Searching for a Breakup

Courtesy of Scott Galloway, No Mercy/No Malice, @profgalloway

-

Audio Recording by George Hahn

“The notion that power should be limited so that no person or institution can enjoy unaccountable influence is at the very root of our democracy.”

—Tim Wu, Columbia University

Capitalism is the most powerful system devised to elevate the human condition. Its oxygen is innovation, which requires healthy markets. America has a proud legacy of knowing when a corporate organism has morphed into an invasive species suffocating an ecosystem via predatory pricing, bundling, or other actions that control the supply of products and/or services. Historically, we step in — a competitive marketplace takes precedence over an aggregation of individual or corporate power. Antitrust laws pierce the canopy, oxygenating the marketplace and preserving a core attribute of innovation and prosperity: churn.

In the 19th century a series of “trusts” were established, in the belief that a centralization of power and sectors, run by thoughtful men, would be good for the economy. Soon there was recognition that the resultant abuse and income inequality warranted an antitrust movement. When Teddy Roosevelt broke up Standard Oil, it was a signal to the nation that Americans were in charge, not American corporations. The government was the sheriff, protecting the little guy.

History is rhyming. This week in a federal court in Washington, the Department of Justice is attempting a similar Heimlich maneuver on the $180 billion search market.

Bill and Paul’s Excellent Adventure

Bill Gates and Paul Allen founded Microsoft in 1975, in the shadow of industry behemoth IBM. For decades, IBM was something akin today’s Apple, Google, and Microsoft rolled into one dominant company. So dominant, it was sued by the U.S. government for antitrust violations, which triggered a major change to IBM’s business model: It “unbundled” software and hardware, meaning it stopped giving its software away for free to its hardware customers. This created, for the first time, a competitive market for software. A market that Gates and Allen would enter just six years later, developing software for the emerging category of personal computers.

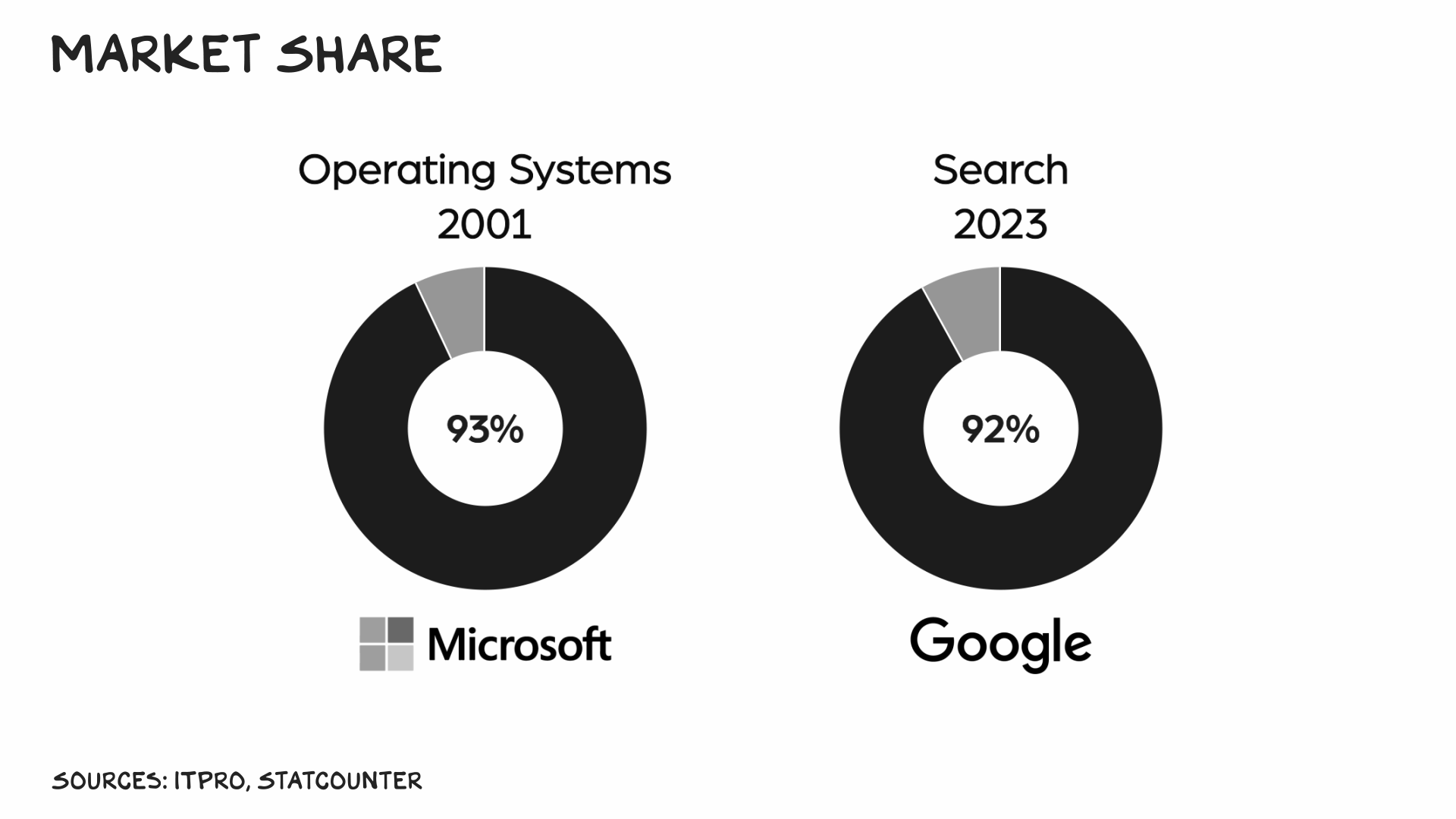

Over the next decade, MSFT software would power the PC revolution: MS-DOS in 1981, Word in 1983, Windows and Excel in 1985, PowerPoint in 1987. Tellingly, PowerPoint was acquired from a nascent competitor, not developed in-house. Over the next decade, Microsoft became known more for entrenchment than innovation. “Embrace, extend, and extinguish” was the company’s strategy for suffocating would-be competitors. It worked — Microsoft supplanted IBM as the dominant force in computing. By 1998, Windows controlled over 90% of the PC operating system market, and Bill Gates was the wealthiest person in the world.

As with IBM before it, Microsoft’s success was recognized with the business world’s Lifetime Achievement Award: a DOJ antitrust suit. The crux of the government’s claim was similar to that made against IBM a quarter century earlier: Microsoft was abusing its commanding position to limit rivals’ ability to get traction with competing products. The headline product in 1998 was the browser: Netscape represented Microsoft’s first serious competitive threat in a decade; to stop it, the company bundled its Explorer browser for free with Windows and cut deals with PC manufacturers to make Explorer the default browser on computers. The DOJ believed this was anticompetitive, the court agreed, and the company signed a consent decree ensuring PC manufacturers greater flexibility regarding the software they bundled with Windows-powered computers.

Google It

The DOJ’s enforcement action oxygenated the marketplace in ways nobody could have foreseen. The same year the department sued Microsoft, the cycle was beginning again. Larry Page and Sergey Brin founded Google in 1998, and over the next decade their company rode a wave of innovation to global dominance. Adwords, the revenue-generating portion of the business, launched in 2000. Then Gmail in 2004, Maps in 2005, Docs in 2006, Android in 2007, and Chrome in 2008. All built on the success of the company’s core products, Google search and the Android operating system — just as Microsoft built its empire on the dominance of its Windows operating system.

Would Google exist today had the DOJ not sued Microsoft? Unlikely. Microsoft tried to compete with Google in search and mobile in the 2000s, but, unable to deploy its bundling and exclusivity strategies, it had to rely on its products — which were inferior.

Google doesn’t dominate computing today to the extent Microsoft did in 1998. Nobody does, as “computing” is a much broader space. But its control of search — the most common entry point to the internet — is a nearly pitch-perfect echo of Microsoft circa 2001. Similarly, a quarter century after its founding, Google has a more than 90% market share, a sclerotic artifact of market power vs. a function of innovation. Its market dominance creates a virtuous cycle of increasing power. An estimated 9 billion Google searches occur every day, vs. 400 million for Bing. The massive delta of data and reach makes for a better product: Click-through rates for ads on Google are 30% greater than on Bing. More usage = more data = more advertising, and so on. Today, Google’s parent Alphabet is worth $1.75 trillion and employs 175,000 people.

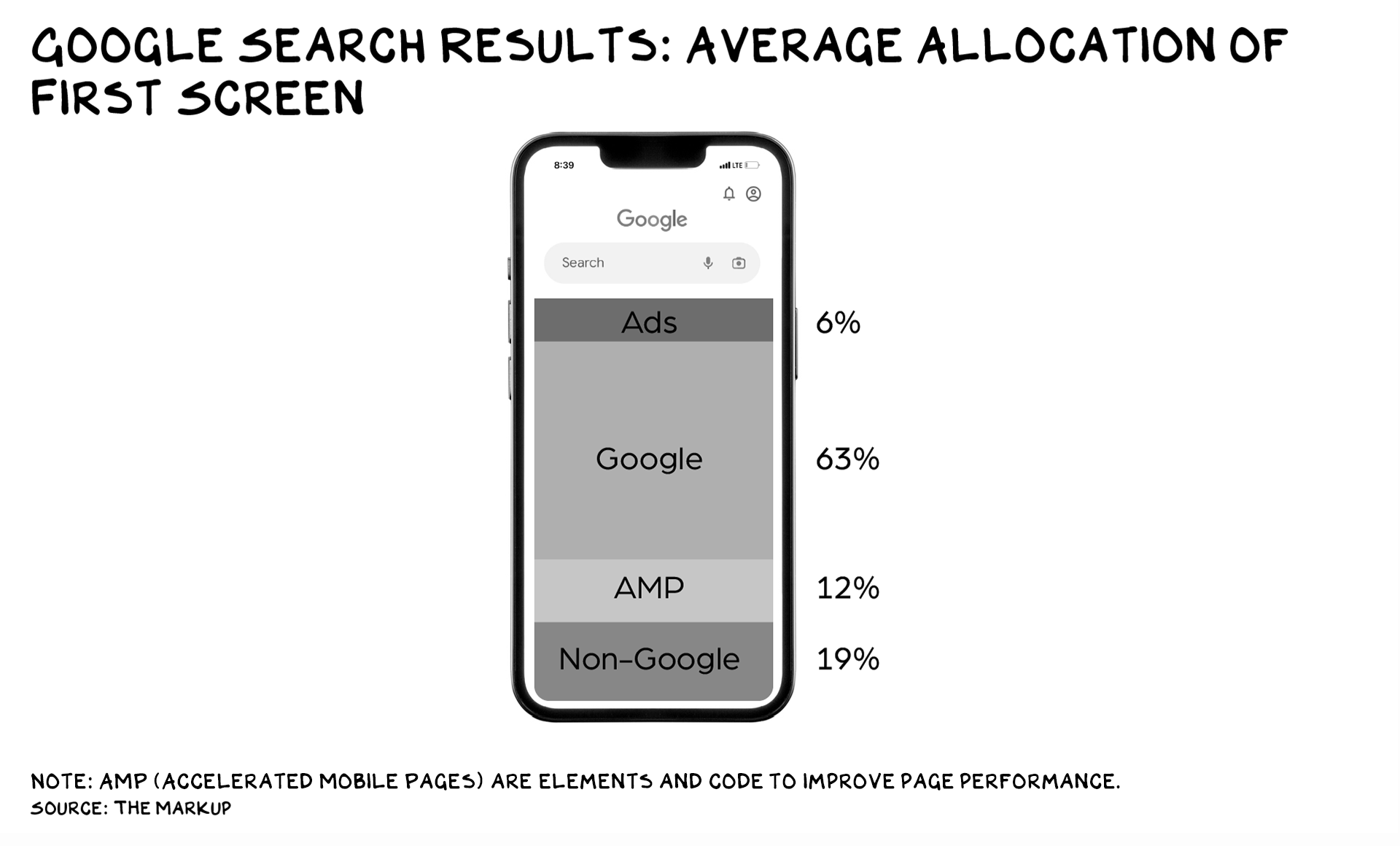

However, what was the last innovative Google product? Restructuring the brand’s architecture under Alphabet? Earnings growth has, mostly, been a function of finding new ways to extract profits from its monopoly: Google search results have become a billboard for Google-sponsored results interspersed with content harvested from other sites and links to Google’s own services. In 2020, The Markup found that Google-associated results (ads for or links to the company’s other services) constituted over 60% of the first screen of an average Google search result. And in 1 of 5 searches, the entire first screen is Google results. This is the meat of its business: Search ads generate 57% of the company’s revenue.

Despite turning search results into a carousel of ads and Google services, Google has racked up 90% market share in search queries — 95% on mobile. How? As Microsoft once did, it leverages its control over the most popular mobile operating system (Android) and spends unprecedented sums on deals assuring it is the default search engine on computers and phones — more than $10 billion per year. Google says it’s the leader because it has the best product, but if that’s so … why pay $10 billion a year to be the default? Dominance in search is also self-fulfilling, as it gives the company unrivaled data re what people search for and what results generate clicks. And Google’s ability to harvest additional data from adjacent products, including Mail, makes it increasingly difficult for competitors to get traction.

One difference? Google learned from the sins of the father and has tried to insulate itself from antitrust enforcement through lobbying and PR. Google spent over $10 million on lobbying in 2022 — in the late 1990s, Microsoft’s only presence in D.C. was an office in the suburbs focused on selling software to government agencies. In addition, today’s tech giants recognize CEO “likability” is key. Wojcicki, Pichai, and Sandberg made millions for their management skills, but billions as likability heat shields for their businesses’ abuses.

The New Gilded Age

The DOJ’s current lawsuit, one of several actions the federal government has taken against tech companies on antitrust and other grounds, reflects a much needed renewal of our free market instincts. Yes, government action is a component of a free market, despite what the techno-libertarian crowd would have you believe. Markets are not the product of divine creation coupled with a laissez-faire approach to regulation but a function of human effort that depends on rules and enforcement to work efficiently. We’ve lost our way with respect to this (see above: lobbying) and are paying the price with declining competition and innovation.

Concentrate

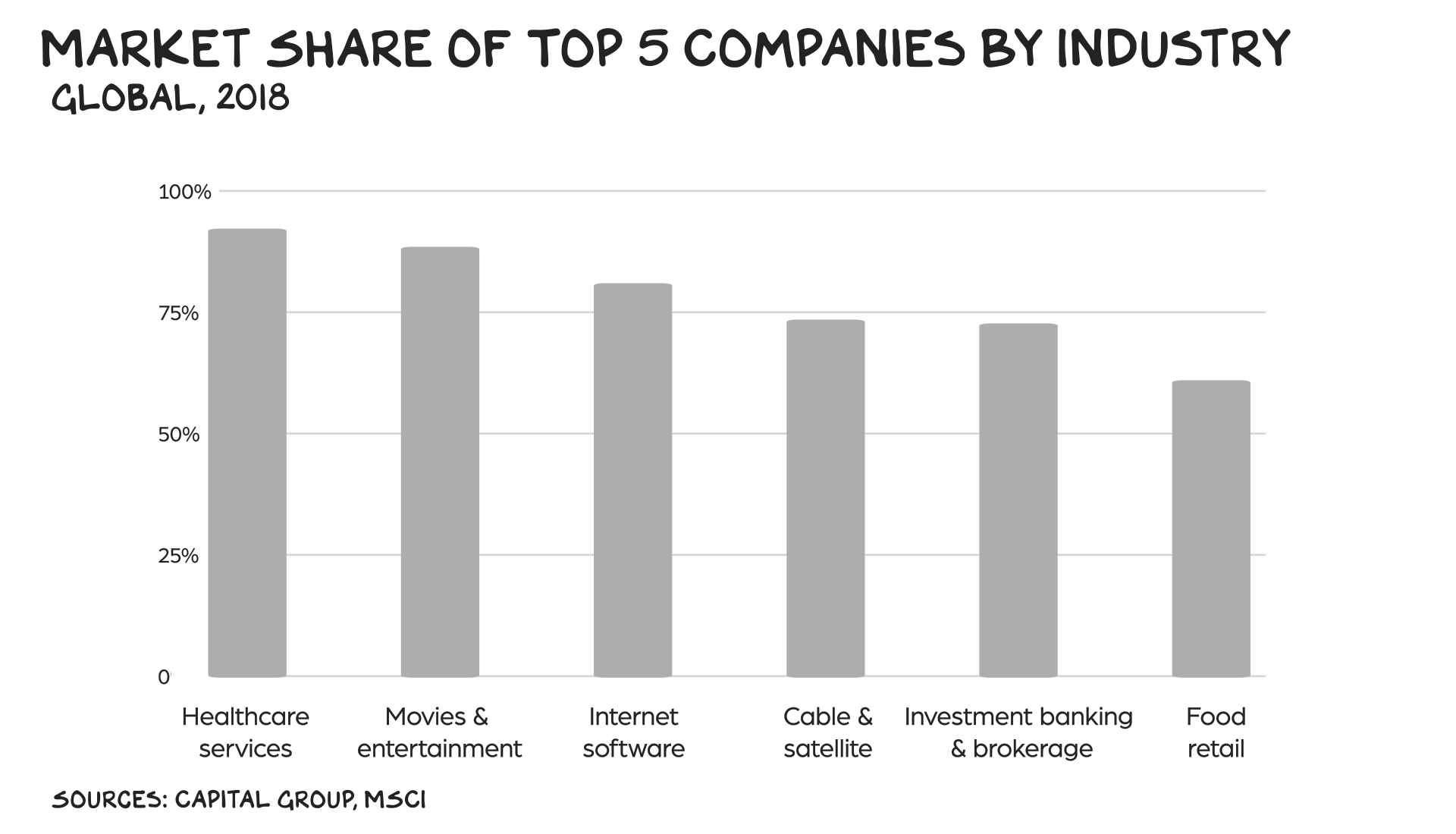

And not just in tech. Three companies control 95% of the U.S. beverage market. Four dominate the meat business, and rising meat prices are the largest contributor to food price inflation. Four airlines control over two-thirds of U.S. air travel, though they are substandard — the highest-ranked U.S. airline by quality of service is Delta … in 20th place, behind Air New Zealand. The next is United, in 49th place, trailing Azul Brazilian and Malaysia Airlines. Monopoly has its privileges, however: In 2014 the Economist calculated that U.S. airlines generated $22.40 in profits per passenger, while European airlines, subject to the rigors of a free market, earned just $7.84.

We see similar consolidation in banking, pharmaceuticals, health care, retail drug stores, publishing (where the DOJ recently had a big win, stopping the merger of Penguin Random House with Simon & Schuster), eyeglasses, and beer. Waves of consolidation are washing over nearly every sector.

Oxygenation

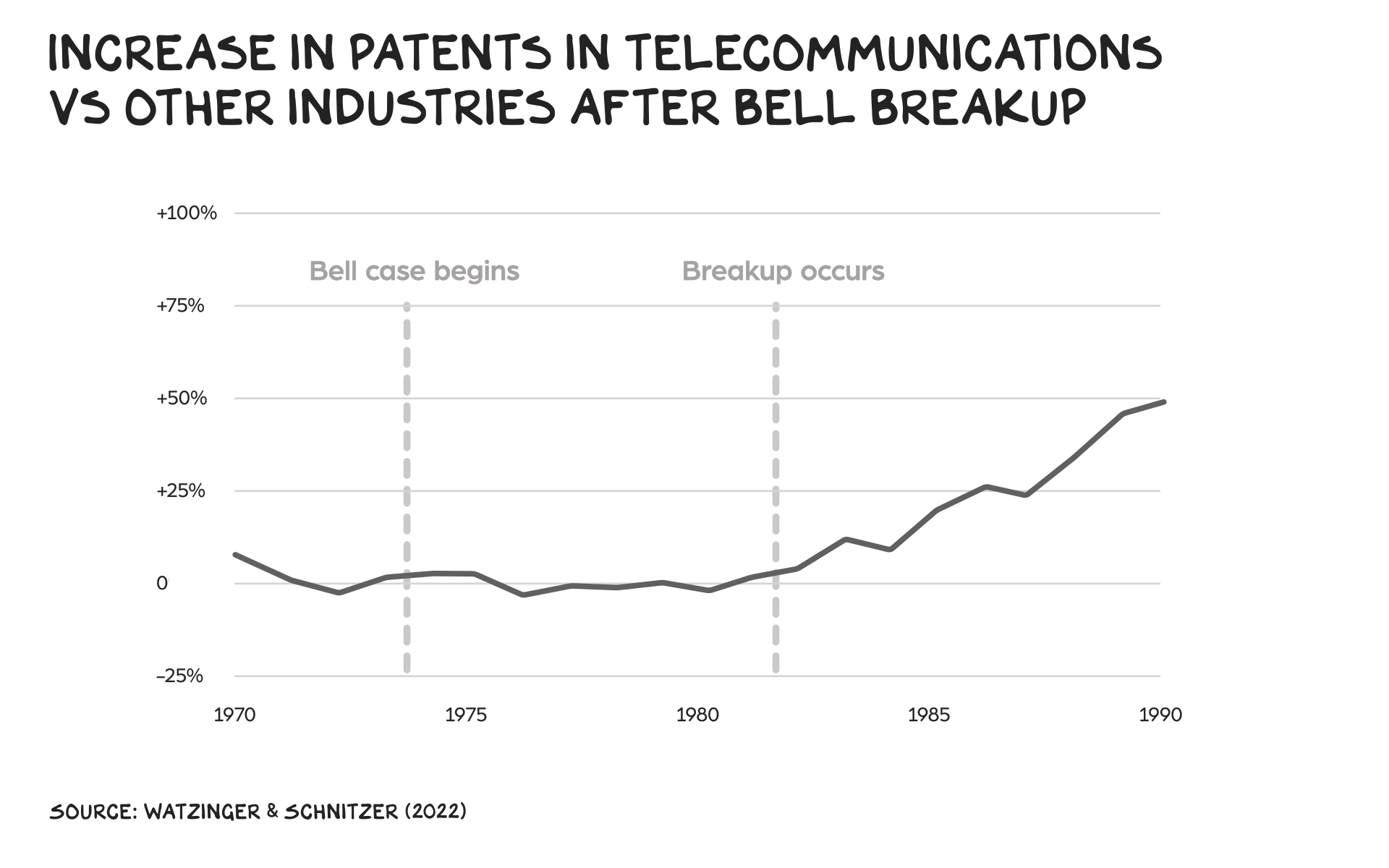

Antitrust enforcement actions are perceived as punishments or moral judgments, but we should think of them as recognition. If a company is good enough for long enough, it can achieve market dominance and earn its profits from stifling competition vs. competing on products or services. It’s the logical, shareholder-driven thing to do. And when we stop them, the benefits accrue to almost everyone. When the U.S. broke up Standard Oil in 1911, its largest shareholder, John D. Rockefeller, became the wealthiest man in the world: The separated companies, free to compete and innovate in the market, were worth dramatically more than when bundled together. The breakup of AT&T unlocked enormous value in the telecommunications industry, leading to more patents, more profits, and eventually the fertile ground needed for the internet market explosion in the 1990s. Microsoft wasn’t broken up in 2001, but it flourished despite the limitations the DOJ put on it, becoming a more innovative company. The action also fired the starting gun for growth in a sector that’s created enormous stakeholder value.

This month’s trial concerning Google’s search dominance likely won’t lead to the breakup of Alphabet. However, I believe severing YouTube and Google would create significant value for shareholders, employees, and customers, who’d see their rents decline. Soon after the breakup, the Alphabet board would demand a strategy for competing in video, and the newly constituted YouTube board would ask how the company was going to challenge its former parent in text search. Even without a breakup, limitations on Google’s ability to perform infanticide on emerging competitors would be welcome. History suggests we are at the start of another 25-year cycle. Just as the web was driving innovation in 1998 (when Google was founded) and personal computers drove Microsoft’s early success, AI appears to be the emerging volcanic force. We need to ensure that the nascent challengers to Google (and to Meta and Apple and Amazon) have the light, air, and space needed to survive and create trillions in shareholder value and hundreds of thousands of jobs.

Ground Zero

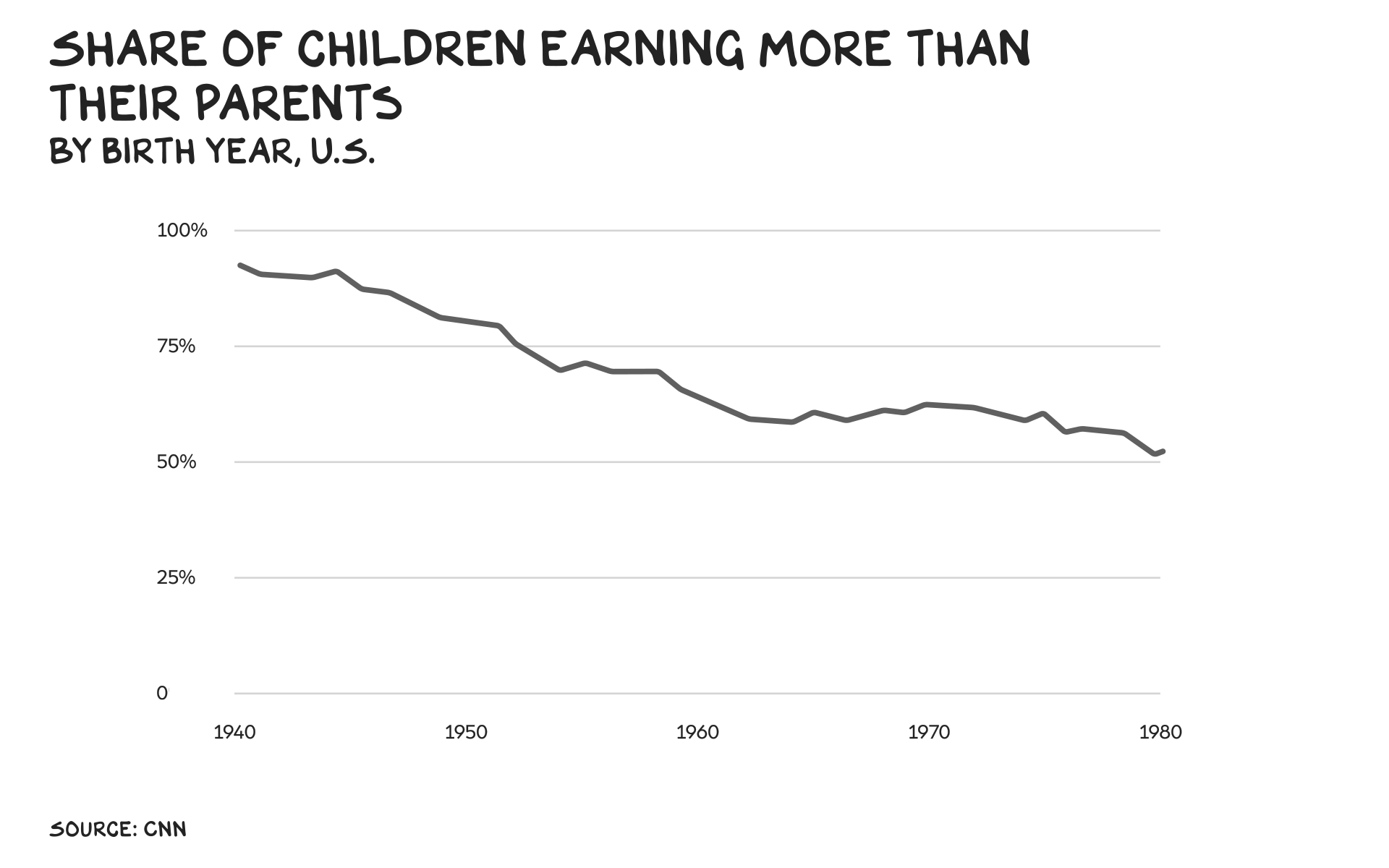

This isn’t about just search engine advertising, or even tech. The power of incumbents to suffocate insurgents before they can grow is mirrored in our society at large. Ground zero for many of the biggest challenges facing America can be traced to one core problem: For the first time in our nation’s history, 30-year-olds aren’t doing as well as their parents were at 30.

This creates rage, shame, and a loss of faith in one another and the country. Limiting Google’s default deals or breaking it up won’t cure these ills. But it’s a step, and a model for what we need to do elsewhere: clear incumbent overgrowth, creating the light and space for the young to prosper.

Life is so rich,

![]()

P.S. My newest lecture, The AI Optimist, is happening next week. Sign up for free to learn how AI will transform our lives and work. Register here.