Did Santa Claus Come Early This Year?

Courtesy of Wade Slome, Investing Caffeine

With all this potential recession talk that has lasted two years, you would expect a lump of coal to arrive in your Christmas stocking this year. But quite the contrary, Santa Claus appears to have arrived early this year as evidenced by the +8.9% spike in prices last month, the largest monthly increase in 10 years. The NASDAQ fared slightly better with a +10.7% rise, and the Dow Jones Industrial Average lagged by a tad with an +8.0% monthly increase.

Different prognosticators have suggested the recent surge in stock prices is a precursor for a “Santa Claus rally.” I do not consider myself a superstitious person, but many traders will act upon this Christmas holiday phase that tends to coincide with an upswing in stock prices. The only problem with this assertion is there is no clearly defined period for this so-called Santa Claus phenomenon. Some say this period occurs in the week after Christmas, while others protest this trend happens in the week before the winter holiday. Looser interpretations place the beginning of the Santa Claus rally right after Thanksgiving.

Regardless of Santa Claus’s rally timing, the gloomy sentiment that dragged the stock market down roughly -11% in recent months from its July highs quickly reversed itself higher during November. How could that be? Here are some key reasons for the latest upturn:

- Inflation is Cooling (see chart below): The Federal Reserve’s preferred measure to track the pace of inflation (Core Personal-Consumption Expenditures) was released yesterday showing inflation has decreased dramatically last month to 2.5% (on a 6-month basis), within spitting distance of the Fed’s 2% target.

Source: Wall Street Journal

- Interest Rates are Coming Down: Generally, there is a strong correlation between inflation and interest rates, so last month we also saw the yields on the 10-Year Treasury Note fall dramatically to 4.25% (4.35% yesterday) after tickling 5.0% briefly at the end of October. The downward movement in rates means lower and more attractive borrowing costs for business loans, mortgages, auto loans, credit cards and other debt vehicles.

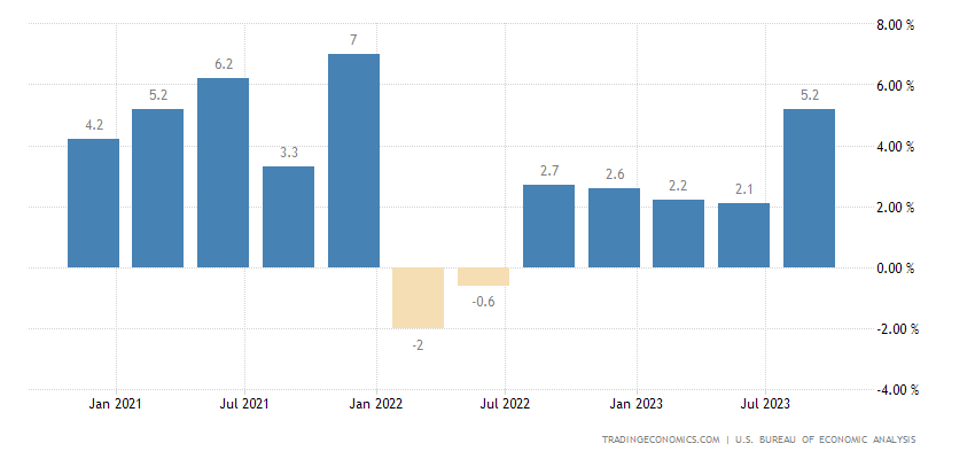

- Economy Remains Healthy: As mentioned earlier, the constant barrage of recession calls over the last two years has been blatantly wrong. In fact, the most recent GDP (Gross Domestic Product) figure for the 3rd quarter came out at a blistering +5.2% growth rate (see chart below).

Source: Trading Economics

- Employment Strength Continues: The labor picture remains strong, as well. Even though the health of the labor market is usually gauged by the unemployment rate, which at 3.9% remains near record lows, the number of employed persons paints a similarly strong picture. As you can see, employment was on a tear pre-COVID, adding about 20 million jobs from 2010 to 2020. Then, after the COVID-low in workers, employment has exploded upward to an all-time, record high of 161 million employed persons (see chart below).

Source: Trading Economics

Cash Hoards on the Sideline

Despite the Federal Reserve signaling the Federal Funds rate could be peaking due to declining inflation and a weakening economy, overall interest rates remain relatively high. As a result, there is a powder keg of dry powder on the sidelines in the form of $6 trillion in institutional and retail money market funds (see chart below). If and when the economy weakens further, and the Federal Reserve reverses course by cutting interest rates, cash will earn less and will likely return to the stock market in droves.

Source: Ed Yardeni (Yardeni Takes)

Santa did not show up for a rally last December in 2022. The S&P 500 index fell -5.9% for the Christmas month last year and finished 2022 down -19%. So far, this year has looked like a mirror image of last year – the S&P is up +19% in the first 11 months of this year. Investors are hoping gifts keep coming in 2023 in the shape of a Santa Claus rally – let’s hope we are all on the “nice” list and not the “naughty” list.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (December 1, 2023). Subscribe Here to view all monthly articles.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in individual stocks, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.