Oil prices ended unchanged today as early Azerbaijan angst sent WTI above $92 and some chatter from the Biden admin that draining the SPR was once again the table seemed to drag WTI back down (but $90 was support).

“The Saudi appetite to withhold oil from market, supported by Russia maintaining a certain level of export constraint, points to higher prices in the short term, all else equal,” analysts at Citi, led by Edward Morse, global head, commodities, wrote in a note dated Monday.

Investors have been looking past worries about China’s economic growth and a sluggish economy in Europe to push the commodity higher amid ever-tightening supplies, as Russia and Saudi Arabia have each curbed production.

API

-

Crude -5.25mm (-1.00mm exp)

-

Cushing -2.56mm

-

Gasoline +732k (+500k exp)

-

Distillates -258k (-200k exp)

After last week’s big surprise product builds (and crude build), all eyes remain on this week’s inventory data for signs that demand is stalling. Instead, API reported a big (5.25mm barrel) crude inventory draw. Cushing stocks continued to drawdown heavily…

Source: Bloomberg

WTI was hovering at $90.80 ahead of the API print.

Shrinking supplies have ignited a flurry of predictions that $100 oil could return on a roster than includes industry heavyweights such as Chevron Chief Executive Officer Mike Wirth and traditional bears at Citigroup.

“Oil trading is a sophisticated game of Chutes & Ladders” and there are some hot spots that may take Brent, and possibly WTI, to $100 a barrel shortly, said Tom Kloza, global head of energy analysis at the Oil Price Information Service, a Dow Jones company.

But whether either benchmark can average $100 for a month is “an interesting question,” he said.

“When there are bullish extremes in sentiment, it is often a sign that the market is about to turn.”

The biggest threats to the oil rally continuing are “changes in fundamentals,” said Troy Vicent, senior market analyst at DTN.

“At current price levels, a diminished appetite for crude imports by China and rising Chinese product exports are the most likely culprits to help cool off this rally in the near term,” he told MarketWatch.

“If this materializes, and particularly if we start to see demand slow elsewhere, it could quickly change the Saudi’s calculus on how far they’re willing to push their voluntary supply cuts.”

Finally, as a reminder, history shows that surging energy costs usually play a role in tipping the U.S. into recession.

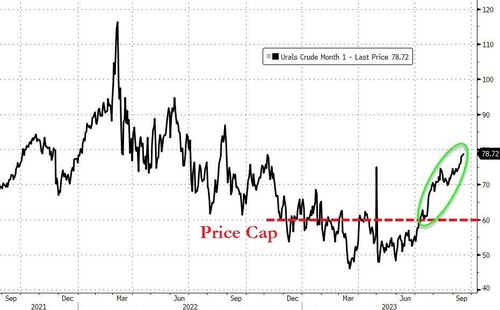

Meanwhile, Russia is killing it…

When will ‘The West’ start fighting back against the price-cap-deniers? (Like Trudeau did today… until absolutely no one else joined him in condemning India).