Ugly 3Y Auction Sees Slide In Foreign Demand, Biggest Tail Since February

In a day that has seen yields slide across the curve in what some say is a powerful reversal from what may have been the cycle highs on Friday, moments ago the Treasury sold 3Y notes in a concession-less auction that saw rather disappointing demand and metrics.

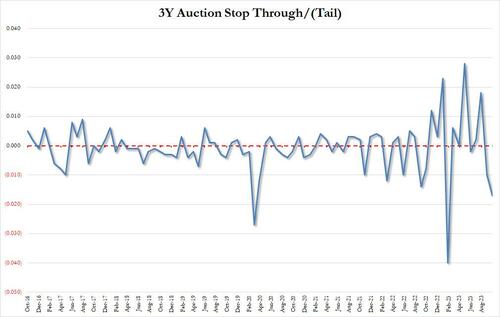

The high yield of 4.740% was another cycle high, up from 4.660% last month and the highest since Feb 2007; the auction also tailed the When Issued 4.723% by 1.7bps, the biggest tail since February’s record 4bps, and the third biggest tail in the past decade.

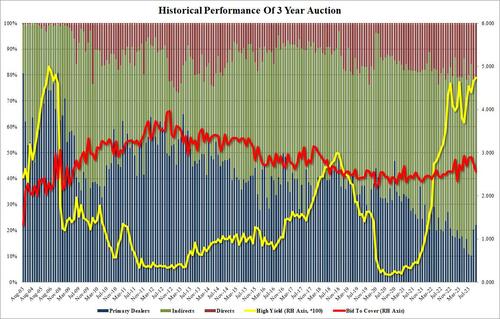

The bid to cover was also ugly, sliding to 2.562 from 2.751 in September, the lowest print since February and well below the six-auction average of 2.792.

The internals were also not pretty: foreign buyers were awarded just 56.0%, the lowest since Oct 22 and far below the 66.2% recent average; and with Dealers awarded a surprisingly high 22.1%, the most since October, Directs were left with 21.9% of the auction, both well above recent averages (14.8% and 18.8% respectively).

Overall, this was a decidedly ugly auction, however much if not all of the lack of demand may be attributed to the sharp pull back in yields across the curve. In any event, tomorrow’s 10Y will be far more important.