Up, up and away – it’s Super Market.

Able to make new highs day after day, faster than a speeding earnings report, more powerful than bad news… Nothing seems to derail this market – so far. In fact, Euro Stoxx just added 1.7% overnight and the Dow is up 17.5% since November and, as I noted to our Members, our Long-Term Portfolio (LTP) jumped 14.4% in a week and is now up 100% since initiating in May of last year – this is getting silly!

Just like super-powers aren’t real – super markets don’t tend to be either and today’s special effects are coming courtesy of CHINA!!!, who are making some bold moves to shore up their beleaguered market. China’s central bank has announced new steps to boost bank lending to households and businesses. This move is part of a broader campaign by authorities to prop up growth this year after a lackluster 2023. It’s a clear sign that Beijing is concerned about the health of its economy and is willing to take significant steps to stimulate growth.

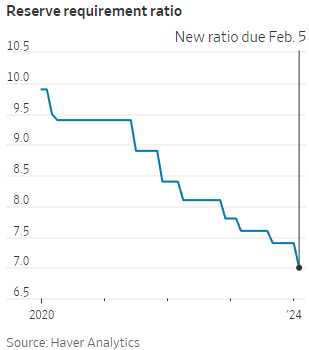

China’s central bank announced new steps to boost bank lending to households and businesses, lowering reserve requirements from 7.5% to 7% (vs 10% in the US). This is an early move in what is expected to be a broad but restrained campaign by authorities to prop up growth. It comes on the heels of signs of gathering government support for China’s swooning stock market, with investors detecting a rash of share buying by pension funds, insurers and other state-linked firms – as we discussed yesterday.

China’s central bank announced new steps to boost bank lending to households and businesses, lowering reserve requirements from 7.5% to 7% (vs 10% in the US). This is an early move in what is expected to be a broad but restrained campaign by authorities to prop up growth. It comes on the heels of signs of gathering government support for China’s swooning stock market, with investors detecting a rash of share buying by pension funds, insurers and other state-linked firms – as we discussed yesterday.

In addition to this, there’s talk of a more bailouts. Rumors are swirling that Beijing is considering spending up to 2Tn Yuan to support the stock market. Even though that’s “only” $282.5Bn – that’s still 7% of the entire Hang Seng and the rumors have sent China’s markets back into a frenzy. While there may be opportunities in this ‘China Bailout Roulette – the risks are very high. Chinese markets are off to a bad start in 2024, continuing the terrible performance of the last couple of years. As we noted previously, foreign investors have fled the country, chasing other markets like Japan and India, and Chinese markets are trading at pretty cheap valuations already.

The Hang Seng Index, which includes the shares of many big Chinese companies, ended the day 3.6% higher, its strongest performance in months. On the Chinese mainland, the benchmark Shanghai Composite Index finished the day 1.8% higher – suspiciously exactly 50% of the Hang Seng gain – indicating the buying may have been forced via Government entities running a program.

The Hang Seng Index, which includes the shares of many big Chinese companies, ended the day 3.6% higher, its strongest performance in months. On the Chinese mainland, the benchmark Shanghai Composite Index finished the day 1.8% higher – suspiciously exactly 50% of the Hang Seng gain – indicating the buying may have been forced via Government entities running a program.

The ratio cut is leverage and a very dangerous kind in which the banks are now gambling with money they certainly don’t have – even while the value of their CRE portfolios are plummeting. China made a massive intervention in 2015 and that didn’t work – until it finally did the following year – so it’s going to be tricky to play and continuing tensions between China and the US have mostly kept us away from the apparent values in China.

-

- Alibaba (BABA) is trading at $74.02, which is $188.5Bn and that’s only 7.7x earnings and they do 35% of their business outside of China and that’s growing. We’ve been putting off buying them but this seems like a good spot – we will discuss it in our Live Member Chat Room this morning:

-

- JD.com (JD) is another Chinese Retailer/Logistics company that I like a lot and they are doing 28% of their business overseas. $23.22 is $34.4Bn in market cap and they have $25Bn in the bank net of debt so the valuation is stupidly low – another one we can add today.

These are, I think, good companies being dragged down by a bad market but, if China shows signs of stabilizing – bargain hunters should show up – eventually.

- Back on the home front, AT&T (T) is taking a hit this morning but for dumb reasons as their “miss” is all due to non-cash adjustments. We’re very happy calling $17 a great bottom for T and it’s already in our portfolios.

- Netflix (NFLX) missed on Revenues, Earnings and Guidance but they are up almost 10% as subscriber counts went up on the assumption that they’ll eventually make more money. At what is now about 35 times earnings – I’m not interested but I wouldn’t short them either.

- Texas Instruments (TXN) beat top and bottom but gave cautious guidance and they are down a bit while Intuitive Surgical (ISRG) beats again and I wish they wouldn’t so we could get back in…

On the Data front, Mortgage Applications are up 3.7% and we’re waiting on PMI at 9:45 and Oil Inventories at 10:30 am. The API report showed a 6.66M draw in Oil but an offsetting 7.2M build in Gasoline. Oil is hovering just under $75 this morning and we may get an opportunity to short if things go well at 10:30 – stay tuned!

Come and join us inside and chat with Phil! You will gain access to our Member Portfolios, Live Chats, and other Member’s Only Perks.

Email Maddie – Admin@philstockworld.com – for a 7-day FREE trial at sign up.

Test open chat:

[wpaicg_chatgpt]