Not looking good so far:

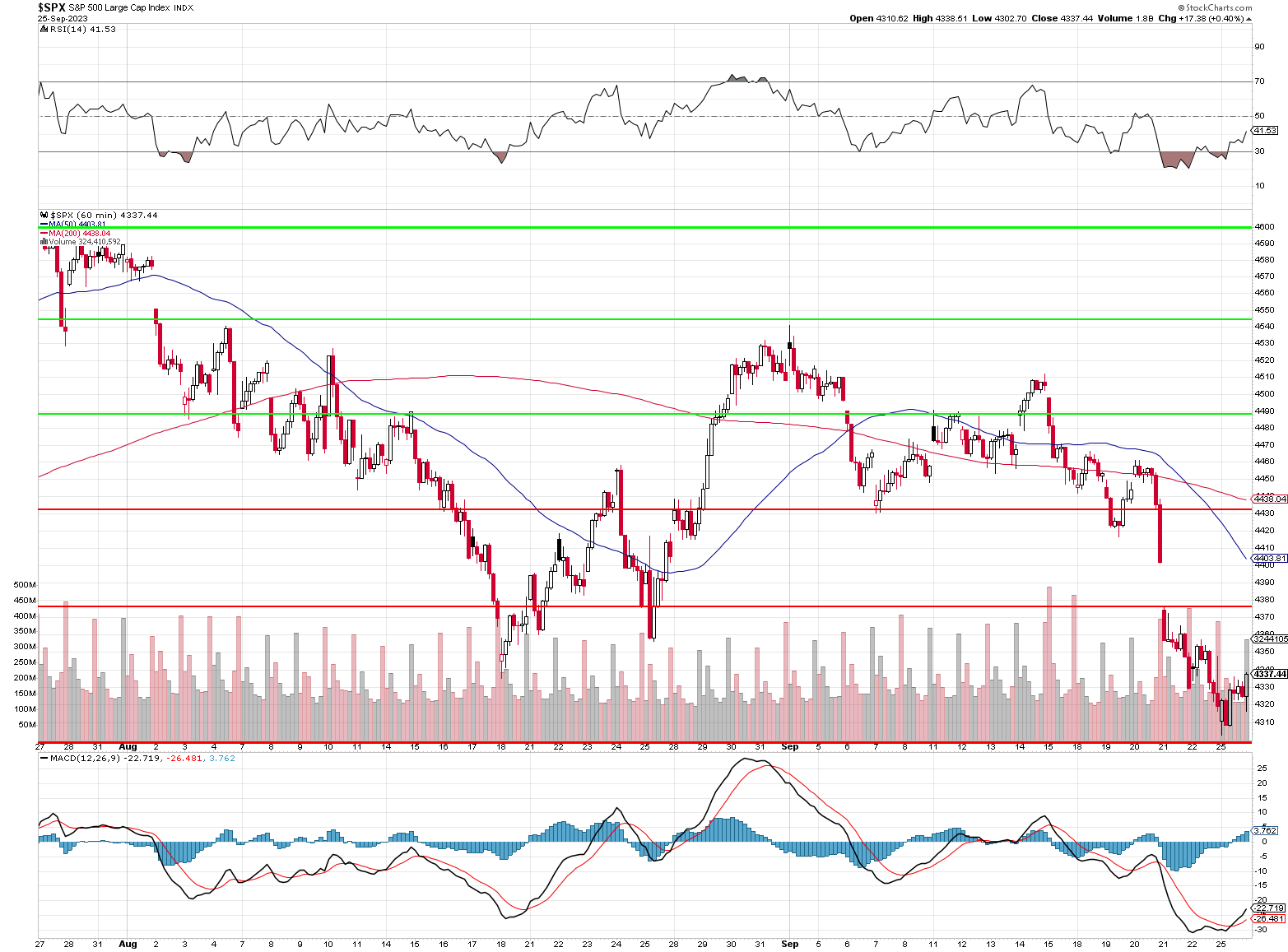

Last week I said: “If we consider the recent fall to be from 4,600 (failed attempt) to 4,320 (not yet), that’s 280 points so we can expect 56-point bounces to 4,376 (weak) and 4,432 (strong) so that’s what we’ll be looking for today and early next week. If we get those, we can remain hopeful but, if not – time for more hedges!“ and here we are, on Tuesday and we haven’t even made the weak bounce yet.

In our 5% Rule™, we throw out spikes and, in order for a dip to be considered a spike (doesn’t matter the time-frame), you want to see a “V-shaped” recovery. If not, then you are dealing with something new and need to take the change of position seriously.

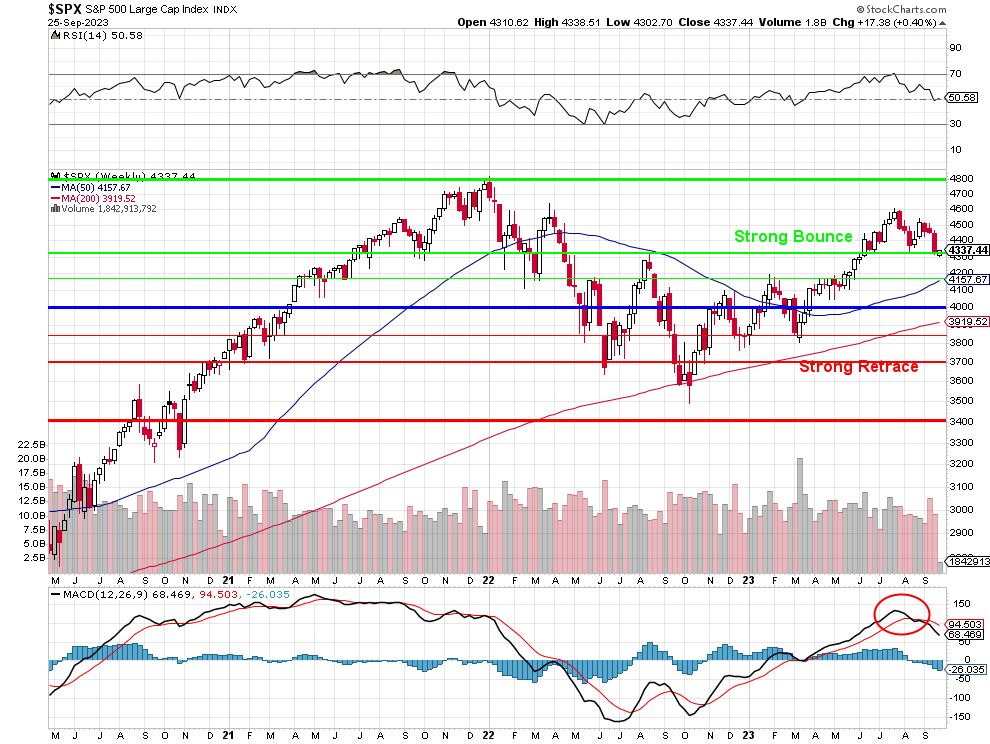

In this case, we took a sharp fall on the 20th and we bottomed (hopefully) yesterday but, in order to feel comfortable going long again, we want to see a recovery in 3 sessions – so Thursday is the day where we need to see a strong bounce (4,432) or we should strongly consider adding more aggressive hedges in anticipation of (as I also said) falling to the next support at 3,840 (strong retrace) to 4,000 (psychological support).

Remember, the 5% Rule™ is not TA – it’s just math – that’s why it works! TA fans, however, will noted that I circled that high on the MACD ages ago and said that would be our top (4,600) and the RSI line at the top of the chart is right in the middle, not oversold at all.

And this whole thing is about avoiding falling below 4,000 but already we can see the 200-day moving average softening well ahead of crossing 4,000 and a sharp decline here can drastically alter the chart and, once the TA people start stampeding, there’s no stopping them…

And this whole thing is about avoiding falling below 4,000 but already we can see the 200-day moving average softening well ahead of crossing 4,000 and a sharp decline here can drastically alter the chart and, once the TA people start stampeding, there’s no stopping them…

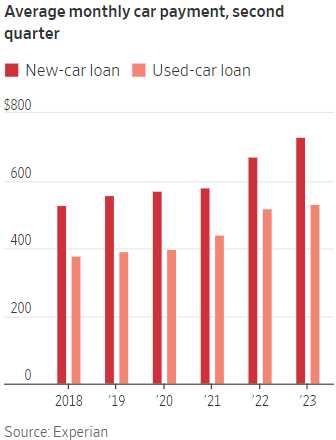

So, once we know where our inflection points are going to be, we shift to the Macros so we can see where the pressure is going to be coming from, right? My concern du jour is that the Fed’s aggressive stance on raising interest rates is now translating into tangible financial consequences for American households.

The impact is most acutely felt by those in need of borrowing for major purchases like homes and cars. The stark contrast between today’s interest rates and those of just a few years ago is making such acquisitions less affordable, as the cost of servicing loans has significantly increased. The rise in credit card interest rates adds to the financial burden of Consumers, especially for those who rely on credit cards to cover basic expenses with higher interest rates leading to higher monthly payments and a more challenging debt landscape.

The impact is most acutely felt by those in need of borrowing for major purchases like homes and cars. The stark contrast between today’s interest rates and those of just a few years ago is making such acquisitions less affordable, as the cost of servicing loans has significantly increased. The rise in credit card interest rates adds to the financial burden of Consumers, especially for those who rely on credit cards to cover basic expenses with higher interest rates leading to higher monthly payments and a more challenging debt landscape.

Even well-off individuals are not immune to the effects of rising rates, as securities-backed loans linked to rate benchmarks have also increased substantially. This has compelled some individuals to sell off investments to cover the higher borrowing costs.

Buying a home or car right now is “completely unaffordable for the typical American household because you’re mixing the higher borrowing costs with the high prices,” said Mark Zandi, chief economist at Moody’s Analytics.

He estimates that the typical American household would need to use 42 weeks of income to buy a new car, as of August, up from 33 weeks three years ago. The National Association of Realtors calculates that the typical American family can’t afford to buy a median-priced home at what are now 7% mortgage rates.

That then begins a cycle (already started) that sucks the income out of the Mortgage and Real Estate Industries, which are commission-based. Though still technically employed, workers see those incomes decline quickly and that’s over 3M US workers and that then affects the banks, movers, furniture stores, etc. and it all spirals out very quickly towards a full-blown Recession.

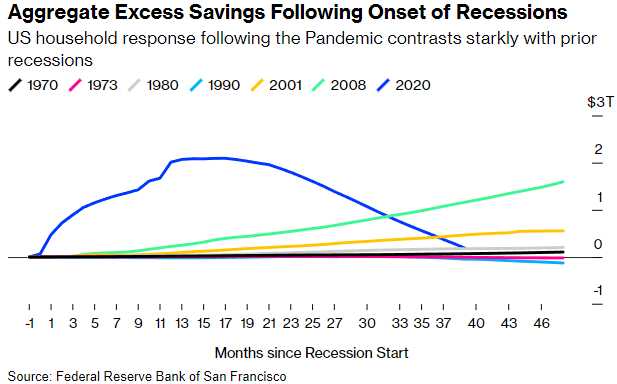

As I have long pointed out, the Government paid (dearly) for us not to have a Recession in 2020 and 2021 and that put a ton of money in people’s pockets but now it’s all gone and people are as broke now as they ever have been in previous Recessions and this one hasn’t even been allowed to start yet!

A recent Federal Reserve study on household finances reveals that the wealthiest 20% of Americans have not only retained their extra pandemic savings but have seen their cash savings increase by approximately 8% since the COVID-19 pandemic began. However, the situation is starkly different for the bottom 80% of households by income. For this majority of Americans, bank deposits and other liquid assets were lower in June 2023 compared to March 2020, even after adjusting for inflation.

All income groups, including the wealthiest, have witnessed a decline in their balances in real terms since a peak in 2021. Among the poorest 40% of Americans, cash savings have seen an 8% drop during this period (this is also bad for banks). The next 40%, representing the middle class, also saw their cash savings fall below pre-pandemic levels in the last quarter. This data raises concerns about the financial health of a substantial portion of the American population, as it points to dwindling financial resources available for consumers.

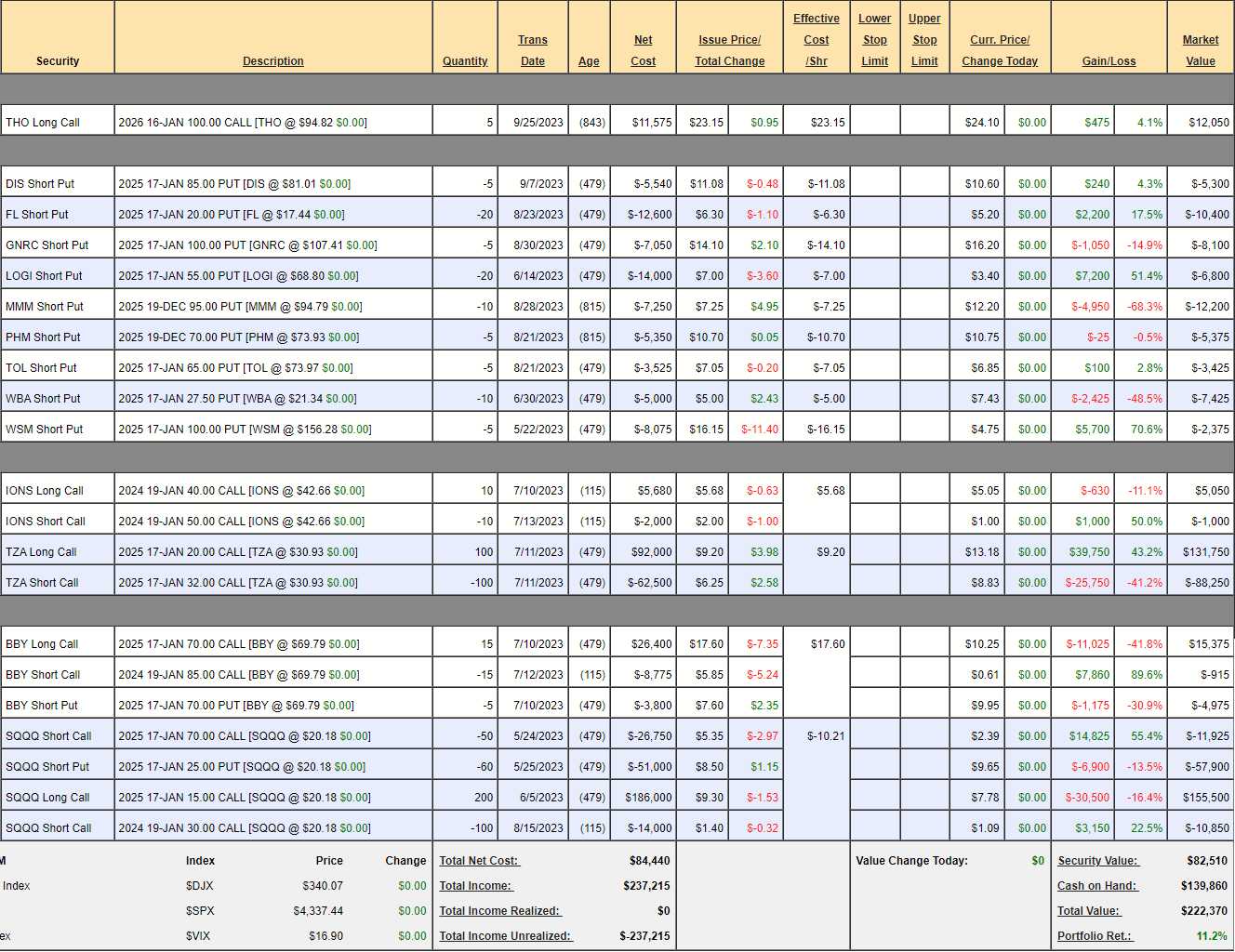

Speaking of hedges: We last reviewed our Short-Term Portfolio (STP) two weeks ago (12th) and we were down 5.5% at $189,045 and now we’re up 11.2% at $222,370, which is up $33,325 on our hedges while our Long-Term Portfolio has fallen from $545,355 to $519,475 and that’s down $25,880 – so we’re perfectly balanced to ride out the dip!

Still, we need to remain vigilant. Clearly we’re a bit bearish since we’re net making money as the market dips but why make a little when we can make a lot? The S&P was at 4,540 on the 12th and now 4,337 so down 4.5% cost us $25,880 in the LTP and made us $33,325 in the STP. The drop we expect is back to 4,000 – so about double what we’ve had so far and that should make us $66,000 in the STP while losing $50,000 in the LTP.

I’m not going to do a full review as not much has changed but let’s go over our TZA and SQQQ hedges thought there is one change we should make and that’s:

-

- LOGI – It’s up too much (50% – $7,200) to risk on a downturn pulling it down so we need to take the money and run on that one.

TZA – This is a $120,000 spread, currently $110,000 in the money and trading for net $43,500 so if the Russell doesn’t go up from here, we’ll make $66,500 (152%) but our hedge (assuming a downturn) is a very reachable +$76,500 at $32+, which is up 175% from here.

Since we already have $131,750 (more than our max on the spread) in our longs and since 2026 options are out, here’s how we can increase our hedge position without spending any money:

-

- Cash in the 100 2025 20 calls for $131,750

- Buy 200 2026 $30 calls for $11 ($220,000)

- Sell 200 2026 $45 calls for $9 ($180,000)

- Roll 50 of the 2025 $32 calls at $8.83 ($44,150) to 75 Jan $35 calls at $3 ($22,500)

That is still pulling net $69,250 off the table and now we have a $300,000 hedge that’s at the money and we will work our way out of the short calls as time goes by. As we only paid net $29,500 for the original spread, we’re putting $40,000 CASH!!! back in our pockets and the spread that’s left is FREE!!! Aren’t options fun?

Keep in mind that our 2026 $300,000 spread only cost net $40,000 and we have enough cash to double down if the Russell drops faster than we think. That should really over-cover the short calls while we roll them along and it would still be net free!

The key to good hedging is KNOWING (mathematically) that you can live with the consequences. That goes back to the game theory lessons we were discussing last week in our Live Member Chat Room.

-

- SQQQ – Our long 2025 $15 calls are already $100,000 in the money and the net of the $300,000 spread is $74,825 so we have $225,175 (300%) net protection if SQQQ goes up 50%, which would be a 17% drop in the Nasdaq – just about right for now.

- We’ve already done with the short 2025 $30s what we are starting to do with the TZA short calls – dismantling them by shifting them to shorter time frames. There are only 50 2025 $70s left and they are so far out of the money, they’re not worth buying back and the $25 short puts seem fair and the worst case would be we’d own SQQQ stock as a hedge we’d sell more calls against – so no big deal.

- That leaves us with the 100 short Jan $30 calls and it’s tempting to buy them back and leave more room to run but it’s not logical as the Nasdaq would have to drop 17% for them to be just at the money and then we have a full year to roll them and the 2025 $100 calls are more than $1 so spending $10,850 to buy them back would be silly.

- Still, it’s painful not to make money while we can so let’s sell 50 of the SQQQ 2026 $35 calls for $6 ($30,000) as that’s still a $100,000 spread to our longs – though we’ll eventually have to spend something to roll them out to match. In the end, since we think there’s zero chance of the short 2025 $70s coming into play – it’s only a 1/4 cover on our longs so not at all worried and more CASH!!! for our portfolio always makes me happy.

-

- Also for the STP, we can add a short play on Oil (/CL) at 90 by shorting the 2x Ultra-Long Oil ETF, UCO at $35.35. If we are targeting $80 (-11%) oil by April, then UCO should fall 22% to $27.53 and the UCO April $35 ($5.40)/$27 ($2.20) bear put spreads are net $3.20 and we can buy 20 of them ($6,400) and sell 10 of the UCO April $40 calls for $4.40 ($4,400) and that puts us in the $16,000 spread for net $2,000.

Now we are poised to make quite a bit of money if 4,320 fails and the S&P drops back down to 4,000 or lower. If the LTP doesn’t lose more than we think, we’ll be net ahead and full of CASH!!! while there are plenty of bargains to be had on the dip.

Happy hunting!

“Down at the end, round by the corner

Close to the edge, just by a river

Seasons will pass you by

I get up, I get down

Now that it’s all over and done,

Now that you find, now that you’re whole” – Yes