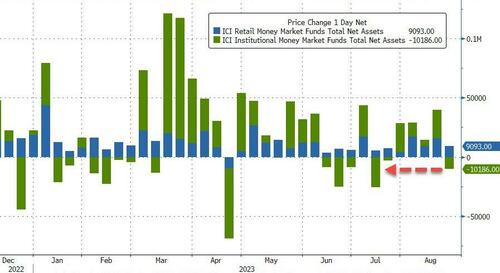

The outflows were driven by institutional funds – the first in 6 weeks. Retail funds saw inflows for the 18th straight week..

Source: Bloomberg

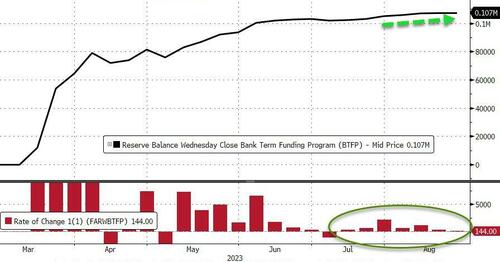

Also of note is that usage of The Fed’s emergency funds rose yet again (admittedly only $144MN) to a new record high…

Source: Bloomberg

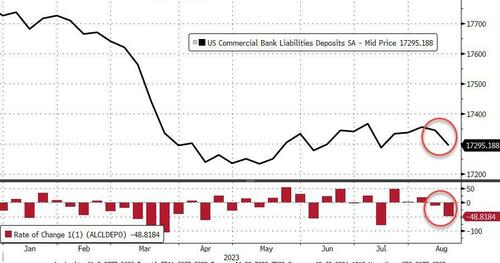

Meanwhile, total bank deposits (on a seasonally-adjusted basis) fell for the second week in a row, plunging last week by $49BN…

Source: Bloomberg

Which leaves the divergence between bank deposits and money market funds wide but perhaps starting to narrow…

Source: Bloomberg

The big drop in deposits was driven by foreign bank outflows (-$31BN) but Large ($13BN) and Small banks ($4.6BN) also saw notable outflows on a SA basis. However, on a non-seasonally-adjusted basis Large (+$14BN) and Small banks (+$1.4BN) saw deposit inflows.

Source: Bloomberg

So, we have the now ubiquitous ‘baffle em with bullshit’ measures showing domestic US banks had $15BN of inflows (NSA) but $18BN of outflows (SA)…

Source: Bloomberg

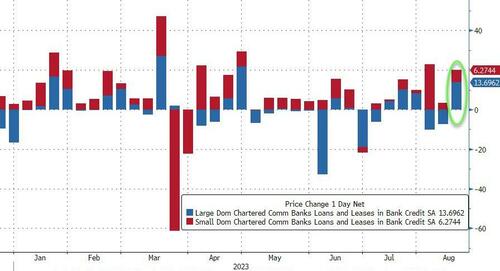

Despite the outflows, Large ($13.7BN) and Small ($6.3BN) banks saw loan volumes increase last week…

Source: Bloomberg

Finally, US equity market cap remains divergent from bank reserves at The Fed…

Source: Bloomberg

So what exactly are the banks going to do in 6 months when The Fed’s BTFP funding expires? That’s a $107BN balance sheet hole that will need to be fixed…