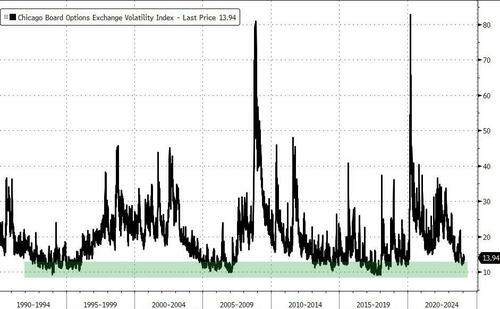

The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.

For those not acquainted, the VIX draws its value from S&P index options with near-term expiration dates, providing a 30-day projection of volatility.

While the VIX isn’t a precision instrument, it serves as a barometer of market sentiment.

Presently, the VIX hovers near its lowest point since January 2020, a period preceding the upheaval caused by the COVID-19 pandemic. Investors, lifted by this low volatility, have been propelling the equity rally for a substantial eight to nine weeks.

In early January, investor Steve Eisman highlighted the excessive confidence that marked the end of 2023 in the markets. For those unfamiliar, Steve Eisman gained notable fame for his role in ‘The Big Short,’ portrayed by Steve Carell in the movie adaptation of Michael Lewis’ book, with the character’s name changed to Mark Baum.

In a CNBC appearance, Eisman expressed unease about the current year, stating, “Everybody’s just a little too fricking happy.”

Over the past year, the S&P 500 index has surged by 24%. There is a strong inverse correlation between the US equity markets and VIX. As the VIX declines, stocks typically rally, and vice versa.

Eisman’s cautionary stance towards market hype resonates with the age-old trader axiom concerning the VIX: ‘When the VIX is high, it’s time to buy, when the VIX is low, it’s time to go.’

At present, the prevailing VIX levels reflect a naive yet robust risk appetite in the financial markets, spurred by discussions of rate cuts for 2024.

“The market scaled a wall of worry throughout the entire year [2023],” remarked Eisman, highlighting that the majority of investors currently harbor optimistic sentiments about the economy.

He added, “Everybody is entering the year so bullish that if there are any disappointments, what’s going to sustain the market?”

The clear message here is that investors currently feel at ease driving up equities, buoyed by higher returns from the Magnificent Seven and a more accommodating interest rate environment, with no significant market shocks in sight.

[ZH: And remember, the lagged yield curve is screaming for some serious volatility ahead…]

If the equity rally continues to gain momentum, there’s a potential for the rumored market melt-up. For the cautious observer, this raises sustainability concerns. Warren Buffett’s timeless advice resonates perfectly in this season of soaring equity prices: ‘When everyone else is scared, get greedy—and when everyone else is greedy, get scared.’